NZD in rude health, currency wars rekindled, gold threatening new run

The rampant rally in the NZD reflects rude health in the New Zealand economy compared to a stagnant global economy, rapid immigration and housing shortage underpinning its housing market, sluggish response by the RBNZ in developing its macroprudential policy tools and a melt-up in global emerging market and commodity currencies as global yields are crushed to new lows by hyper-active central bank policy easing. The AUD/NZD has fallen through key psychological support significantly under-performing its yield spread. This reflects the much higher uncertainty in Australia related to an over-supply of apartments. We see evidence of a rekindling of the currency wars as EM and commodity currencies are forced up against their will. Global asset markets look more unstable underpinned by record low yields despite greater uncertainty over the global economic outlook in the wake of the USA payrolls and intensifying Brexit uncertainty. Gold may continue its resurgence as the alternative currency and safe haven.

Rampant Kiwi

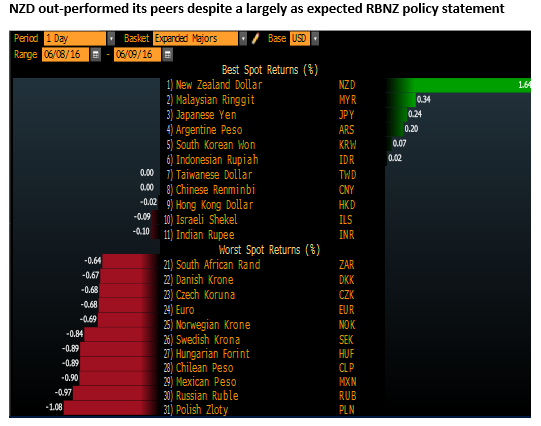

The NZD surged in the lead-up to the RBNZ meeting yesterday and following it. Its gains on Thursday after the RBNZ announcement are especially impressive because most other currencies were pulling back from their strong run against the USD since the much weaker than expected US payrolls report.

The AUD/NZD drop highlights the higher risks for the Australian Economy

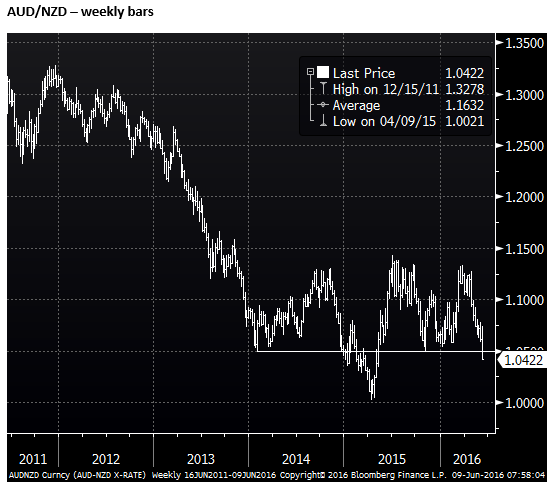

The AUD/NZD has dropped abruptly to below 1.05, and may be causing a number of players to capitulate on bets the cross would rally as the gap between their economic growth rates and interest rates had narrowed significantly over the last year.

The RBA also held its rates steady and removed an easing bias from its statement earlier this week following much stronger than expected Q1 GDP, stronger trade data, house prices, business credit, job ads, and services PMI. The AUD may also have benefited from stronger oil and gas prices more than the NZD, and some recent firming in iron ore and steel prices.

However, these developments failed to lift AUD much vs. the NZD and the post-script of the RBNZ’s policy announcement that still has an easing bias is a sharp drop in the AUD/NZD through a key psychological support. The AUD/NZD went very close to an historic brush with parity in April 2015; many will be wondering what may stop it this time.

The last time AUD/NZD had a brush with parity, the RBA was in the process of delivering policy cuts in early-2015, and the RBNZ was on hold after a series of four 25bp rate hikes in 2014. The yield gap was at its widest in favour of the NZD since 2007, and the low AUD/NZD might have been justified by the rates spread.

