North Korean tensions support EUR vs. USD and Asia

The North Korean tensions include a bigger tail risk than usual. NK is firmly focused on developing its capacity to deliver a nuclear warhead to the USA, and the USA is set on preventing this happening. The most obvious next step is for the USA to intensify pressure on China and other nations to stop trading with NK. China and Russia may see NK as a wedge issue that they can use to drive a bigger gap between the US and its traditional allies, in particular, Europe. China is successfully building its relationship with Europe, while USA relations with Europe have weakened. NK tensions are highlighting the diminishing global political influence of the USA and distracting it from a range of domestic political issues that are coming to a head in Q3. Tensions between the US and China are threatening to deteriorate and may already be weighing on Asian currencies. Europe is relatively well placed to avoid disruption and may benefit from closer relations with China. A number of EM markets have weakened in the last month, including KRW and TWD, facing higher risk from NK and weaker high-tech equities. Higher global bond yields are spilling over to weaker equities and weaker EM currencies more generally. German bond yields broke to new highs this year. The ECB account of its June policy meeting said that the committee contemplated removing an easing bias on its APP. In contrast, the FOMC minutes leaned more dovish. Stronger growth momentum, lower economic and political risk, and shifting ECB policy bias is boosting the EUR.

North Korea tensions boost case for EUR over USD and Asia

Over the years the market has learned to look through flare-ups related to North Korea. They tend to rise and fall and have little lasting impact on local or global markets.

This may still be the base case, however, the tail risk appears significantly larger this time and there is reason to be cautious and ready for wider fallout. Already it may be weighing on KRW, TWD and other Asian currencies.

North Korea is closer to being able to deliver a nuclear bomb via an intercontinental missile; closer to being able to hit the USA.

Few people seem to understand the motives of the North Korean leaders. There does not appear to be an alternative agenda in North Korea apart from to improve its weapons technology and to show it is more prepared than the USA to go to the edge and over.

There appears to be little reason to negotiate with North Korea, few would expect them to halt their weapons program. The question USA leaders need to face is – are they willing to live with the prospect of NK having the technology to deliver a nuclear weapon to the USA. If not then when is the best time to attempt to force some kind of regime change.

US Ambassador to the UN, Nicky Haley said, “The United States is prepared to use the full range of our capabilities to defend ourselves and our allies”, “One of our capabilities lies with our considerable military forces. We will use them, if we must, but we prefer not to have to go in that direction.”

She said the US was eyeing penalties against “any country that does business with this outlaw regime”.

President Trump said, “I don’t like to talk about what I have planned, but I have some pretty severe things that we’re thinking about,” he said. “That doesn’t mean we’re going to do them.”

Trump says US mulling ‘very severe’ response to North Korea missile test – The Guardian.com

The most obvious way forward at this stage appears to involve increasing pressure on China and other nations to stop trading with NK. It appears that the US see a need for forceful action, and the most immediate threat to global markets is tension between the US and China and other nations that trade with NK.

Donald Trump’s romance with China’s Xi has cooled, ‘ass-kicking’ could lie ahead – The Guardian.com

This generates a risk to both the USA and Chinese economies, and given their size and importance, to global growth and investor confidence.

It brings into play USA and Chinese relationships with other nations and regions. Since Trump’s election, USA relationships with other nations have weakened, while China has increasingly been building stronger relationships with other nations.

In particular, the next most influential nation, Germany, as a leader for the Eurozone, has been moving closer to China and distancing itself from the USA. It is thus less likely to join the USA in pressuring China to place tougher economic sanctions against NK.

China, Germany Step Up as U.S. Retires From World Leadership – Bloomberg.com

While few nations would like to see NK further develop its weapons technology, China and Russia may see NK as a wedge issue that can be used to drive a gap between the USA and its traditional allies, and thus may not be so keen to help the USA tighten the noose around NK. Indeed they have shown ambivalence, calling for calm from both the NK and USA sides, illustrating that they are not siding clearly with the USA.

NK itself probably sees the tensions it is creating between China and the USA as useful development, highlighting the weakening position that the USA has in global politics, creating a bigger more complex problem for its main adversary, the USA.

