On the lookout for RBA mood swings

The RBA Governor’s speech last week suggested that the RBA is very comfortable with the current policy settings and a hike is unlikely for several months, arguably not until well into next year.

On the other hand, the minutes from the 4 July policy meeting, released on 18 July, gave a number of hints that the growth and even the inflation forecasts in the quarterly Statement on Policy will be upgraded. If so, the RBA policy statement on Tuesday, 1 August might generally sound more optimistic, referencing an improved economic outlook that is to be released in the quarterly RBA Statement on Monetary Policy on Friday, 4 August.

The RBA is likely to at least acknowledge in their policy statement on Tuesday that the AUD has appreciated recently. It could attempt to talk it down by saying that this complicates the adjustment in the economy (as opposed to recent statements where it has said an appreciating exchange would complicate the adjustment).

The RBA has provided little guidance on policy this year. But Governor Lowe and Deputy Debelle have attempted to quell speculation that the RBA may respond to policy normalization abroad. It is unlikely in our view, but possible that the RBA guide in its policy statement that a period of stable rates would be prudent. Any such guidance, especially combined with a more direct comment on the exchange rate complicating adjustment, could see significant knee-jerk selling in the AUD.

Still Significant slack in the labour market

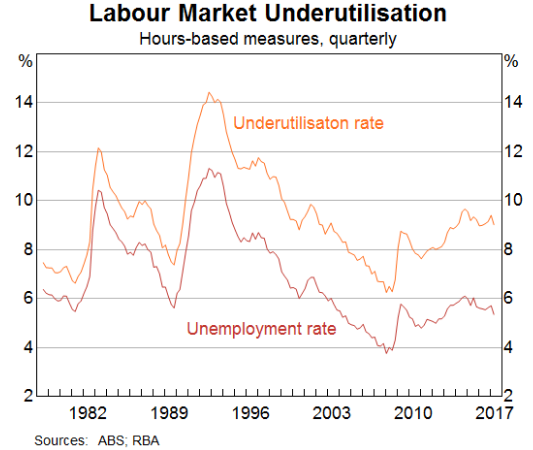

In his speech on 26 July, last week, RBA Governor Lowe highlighted that while “there has been a welcome pick-up in employment growth”, there remains significant slack in the labour market.

He said that the unemployment rate (5.6%) is still “around ½ a percentage point above estimates of full employment.” Furthermore, he noted that a measure of under-employment that incorporates people that are working part-time, but would like to work more hours, point to even more slack in the labour market.

(Source: The Labour Market and Monetary Policy, Philip Lowe; 26 July – RBA.gov.au)

He said that while some countries (presumably including the US, Japan, and the UK) are close to full employment and may be closer to experiencing a pickup in wages growth, this has a “fairly low probability in Australia, especially in light of the continuing spare capacity in our labour market.”

Subdued outlook for housing

RBA Governor Lowe reiterated that the RBA is not considering cutting rates further given the already high level of household debt and the financial stability risks that might arise from yet lower rates placing more upward pressure on house prices.

However, the RBA Governor sounded quite relaxed over the current state of the housing market, suggesting a hike in rates to quell rising house prices is not being considered either.

He was asked about his opinion of the housing market in Q&A after the speech; he noted several reasons why prices growth may slow.

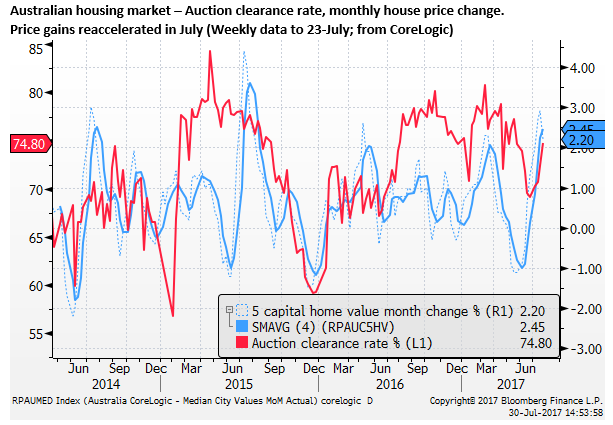

He said, “Some of the heat is starting to come out of the Sydney and Melbourne markets. We’ve got a way to go, we have been through this before, we thought things were slowing down, and they sped up again. But it does look at the moment that the monthly price increases look a bit smaller, and the auction clearance rates have come down.”

Our read on the data is that house price growth has been following a normal seasonal pattern, picking up again recently and still growing at a rapid rate. Auction clearance rates are not off much. However, what matters for policy is what Lowe thinks, and he does appear to be relying on a number of factors to provide comfort that house price growth will fall further.

