The market looks to Yellen for inspiration

San Francisco Federal Reserve President Williams might vote for a hike sooner rather than later, but he appears to be on the hawkish side of the debate, at least with respect to the next rate move. He is also more bearish than his colleagues on potential growth and sees a lower neutral policy rate in the long-term. We expect Yellen to build the case for a hike later this year, but we doubt there will be much desire to move ahead of the US election. Much will still depend on evidence of ongoing recovery. She is likely to offer something for everyone, acknowledging both risks for moving too fast and too slow on policy normalization. Market reaction may also depend on how much emphasis she places on the current and expected future neutral interest rate. She may attempt to refocus attention away from the next hike and discuss the outlook for a lower normal level of interest rates in future. If so, this may serve to dampen upward pressure on the USD. BoJ policy uncertainty continue to hang over global markets. BoJ Kuroda’s comments over the weekend suggest more policy easing may come on 21 September, but do little to dispel market concerns over the scope and effectiveness of further BoJ policy action.

Williams calls for a hike sooner rather than later

The market of course is waiting for the final word on Fed policy from Chair Yellen at the annual Jackson Hole Symposium on Friday 26 August. If she sounds anything like San Francisco Federal Reserve President Williams in a speech he made on Friday last week, then we might expect a sell-off at the front of the US yield curve and a rebound in the USD as the market raises the odds of a hike as soon as the next policy meeting on 21 September.

Williams has been sending mixed signals lately depending on whether he has been talking about longer term policy and the Fed’s perception that the neutral rate is now lower, in the order of three percent or perhaps lower. In which case rate hikes might be done more cautiously, with limited need to raise rates across the cycle. Or talking about the short term and his perception that the US economy is essentially at its full-employment level, inflation is below but not so far below its 2% target, and it is time to move forward with a second rate hike to reduce risk of overshooting the Fed’s targets and needing to brake harder later. And to avoid excessive build-up in financial stability risks associated with excessive asset prices.

William’s speech on Friday focused on the short term policy agenda and he was on the more hawkish side of the FOMC, seeing the case essentially made for another rate hike.

He thought that the current pace of monthly payrolls gains needed to sustain full-employment was around 80K, with estimates ranging from 50 to 100K. As such, the current pace of jobs growth this year, averaging 186K, or 190 in the last three months to July, is “over twice as fast as we need to keep up with the labor force growth, and, quite honestly, is unsustainable in the long run.”

He said, “I see [the natural rate of unemployment] as about 5.0%, which means that with unemployment at 4.9%, we’re right on target.” He said, “the multiple other indicators [of labor market health] are sending similar signals, with almost universal improvement across then all.” He confirmed he sees even the participation rate that is around its lows since the 1970s as “pretty close to what I see as normal”, lower because of demographic trends.

On inflation, Williams sees the underlying inflation rate is in the 1.5 to 1.75% range. He said, “Not quite at our target, but the strength of the labor market should help us along”

Regarding Brexit, Williams said, “There’s no sign that it will have enough of an impact to knock our economy off course”

He said, in the context of a strong domestic economy with good momentum, it makes sense to get back to a pace of gradual rate increases, preferably sooner rather than later.

He argued that waiting too long to hike can generate imbalances, giving several examples. “In the 1960s and 1970s, it was runaway inflation. In the late 1990s, the expansion became increasingly fueled by euphoria over the “new economy,” the dot-com bubble, and massive overinvestment in tech-related industries. And in the first half of the 2000s, irrational exuberance over housing sent prices spiraling far beyond fundamentals and led to massive overbuilding. If we wait too long to remove monetary accommodation, we hazard allowing these imbalances to grow, at great cost to our economy.”

Williams is more pessimistic on long run potential than most of his FOMC colleagues

Williams gave a pessimistic assessment of potential GDP growth, helping explain both a willingness to see growth currently strong enough to generate inflation, and also a lower neutral interest rate. He said the “new normal” is lower “trend growth of a little over 1.5% going forward.”

This estimate compares with an estimate of 2% longer run GDP growth in the most recent FOMC Summary of Economic Projections in June, with a range of forecasts of 1.6 to 2.4% and a central tendency of 1.8 to 2.0%. This places Williams right at the bottom of the rung for estimated potential growth in the economy.

Similarly, at “around 5%”, he also appears to be on the higher side of FOMC member projections for neutral unemployment. The median longer run unemployment projection has been 4.8% in March and June, the range from 4.6% to 5.0% and the central tendency 4.7 to 5.0%.

Williams is currently hawkish but probably not far from the center

We might conclude that Williams is at the hawkish end of the current spectrum of FOMC members (and not a voter this year). However, as the head of one of the most economically significant districts formally led by the current Char Yellen, we should not under-estimate his importance in the debate at the FOMC.

Williams has never dissented and he does not stray too far from the reservation when speaking. So while sounding somewhat more hawkish than his peers, we presume he would not be talking up the prospect of a cut sooner rather than later, if the consensus developing among the core decision makers at the Fed was that that hike was not likely this year.

