Old Skool moves in US yields and dollar

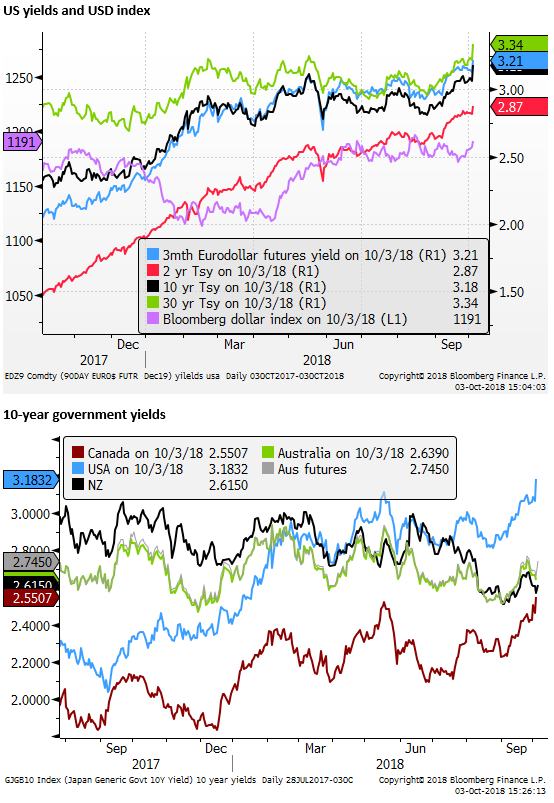

US yields shot higher Wednesday after 10-year yields rose above previous highs for the year. While rising US yields haven’t helped the USD all that much in the last year or two, the USD experienced a broad-based rise in line with the rise in US yields today. The rise in yields is too sharp, and risks surrounding other currencies (Italy-EUR, Brexit-GDP, tariffs/oil – Asia FX) too large to ignore. Recent Fed comments suggest they will raise rates for some time, Amazon wage hikes gel with a tightening labor market, and US ISM reports are very strong. Breakevens and term premium estimates have hardly moved this year and point to upside risk for US yields.

US yields pop

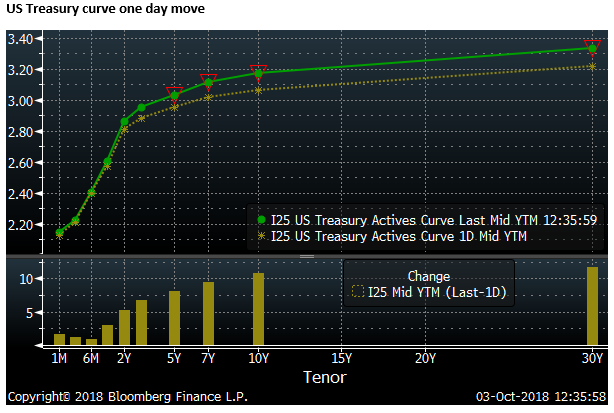

US 10 year bond yields are on a tear on Wednesday, after breaking previous highs for the year, up over 11bp on the day to a new high (3.18%) since 2011.

The rise in yields on the day is notable for steepening in the curve with a still sizeable 5bp rise in 2yr Treasury yields, and a rise over 11bp on 30yr yields.

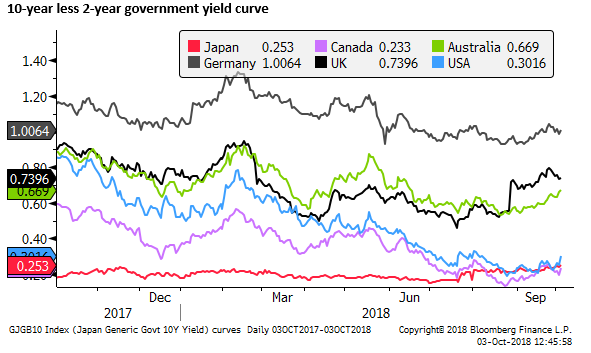

While the rise in US yields has dragged up yields globally, they contributed to a further increase in the USD yield advantage over other currencies and broad-based gains in the USD.

