Non-oil Commodity prices may reveal improving global growth trends

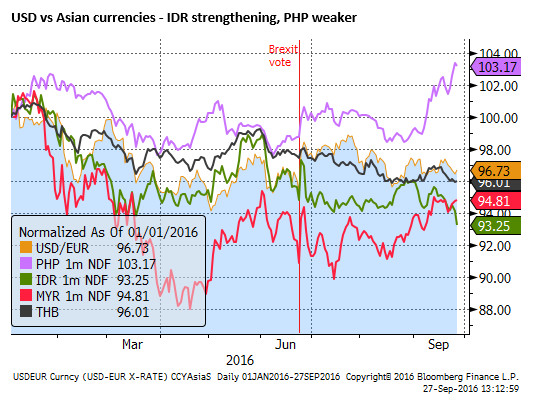

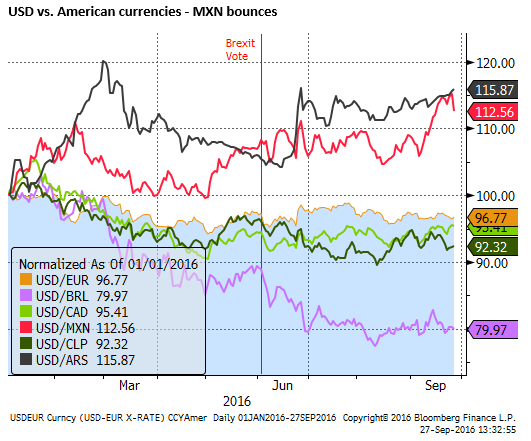

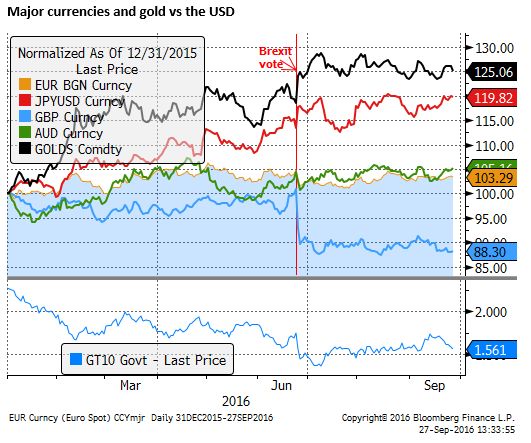

FX markets are still searching for clear direction. We have seen some evidence of a return to demand for higher yielding EM and commodity currencies in a risk constrained environment. Lower global yields and some evidence of economic stability or strength in selected EM and commodity producers are attracting capital to these currencies. The JPY remains relatively strong, but so far USD/JPY has stalled above the 100 level. EUR remains directionless held back by fundamental concerns over Brexit and its banks. But equally the aversion to risk from these factors may be discouraging capital outflow and supporting the EUR. GBP looks vulnerable, so far stalling just above support lines since the Brexit vote against several currencies. Commodity markets are showing some signs of strength. Oil may be the exception, but it too is in the middle of its range since mid-year. Economic growth appears to have stabilized and has been better that expected in China this year, helping support commodity prices. This may provide the case for further gains in EM and commodity currencies. However, this depends on the market continuing to see US rate rises delivered in a halting fashion. USA durable goods orders and PCE inflation data this week pose a risk to the benign outlook for USA rates.

Firming EM and Commodity Currencies

There has been significant divergence in emerging market currencies, but most are tending to strengthen unless undermined by specific domestic factors. The Indonesian Rupiah (IDR) has rallied to a new high this year; USD/IDR fell below a base-line since March.

The Mexican peso has been weak on risks of a Trump presidency and lower oil prices. MXN bounced back sharply after the first presidential debate and may have triggered a reversal of its recent weak trend.

