Oil may be stabilizing, rate pressure on EUR

As we head towards the US payrolls report, US rates have continued to drift up this week, building on the rise last week on a less dovish than expected FOMC. Provided the payrolls report is not too far from expected, the EUR may reassert its recent downtrend. The spreads between EUR and USD interest rates have moved to new lows since 2007. Oil prices appear to be shaking off the bear-market, rejecting moves much below $50 and energy sector equities have performed well recently, offering support for the CAD. The RBA is keeping a rate cut up its sleeve for now.

Oil prices stabilise and energy sector equites rebound

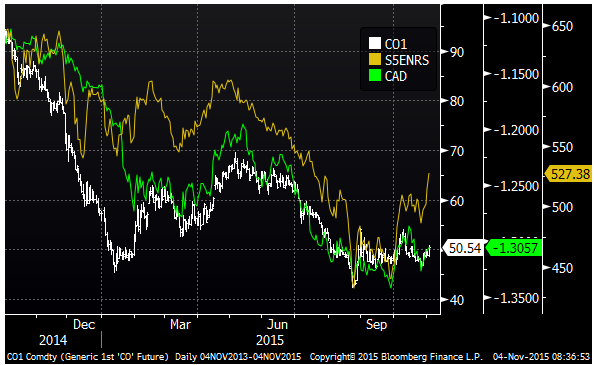

Oil prices resumed a rally that began a week ago to rise to a high since mid-October. News reports are citing higher rates of capacity utilization at US refiners, suggesting US demand is increasing. The change in the utilization rate has risen for the last two weeks and analysts expect it to rise again when released today by the US Energy Information Agency.

Prices are also reported to have been boosted by political tensions in Libya and Brazil disrupting oil production from the two countries. Another more subtle factor noted by the Aussie Oil & Gas Observer is that the downgrade of Saudi Arabia’s sovereign rating by S&P last week from AA-to A+ could put more pressure on the KSA to act in concert with key OPEC players to try to drive oil prices back up and puts its budget back on track.

Political tensions may just as easily dissipate and could be ignored in a bear market. The fact that oil prices are rising on these reports suggests that underlying conditions may be turning up for oil prices. This outlook is further supported by a recovery in energy equites that are up 5% this week, leading the broader equity market.

Oil prices were testing the lower end of their range last week, and have recovered to be back in the middle of the range over the last few months. They appear to be rejecting levels much below $50. The low for the year in August was around $42 in the heart of the August market upheaval. Apart from that low, the Brent contract has traded between $46 and $54 for the last few months. This is also around the lows in January this year and the lows in 2009 during the great recession. Oil may be finding more significant support and starting to form a base.

If so, it might also lend support to the CAD and to some extent AUD given its rising exposure to natural gas exports. However, as discussed yesterday, AUD is likely to be weighed down by weaker metals prices and coal prices that are still languishing at long term lows.

The chart below shows oil, CAD/USD (inverted) and the US S&P energy sector equity index

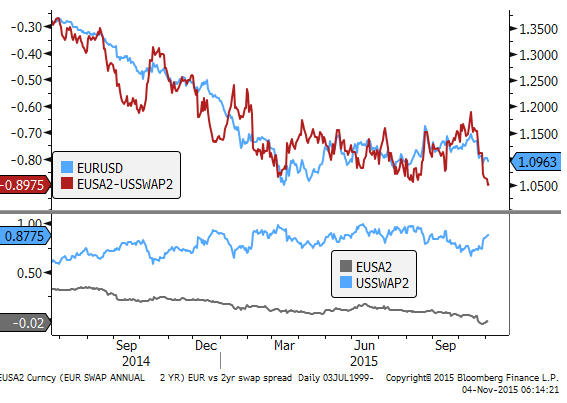

New lows in the EUR/USD 2yr swap rate spread

US rates have continues to rise this week after a solid rebound following the FOMC meeting last week. The data since the FOMC has been mixed, and much may depend on the labour data this week. Nevertheless, higher US rates against lower rates in the Eurozone since the ECB meeting two weeks ago and stable rates in Japan, have reignited the interest rate support for the USD. The EUR/USD 2yr yield spread has fallen to a new low since 2007. Not surprisingly EUR/USD is under pressure, and provided the US payrolls data is not far from expectations, the EUR may well continue its recent down-trend.

RBA signal it is considering cutting rates

The Australian rates market has more than fully reversed the fall in rates after its lower than expected CPI data last week as the RBA failed to deliver the cut some were expecting and sent mixed messages in its policy statement.

The market will be waiting for some clarity from the RBA governor Stevens when he speaks at a conference tomorrow morning in Melbourne. The statement yesterday did include an easing bias. It said, “Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand.”

But it decided it best to keep that easing up its sleeve in part because it “thought that the prospects for an improvement in economic conditions had firmed a little over recent months.” This note of optimism appears to have reduced rate cut expectations.

It was somewhat surprising to see the AUD and rates higher on this statement. The RBA did sent a pretty clear signal that they are considering cutting rates again. It will need to see those prospects for improvement build further, in my view, to prevent a rate cut. And with the risks to the commodity sector increasing and the housing market activity peaking, a low exchange rate will probably be required to keep fledgling business confidence in non-resource sectors alive.

In the news

- Brazil’s largest workers union has been on strike since Sunday in protest at asset sales by oil company Petrobras and a dispute over salaries and rights for domestic staff. “Petrobras has claimed there will be no impact on oil production or refining, but increasing evidence suggests this is not the case,” said analysts at Energy Aspects, a London-based consultancy.

