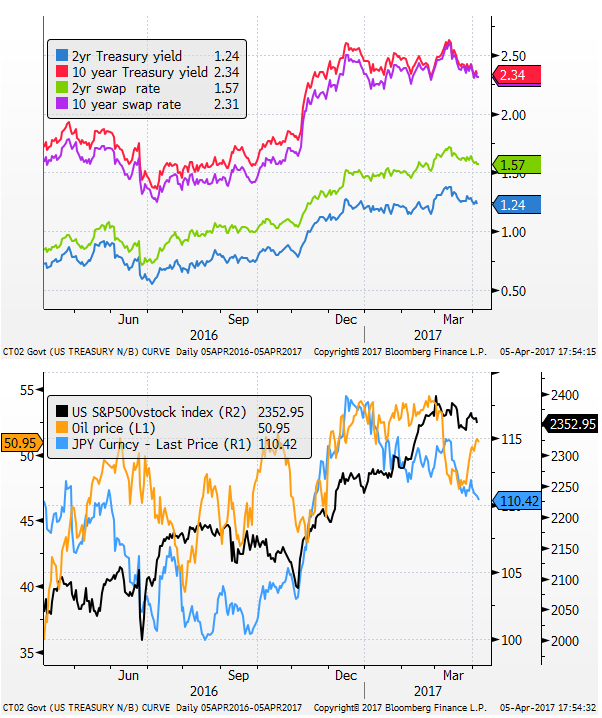

Market yet to react to approaching Fed asset run-off

It is surprising to see US yields fall and the bond curve at its flattest point since December after the FOMC minutes where the Fed firmed up expectations it would begin its asset run-off later this year, after one or two more rate hikes. The fall in equities in recent weeks and lower bond yields may reflect the Trump administration’s setbacks and falling confidence that it can deliver tax reform. Additionally, there may be some worries over geopolitical risks as gas attacks in Syria and ballistic missile tests in North Korea add pressure on the Trump administration. As yet there is also no smoking gun on inflation in the USA and some mixed economic reports recently. Lower equities and yields continue to support JPY and gold. However, the Trump/Xi meeting has the potential to deliver soothing rhetoric for the equity market, and the ADP employment report was again much stronger than expected, raising the odds of a strong payrolls report. This may lift US yields, and support the USD/JPY from the low end of its current range. Much may depend on the wages data and indicators of tightness in labor market.

Balanced views

The Fed minutes were balanced as should have been expected, in that the FOMC did not much change their forecasts for the economy, inflation, or the path of interest rates over their three-year horizon in the Summary of Economic Projections presented at the day of the meeting on 15 March.

Minutes of the Federal Open Market Committee, March 14-15 – FederalReserve.gov

FOMC Summary of Economic Projections March 15 – FederalReserve.gov

Meeting calendars, statements, and minutes (2012-2017) – FederalReserve.gov

The Fed did, of course, raise its Fed funds rate target at the 15 March meeting by 25bp following on from its hike in December. The hike was described at the time by Fed Chair Yellen, and in these minutes, as consistent with the FOMC’s pre-existing projection of a gradual removal on monetary accommodation.

Beginning the asset run-off discussion

The minutes were notable for formally starting the debate on the timing of running down the Fed’s swollen balance sheet – holdings of Treasuries and Agency MBS.

The minutes said, “Provided that the economy continued to perform about as expected, most participants anticipated that gradual increases in the federal funds rate would continue and judged that a change to the Committee’s reinvestment policy would likely be appropriate later this year.”

So most FOMC participates expect the asset run-off to begin later this year, after some further rise in the Fed fund’s rate.

The minutes did not say whether the beginning of the asset run-off might be accompanied by a pause in rate hikes, but some pause might be expected to assess the market impact of the asset run-off.

NY Fed President Dudley said as much in a Bloomberg TV interview on 31 March. He said, “If we start to normalize the balance sheet, that’s a substitute for short-term rate hikes,” and “we might actually decide at the same time to take a little pause in terms of raising short-term interest rates,” Dudley said.

Dudley Says a Couple More Hikes Seem Reasonable – bloomberg.com

Hike now so we can pause later?

This might explain to some extent the willingness of the Fed to hike in March. The median and mode of FOMC members’ forecasts since December last year have been three hikes in 2017. As such, a hike in March this year puts the Fed slightly ahead of this forecast timeline.

If most participants see an asset run-off later this year and two more (of three in total) rate hikes this year, it might like to get these hikes done before the final quarter of the year, so they can then pause and assess the impact of an asset run-off.

The FOMC’s rate projections do not give any indication that they expect to pause rate hikes to evaluate the impact of an asset run-off. The mode and median forecast are for a further three rate hikes in 2018, consistent with a steady path of rate hikes in conjunction with an asset run-off.

It may be the case that FOMC members have not yet fully incorporated the impact of an asset-run-off on their rate forecasts. As it comes into effect, they may be more willing to slow the path of hikes, below that in their current projections.

But there is scope for a pause of up to around nine months in these projections. If the Fed completed three hikes this year by September 20, it could then wait until June-2018 before resuming hikes, and still have time to complete three hikes in 2018 (hiking every second meeting to December 2018).