Curve flattening in the USA has been frequently mentioned as a sign that monetary policy was becoming tight. Several Fed members in recent months have said that they would not be inclined to raise short-term rates past the point of inverting the yield curve. The most recent rise in yields in the US has been accompanied by some steepening. The 2s to 10s curve is above 30bp, up from a low on 24-August of 19bp, its steepest since around the beginning of August.

Fed rates policy unanchored

Powell’s speech on Tuesday emphasised a “risk management” role in the current policy approach. The economy is pretty hot, but inflation appears well anchored near its target, so until something changes, such as inflation accelerates, or the economy slows down, Powell says the Fed is likely to pursue a gradual pace of rate hikes.

A key message in recent Fed speeches and statements is that they are now much less influenced by estimates of theoretical values of neutral interest rates or unemployment. Now that they are within the vicinity of these neutral levels, the Fed is much less sure of the accuracy of their estimates or value in setting policy. As such, until something breaks, we should expect a gradual rise in rates.

This theme was discussed succinctly in the following article by well regarded Fed watcher Tim Duy:

The Fed’s No Longer Guided by Concept of Neutral Rates; 1 Oct – Bloomberg.com

In light of the ongoing strength in US economic surveys and data, the Fed messaging suggests no let up in the gradual pace of rate hikes (quarterly). The data raises the risks that the Fed, in fact, falls behind the curve by moving rates too slowly, and/or they raise rates over a longer time frame, unanchored by notions of neutral rates.

Strong ISM reports

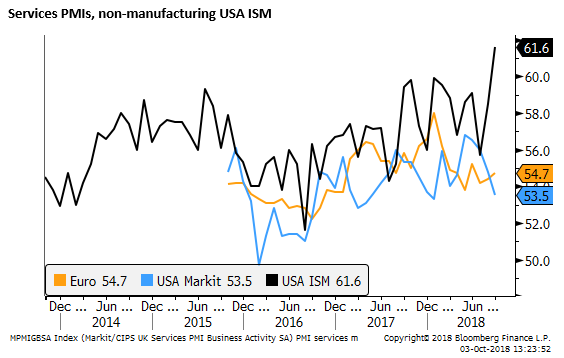

US economic reports on Wednesday include a very strong non-manufacturing PMI (61.6) a high since 1997. It is hard to believe; rebounding even as the Markit PMI services index dipped to 53.5 in September.

The strong ISM non-manufacturing report combines with strong manufacturing ISM that dipped from its highest level since 2004 in August to 59.8 in September.

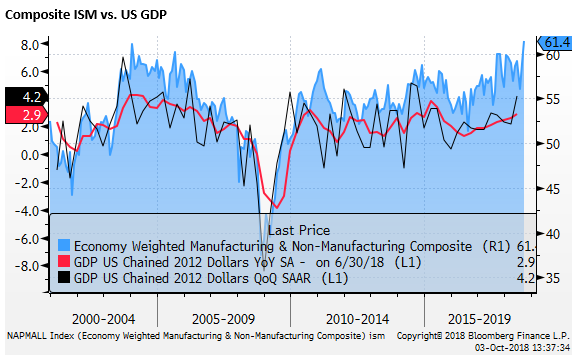

Taken at face value, the combined ISM reports might point to even stronger GDP growth in the second half of the year.

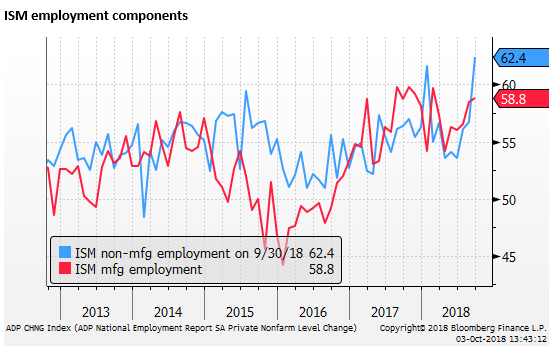

The US ADP payrolls report has had a dubious history is predicting the government BLS payrolls report, but it rose 230K in Sep, above an expected 184K, suggesting the government report on Friday may also be strong. But other indicators of the labour market also point to a strong result, not least the ISM employment components.

Wage pressures on the radar

The market may be weighing the odds of another stronger than expected average hourly earnings report on Friday, after it rose more than expected in August (2.9%y/y), a new cyclical high.

