Mounting risks for Eurozone and China

Under-performing Eurozone corporate assets point to downside risk for the EUR, as does higher US real yields and higher US hedging costs. German industrial data has deteriorated, and wage pressure in the US is rising. Unless the Italian budget standoff is resolved, EUR should develop a clearer downtrend. Chinese equities remain under pressure, and the recent Bloomberg reports of alleged Chinese state-sponsored hacking points to major long-lasting risks for Chinese industry. We wonder why major media outlets are not picking up on what is arguably the biggest global geopolitical scandal. Australian commodity prices continue to rise, but the AUD remains a proxy for heightened financial and economic risk in China. There is some evidence of peaking in the Australian economy.

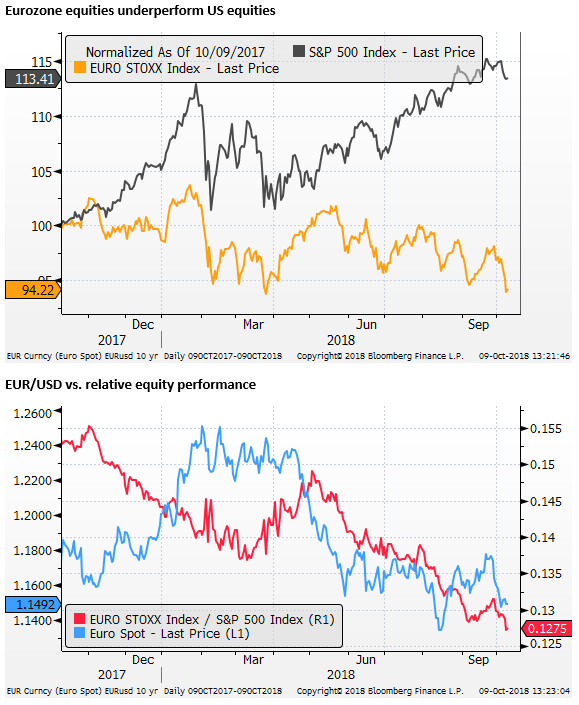

Euro corporate assets under-perform

The EUR appears to have become more closely correlated with Italian bond yields in recent days. The brewing Italian budget crisis has undermined Euro equities and corporate bonds relative to the USA. Unless the issue is resolved, which seems unlikely any time soon, the EUR may develop a clearer down-trend.

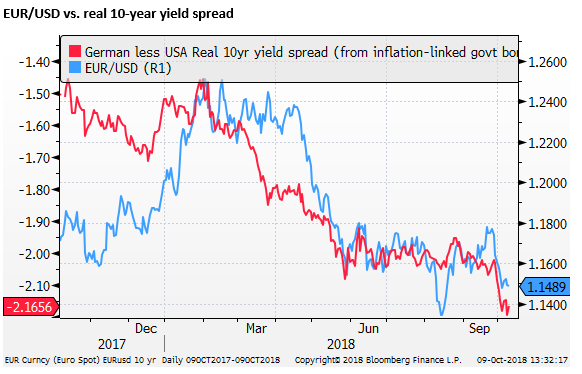

Higher US real yields may reinforce a EUR down-trend

With so much focus on potential and actual fallout from Italian politics, perhaps the market has not paid enough attention to relative economic performance, and the shift in real and nominal yield spreads between the USA and the Eurozone. The sharp rise in US government yields in the last week should add further impetus to a weaker EUR/USD trend.

Much of the recent rise in US bond yields are driven by a rise in real yields and the term premium, which should provide fundamental grounds for a stronger USD.

Cost of USD 3mth hedges jumps

The three-month cost of hedging USD exposure or leaving unhedged exposure to EUR and other major currencies has increased sharply since end-Q3. This is typical of this time of year, as investors and corporations set hedges across the turn into the year. But the carry for long USD positions has increased more than previous years and may tend to support the USD exchange rate. It points to a relative shortage or tightness in USD liquidity.