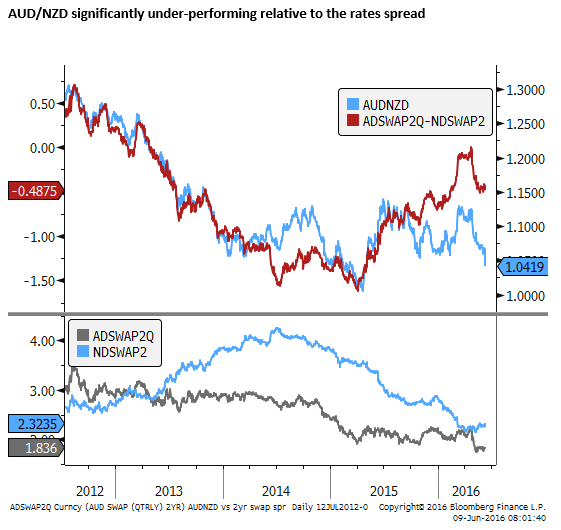

This time the currency pair is significantly under-performing its past relationship with the rates spread, after the RBNZ more than fully reversed its 2014 rate hikes with five 25bp cuts from June last year to March this year. Over the same period the RBA cut once in May.

Unstable Australian housing market

However, the sharp fall in the AUD/NZD may reflect the proximity of risks that appear much greater in Australia. As discussed in our report earlier this week (AmpGFX – What keeps the RBA awake at night; 8 June), “The outlook for the Australian economy is highly unstable.” A key cause of concern, one discussed ominously in the RBA policy statement on Tuesday, is an over-supply of apartments, juxtaposed against a tightening in credit conditions to foreign buyers and investors in those apartments, and prices already falling below the agreed off-the-plan settlement prices.

The risk is high that financial stress associated with this sector spills over to broader weakness in the Australian housing market. But remarkably, investors appear to be running harder in recent months to buy existing housing stock ahead of possible tax chances if the opposition Labor Party win the 2-July election. The polls are close in the election, but the betting market only rates the chances of a Labor victory at less than 30%.

The recent resurgent housing market in Australia appears more unstable than normal. It makes sense from the global perspective of hyper-active global monetary policy crunching yields and pumping up asset prices as Australian savers find fewer alternative places to invest. But buyers are ignoring the risks of an over-supply of apartments in the major cities, presuming these do not offer a sufficient substitute for the existing stock of housing.

The rush to beat possible tax changes that are not likely in any case and over 12 months away, also ignores reasoning that if enacted they will reduce the incentive for future investment and reduce demand and expected future re-sale value. It adds to the risk that there is a short term blip higher in prices that is reversed either after the election if the Liberal National Coalition is returned to power, or even something more unstable and hard to predict if the Labor party is elected.

Housing underpinned in New Zealand by short supply and rapid immigration

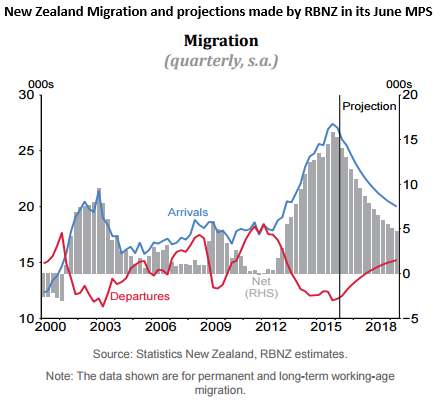

A key point of difference between Australia and New Zealand, is that the latter is in the midst of a record immigration boom that has dramatically tightened its housing market. The RBNZ has enacted macroprudential measures to help control its housing market boom, and may extent thiese over the coming year, but its housing market, at least for the next year and probably several years looks much more stable.

The immigration boom is also providing broader support for the economy and even though the gap in economic performance has narrowed between New Zealand and Australia, and both are benefiting from a boost in Chinese tourism and education and other services, the underlying state of the housing markets in both countries points to a substantially higher immediate financial stability risk in Australia.