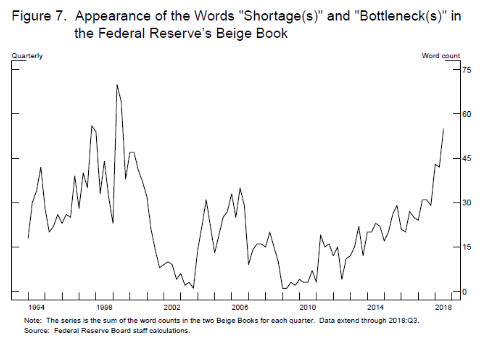

Anecdotal evidence continues to point to rising wage and inflation pressure; something that Fed Chair Powell spoke of in his speech on Tuesday, even as he played down its significance. He said, “I am sure that, like us, many of you are hearing widespread anecdotes about labor shortages and increasing bottlenecks in production.” He then presented a chart showing that the Fed’s Beige Book used the words “shortages” or “bottlenecks” more often than at any time since 1999.

Add to that news that Amazon has raised its wages for employees. From 1 Nov it will apply a minimum wage of $15 per hour for 250,000 employees, and another 100,000 seasonal employees. A rise of several dollars (in the order of a 25% increase). It is also reported to be increasing wages for higher paid workers. The move might be expected to raise pressure on other employers to follow suit.

Amazon to Raise Its Minimum U.S. Wage to $15 an Hour – WSJ.com

It will be interesting to see if this moves the dial on overall wages growth in November onwards.

Upside risks to bond yields from inflation expectations and term premium

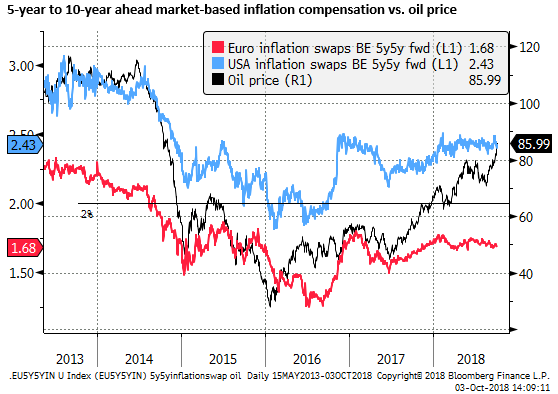

The steady rise in oil prices over the last year to a high since 2014 may also be contributing to higher inflation expectations and higher yields, although market-based measures of long-term inflation expectations have been stable most of this year. The fact that they haven’t risen yet may point to further upside risk for yields.

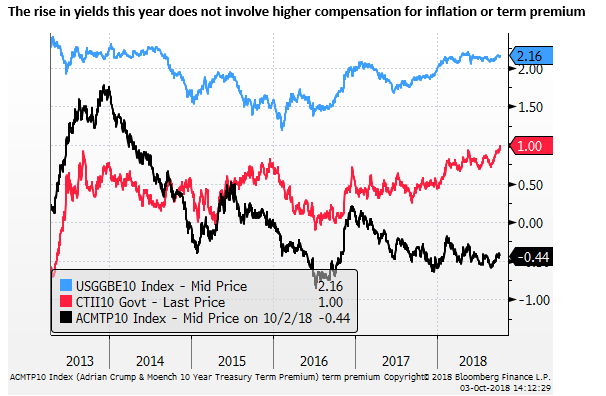

To date, most of the rise in US long-term yields appears driven by real yields. Neither inflation breakevens nor the Adrian Crump & Moench estimate of the 10-year term premium has risen much this year.

The lack of upward movement in the term premium is surprising in light of the accelerated net sales of the Fed’s Treasury and Agency bond portfolio, the taping in ECB bond purchases, and “stealth” tapering by the BoJ. Tapering central bank purchases point to an additional upward risk for yields.

Strong US equities supporting yields and the USD

US equities were able to hold near their record highs notwithstanding the surge in US yields. Earlier this year, after 10-year yields rose sharply in January from around 2.50% to approach 3.0%, US and global equities experienced a significant correction. At some point, rising US yields may again curtail the strength in US equities.

At this time, the strength in the US equity market may be contributing to the rise in US yields and strength in the USD.

