Kuroda the ball is in your court

The USD/JPY may have reached a high this week ahead of the 29 July policy meeting, but it has recovered significantly since the Abe election triumph and breached key resistance around 105 to 105.50. Much depends on the BoJ monetary policy meeting on 29 July. The JPY has rallied after every policy meeting this year and the ball is now in Kuroda’s court to break this trend. A decisive multi-pronged policy easing next week ahead of a widely anticipated fiscal stimulus boost in the second half of the year should be sufficient for the USD/JPY to revert to a persistently weaker trend in light of a recovery regaining momentum in the USA and abating fear of Brexit fallout beyond the UK.

Blow-off top in USD/JPY – for now

The USD/JPY fell sharply on Thursday after a rapid further extension of its rally on Wednesday. The fall was blamed on an interview by BoJ Governor Kuroda dismissing the possibility of helicopter money policy, although the run up to a peak of 107.5 early in Asian trading on Thursday (from around 106.1 a day earlier) and retreat so far to a low of around 105.5 in the hours after the Kuroda comments, may be something of a blow-off top after a stop-loss run.

The surge to 107.50 from around 100 in less than two weeks since the Abe/LDP decisive election win in upper house elections may have placed a top in the market ahead of the BoJ meeting on 29 July. So far USD/JPY has retreated to the mid-105s which is a key support region for the JPY (the low that preceded the previous BoJ policy meeting on 16 June).

The surge from around 100 is the biggest recovery so far in the downtrend this year and has been accompanied by a significant improvement in sentiment for USD/JPY. However it might be regarded as still in a down-trend and much will depend on its capacity to consolidate its recent gains in coming weeks.

The Ball is in Kuroda’s Court

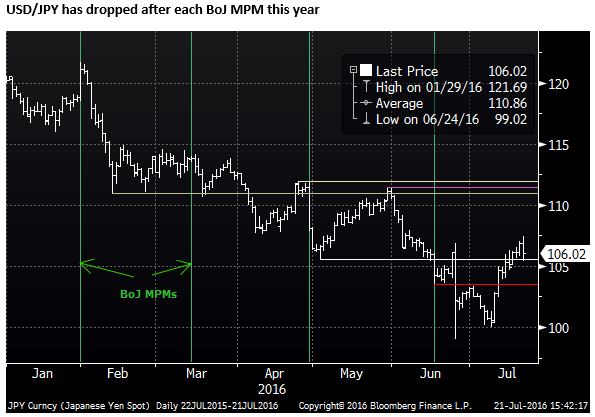

The JPY performance after the BoJ policy meeting on 29 July will be very important in establishing whether the USD/JPY has indeed turned the corner. After each policy meeting this year, USD/JPY has fallen soon after.

At the two previous policy meetings on 28 April and 16 June, the BoJ disappointed expectations that it might further ease policy; the failure to do so fueled sentiment that the BoJ was running out of ammunition and ideas.

The USD/JPY has regained the level that it was trading at immediately before the previous monetary policy meeting on 16 June (105.6), sending the first signal that the down-trend may be ending.

For the pair to more clearly indicate a change of trend, the USD/JPY may need to eventually move above the levels it traded at before the 28 April policy meeting. Like the meeting next week (29 July), the 28 April MPM had more significance because it coincided with the BoJ’s quarterly Outlook report in which it updates its CPI and GDP forecasts for the next three years.

The failure to ease policy at the 28 April policy meeting was a big let down to the market and suggested that the BoJ was prepared to live with a sustained period of JPY strength and await the outcome of the July upper house election.

The USD/JPY responded aggressively to the 28 April policy meeting dropping from just shy of 112 to 108 and onto 105.5 in the following week. USD/JPY attempted to regain the 112 level again in late-May (reaching a high of 111.45 on 30 May), but failed and retreated soon after PM Abe announced on 31 May that he was delaying the second sales tax hike for 2.5 years

The mid-105s shows up as a support level for the USD/JPY as the low in the days after the 28 April policy meeting and the level just ahead of the 16 June policy meeting. As such it would not surprise to see USD/JPY bottom around this region ahead of the 29 July policy meeting.