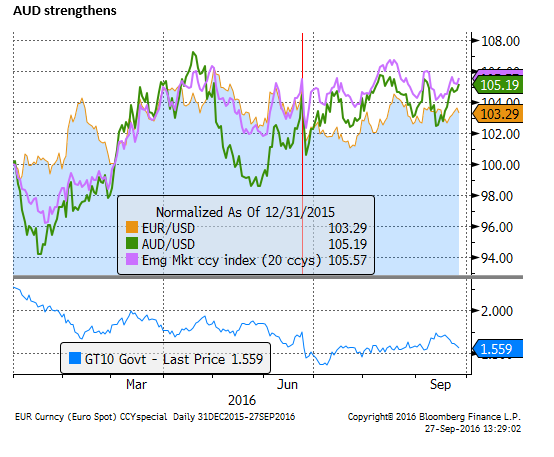

The chart below shows the AUD, EUR and an index of 20 emerging market currencies. The AUD has lifted in conjunction with the recovery in EM currencies. The chart also shows the fall in US Treasury yields back into their previous range. Lower yields are contributing to gains in higher yielding currencies.

Over the last week, the USD is also lower against JPY and EUR. The JPY has retained a rising trend and is testing the key 100 level. The JPY has strengthened since the BoJ meeting on 21-Sep where rates were essentially left unchanged against expectations that the BoJ might have cut the cash rate and steepened the JGB yield curve.

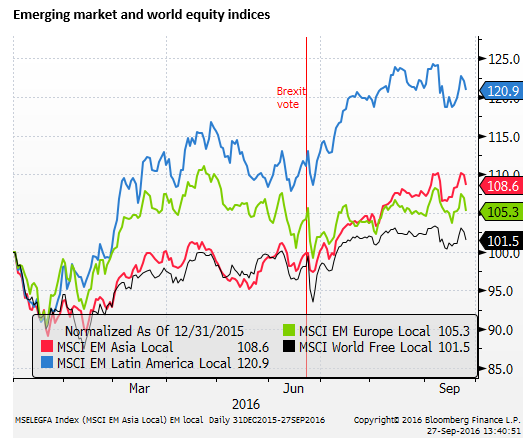

While yields have fallen and lifted demand for higher yielding assets, including EM and commodity currencies, equities have not sustained recoveries since the BoJ and FOMC meetings last week. As such risk appetite is mixed.

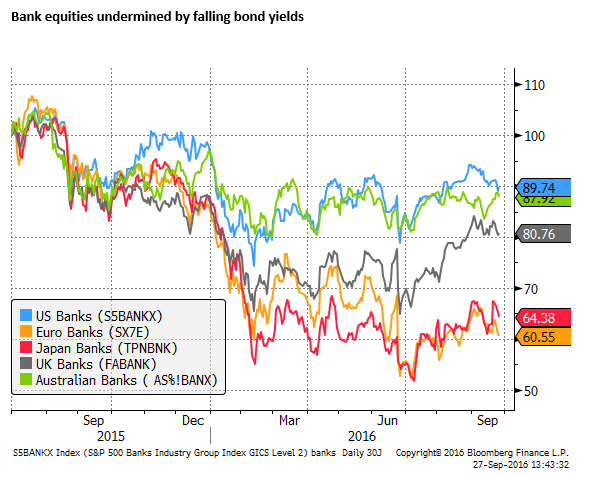

Bank equities have been relatively weak, dragged down by European banks, led by Deutsche Bank. Japanese banks have also given back some of the gains made in the lead-up to the BoJ meeting last week, undermined by the flattening in the Japanese yield curve and overall still very low yields, mostly below zero. The stronger JPY since the BoJ meeting is probably contributing to the curve flattening in Japan and weaker bank equities.