As such, we might expect, ongoing tensions in NK, risking a bigger rift between China and the USA, spilling over to trade policies, and generating highly complex and nuanced responses from other major nations like Germany, as they seek closer economic and trading relations with China.

Germany and Europe appear relatively better placed to be hurt least by tensions related to North Korea. It is likely to support the USA on trade restrictions with NK, but does not have to lead any criticism of China if it doesn’t meet US expectations on restricting trade with NK. China will be eager to keep building stronger relations with Germany and Europe to build its influence globally and dampen the capacity of the US to wield global influence.

The risk is that NK tensions increasingly spill over to trade relations between China and the USA. This poses a significant risk to the economies of South Korea, Taiwan and other Asian nations that are significantly exposed to trade between China and the rest of the world.

The more intense focus in the USA in dealing with NK poses risks to the USA economy, including distracting US policymakers away from domestic issues such as healthcare, tax reform, the debt ceiling, spending bills and next financial year’s budget (beginning in October). The coalescing of many of these issues in Q3 creates higher uncertainty over US economic and monetary policy into the second half of the year.

The capacity of Europe to place itself on the fringe of the NK issue and build stronger economic and political relations with China, makes it appear as a relatively safe place to invest. The more fraught relationship between Germany and the USA since the election of Trump may only increase the prospect that Europe pulls closer to China.

The G20 in Hamburg this weekend is an important event where Trump and other leaders will be able to state their positions with respect to NK and pressure each other to support their actions.