Australia pumped up its housing market in 2013/2014 in an effort to cope with a steep down-turn in resources investment. This has been effective in helping underpin the economy, but now leaves the Australian economy with a lot of new apartments coming on stream and much higher house prices, owned by a greater share of highly leveraged investors.

The bottom line is that AUD is a high risk currency and it is not surprising that it is slumping relative the NZD.

RBNZ policy statement served up the usual

There was nothing remarkable in the RBNZ policy press-release on Thursday. It continued to argue the case for a lower exchange rate and repeated the policy guidance that, “Further policy easing may be required to ensure the future average inflation settles near the middle of the target range [1 – 3%].”

Monetary Policy Statement fueled the kiwi flames

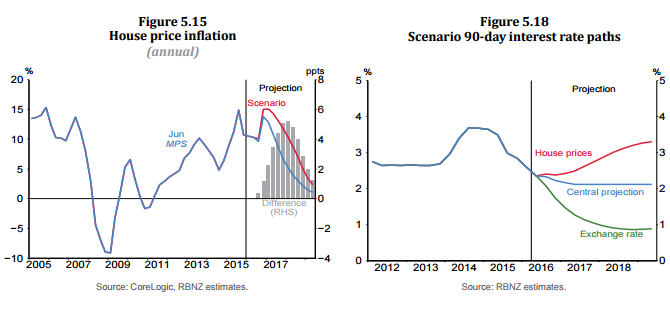

The RBNZ monetary Policy Statement said that it is essentially accepting a slower return to its inflation target to avoid further exacerbating rapid house price gains and their associated financial stability risks.

Rates are relatively high in New Zealand (2.25% official cash rate) in the current record low global yield environment, placing upward pressure on the NZD, but mortgage rates are at record lows in New Zealand and are fueling more rapid property investment.

The fact is that the New Zealand economy is in rude health compared to most countries in the world, and the pressure to cut rates arises mainly via the strength in the exchange rate.

In the current global environment of record low yields and expanding QE policies in Europe and Japan with negative rates, spilling over to global markets, the risk is that the NZD become more uncomfortably high for the RBNZ.

Helpless Governor

The RBNZ Governor Wheeler could not betray his sense of helplessness when asked about the prospect of intervention to weaken the NZD. He essentially said global FX flows were apt to overwhelm any intervention that the RBNZ might under-take. His lack of confidence in this tool appeared to only embolden speculative buyers of the NZD during his press conference.

Macroprudential measures coming too slow

A key issue for the RBNZ is the strength of the housing market. Most observers of the RBNZ have been looking for it to enhance macroprudential measures to cool the housing market and provide clearer scope to lower interest rates in the pursuit of capping the NZD and lift CPI inflation. However, the RBNZ has been slower to move on new macroprudential measures than expected, generating upward pressure on the NZD.

The RBNZ failed to use its Monetary Policy Statement to put any flesh on possible new macroprudential measures. Worse, it included a scenario where house prices rise faster than forecast over the next two years, resplendent with a higher interest rate forecast.

Most observing the New Zealand housing market would rate this a high probability not just a scenario to consider as a possible outlier to the Bank’s base case forecast.

The RBNZ might have been better served by including a scenario where they introduce new macroprudential measure and these cause house prices to fall more than forecast, allowing the markets imagination to work in favour of a weaker NZD.

The topic of macroprudential measures was addressed in the RBNZ Governor’s press conference. He did hint that new caps on Loan-to-Value ratios are likely to be introduced. Currently a limit of 70% applies to investors in Auckland, he might lower that and/or extend it to other regions and owner-occupiers.

However, the timing was nebulous, despite being needed now. Asked if the Reserve Bank would have new controls in place before the end of this year, Governor Wheeler said: “It’s possible that we would be moving before the end of the year, or before that.” (Source: Interest.co.nz)

Ahead of the 28 April policy meeting the market speculated the RBNZ might cut and announce advanced planning on macroprudential measures with its 11 May Semi-annual Financial Stability Report. Alas the market received only more talk about coming measures including possible Debt-to-Income caps.