Dudley more patient

Other Fed speakers last week also appeared to favor a hike later this year, although were less forthright than Williams suggesting they might prefer waiting until December.

New York Fed President Dudley, holding a permanent voting position and seen as very close to the core view on policy, said a hike in September was “possible” and the market, with only one hike priced in through the end of 2017 was “complacent” to the risk of higher rates in the coming year.

However, Dudley’s assessment that a hike was “possible” in September was much less forthright than his and others’ assessment in May that a summer hike (June/July) was “likely”.

Our read, as we discussed in our report last week (AmpGFX – The long and short of Fed policy, 17 August) is that he would prefer to wait through the election, accumulate evidence through until December, before deciding on the next rate decision. But that based on recent evidence he would likely vote for a hike before year end.

FOMC minutes suggest patience

Our read on the FOMC minutes of the 27 July policy meeting released last week, discussed in our report (AmpGFX – Fed minutes show caution, 18 August) was that the core decision-makers appeared to be more cautious since Brexit and were prepared to wait a bit longer on moving forward with a hike, suggesting the most likely timing of a hike would be December.

It is possible that the needle has moved toward a hike in September, following the strong July payrolls report (released on 5 August) and the strength of the rebound in global asset prices in recent months since Brexit, raising the concerns over excesses and financial stability risks and market complacency over low rates over the coming year.

But then retail sales and GDP were weaker than expected, although both with mitigating factors (inventories have contracted significantly from GDP for five months, and retail sales were coming off a solid Q2). Other data has been mixed, core CPI was a bit lower than expected, and core PPI was lower than expected. However, manufacturing production was stronger than expected in July.

Ahead of the September 21 policy meeting there are several further key data points that could sway the September policy meeting decision, including durable goods orders due on Thursday 25 August a day ahead of Yellen’s speech this week. Before the September policy meeting the FOMC will see another payrolls, retail sales, PCE deflator and ISM reports.

Business Investment a key swing variable for FOMC

The weak trend in business investment over the last year has been a persistent bug-bear for the Fed helping delay policy tightening (raising the importance of the durable goods orders report out this week).

Through 2015 and earlier this year, the contraction in the energy sector and broader weakness related to a weak global economy and a strong US dollar contributed to this drag. However, as the 21-July FOMC minutes noted, drilling activity has increased in recent months, and the drag from the energy sector should diminish.

The FOMC minutes noted some signs of cautious optimism in business investment, but there were factors still seen to be holding it back; “including concern about the likelihood of an extended period of slow economic growth, both in the United States and abroad; narrowing profit margins; and uncertainty about prospects for government policies.”

As such, some recovery in business investment might be expected after several quarters of contraction, and will be watched for closely by the Fed as an important signal that the economy is healthy and is ready for further policy tightening.

Lockhart closely watching business investment

As Atlanta Federal Reserve President Lockhart said last week, “I acknowledge there is tension between an assumption of an upswing in business investment and what people in the business community are saying. For that reason, I’ll be watching carefully for signs of a pickup in capital expenditures.”

He further said, “I’m expecting decision makers’ caution regarding capital expenditures to fade, to an extent, as sustained growth of consumer activity proves out over the coming quarters. My staff has performed statistical analysis that suggests that increases in consumer spending tend to lead acceleration of business investment.”

He is projecting “moderate growth through 2017 and achievement of the Fed’s core monetary policy objectives over the next year and a half.” But he said, “The risk that concerns me most is the risk that an upswing in business investment fails to materialize.”

He concluded that, “I’m not locked in to any policy position at this stage, but if my confidence in the economy proves to be justified, I think at least one increase of the policy rate could be appropriate later this year.”

“At least one hike”, suggests he could vote for two, but the tone of the speech, and the term “later this year”, suggests some patience and no hurry to act at the next opportunity.

The question is, will Chair Yellen say more and how will the market react.

Yellen to offer something for everyone

We expect Yellen to offer a something for everyone, but leave her options open. She is likely to speak with optimism towards the economy, concurring with her colleagues statements last week that the outlook for steady progress towards the key policy mandates is on track and expected to continue. She might argue that the economy is relatively close to full-employment and barring any surprises further policy tightening is likely later this year.

The question is – will this be enough to shift the market to more fully price in a rate hike before year end and more through the course of next year?

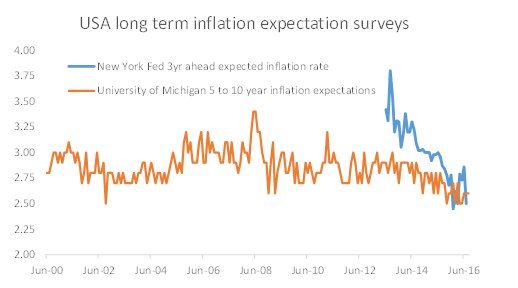

This may depend on how she characterizes the risk to this scenario. Risks and reasons not to rush forward with the next hike remain low survey and market-based measures of inflation expectations, weak business investment in the last year or so, increased global uncertainty pertaining to Brexit and ongoing uncertainty related to Chinese financial strains.

