NZD well placed to benefit from improving EM/commodity currency sentiment

In our recent reports we have expressed a positive view for EM and commodity currencies (See AmpGFX Reports on 12 and 14 April). One of the currencies we have been watching in this regard is the New Zealand dollar. The NZD has some favorable attributes in contrast to a number of other commodity currencies; including the AUD. It has political stability, a stronger housing market, and in our view too much risk of further rate cuts by the RBNZ are now priced-in. In contrast, Australia is facing a tight fought election of 2 July, declining immigration and an over-supply of apartments, and its banks are under pressure. The AUD has benefited from a bigger rebound in its commodity prices than NZD, and recent strong economic reports in Australia have lifted the AUD a little more than the NZD. Based on the differential in their yields, AUD/NZD still looks like it could rise significantly further. However, the sluggish rise in AUD/NZD may reflect the higher risk elements in Australia.

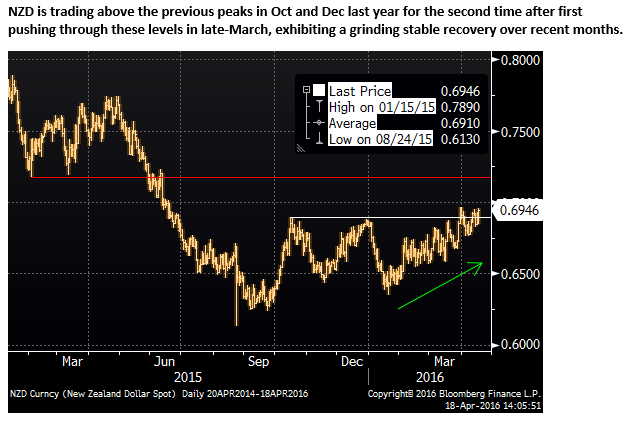

Rising trend in commodities and emerging market assets

The sharp recovery in oil prices and equities in the wake of the failed agreement at the Doha oil producer talks over the weekend highlights the recent bullish trend in emerging and EM currencies. Several currencies are exhibiting a rising trend over recent months, pushing through resistance levels. The NZD is no exception. In light of the recent improvement in economic reports from China and several other Asian countries, sustained pickup in commodity prices, record low government bond yields, prospects for more policy easing in Japan, and policy on hold for longer in the USA, we continue to anticipate further recovery in demand for EM and commodity currencies. While longer term risks remain, it appears that sentiment still has room to improve in the near term.

Political risks in Australia

One reason we have tended to favor NZD over the AUD is the uncertainty over the upcoming election (2 July) in Australia, with the opposition Labor Party drawing even in polling with the ruling Liberal National Coalition (LNC). As we have discussed in several reports this year, the election is likely to highlight underlying vulnerabilities in the Australian economy with debate over contentious taxation policy on housing investment.

Malcolm Turnbull’s Senate charade to bring on election – AFR.com

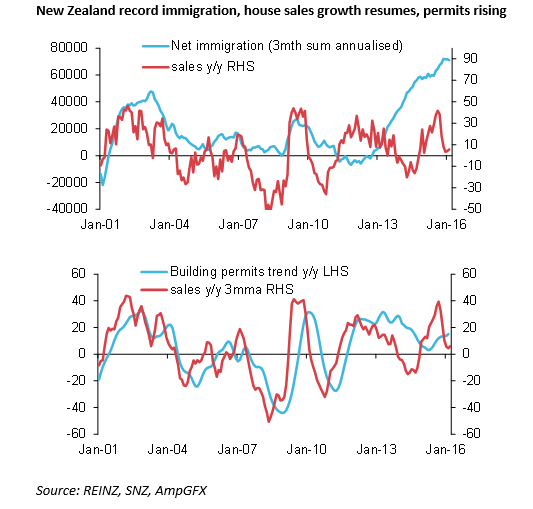

New Zealand housing market strength

A second reason is the relative strength of the New Zealand housing market underpinned by rapid immigration. The RBNZ has implemented macroprudential policy to cool the housing market, mostly in the largest city of Auckland. This was a factor that gave the RBNZ space to cut rates in December and March. However, the housing market remains hot; it has resumed price and sales growth in Auckland and is rising strongly in a number of other cities. As such, the RBNZ will be reluctant to cut rates further.

Auckland rebounds – Corelogic.co.nz

House price records smashed across New Zealand as ‘Halo Effect’ grows – REINZ.co.nz

In contrast, in Australia immigration has slowed. And after a rapid run up in building activity over the last two years there is an over-supply of apartments leading to weaker prices at least for this sector of the housing market.

Reserve Bank warns of apartment price shock – TheAustralian.com.au

Melbourne CBD apartment values fall 30pc, settlement fears rise – AFR.com

This generates greater uncertainty over the economic outlook and financial stability in Australia, even though recent Australian economic data have improved.

Australian banks under scrutiny

A third reason is that bank share prices in Australia are under pressure on a number of fronts, dragging on the overall Australian share market. The latest pressure point is the opposition Labor party calling for a Royal Commission into banks following several scandals, including facing litigation over rigging benchmark interest rates in an echo of the LIBOR scandal in the big global money center banks.

Labor royal commission will explore options for attacking serious fraud – AFR.com

We are not looking for any of these risks to imminently bring down the Australian economy that otherwise is showing an improving trend overall in activity and employment. But they are significant enough to place a cloud over the outlook for the AUD and are likely to get increasing ‘air-time’ in the run up to the election now expected on 2 July.