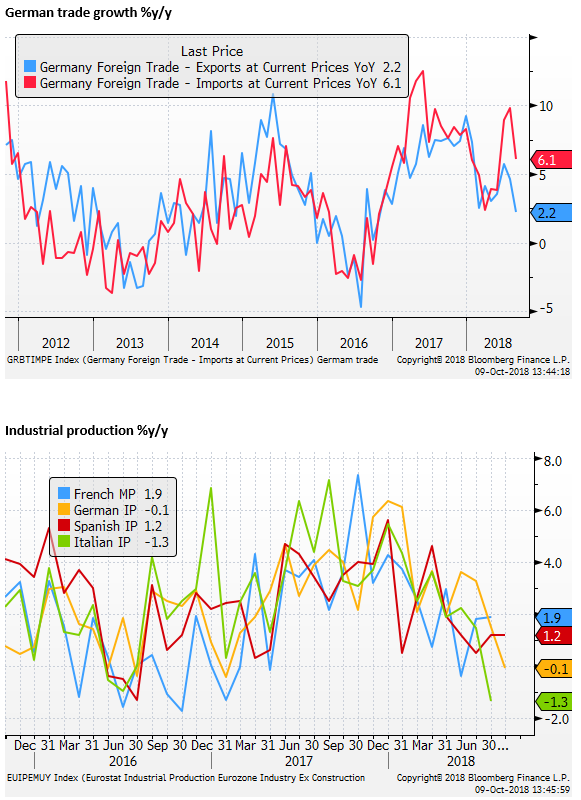

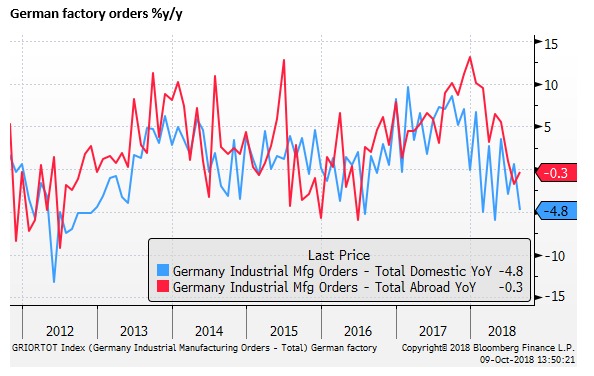

Weak German industrial reports

Recent economic reports point to sluggish in Euro’s largest economy. German export growth has stalled in recent months (2/2%y/y in August, slowest since Oct-2016). German industrial production fell 0.1%y/y in August, a low since Jan-2017. German factory orders fell 2.2%y/y in August, led by a slide in domestic orders; down 4.8%y/y

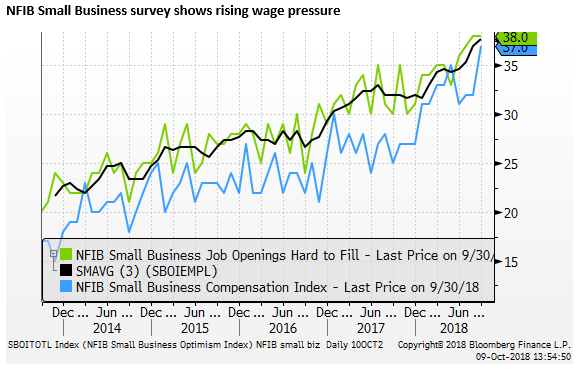

More evidence of US wage pressure

In the US, wage pressure appears to be building. The NFIB small business survey showed a sharp pick up in compensation costs to a new record high, while its jobs hard to fill index remained at a record high.

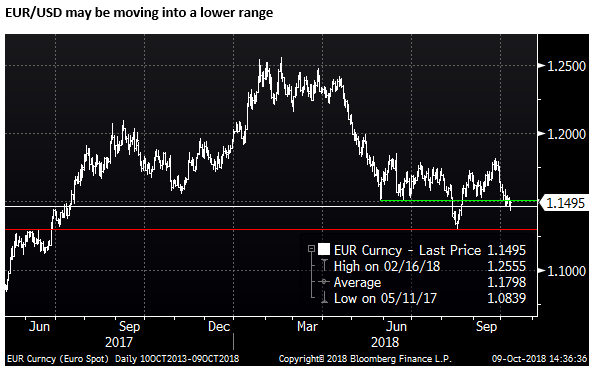

EUR/USD may be fading into a weaker range

The EUR/USD trading pattern has been choppy and mixed since mid-year. It is finding support around 1.13 to 1.15, the highs during the peak years of ECB QE policy from 2015 to 2016. The market seems reluctant to sell the EUR in this longer-term support zone.