But there appears to have been little advance since then. At the policy press conference on Thursday, Governor Wheeler said there was much more work to be done on DTIs and these were possible only sometime next year.

So the prospect of macroprudential measures remain a factor that may impinge on the housing market and open the door for rate cuts and a lower NZD. However, the timing has been pushed back to an uncertain frame of later this year, contributing to the resurgent NZD. LVRs are possible this year, but DTIs which offer the hope of being more effective appear more than a year away.

One mitigating factor is that the New Zealand subsidiaries of Australian banks that have essentially cut out lending to foreign investors in Australia without Australian-sourced income, have recently extended the new tougher lending rules to New Zealand. This may help take some steam out of the New Zealand property market, however local investors are driving the market.

Hyper-active central policy easing and resumption of currency wars and resurgent gold

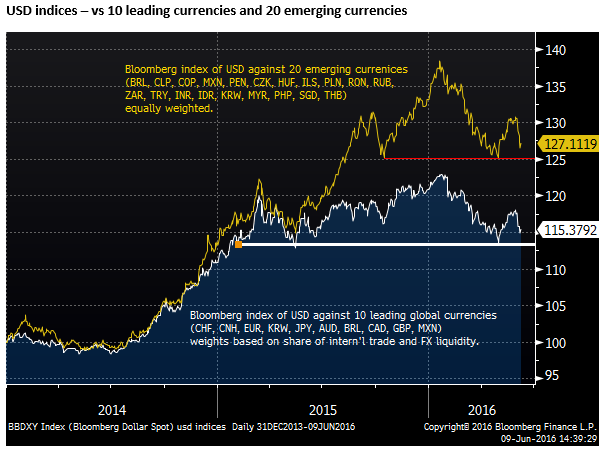

Since the US payrolls report last week we have seen global bond yields crushed to new lows and a melt-up in emerging market assets.

The payrolls were a shock and threw significant doubt over the state of the US economy. Nevertheless, the fall in yields and run up in equities were an odd and excessive response to this development.

It appears that the hyper-active central bank policy easing in Europe and Japan played a big-part in this melt-up. The ECB began purchasing corporate bods this week, and are scheduled to kick-start the Targeted Long Term Refinancing Operations (TLTRO) in 22 June.

The BoJ continues to amass bonds and drive its yields into negative territory and is widely expected to further expand its QE policy and possibly cut rates further in coming months (if not on 16 June).

Only the prospect of Fed policy tightening was keeping yields up, and with this fading on the weak payrolls data, yields have been crushed.

The crush in yields has forced up asset prices and tightened credit spreads globally. But this has happened without any improvement in the global growth outlook, it came despite a weaker outlook in the most important economy – the USA, and increased Brexit fears.

We have seen something of a resumption in the currency wars with then USA winning, emerging market and commodity currencies have been forced up against their will. The EUR and JPY having earlier strengthened, have stalled. The GBP is being held back by heightened Brexit uncertainty.

We appear in a more unstable state, yields are extraordinarily low, global asset prices are high, underpinned by low yields, and global growth expectations remain stagnant and appear more uncertain.

Gold has rebounded, in most respects reflecting the weaker USD, but also as an alternative asset from the weak major currencies, low global yields, and the fear of what happens next if global monetary easing continues to fail to lift global demand.

What happens next is either asset prices fall as deflation and default risk rises, or official policy becomes even more hyperactive rekindling currency wars and/or opts for overt inflation policies such as the so called Helicopter monetary policy.

Only a quick resumption of confidence in the US recovery and prospects for Fed hikes might cap gold again. We see some risk that the FOMC appears more hawkish than expected next week, but with the Brexit risk hanging over the market and the US election campaign adding to uncertainty in the US economy and its relationship with its trading partners, we wonder if gold is about to see a run to new substantial highs for the year.