Passive and Predictable asset run-off

There is no metric on how much effective policy tightening might result from an asset run-down. Obviously, it will depend on how fast assets are disposed of. The degree of effective policy tightening might be judged by the upward pressure on bond yields, and steepening in the yield curve.

The FOMC might tend to think an asset run-off can be done without all that much effect (little net impact on bond yields/curve steepening), and they can proceed with a smooth and gradual path for hiking rates with the asset run-off occurring in the background.

The FOMC minutes said, “Many participants emphasized that reducing the size of the balance sheet should be conducted in a passive and predictable manner.”

Most participants desire the asset run-off to be as innocuous as possible, dampening the impact on bond yields. This is consistent with the message from the Fed that it prefers to use its Fed funds target as the primary instrument of monetary policy.

Plan to be announced well in advance (mid-year?)

The FOMC minutes said, “Nearly all participants agreed that the Committee’s intentions regarding reinvestment policy should be communicated to the public well in advance of an actual change. It was noted that the Committee would continue its deliberations on reinvestment policy during upcoming meetings and would release additional information as it becomes available. In that context, several participants indicated that, when the Committee announces its plans for a change to its reinvestment policy, it would be desirable to also provide more information to the public about the Committee’s expectations for the size and composition of the Federal Reserve’s assets and liabilities in the longer run.”

As such we should expect to know the plan “well in advance” of the actual implementation of an asset run-off policy. At a guess, this suggests by around mid-year or at least some time in Q3.

The plan already looks to be taking a pretty clear shape – gradual and steady, a reduction in the reinvestment of maturing assets, running down holdings of Treasuries and Agencies at the same time.

Bond market has shown little reaction to date

The idea of a gradual run-off, and a pause in rates as it starts, might be consistent with fall in yields seen after the minutes today. However, it is surprising to see yields lower when a run-down in Fed assets, increasing net supply of bonds, should place upward pressure on yields. While the market had established some expectation of a run-off, this is the first official policy comment on the topic and firms the case for it beginning this year.

Furthermore, yields might find upward pressure arising from much stronger than expected ADP employment data and firming global growth trends that should be swinging the balance of risks towards a faster pace of policy tightening by the Fed.

The US bond market curve has essentially been flattening since the Fed delivered its December rate hike. It is hard to see where the market has started to build in the likelihood that the Fed begins its asset run-off later this year and pauses rate hikes in the initial phase of this action.

Fading Confidence in Trump administration

The weaker US equity market that peaked on 1 March may account for some of the recent fall in US yields and curve flattening, including during trading on Wednesday. USA equities fell after the FOMC minutes were released.

Weaker equities and weaker US yields in recent weeks may reflect the poor political performance of Trump; including the failure of the healthcare bill and ongoing questions over alleged links to Russia. The market has down-shifted its expectations for tax reform and infrastructure spending.

There may also be some increased concern over how the USA will handle rising geopolitical stress after chemical gas attacks in Syria and ballistic missile tests by North Korea.

Such considerations may be weighing on US equities, US yields and the USD against safe havens, JPY, and gold.

Lower US bond yields and firming global growth expectations may also tend to underpin emerging market and commodity currencies; although they are more mixed recently, with one eye on equities as well.

No smoking gun

The economic data also continues to matter for the outlook for Fed policy. It just hasn’t forced their hand one way of the other in recent months to sound more or less hawkish. There is no smoking gun on inflation yet. The labor market is tightening, but wage data has eased. PCE core inflation is stable around 1.75%, below the 2% target.

Symmetrical inflation target

In the FOMC minutes and the statement presented on 15 March, the Fed emphasized that its 2% inflation target is symmetrical, not a ceiling.

The minutes said, “A few members expressed the view that the Committee should avoid policy actions or communications that might be interpreted as suggesting that the Committee’s 2 percent inflation objective was actually a ceiling. Several members observed that an explicit recognition in the statement that the Committee’s inflation goal was symmetric could help support inflation expectations at a level consistent with that goal, and it was noted that a symmetric inflation objective implied that the Committee would adjust the stance of monetary policy in response to inflation that was either persistently above or persistently below 2 percent.”

In its 15 March policy statement, the Fed said, “The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal.”

The symmetrical nature of the 2% target was already well known, but by pointing it out, it suggests some FOMC members might quite like to run inflation above the target for a while since inflation has been below target for some time (over 4-years). They would argue this would help lift and anchor inflation expectations at a higher level more consistent with sustaining inflation around 2%.

However, the mere fact that the FOMC needs to point this out at all should also remind the market that the inflation is close to target already. Headline is in fact recently above target (PCE deflator 2.1%y/y in Feb), and core (excluding food and energy) was 1.75%. The Dallas Fed trimmed mean PCE was at 1.9%y/y, a fact noted in the minutes.

One factor that keeps the Fed from lifting its inflation outlook is that it believes there is residual seasonality in the inflation data that may tend to lift inflation early in the year, from which it may settle back down later in the year. The FOMC also mentioned this in their minutes.

Trump/Xi meeting should help boost confidence

The Trump meeting with Chinese President Xi comes into focus Thursday followed by the labor data on Friday. One might expect the Trump/Xi meeting to provide calming sound-bites for the market, potentially supporting the US equity market.

The ADP employment report suggests that a strong labor report should result on Friday. Key metrics will be the wages data and indicators of labor market tightness (unemployment and under-employment).