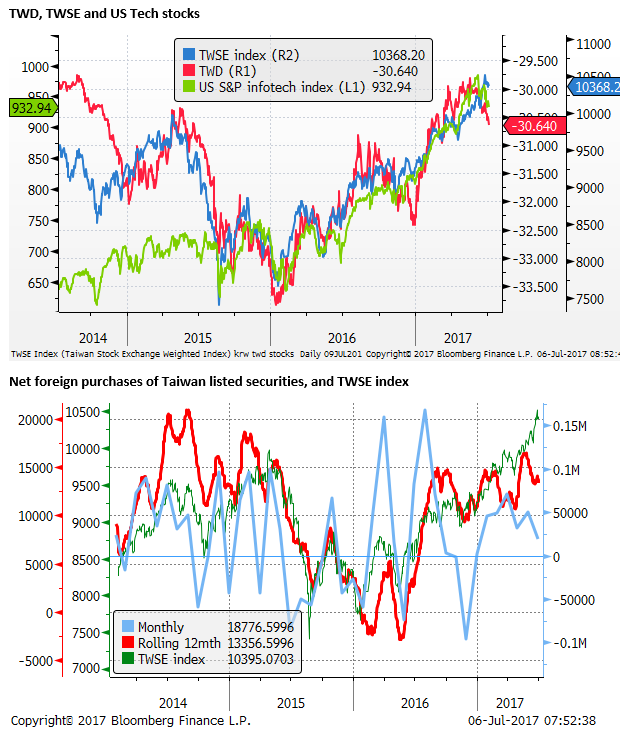

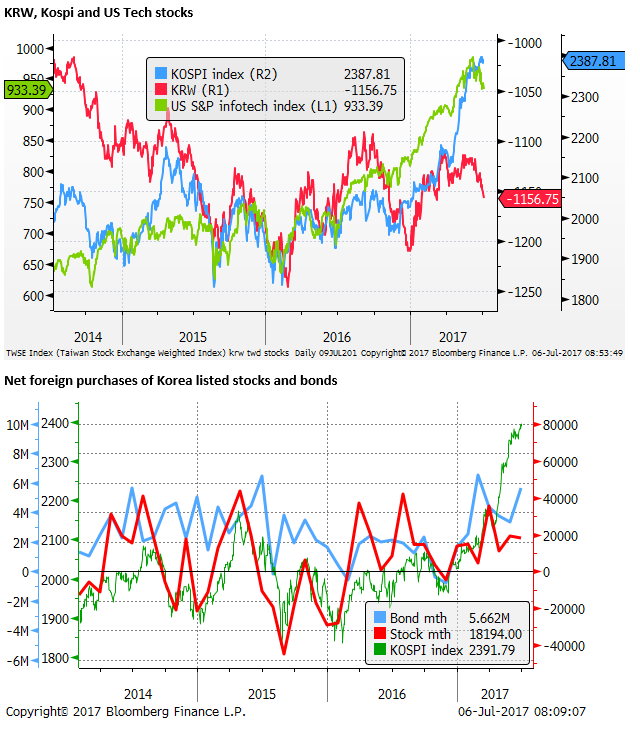

Weakness in KRW and TWD

There has been a consistent weakness in KRW and TWD over the last month. This may have started with a correction in high tech equities that have significantly underperformed other sectors in the last month. However, the Kospi and TWSE stock indices continued to rise and experience net foreign investor inflows at least through June.

There has been a relatively unusual divergence in the KRW and TWD exchange rates (weaker) from their domestic stock market equities (stronger). Their currencies have followed more closely US tech sector equities since early-June.

More recently, these currencies may reflect increasing tensions related to North Korea.

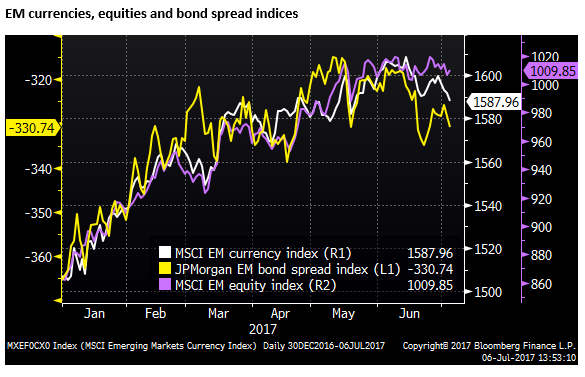

Broader weakness in EM currencies

Several EM currencies have weakened in the last month or at least in the last week. The Russian Ruble (RUB) has weakened significantly over the last month. This reflects weaker oil prices. The Russian PMI data also point to a broad slowing in the economy.

The Turkish lira (TRL) has fallen significantly in the last week. Higher global bond yields maybe undermining the TRL and several other high-yield EM currencies to varying degrees.

Global equities are experiencing some downward pressure from higher bond yields, including EM equities and bonds, spilling over to broader EM currency weakness.

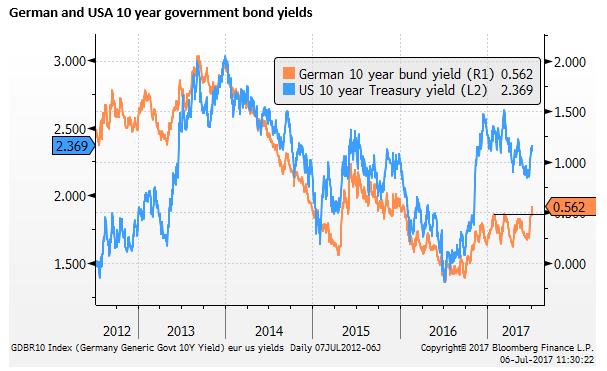

Eurozone yields break to a new high

Eurozone long term yields have jumped on Thursday, leading a rise in global yields. The rise in German 10 year yields, pushed them through the top of the range this year, to a high since Jan-2016 generating a rising trend.

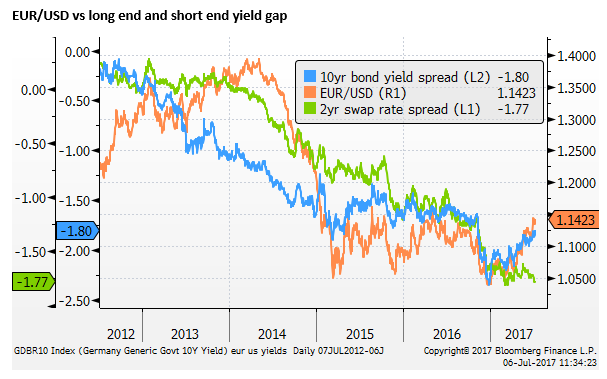

The rise in German 10 year yields, is also resulting in a narrowing of the yield gap between US and German long-term bond yields this year, helping justify a stronger EUR, even though the short-term yield gap has widened further.