- Libya declared force majeure on crude oil loadings from the Zueitina Port, amid an escalating conflict between the divided country’s two rival administrations, which has put exports at risk. (Libya and Brazil disruptions send Brent above $50 – FT.com)

Markets on the Move

- US 2yr swap rates rose 1.2bp on Tuesday, up 3.2bp this week to a high since mid-Sep, continuing the rise last week sparked since the FOMC suggested it still favours a hike at the 16 December meeting.

- Euro 2yr swap rate fell 1bp on Tuesday, and remains well down since the ECB hinted it would further ease policy on 3 December, now below zero at -0.02%.

- The 2yr swap spread for the EUR/USD has fallen by around 20bp since the ECB meeting to a new low this year of -90bp, below the previous low in August.

- UK 2yr swap rate rose 3.4bp on Tuesday, up 5.5bp this week, rising almost as much as the US rate since the FOMC last week.

- Australian March 3mth bill futures rates rose by around 4bp ahead of the RBA announcement yesterday, and a further 4bp after, to be up 8bp on the day. These rates have more than fully reversed the fall after the weaker CPI data last week, aided in part by the more hawkish that expected FOMC last week.

- New Zealand 2yr swap rates are down 4bp since the weaker than expected NZ employment report this morning. NZ rates up modestly in the last week supported by higher US rates.

- US stocks firmed reaching a high since July, now in the top half of the stable range between Feb/Aug, essentially fully recovered from the Aug/Sep period of global market correction.

- The energy sector led equity gains up 2.5% on Tuesday, up 5% this week.

- Brent oil price futures rose $1.5 to $50.2, extending the recovery that began a week ago from around $46.5 the lows since mid-Sep to a high since mid-Oct. The technical outlook appears more stable with oil in a side-ways range gravitating towards $50 since early-Aug, apart from a brief fall to the low for the year of $42.2 during the August global market upheaval. Current levels are also around the lows set in January this year at the end of the sharp slide from above $100 in the second half of 2014. The recovery in US listed energy company shares in the last month, while supported by strength in the broader equity market, also points to more confidence in the stability and possible recovery in oil prices. The chart below shows Energy sector share prices and the Brent oil futures contract.

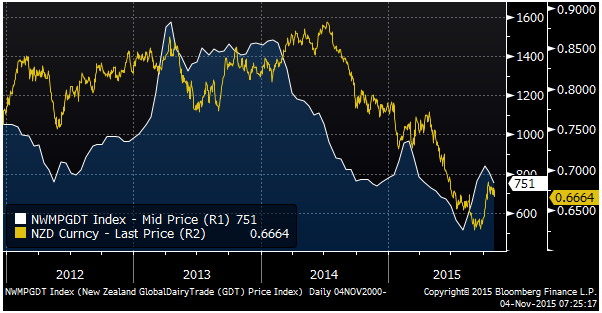

- Dairy prices in the GlobalDairyTrade biweekly auction conducted by New Zealand’s Dairy cooperative company Fonterra fell on Tuesday. The GDT index fell 7.4%, the second fall in a row after falling 3.1% on 20-Oct. The falls come after a 63% recovery in the index between mid-Aug and early-Oct, and prices are still up 46% from this low. However, the index is little change over the last year and down by around half from the peak levels in early 2014. The chart below shows the GDT dairy index and NZD exchange rate. The lower milk price contributed to a weaker NZD in the Tuesday offshore session. NZD fell back to the lows of the over-night session after the weaker than expected NZ employment data

- As discussed yesterday, iron ore prices have fallen back to around their lows for the year seen in April and July, falling sharply in Monday and down a bit further on Tuesday. Coal price indicators so far have gained little support from the improvement in oil prices over the last week. Futures contract prices in China have remained little changed in the last week at record lows

Economic news

- New Zealand: Employment fell 0.4%q/q in Q3, weaker than +0.4% expected, and was revised down from +0.3% to +0.2% in Q2. Growth from a year earlier was +1.5%y/y, down from 3.0%y/y in Q2.

- New Zealand: Unemployment rate rose from 5.9% to 6.0% in Q3, as expected.

- New Zealand: Both wage growth measures were lower than expected. The most watched Labour cost Index (adjusted for compositional changes) rose 0.4%q/q, below 0.5% expected, up only 1.6%y/y, little changed from this benign rate for the last three years, down from 2.0% in 2011/12, much below the peak of 4% in 2008.

- Australia: Service sector PMI fell from 52.3 to 48.9 in Oct, down for a second month from the peak in Aug of 55.6, a high in data available back to 2010. The three month average was 52.3.

- Australia: Retail sales rose 0.4%m/m in Sep, the same as Aug, as expected. Real retail sales for Q3 rose 0.6%q/q, below 0.7% expected, and Q2 sales were revised down to 0.7%q/q from 0.8%.

- Australia: Trade balance was a deficit of -$A2.32bn, narrower than -2.9bn expected, and revised down to -2.71bn from -3.10bn in Aug. Exports rose 3.0%m/m, imports rose 2.0%m/m

- USA: Factory orders fell 1.0%m/m in Sep, a bit weaker than -0.9% expected, and were revised down from -1.7% to -2.1%m/m in Aug.

- USA: vehicles sales rose from 18.12m saar in Oct from 18.07m, above 17.70m expected to their highest level since 2005

- UK: construction sector PMI was 58.8 in Oct, as expected, down from 59.9 in Sep. The three month average was 58.7, a high since March.