However, the EUR may also be establishing itself below the base seen for most of Q2 (in the low 1.15s), barring the brief swoon down to 1.13 in mid-August during the height of the Turkish crisis. A failure to rebound soon may reinforce the notion it is developing a down-trend.

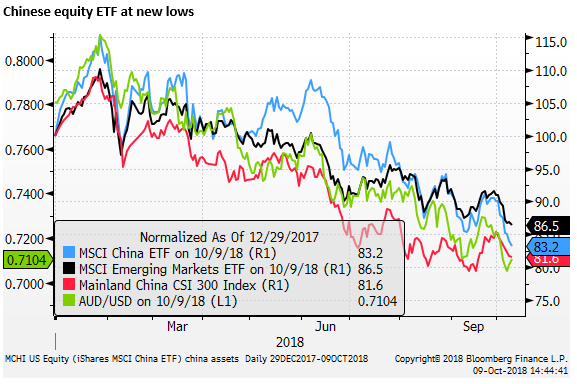

AUD faces headwinds from weak Chinese assets

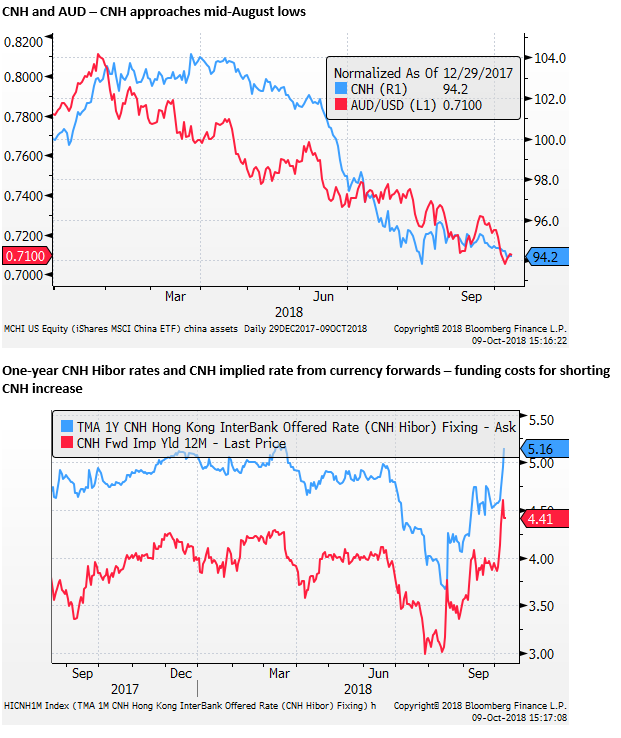

The AUD has firmed from recent lows but continues to face headwinds from China’s financial markets. While Chinese mainland equities haven’t slipped to new lows, offshore Chinese indices may be a clearer reflection of weaker sentiment; including the iShares MSCI China ETF listed in the USA.

Chinese currency hemmed at lows for the year

The Chinese currency has weakened, consistent with weaker Chinese equities and tightening US monetary policy. However, in this period of heightened risk for the Chinese economy, the Chinese authorities appear to be engineering tighter control over the currency, including allowing a spike in funding costs for shorting CNH in offshore markets.

Chinese state-sponsored hacking allegations

The recent explosive story from Bloomberg alleging Chinese state-sponsored hardware hacking has had a deep impact on several tech company share prices, including Super Micro Computer listed in the USA, who is at the heart of the allegations, and computer maker Lenovo listed in Hong Kong. Lenovo is not named in the reports, but its share price fall illustrates the broader implications for trust in Chinese manufacturing. Bloomberg has reported again today of a similar situation exposed at a US telecommunication company.