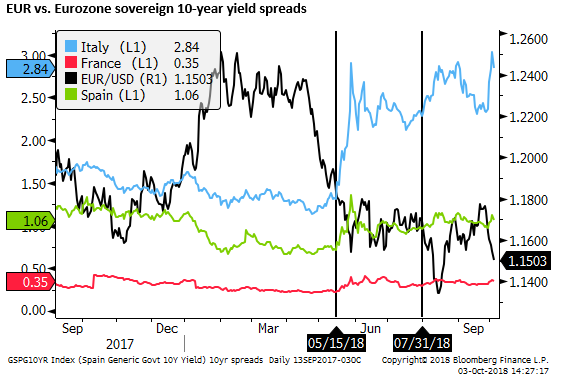

EUR failed to benefit from easing Italian budget risk

In a volatile session, the EUR/USD fell to a low since 20-August. It is interesting that it was not able to hold onto initial gains as Italy made concessions on its budget targets that allowed for a partial recovery in Italian bonds and equities.

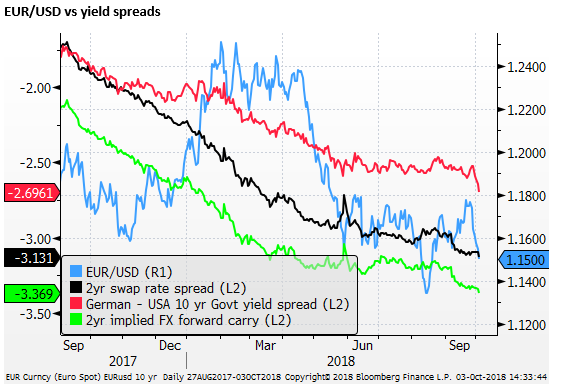

EUR/USD has not been all that responsive to yield spreads between the two currencies in recent years, but perhaps they are contributing to weakness in the EUR. It may also be the case that the rebound in Italian bonds and concessions by the Italian government on its budget projects are not sufficient to significantly reduce the risks for the Eurozone.

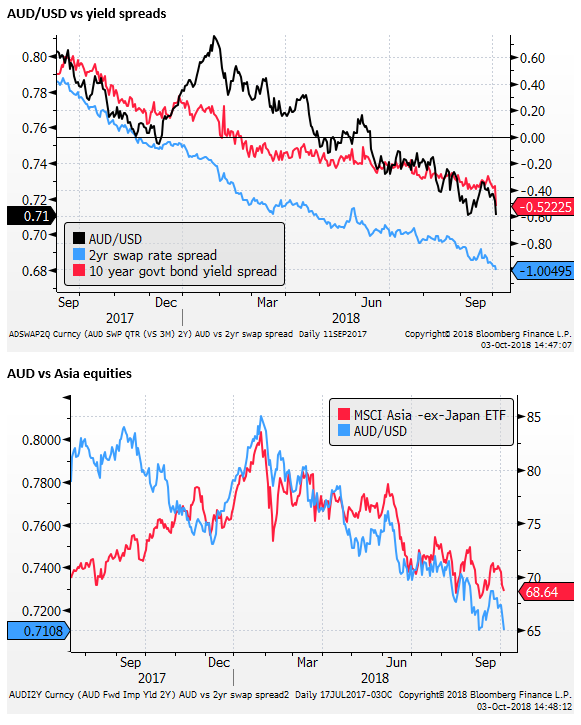

Hard hit AUD and NZD

The AUD and NZD were hit relatively hard; down over 1%. The falls are consistent with higher US yields; even though, like the EUR, they have not paid as much attention to their relative yield spread over recent years as they have in historically.

Both currencies may also reflect increased domestic market concerns. Australia reported weak building approvals and news reports continue to point to tightening credit conditions and potential fallout from a weaker housing market. Auto sales were also softer, and the Australian equity market has noticeably underperformed global markets in the last month, despite gains in its energy and material sectors.

New Zealand has continued to show very weak business confidence surveys, and job ads dipped in September, maintaining a more subdued growth rate over the last year.

Asian currencies and equities are weaker, dragged down by ongoing fears related to China/tariffs, higher oil prices and higher US yields placing broader downward pressure on emerging market equities