Negative feedback from US protectionist policies may boost gold

The rapid demise in Chinese assets on Monday on rehashed news that the US is set to announce investment restrictions, despite RRR cuts, reveals a deeper vulnerability in investor confidence in China. The US equity market started to show signs of negative feedback from the US administration’s protectionist policies. The remarkably contradictory comments by Navarro breed even more confusion than normal over White House policy. If economic and investor confidence has been unsettled in Asia and Europe, and the USA is starting to feel negative feedback from its own policies, gold may be poised for a recovery.

China markets show vulnerability

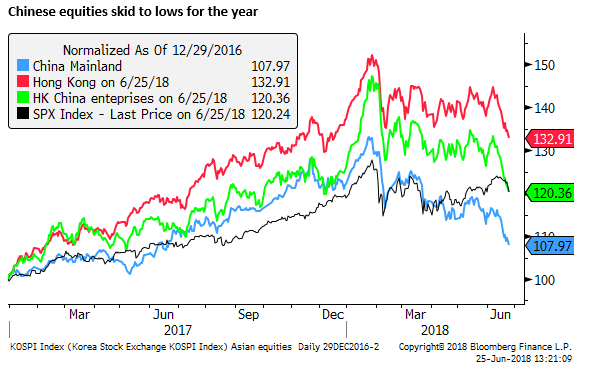

The cut in the Reserve Requirement Ratio (RRR) for Banks by the Chinese government was probably designed to cool fears over weaker growth and deleveraging, and shore up the flagging Chinese equity market.

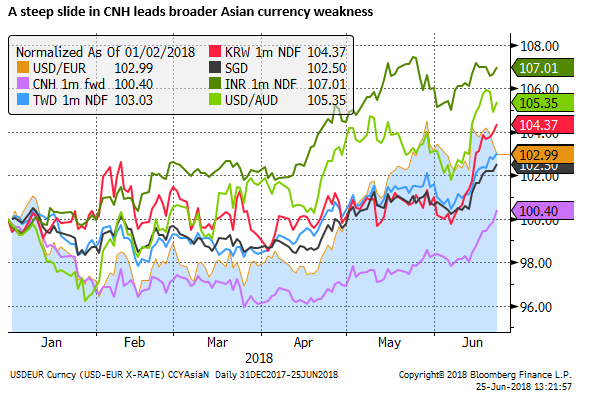

However, the Chinese equity market fell sharply on Monday to revisit its lows last week and the Chinese currency depreciated by one of its largest one-day margins (over 0.5%), extending its relatively sharp slide over the last two weeks.

The falls in Chinese assets spread across EM Asia, extending the regions relative weak currency and equity performance in recent weeks.

Recycling Investment Restriction news

The financial press pinned much of the fall in Chinese assets on reports that the US was set to announce restrictions on inbound investment from China in US high tech industries. The news was seen to be ratcheting up the pressure on China across trade and investment.

However, these investment restrictions have been in the works for weeks. Back on 29 May, when the US administration sent out a statement announcing that it was moving ahead with a 25% tariff on $50bn in Chinese goods (to be listed on 15 June), it also announced that investment restrictions would be listed by 30 June.

So here we are in the last week of June; there should be little surprise that the US is planning to announce investment restrictions this week.

And yet the financial media appeared to say that this was a new story that has surprised the market and driven a new wave of selling in asset markets. This seems to be a case of selective memory and choosing a narrative to explain the fall in Asian markets.

It is true that the market is hypersensitive to news on restrictive policy related to trade and investment, and this further detail about a previously announced policy may have contributed to weaker markets in Asia. But the steep further fall in Chinese assets on Monday suggests that there is more vulnerability than might normally be the case.

This additional vulnerability in China may reflect the evidence of financial stress that has been building in recent weeks after a number of bond defaults, the troubles reported an HNA, weak credit growth and activity indicators in May.