The Big Hack: How China Used a Tiny Chip to Infiltrate U.S. Companies – Bloomberg.com

New Evidence of Hacked Supermicro Hardware Found in U.S. Telecom – Bloomberg.com

An explosive story without the bang

In our view, this story is one of the most important for global financial markets; pointing to a harder US policy on trade and investment relations with China. And generating long-lasting trust issues for Chinese exports and investment. It appears to be part of the reason for a deeper fallout for emerging markets, especially those in Asia, although it is hard to disentangle from the recent impact of a surge in US yields.

We are surprised how little attention this story has got beyond Bloomberg’s reporting. There has been little follow-up from the WSJ or FT. It’s a major scandal, and denials from governments and companies are incongruous with the number of sources Bloomberg is quoting.

Adding to the significance of this story is that it came on the same day that US Vice President Pence made hard-hitting allegations against the Chinese government including systematic and broad-reaching coercion of the social and political system in the USA, and days after a significant incident between US and Chinese warships in the South China Sea.

Remarks by Vice President Pence on the Administration’s Policy Toward China – WhiteHouse.gov

The initial story has many unexplored angles, so why haven’t we heard more? Bloomberg essentially alleges that the Obama administration buried the story and attempted to work around the threats of Chinese espionage. And that major US companies like Apple accepted a “devil’s bargain” in continuing to use companies in China for manufacturing parts. The story helps explain why the US and Australia over recent years locked Chinese IT company Huawei out of major government telecommunication infrastructure projects.

The story poses a major risk for Chinese commerce because it throws a cloud over IT goods manufactured in China, or by companies that have close commercial interests with China. It suggests that the US may be planning long-lived tariffs and investment restraints on China, and will seek stronger action from its allies. It suggests that the USA and China, the two major super-powers, may become more adversarial.

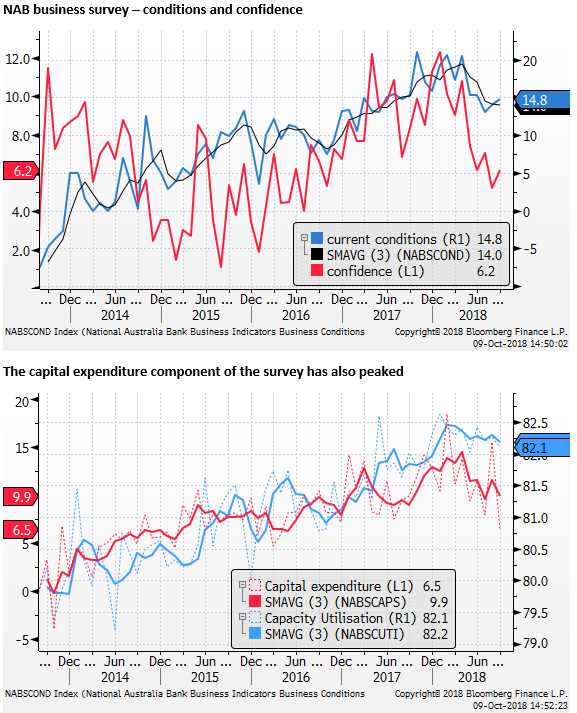

Australian economic reports show some peaking

Recent economic reports continue to support the notion that the RBA can hold rates steady for some time. However, there is some evidence of peaking, making the AUD more vulnerable to other influences, including a stronger USD, weaker confidence in China, and domestic concerns over the property market and political cycle.

The NAB business survey shows that conditions remain relatively solid, albeit down from highs earlier in the year.

The RBA can still argue that labour market indicators are strong, although job ads and skilled vacancies are below peaks earlier in the year.

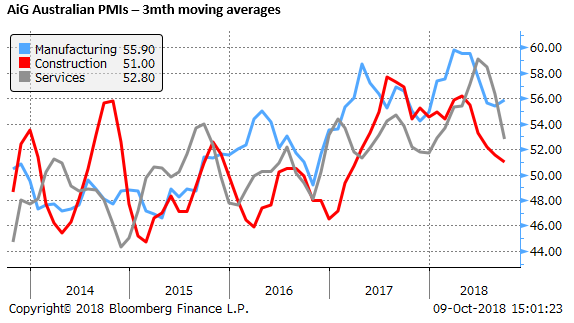

The construction sector PMI from AiG is showing the effects of peaking in the housing market, slipping to 49.3, a low since Jan-2017. AiG noted weakness in houses and apartment construction, offset by strength in engineering, led by publicly funded infrastructure projects.