It may depend on how she assesses the balance of risks associated with, on the one hand, a lower bound on policy and, on the other, possible over-stretched financial asset prices. Rates so close to the lower (near zero) bound mean less scope to respond to negative shocks, supporting the case for delaying policy easing until inflation is more clearly rising. But maintaining low rates for a prolonged period may encourage investors to over-reach in asset markets and create higher risk of a deep price correction with fallout to the economy, arguing for a rate hike sooner to keep investor exuberance in check. FOMC minutes illustrate that both considerations have featured in the debate.

The new low normal

It may also depend on how much emphasis Yellen places on the longer run assessment of the neutral interest rate and research on the current neutral policy rate.

Dudley said in a speech on 31 July, “Estimates of the neutral real short-term interest rate obtained from many of the DSGE models used within the Federal Reserve System are currently clustered around zero, and this seems reasonable to me. An implication is that at present there is only a small gap between the actual real short-term rate of about -1 percent and the neutral real short-term rate. In other words, U.S. monetary policy is accommodative, but only moderately so.”

Chair Yellen made the same point in her press briefing after the June policy meeting. She said, “I think what we can see, and what many econometric and other studies show, is that the so-called neutral rate—namely, the level of the federal funds rate that is consistent with the economy growing roughly at trend and operating near full employment—that rate is quite depressed by historical standards. Many estimates would put it, in real or inflation-adjusted terms, near zero.”

It has been a topic of much discussion it seems both inside and outside the Fed over the last several months over the degree to which the neutral rate over the long term has fallen. The FOMC Summary of Economic Projects has lowered this forecast from 4.25% in 2012 to 3% in June this year.

It is quite possible that Yellen speaks at length about the neutral policy rate both currently in the context of ongoing headwinds since the 2008 Global Financial Crisis and over the long term as demographic and global factors depress the neutral policy rate.

If so, and it may be her intention, the market may focus not so much on whether the Fed eaks out one policy hike later this year, but what will drive Fed policy beyond that. It is possible for Yellen to point to a hike later this year, but suggest that the entire tightening cycle may be shallow and drawn-out. In which case, the market may resume its skepticism over policy hikes and tend towards selling the US dollar.

BoJ confusion remains

Even more uncertain and of market significance is what the BoJ does at its next policy meeting on 21 September. The USD/JPY is firmer on Monday morning following an interview by BoJ Governor Kuroda reported in the Japanese press over the weekend. Bloomberg news translated Kuroda as saying there is a “sufficient chance” of easing at the next policy meeting.

That doesn’t make sense, so we will assume something is lost in translation. Sufficient seems to imply conditions warrant further policy easing. But “chance” suggests uncertainty. Is the uncertainty attached to the comprehensive review? Will policy be eased only if the review finds the BoJ’s policy tools still effective?

Kuroda is reported as saying that Board members will discuss the economy and financial situation based on the comprehensive review, and if needed will take further easing steps without hesitation.

The comprehensive review of policy was ordered at the last meeting on 29 July. The fact that it was ordered in place of significant further policy easing itself created doubts and confusion over BoJ policy easing. It suggested that the BoJ had lost confidence in its policy measures and had doubts about extending them further. The BoJ has faced much criticism over the effectiveness of negative interest rate policy (NIRP) and dysfunction in the bond market from its JGB purchases.

Perhaps the comprehensive review was ordered with the intention of establishing clearer evidence that these policies have worked, and could be effective if extended further. If so the review may serve as a catalyst to further lower interest rates and expand asset purchases.

However, the market appears far from certain these policies will be enhanced or are effective. Since 29 July, JGB yields, market interest rates and the JPY are higher, suggesting the market fears some unwinding of these policies, or at least sees little scope for the BoJ to extend them further.

It is far from clear what the BoJ may decide on 21 September or what its comprehensive review will say. It is equally unclear how the market might react.

In his interview over the weekend Kuroda said that technically there is room for a deeper cut in NIRP, but continued to rule-out so-called helicopter money policy.

But the NIRP policy has come under enormous criticism for eroding banks’ profits and since it was introduced on 29 January it has failed to weaken the JPY. It is perhaps the most criticized part of BoJ policy. We have argued that unless the BoJ in cooperation with the MoF and government set up a clear FX intervention policy to compliment NIRP, the policy is likely to fail and leave the BoJ reputation even more damaged. (AmpGFX – BoE shines, BoJ needs to regain the initiative, 5 August).

The BoJ and government need to tackle the strengthening JPY if they are to turn the tide on BoJ policy credibility. But there is no sign that intervention policy, other than to combat rapid short term moves on JPY, is being contemplated by the government or within the BoJ’s comprehensive policy review.