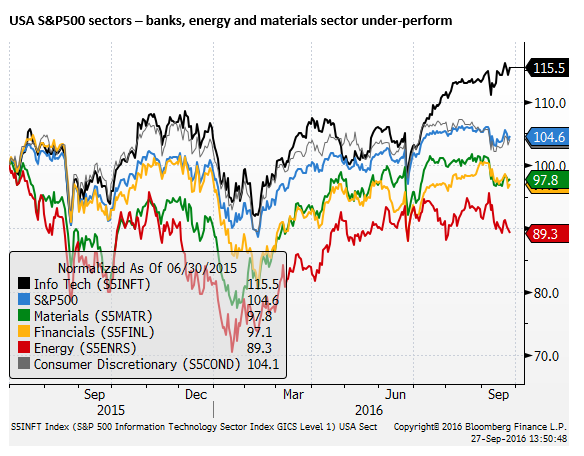

In contrast to the boost to most riskier assets from lower bond yields, bank shares have been dampened and are significantly under-performing other sectors.

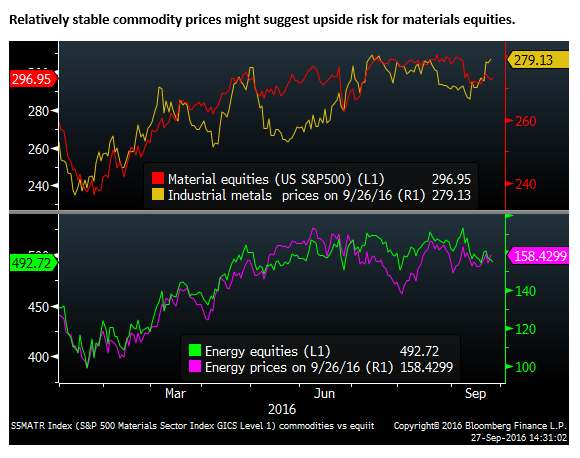

Overall equity market performance has also been undermined by weaker energy shares recently. Other material producer equites have also failed to bounce back in recent weeks, despite the fall back in government yields globally.

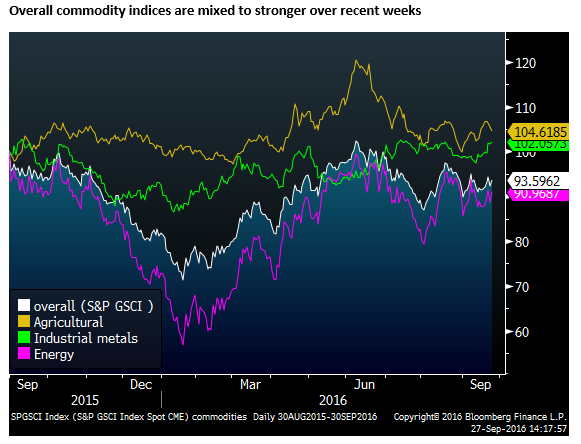

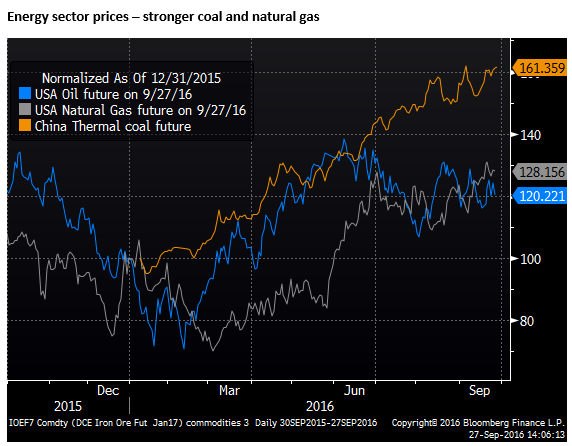

Non-oil industrial commodity price strength

Oil prices have been volatile recently, down from the peak for the year in June, up from the low in August, and now close to the middle of a narrowing wedge. However, there has been more consistent strength in natural gas and coal prices.

Steel and iron ore futures are down from a recent peak in August, but firmer over the last week, and up solidly from the beginning of the year. Coking coal (used in steel-making) has rallied sharply this year and remains near highs. The stronger steel markets indicators are consistent with improved demand in China this year and consolidation in China’s coal mining.

Copper prices are stronger over the last two weeks and broader indices of industrial metals are approaching previous highs for the year in June.