New Zealand dollar charts a new course

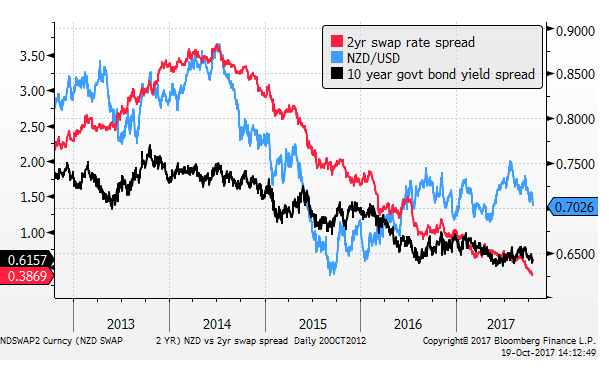

The NZD has taken a hit on the formation of a un-proven left-leaning coalition, after nine years of a right-leaning, essentially one-party led government that oversaw a return to significant budget surplus and stable solid economic growth. At least some change was always coming, since the election on 23-September, as NZ First held the balance of power and was set to enter government. While the market should not have seen this outcome as a big surprise, perhaps the reality has hit home, creating further downside risk for the NZD. We expect the new Labour-led government under new PM Ardern to provide solid leadership that keeps reasonable control over the budget. There are reasons to see some positives for the economy, as Labour will pursue increased social and infrastructure spending. However, Labour is planning policy changes that may significantly further weaken the housing market and cut immigration. These measures are likely to feed through to a weaker economic outlook and a weaker NZD. In our view, the NZD has been over-valued for some time; perhaps the change in government may prove to be a catalyst that sets the currency on a new weaker course.

New leadership

The NZD dropped sharply on the formation of an untested left-leaning coalition government led by Labour. A change from a stable right-leaning essentially single-party government that had ruled for nine years and overseen a return to budget surplus and stable, strong economic growth.

However, the result should not have been a big surprise; it was at least a 50% probability since the election. Winston Peters essentially made the decision as leader of NZ First that held the balance of power.

In retrospect, the market appears to have had unrealistic expectations that NZ First might side with the Nationals, perhaps because they won the most seats in parliament. However, NZ First’s policies are more closely aligned with those of the Labour Party. Peters said he thought New Zealanders want change and so he delivered it.

The press conferences by Labour leader Ardern and NZ First leader Peters brought home to the market that New Zealand is set to take a significantly different path on key issues for the economy; housing, immigration, and taxation. And there is likely to be a change in the RBNZ mandate.

NZ First has extracted four out of around 20 ministerial posts in the cabinet, and one parliamentary under-secretary. Not bad for a party that won 9 seats in the 120 seat parliament. Peters has also been offered the Deputy PM role, but has not said if he will take it. Clearly it’s good to be the king…..maker.

The Greens that won 8 seats will get three ministerial posts outside of the cabinet.

Jacinta Ardern, leader of the Labour Party, enlisted only around two months before the election because the party was losing the campaign, will be PM. Her party won 46 seats. The main opposition will be the National Party with 56 seats. Its leader, former PM Bill English, has not announced yet if he plans to stay on as his party leader.

Ardern said the full agreements of Labour with her coalition partner NZ First, and supply agreement with the Greens will be released next week.

The change in government creates inevitable uncertainty over the quality and direction of government. However, Ardern has performed well in a high-pressure campaign and has equipped herself well in coalition negotiations. There should be reasonable confidence in her ability to grow quickly into the role of PM. She seems quite reasonable, intelligent and has a good command over the media.

As such, there should not be fear of a chaotic, dramatic lurch towards the left or extreme populist policies that might cause significant damage to economic growth. Nevertheless, there will be policy shifts in key areas for the economy, including housing, immigration, and monetary policy. And higher taxes and spending than under Nationals.

Housing market under pressure

Ardern said that “we have always said we would prioritize putting in place that ban on foreign ownership of existing homes, and that hasn’t changed. Labour and NZ First are also expected to place firmer restrictions on foreign investment across infrastructure and land.

Labour has also said that it will phase in the removal negative gearing on property investment. A policy that is likely to significantly reduce demand for housing by investors.