The market does not have a firm expectation of what to expect from the BoJ on 29 July, but it is clear that no policy change would be a massive let down for the market, potentially setting off a sharp fall in USD/JPY that may completely wipe out its recent recovery. The ball is clearly in Kuroda’s side of the court and he must consider his options carefully.

It is conceivable that he decides to wait until after the LDP government announces its fiscal plans but this will not occur until August at the earliest. Surely Kuroda realizes that this tactic would unsettle the market and unwind what has been a promising initial response to the policy direction discussed by Abe and his team in recent weeks. We see the probability of policy action next week as close to 100%.

Helicopter talk a distraction

Kuroda might have said that he is not interested in helicopter money, but in fact this increases the chance that the BoJ eases policy next week, since it implies that Kuroda is not necessarily waiting for the government to provide any fuel for a helicopter by announcing new fiscal spending. It also allows the BoJ to add more QE than just that that may relate to new fiscal stimulus.

The BoJ is already pursuing far greater QE (JPY 80 tn per year) than any possible boost to fiscal spending that has been discussed in the ball-park of JPY 10 to 30 tn sum spread over several years; some ear-marked for long-term infrastructure investment.

In the BBC program where Kuroda said there was “no need and no possibility for helicopter money” he also said Japan should not forfeit a clear separation between fiscal and monetary institutions. This seems to give weight to the idea that the BoJ will ease policy next week in fact to emphasize this separation.

A key point of reasoning in the idea that helicopter money is more effective is that combined fiscal and monetary policy easing is more powerful in boosting growth and inflation than one or the other in isolation. If Kuroda is willing to ease policy further it does not have to exactly match the timing of new fiscal spending to achieve this combined benefit.

If Kuroda eases this month and the government eases fiscal policy in the second half of the year, then by some definition Japan will have launched a version of helicopter money. This version may well be sufficient to see a more permanent shift in the tone of USD/JPY sending it on its way to test the 110/112 resistance region and perhaps higher depending on global developments.

The focus on so-called helicopter money is a bit of an anomaly and distraction. A pure form of such a policy (and there are still various definitions being proffered in the market) would raise a whole range of complications that makes it still very unlikely. Japan is quite a distance from introducing large scale helicopter money. It is conceivable it might introduce a gimmicky small version associated with its fiscal policy expansion planned for Q3, but if it did, it would surely need to maintain the much larger QE program currently in place. Kuroda’s dismissal of the concept is hardly a surprise. He is really against the most extreme version of the policy that might hand over the central bank’s virtual printing press directly to the government.

BoJ still has ammunition

A point of concern in the market is that the BoJ is buying so many government bonds now that it is reaching the limits of how much more it can buy per month and in total. This may be why the BoJ decided reluctantly to introduce Negative Interest Rate Policy (NIRP) in January, seeking a new dimension via which to ease policy.

NIRP appeared to generate more unintended negative consequences than anticipated. While it has driven down borrowing costs which may have helped lift investment, it also weakened bank profits and undermined household and corporate confidence. As such, some also doubt the BoJ can or should further cut rates.

We have contended that the main reason for the amplification of negative consequences has been the perverse rally in JPY. In fact we argued that to be effective NIRP really must be matched by an FX intervention policy to at least cap the domestic currency.

The lack of follow up policy easing since January despite the strong JPY and a sharp fall in inflation expectations placed further doubts on the capacity of the BoJ to further ease policy.

However, BoJ governor Kuroda has consistently stated that he still has ample room to maneuver and will do so if required. He reiterated this view in the same BBC report where he dismissed helicopter money. He said, “I don’t think there is any significant limitation of easing monetary conditions in Japan if necessary”. He said the BoJ can yet still increase the quantity of purchases, the quality (such as the type of assets purchased), and further lower negative interest rates.

The limitations of BoJ policy may be a concern for the market eyeing the unintended negative consequences, but functionally there is still plenty of government debt for the BoJ to buy. It currently owns around 34% of government debt which is one of the largest in the world at around 250% of GDP; so while the market may feel disrupted, the BoJ could yet buy a greater amount per month for several years as well as expand purchases of private sector assets.

If JPY were to again embark on a persistently weaker trend, the concerns over disruption from negative yields across the yield curve may seem less of a worry. The yield curve may in any case start to rise and Japanese investors that are reluctant to let go of these bonds now might more readily do so fearing loss resulting from higher yields as inflation expectations recover.