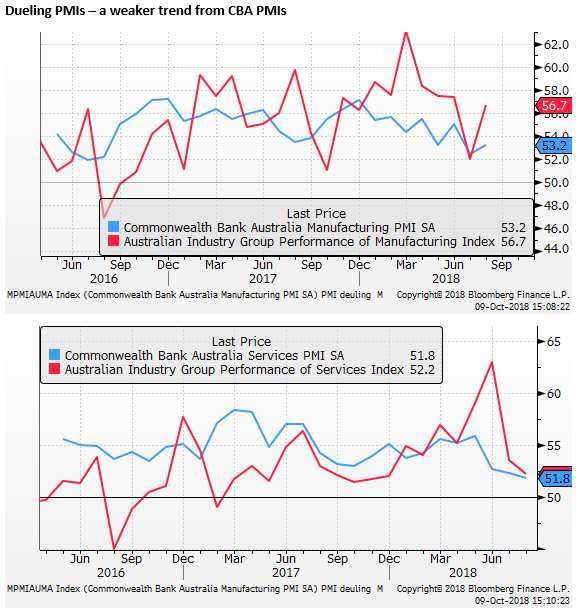

The newer PMI data from Markit, sponsored by CBA, are showing more negative trends than the AiG series for services and manufacturing.

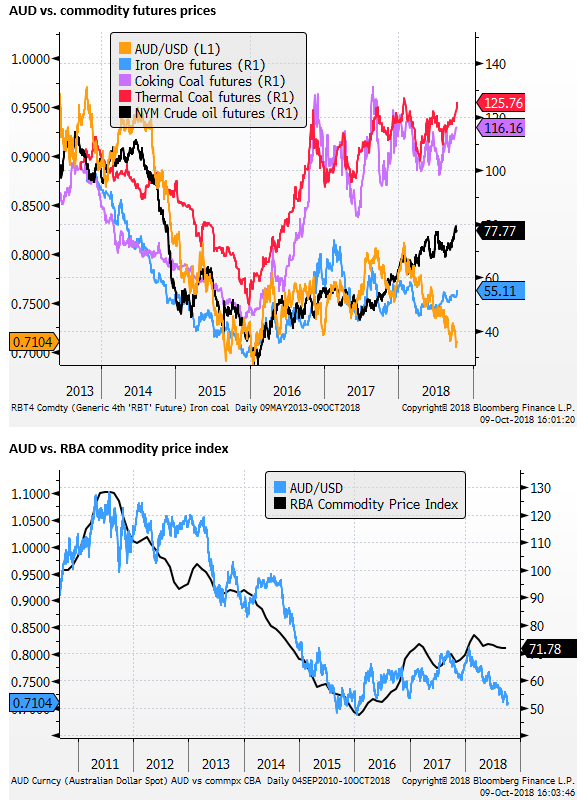

Commodity prices continue to support the AUD

The AUD continues to draw some strength from commodity prices. Chinese metals futures prices have firmed this week. Some have argued that China is and will continue to ease monetary and fiscal policy to offset risks from tariffs and tightening shadow-banking finance. And this will support demand for Australian commodities and the AUD.

However, the AUD has proven more reactive to indicators of stress in global financial markets so far this year. We would be wary of any rise in commodity futures prices in China in the context of a weaker CNY and financial market stress. Investors in China may consider them a hedge against the Chinese currency and financial assets. Their price rises may be indicative of financial stress rather than a sign of stronger demand.

Nevertheless, commodity prices relevant to Australia, especially in the energy sector would be consistent with a significant recovery in the AUD. The differential between the two is contributing to strong profitability in the mining sector and a narrowing trade and fiscal balance for Australia.