Kuroda the inflator – framing the BoJ decision

Kuroda has expressed increased confidence in achieving his inflation target in about one-year based on a number of new measures and appears more willing to look through oil price falls than he was a year ago. However, the current set of BoJ forecasts are only on the cusp of acceptable with respect to this time horizon and Kuroda will be very reluctant to allow more time without further expanding monetary policy to signal his seriousness in achieving sustainably higher inflation. There are arguments for and against further easing tomorrow, government spokespersons have aimed to either dampen expectations of further easing or exert pressure on Kuroda to hold fire. One more day to find out.

BoJ inflation target, time-frame, and policy framework

The preferred measure of inflation historically used by the BoJ and which appears in its semi-annual Outlook for Economic Activity and Prices (OEAP) released at the end of April and October (forthcoming on Friday in conjunction with the latest monetary policy decision) is CPI less fresh food.

The BoJ also updates these inflation forecasts in its January and July policy statements. The most recent forecasts released in July had mid-points for CPI less fresh food of +0.7%y/y at end-March 2016 (otherwise referred to as Fiscal 2015), +1.9% at end-March 2017 (referred to as Fiscal 2016), and +1.8% at end-March 2018 (Fiscal 2017) – excluding the effect of the next hike in consumption tax that is slated to be implemented in fiscal 2017.

In its last OEAP in April the BoJ said, “Although the timing of reaching around 2 percent depends on developments in crude oil prices, it is projected to be around the first half of fiscal 2016, assuming that crude oil prices will rise moderately from the recent level.”

Most recently in a speech on 29 September the BoJ governor Kuroda repeated the same forecast. He said, “The timing of reaching around 2 percent is projected to be around the first half of fiscal 2016, but it should be noted that the timing could be either earlier or later than the projection, depending on developments in crude oil prices.”

Initially, when Kuroda accepted the challenge to target 2% inflation in April 2013, he set himself a horizon of 2 years. Since then he has consistently had the 2% (or just below) forecast within 2-years. He has allowed it to slip past the original 2-year date of (April 2015), but now has the target in sight within one-year. Currently he is talking about the first half of fiscal 2016. This refers to the period from April to September of 2016, so practically that means by September-2016, in about one year.

Kuroda is keen to get inflation expectations moving higher and is reluctant, therefore, to let the timing of his inflation goal continually slip into the future. Practically he may have to, but before allowing himself leeway to accept a longer time-frame his is likely to expand monetary policy to keep up the impression that he will not rest until inflation is achieved on a sustainable basis.

As it stands, the inflation forecast is on the cusp of acceptable with respect to his current time-frame. The mid-point is 1.9% at end-March 2017, six months after the date he has recently forecast as the time by which he expects to reach around 2% inflation. He can’t credibly let that forecast fall below 1.9%y/y for end-March 2017 (Fiscal 2016), without trying harder and expanding monetary policy easing further.

The new measures of inflation watched by the BoJ

These messages on inflation include the proviso that oil prices start to recover. Clearly, he cannot expect to reach his target if energy is a major part of that price measure and these prices are still falling.

To this end, the BoJ has started using a new core measure of inflation in its monthly Report of Recent Economic and Financial Developments (RREFD). This report comes out the day after monetary policy statement releases. It is CPI less fresh food and energy, essentially also subtracting energy from its core measure that has historically appeared in its key forecasts in the OEAP.

Somewhat confusingly this measure is different from a similarly named measure from the government which is released tomorrow just ahead of the BoJ policy announcement called CPI less food and energy. The government measure appears to subtract all food not just fresh food.

In effect, the BoJ is targeting this new core measure CPI less fresh food and energy. The chart below is taken from the latest RREFD released in full text English version on 9 October. It shows the BoJ’s new core measure (CPI less fresh food and energy) and the government’s core measure (CPI less food and energy). It also includes the BoJ’s old core measure that still features in the most recent forecasts in the OEAP (CPI less fresh food).

The chart illustrates that the BoJ core measure and the government core measure are both accelerating, currently around 1%, half-way to the BoJ target of 2%. The government measure is less favourable; last reported at 0.8%y/y in August and is expected to rise to 0.9%y/y in the data release tomorrow for September. The BoJ measure was last at 1.1%y/y in August.

We can see from the chart that the two are closely correlated, and so if the government measure rises as expected, the likelihood is that the BoJ measure will also rise. I suppose economists delving into this data will help provide an estimate of this BoJ core measure not too long after the release tomorrow.

The chart also shows the CPI less fresh food measure that features in the OEAP forecasts getting further away from the 2% target, last reported at -0.1%y/y, and forecast to fall further to -0.2%y/y in September.