And set up a working group to find a “fairer balance between the taxation of income and assets, in particular the capital gain associated with property speculation.” The result of which may increase capital gains tax, further reducing investor demand for housing.

New Zealand currently does not have a general capital gains tax, although it does treat the capital gain on residential land resold within 2-years as income for tax purposes. This policy was implemented in November 2015 to attempt to contain the frothy property market, with limited effect. Labour intends to extend this “bright-line test” to five-years, making it tougher for property investors.

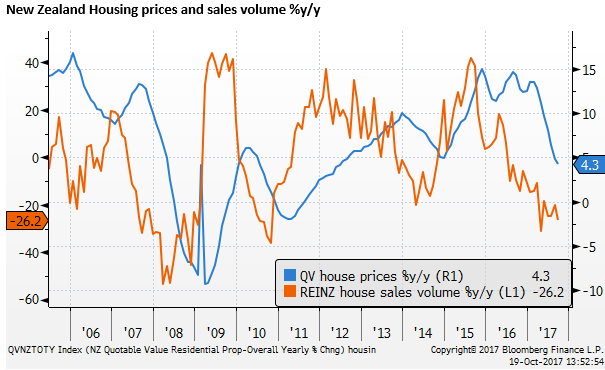

The housing market has already been under pressure this year. It has weakened in part on macroprudential measures by the RBNZ, and some broader tightening in lending standards, but probably also on nerves ahead of the election of the policy changes described above. The change of government is likely to keep the housing market in retreat.

No tax cuts but higher spending

Labour’s policy was to “Reverse National’s proposed tax cuts and re-invest that money in a fairer package of support for families and in core public services such as health, education, housing and police.”

It also plans to take stronger action to ensure multi-national companies pay their fair share of tax.

Build affordable housing

Labour and NZ First both want to build more affordable housing. They propose a new body called “Kiwibuild” to build 100,000 new homes over ten years. The houses would only be available to be purchased by first home buyers and be held for five years (else payback all capital gains).

http://www.labour.org.nz/kiwibuild

Less immigration

Asked about immigration, Ardern said that “you will already be familiar with our policy and we will be sticking with it.” Labour’s policies include tighter criteria for skilled immigrants, and tougher criteria for student visas, targeting a 20,000 to 30,000 fewer immigrants annually (from 72,000 over the last 12-months).

http://www.labour.org.nz/immigration

Broader RBNZ Mandate

Labour proposed changes to the RBNZ mandate, broadening its scope from focussing on inflation, including asset price inflation, to also include achieving full employment. “Bringing into line with other countries such as Australia and the United States.”

It also wants to introduce a Committee approach to policy decisions, including some external members. Currently, the RBNZ Governor has the final call on policy.

These changes are not too dramatic and would seem only to bring the RBNZ more into line with the RBA and Fed. They do downgrade inflation targeting in favour of employment. And suggest that in a higher inflation environment, the RBNZ might not be as eager to tighten policy. However, the RBNZ, like many countries, has undershot its inflation target for many years, and in practice, it has not operated with much difference to other central banks.

NZ First has a much more radical view of the central bank. However, Peters pointed out in his press conference that his party has not got the Finance Minister’s job. He is likely to be content with the changes proposed by Labour.

NZ First wants “the Reserve Bank Act to ensure that the role of the Reserve Bank is broadened to include not just control of inflation but also critical macro-economic factors such as the rate of growth, export growth, the value of the dollar, and employment.”

http://www.nzfirst.org.nz/an_economy_with_the_hand_brake_on

In his press conference, NZ First’s leader Peters was asked whether “he expected to go the whole hog in terms of the Singapore-style model where the currency was the key monetary policy tool rather than the Official Cash Rate.” He responded, “we should go down the road of the Singapore model…but I didn’t secure that.”

Peters flare for the Dramatic

Nevertheless, Peters did not go quietly on his desire for a weaker exchange rate. He suggested that the government should get more active with polices to subdue the NZD, to support stronger export growth.

He also gave a dire outlook for the economy, saying that the coming storm is not his fault.