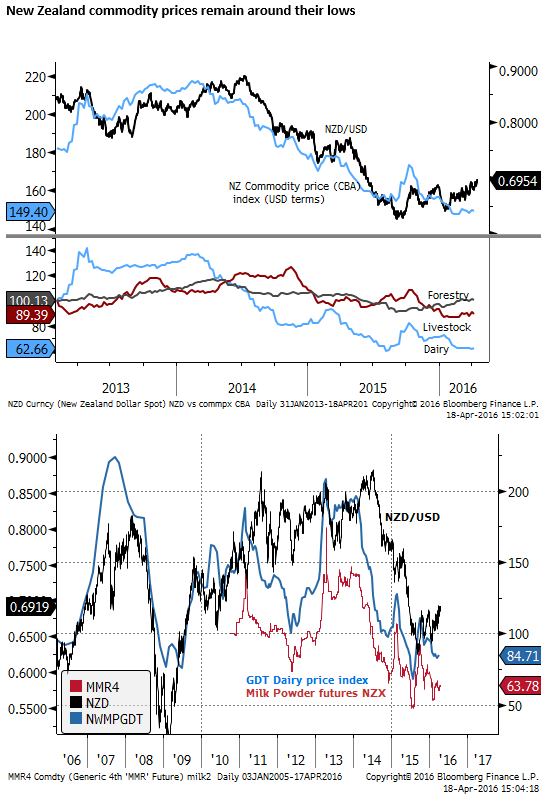

New Zealand Commodity prices remain low

The AUD has been supported more than the NZD recently by the rebound in its key commodity export prices, in particular iron ore. It has also benefitted from a recovery in energy prices, given its large and increasing exposure to natural gas exports.

New Zealand commodity prices have not recovered much. As such the RBNZ will still be calling for a lower NZD in its policy statement next week. But of course this is nothing new.

RBNZ March MPS : “The trade-weighted exchange rate is more than 4 percent higher than projected in December, and a decline would be appropriate given the weakness in export prices.”

Nevertheless, the recent improvement in activity indicators in China and gains in broad commodity prices will tend to support the NZD as well. The relative performance of commodity prices tends not to have a big impact on the NZD vs. the AUD.

There is also the possibility that milk and agriculture prices also start to recover from what are very low levels.

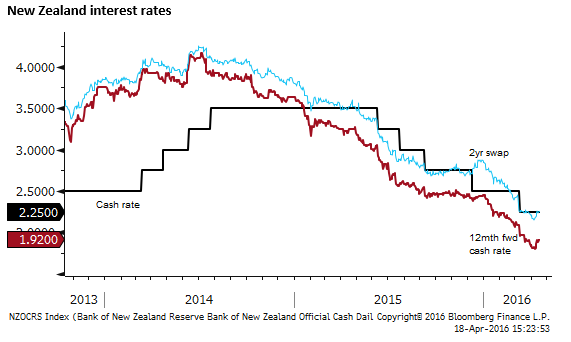

RBNZ may defy expectations of further rate cuts

More specifically, we see little risk that the RBNZ follows up its December and March rate cuts at its next meeting in April. In fact, we see the probability overall of further easing this cycle has lessened somewhat since March.

The RBNZ eased policy in March for essentially two reasons, it had downgraded its outlook for its trading partner growth and inflation, and it was responding to lower inflation expectations surveys. On the other hand it remained relatively upbeat on the prospects for domestic demand growth.

RBNZ March MPS: “Domestically, the dairy sector faces difficult challenges, but domestic growth is expected to be supported by strong inward migration, tourism, a pipeline of construction activity and accommodative monetary policy.”

The RBNZ was early in responding to the weaker global growth outlook, and is unlikely to be influenced by the recent downgrades to IMF growth forecasts or the policy easing by the Monetary Authority of Singapore based on a weaker global growth outlook. In fact, since the RBNZ downgraded its global growth assessment, economic activity data in China, India, and several other countries in Asia has picked up. Furthermore, global financial markets volatility has eased, suggesting downside risks to global growth have lessened.

Over recent months, the RBNZ have received no further survey data on inflation expectations. Actual inflation was reported as expected in Q1, up somewhat or at least the same on headline and key underlying measures since Q4, essentially in line with the RBNZ’s forecasts in its March MPS.

The RBNZ would much prefer to adjust policy when it releases its quarterly monetary policy statements, unless there was a pressing need to move at interim policy reviews. There does not appear to be a pressing need and the prudent thing would be to wait for more information.

The market has a 26% chance of a 25bp rate cut priced in next week and 33bp of cuts priced in over 12 months. On both counts we think this is too much; we see little chance of a cut next week and are not convinced that the RBNZ will cut again from a record low of 2.25% cash rate.

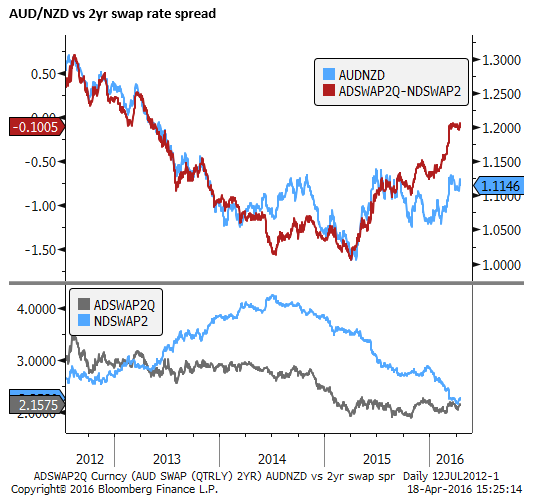

We are not advocating selling AUD/NZD. This cross actually looks cheap relative to the rise in the yield spread between the two over the last year. However, the lack of pick-up in AUD/NZD may reflect the greater political and financial stability risks in Australia.