ECB talked about removing APP easing bias in June

The rise in German yields on Thursday appeared to be supported by the ECB’s Account of the Monetary Policy Meeting on 7-8 June.

Yields have jumped sharply since 27 June when Draghi spoke at the ECB central bank forum, sounding more confident in the capacity of the ECB to reach its inflation target over the medium term. Following that speech, which generated a sharp rise in the EUR and German bund yields, some ECB officials came out to say that the market had over-interpreted Draghi’s speech that emphasized the need for patience and sustained monetary accommodation.

The ECB account of the June policy meeting released on Thursday continues to call for patience and sustained policy accommodation, but it indicated that the committee members discussed changing the guidance on its Asset Purchase Programme (APP).

It appears that Eurozone bonds and currency are especially sensitive to evidence that APP tapering is moving into view, however gradual and cautious the ECB sounds.

At the ECB 8 June policy meeting, the ECB removed the downside bias to cut rates and moved from a downside bias to a balanced outlook for growth (Comey lets loose, Draghi hangs loose, 9 June – ampGFXcapital.com).

The market was so hyped up ahead of the June ECB meeting, looking for evidence that the ECB was moving toward tapering, that the EUR weakened somewhat after the ECB meeting, because the ECB also unexpectedly lowered its inflation forecasts.

The ECB account of the MP meeting had the opposite effect on Thursday, boosting the EUR, and sending German bond yields to new highs, because the account indicated that the ECB were discussing removing the easing bias on its APP.

They decided not to, mostly, for fear of triggering a rapid rise in the EUR and yields, that would tighten monetary conditions prematurely. But the chances that they actually expand APP are low, the guidance was appropriate only “for now”, and the bias “could be reviewed”, suggesting that at upcoming meetings it could be dropped.

If they are willing to drop the bias to expand APP, then they appear to be moving closer towards tapering the size of the APP.

Extracts from the ECB account of MP meeting:

“It was argued that the improved economic environment with vanishing tail risks, in principle, suggested also revisiting the easing bias with respect to the APP purchases, whereby the Governing Council signalled its readiness to increase the pace and/or duration of the asset purchases if necessary. However, it was cautioned that prudence remained warranted, as the economic expansion had yet to translate into stronger inflation dynamics, and a sustained adjustment in the path of inflation towards the Governing Council’s inflation aim could not yet be confirmed. The assessment of the prospects for a sustained adjustment argued for patience, as the inflation outlook remained vulnerable to a premature tightening of the monetary policy stance. Therefore, in the light of the prevailing uncertainties, predominantly related to global factors, the Governing Council was well advised to adapt its forward guidance to the changing economic environment only very gradually.”

”While such changes [expanding the APP] had become less likely, leaving this part of the Governing Council’s forward guidance in place for now was considered, on the whole, preferable.”

“At the same time, it was cautioned that even small and incremental changes in the communication could be misperceived as signalling a more fundamental change in policy direction. This could trigger unwarranted movements in financial conditions, which could put the prospects of a sustained adjustment of inflation at risk.”

“While there were valid reasons at this juncture to retain the APP easing bias, it was noted that, as the economic expansion proceeded and if confidence in the inflation outlook improved further, the case for retaining this bias could be reviewed.”

“Therefore, continued caution in communication remained warranted. In particular, it was necessary to avoid signals that could trigger a premature tightening of financial conditions.”

FOMC minutes lean dovish

Contrasting with the ECB account, released on Thursday, the FOMC minutes released on Wednesday suggest that the Fed are less confident on the path for policy.

Following the 13-14 June FOMC meeting, the USD rose and US yields recovered, because the Fed pressed ahead with its third quarterly rate hike in a row, and set out a plan for unwinding its asset holdings. Chair Yellen indicated that the asset unwind was expected this year and could commence relatively soon. And she downplayed the sharp recent fall in US inflation as related to special factors that were likely to be temporary.