Troubled HNA Group Shuffles Assets to Raise Money – CaixinGlobal.com

China is moving to ease policy and we should expect that it will continue to attempt to shore up investor confidence in the weeks ahead. This may prevent recent financial stress from snowballing into financial crisis. But recent price action suggests that we need to be more concerned over the state of the Chinese economy and financial system

Negative Feedback to the USA

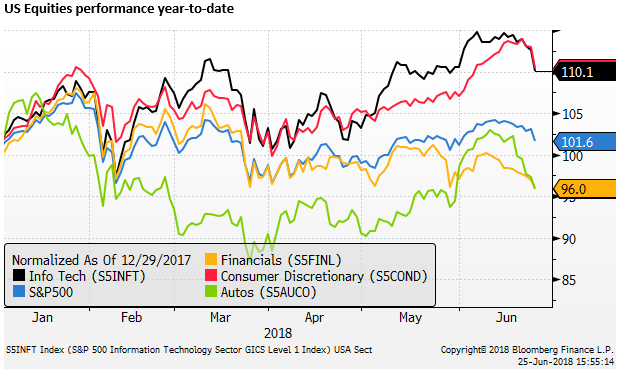

In US trading, the US stock market came under more severe downside pressure than has been seen for a while, reflecting concerns that the USA may suffer negative feedback from its own trade and investment restrictions.

One of the harder hit sectors was high tech equities, in which the US administration is supposed to soon to announce inbound investment restrictions against China.

Up until now, there has been relatively little feedback to the US economy and financial markets from its more aggressive policy stance on trade.

At his appearance at the ECB Forum on Central Banking last week, Fed Chair Powell said, “for the first time we are hearing about decisions to postpone investment, postpone hiring, postpone making decisions. That is a new thing. If you ask is it in the forecast yet, is it in the outlook, the answer is no. And you don’t see it in the performance of the economy.”

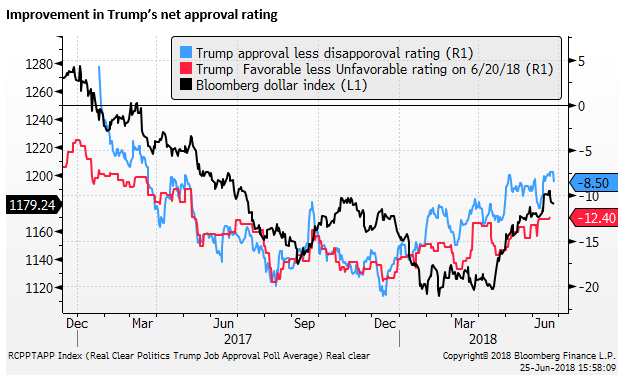

The Administration has been emboldened to push hard on trade seeing little negative feedback to US financial markets or economic reports. Given its large trade deficit, the Administration has said it is well placed to win a trade war, and this appears to have gone down well in the electorate with Trump’s approval rating creeping higher in polls.

However, the steep fall in US equities on Monday, after creeping losses last week, maybe starting to reveal some vulnerability in US markets to US administration policy.

The USD weakened against the EUR and JPY on Monday, perhaps because the market is beginning to see the risks that pursuing trade restrictions against multiple trade partners and threatening to restrict foreign investment in the US may be as detrimental to the US economy as its trade partners.

The specific news that Harley Davidson would shift some production of its motorcycles from the US to offshore factories to avoid tariffs imposed by the EU in retaliation for steel tariffs imposed by the US also appeared to hit home that US trade policy could have unwanted negative impact on the US economy.

Confusion at the White House

The US administration has been accused of sending mixed signals, sowing confusion and generating volatility in the financial markets. But they may have set a new bar on this front today with comments by Treasury Secretary Mnuchin saying on Twitter that, “On behalf of @realDonaldTrump, the stories on investment restrictions in Bloomberg & WSJ are false, fake news. The leaker either doesn’t exist or know the subject very well. Statement will be out not specific to China, but to all countries that are trying to steal our technology.”

Later Trade Advisor Peter Navarro said on CNBC that the market was over-reacting, and the Administration has “no plans to impose investment restrictions on any countries”.

Both of these statements contradict the 29 May White House statement released on its website that said, “To protect our national security, the United States will implement specific investment restrictions and enhanced export controls for Chinese persons and entities related to the acquisition of industrially significant technology. The proposed investment restrictions and enhanced export controls will be announced by June 30, 2018, and they will be implemented shortly thereafter.”

US Stocks recovered some of their steep losses after the Navarro comments, but remain well down as the contradictory reports create confusion over US policy.