He said, an “economic correction or a slowdown is looming, and the first signs are already here, in the housing market slowdown, in Reserve banks and trading banks’ nervousness, in the cessation of hot money from abroad, in property ownership concerns, in receding consumer optimism, and in ebbing retailer confidence”

“Despite having no influence on these risks, some will attempt, when the looming dangers come, to heap the blame on us. That those blame caricatures are both spurious and misplaced, won’t stop attempts to ascribe the cause of these events. That’s why we are putting the cause of this scenario out front, right now, such that such attempts will fail. Awareness of this looming consensus has affected our decision. Our choice today relates to how best we mitigate, not worsen, what is coming, we believe, and its impact on as many New Zealanders as is possible.”

He wants NZ to “start returning to an economy that understands that we live or die by exporting, that exporting as against GDP has been in decline and that we’ve got to turn it around. Unless we get far more people, far more successfully, businesses, enterprises and individuals offshore bringing money back to the family New Zealand then the slide we are currently on will continue.”

When asked if this will require a fall in the NZD, he said, “I’ve got to tell you we have not got the Minister of Finance’s job, and its for him to answer those questions. But if the IMF, and every other commentator has been saying, including the head of the Reserve Bank, that our dollar is over-valued, then perhaps the political system should respond to it. And they have been saying it for an awful long time.”

Less Capitalism

Peters also pressed the case for recasting New Zealand as less capitalist and more concerned with spreading wealth.

He said, “Far too many New Zealanders have come to view today’s capitalism not as their friend, but as their foe. That is why we believe capitalism must regain its human face.”

We wish to address the issue of poverty and concentration of wealth in fewer hands. A key focus for his party is regional development, “redressing the infrastructure deficit, especially in the regions.”

Implications for the NZD

Immigration and housing affordability were key issues in the New Zealand election. The Nationals were already implementing policies designed to address these issues. However, under the Labour/NZ First/Green government, significantly more aggressive policies to address these concerns will be pursued.

Immigration has been a double-edged sword for the economy. It has created upward pressure on house prices and generated stronger economic growth. Both factors that have contributed to a stronger NZD. On the other hand, it has helped keep wage growth subdued.

The shift in immigration policy may take time to affect the actual flow of immigration, but it should be expected to slow significantly in the next two years. On balance we see this as a negative for growth and the NZD.

Labour policies on the housing market appear much more proactive. The housing market is already slowing down. We might expect this to continue, with some risk of a significant fall in house prices that might spill over to weaker consumer demand and some financial stability risks.

This presents a significant downside risk for the NZD. However, mitigating this, the RBNZ could unwind its significant macroprudential measures that appear to have helped cool the housing market in the last year. The housing market does not appear to have excess supply, so the RBNZ might be able to help stabilize a falling housing market by unwinding macroprudential measures if required.

Nevertheless, the potential increased downside in housing prices is a reason to see more downside risk for the NZD.

At the margin, a change in the mandate for the RBNZ could be viewed as a bit negative for the NZD. However, as mentioned, Peters is unlikely to get his way on shifting the mandate to include a currency target.

Peters views on more government intervention to achieve a lower exchange rate and more export-orientated economy are in fact unlikely to generate any meaningful policy response that might directly undermine the exchange rate.

The government is planning a more direct role in building affordable housing. It is also expected to support more infrastructure spending. And it plans to spend some of the surplus on family benefits. As such, fiscal expansion is likely, and this could help boost economic growth and the exchange rate.

Fiscal responsibility is well engrained in the attitude of both major political parties. And while the Labour coalition will spend more on social services and maintain higher overall tax, and pay less concern with business and investment incentives, it is likely to keep reasonable control over the government budget.

At some level, the shift in orientation from capitalism to socialism may discourage investment and weaken economic growth and be seen as a negative for the NZD. However, the shift is unlikely to be too radical.

Perhaps the National government can be accused of not better addressing speculation to the housing market and a build-up in household debt. Labour’s more proactive taxation policy in this area might help improve this balance and provide a basis for promoting more investment in productive capacity.

In any case, the government is likely to remain relatively responsible. Over time we expect the fear of the unknown should ease and any discount in the NZD for broad political uncertainty should fade.

In our view, the NZD has been relatively expensive for some time. The fall in the last day may seem overly dramatic to an event that should have been not too surprising. However, the shift in policy direction is significant and may reinforce factors, such as a weaker housing market, which, arguably, should already have weighed on the exchange rate more than it has. As such, it may prove to be a catalyst for a more permanent shift to a weaker NZD trend.