However, the minutes released Wednesday indicate that the low inflation outcomes were a significant cause for concern. And there was some reluctance to hike rates once the Fed begins unwinding of its Asset holdings.

The USD and yields did not react much to the FOMC minutes released on Wednesday, perhaps because the market is seeing broader global trends towards less monetary policy accommodation and higher yields.

The Fed minutes did illustrate that financial stability concerns are playing a bigger role in policy decisions, emboldening the Fed to tighten despite the weaker inflation outcomes. The Fed was concerned by high asset prices and easing financial conditions (despite their policy tightening to-date).

Nevertheless, the minutes suggest that the Fed will be more cautious about rate rises ahead, both because inflation is lower and they are readying to wind-down the balance sheet.

All FOMC members thought the asset unwind would begin this year; several thought in a couple of months (September meeting). Some preferred later.

A WSJ article from earlier in the week suggested that the Fed might prefer to start the QE unwind in September, but then delay a decision on further rate rises until December. This seems to gel with some reticence to hike during the balance sheet unwind.

FOMC minutes on inflation

There were “several” FOMC members concerned that low inflation would persist and that the historical relationship between “resource utilization” and inflation [Phillip’s curve] “appeared to be weaker than in previous decades.”

And “some participants” emphasized downside risks, particularly in light of the recent low readings on inflation along with measures of inflation compensation and some survey measures of inflation expectations that were still low.”

Countering these views, “a couple of participants expressed concern that a substantial undershooting of the longer-run normal rate of unemployment could pose an appreciable upside risk to inflation or give rise to macroeconomic or financial imbalances that eventually could lead to a significant economic downturn.”

“Participants agreed that the Committee should continue to monitor inflation developments closely.”

“Several” and “some” expressing concern over low inflation is more than “a couple” countering their views. But there were presumably a larger number of fence-sitters. They all agreed inflation developments needed monitoring.

It is noteworthy that the couple countering the low inflation concerns brought into the discussion “macroeconomic or financial imbalances.”

FOMC minutes on financial stability

The minutes said, “In their discussion of recent developments in financial markets, participants observed that, over the inter-meeting period, equity prices rose, longer-term interest rates declined, and volatility in financial markets was generally low. They also noted that, according to some measures, financial conditions had eased even as the Committee reduced policy accommodation and market participants continued to expect further steps to tighten monetary policy.”

“A few participants expressed concern that subdued market volatility, coupled with a low equity premium, could lead to a buildup of risks to financial stability.”

“A few participants also judged that the case for a policy rate increase at this meeting was strengthened by the easing, by some measures, in overall financial conditions over the previous six months.”

FOMC minutes on asset wind-down

All participants agreed that it “would likely become appropriate” begin reducing the Fed’s holdings of Treasuries and Agency bonds this year. But there was disagreement on how soon and how this might affect rate policy.

“Several preferred to announce a start to the process within a couple of months.”

“Some” want to wait before commencing QE down, to allow more time to assess the outlook for the economy and inflation, and “Several” thought that a QE wind-down would result in more gradual rate hikes.

“A few of these” were concerned that the market might “misinterpret” the balance sheet wind-down as a “less gradual” policy normalization.

“Some others” thought the QE wind-down would not make much difference to the path for rates.

“Several participants indicated that the reduction in policy accommodation arising from the commencement of balance sheet normalization was one basis for believing that, if economic conditions evolved broadly as anticipated, the target range for the federal funds rate would follow a less steep path than it otherwise would. However, some other participants suggested that they did not see the balance sheet normalization program as a factor likely to figure heavily in decisions about the target range for the federal funds rate. A few of these participants judged that the degree of additional policy firming that would result from the balance sheet normalization program was modest.”

A “few participants” that supported the rate hike in June, “were less comfortable with the degree of additional policy tightening through the end of 2018 implied by the June SEP median federal funds rate projections.” This suggests that they were biased towards delaying hikes as the QE wind-down proceeded.