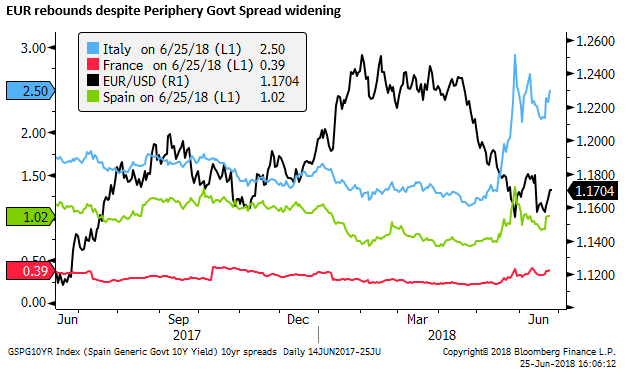

Strength in the EUR may be limited

Strength in the EUR may have been the flipside of some USD weakness, but it was harder to fathom with further spread widening in Italian bond yields over Bunds. Political risk in Italy increased after a strong performance by right-winged anti-immigration, Eurosceptic parties in municipal elections.

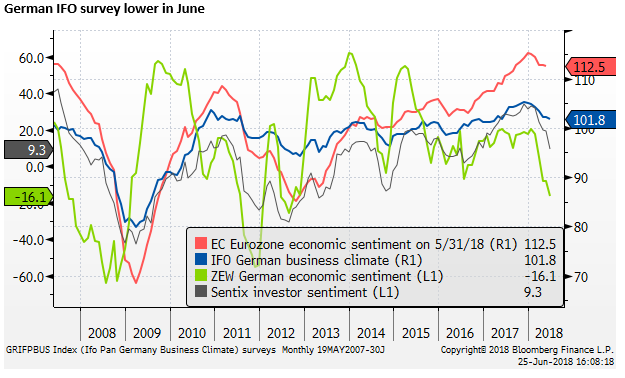

The German IFO business climate indicator fell a bit further in June, continuing to suggest that the European economy has lost momentum this year. Furthermore, Germany’s political stability continues to be unsettled by a disagreement over immigration policy.

Tougher US trade policy, including threats by the US administration to impose higher broad-ranging tariffs on European cars, can hardly help bolster confidence for the Eurozone.

As such, it is difficult to see sustained gains in the EUR.

Gold may be poised for recovery

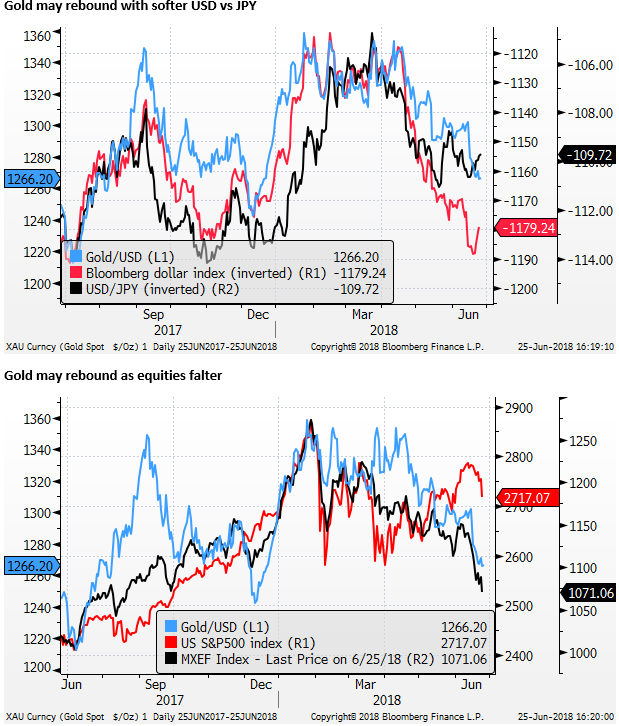

With trade policy threatening investor confidence in Asia, Europe and the USA, generating what appears to be safe-haven demand for JPY, and undermining global equities, it is surprising to see the price of Gold languishing.

Its fall over recent months is consistent with broad strength in the USD. But if we are moving into a new phase where confidence in the sustainability of US economic growth is called into question, adding to already troubling signs in Asia and Europe, then gold may be poised to rebound.