Kuroda has certainly spoken with some confidence that Japan is on track to reach its inflation target in around one-year. In his speech on 28 September he said:

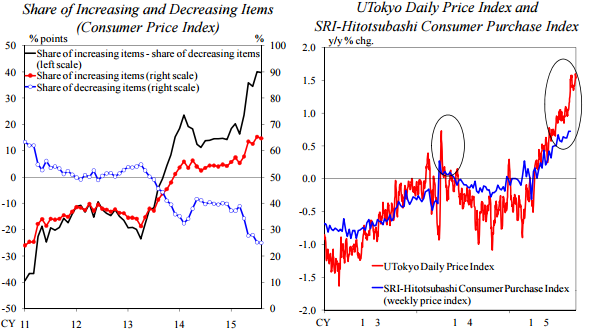

“There is a variety of evidence that firms’ price-hiking behaviour has become widespread and sustained since the start of this fiscal year. For example, looking at the items that make up the CPI (all items less fresh food), the share of items for which prices rose minus the share of items for which prices fell has risen markedly since the beginning of this fiscal year and recently has reached the highest level since 2000.”

“In addition, price indices compiled by the University of Tokyo and Hitotsubashi University by aggregating the prices of food and daily necessities also show clear price increases since April this year on a year-on-year basis, and the increases seem to be accelerating.” The charts below are taken from this speech, illustrating these two measures.

The UTokyo Daily Price index was launched in May-2013. It uses scanner data collected daily from about 300 supermarkets sampled from all over Japan. The goods included are “processed food, beverages, household goods and the like” (this suggests it excludes fresh food like the BoJ core measures). However, “electrical appliances and other consumer durables, services, and the like are not covered”. “As a result, the index covers only 17 percent of the official CPI in terms of consumption weight.”

The accelerating trend in this supermarket index may point to further progress in reaching the BoJ target. It was last recorded at 1.65%y/y on 26-October. On a monthly basis it rose 1.25%y/y in September, up from 0.96%y/y in August and 0.78%y/y in July, accelerating quite rapidly in recent months. (UTokyo Daily Price Project).

SRI-Hitotsubashi consumer purchase index is calculated based on the “POS data of 4000 stores, such as supermarkets, convenience stores, drug stores, and large retail stores”… “from approximately 4,000 retail stores”….covering “processed foods and daily necessities”. It “does not cover fresh foods, packed lunches, served beverages, and so on.”

Their website includes a chart which shows the CPI measure accelerating to a high annual growth rate in the latest data just under 1.0%y/y. (SRI-Hitotsubashi Consumer-purchase Price Index).

The arguments for and against policy action

These newly developed daily rapid ‘big data’ sets provide a case for which Kuroda can actively claim he is on track to meeting his inflation target on time. There is a rising trend in these inflation measures coincident with his monthly core inflation measure excluding fresh food and energy.

The latest movements in oil prices suggests that there will be some further delay in reaching the core measure used in the OEAP, which includes energy. But the BoJ may start to explicitly include its new core measure in its new OEAP due tomorrow, or use it to explain why there may be a delay in reaching these targets, such that they do not need to respond with further policy easing.

However, the forecast for inflation over the next few years cannot ignore the latest falls in oil price and risks to economic growth that arise from downward revisions to emerging market growth, particularly Chinese growth since the middle of the year.

Kuroda in recent remarks has chosen to highlight the broadening and rising trend in prices outside of energy arguing, crucially, that inflation expectations are rising across the community. At face value it appears he is now much more willing to look through the influence of oil prices as transitory. However, there is a risk that lower energy prices begin to dampen and slow the rise in inflationary expectations he is still trying to achieve. And the growth outlook still remains challenging, should this lose momentum, so will the progress on achieving sustainable inflation.

Kuroda is no doubt pleased with accelerating underlying measures of inflation over the last six months or so, but he still has a significant distance to go to achieve the 2% target in a sustainable manner. Arguably he needs inflation to rise above the target for a time to more permanently shift inflation expectations up to 2%. He can ill afford a set-back in the current momentum in rising inflation that is only now just starting to take hold in the last six months or so.

It is quite possible that his BoJ aims to bolster that progress tomorrow by further easing monetary policy to counter the recent further deterioration in the outlook for commodity prices and emerging market growth. The current set of forecasts only just comply with Kuroda’s current time-frame for achieving his inflation target in about one-year. Even a modest downward revision in the underlying inflation outlook excluding oil may be sufficient to tip the argument in favour of more policy easing.

However, it is also equally possible that he keeps that easing up his sleeve to assess the outcome of recent policy developments at the ECB and China, and the increased prospect that the Fed tightens in December.

Yesterday, Koichi Hamada, an advisor to PM Abe said, “The BoJ’s new core CPI measure that excludes fresh food and also energy is a better indicator to discern the trend in prices now.”…”as long as the new core measure is rising, the BoJ has no need to expand its monetary policy.”

The hints from Finance Minister Aso last week and government advisors since last week suggest that the BoJ will not further ease policy tomorrow. Whether they are in the know and massaging expectations towards a no policy change or simply trying to exert political pressure on the BoJ is unclear.