He said, “My hope is that a combination of factors continue to move us in that direction [of lower house prices]. We’ve got a lot of extra supply coming onto the market; this year is a peak year of additional supply. Rent growth is weak; we saw in today’s CPI that rents were up 0.6%y/y and 0.2%q/q. There is less foreign demand; Chinese have restricted capital flows in a way, there has been higher taxes on foreign investors, in stamp duties. The banks have increased some interest rates, and they have tightened up the lending conditions. And we’ve got better infrastructure transportation investment taking place. Those things, particularly in Sydney and Melbourne, should take some of the pressures off the housing market, and the current slowing we are seeing will be sustained.”

Certainly, these are reasons to be more patient before raising rates to quell further leveraged housing investment.

Down-playing the neutral rate discussion

One argument for raising rates is that they are so low they are generating financial stability risks. The RBA’s own research presented to the public via its 4 July policy meeting minutes, released on 18 July, was that the neutral rate is around 3.5%, 200bp above the current policy setting. As such, a modest increase in rates would still leave them accommodative and support further recovery in the labour market.

However, Governor Lowe has not ventured into any such thinking. Instead, he took the same tack as Deputy Governor Debelle in a speech the week earlier, on 21 July, suggesting that the inclusion of this discussion in the policy minutes had little relevance to current policy debate and was just one of a regular series of topics for discussion presented to the policy board.

He said that there “had been a lot of media discussion about it, and a lot of it misinterpreted our intentions.” He said commentators “got overly excited by its inclusion in the minutes.”

Lowe’s comments suggest that the neutral rate discussion was not planted in the minutes to warn the market that the RBA is thinking about raising rates any time soon. However, they still suggest that the RBA thinks its current policy settings are very accommodative, and should be considering hiking rates well before it reaches its policy targets.

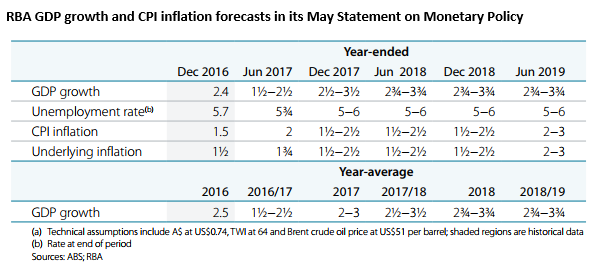

Nevertheless, the RBA Governor Lowe left this discussion for another day, suggesting that he is quite comfortable with the current policy settings. The RBA might argue that there is still plenty of time to raise rates with inflation forecast to remain below the mid-point of its target for quite some time. In the May Statement on Monetary Policy, the RBA forecast inflation returning to target around mid-2019.

(Source: Statement on Monetary Policy; May 2017 – RBA.gov.au)

No automatic response to policy tightening abroad

To damp down rate hike speculation further, both Debelle and Lowe in their recent speeches said that shifts towards removing monetary stimulus in other countries have “no automatic implications for monetary policy in Australia”. Lowe said, “These central banks lowered their interest rates to zero and also expanded their balance sheets greatly. We did not go down this route. Just as we did not move in lockstep with other central banks when the monetary stimulus was being delivered, we don’t need to move in lockstep as some of this stimulus is removed.”

Upbeat July minutes

While the media focused on the neutral rate discussion in the July minutes, and the RBA went out of its way to hose down its significance, perhaps it has been forgotten how surprising more upbeat the minutes were relative to the actual July policy statement, or minutes from earlier months.

They noted that, “The value of retail sales had increased in April, consistent with liaison reports that suggested conditions in the retail sector had improved. Members noted that the recent pick-up in growth in employment should also support a pick-up in household income growth, and therefore consumption growth, in the period ahead.”

They acknowledged for the first time the boost in demand from increased government spending on infrastructure. It said, “The most recent Australian and state government budgets suggested that fiscal policy would be more expansionary in 2017/18 than had previously been expected. Some of this expansion was expected to come from more spending on public infrastructure, particularly in New South Wales. Reflecting this, work yet to be done on public infrastructure had increased in recent quarters to a relatively high share of GDP. Members noted that infrastructure investment was expected to have significant positive spillovers to other parts of the economy. Non-residential building approvals had also risen in recent months.”

The minutes also mentioned two factors that may tend to lift wages and inflation, albeit perhaps temporarily. A higher minimum wage increase of 3.3% to take effect on 1 July, and higher electricity wholesale prices. These factors may result in a somewhat higher RBA inflation forecast in the next year in its quarterly statement on monetary policy.

Perhaps more importantly, the July minutes said, “Members noted that the strength of recent labour market data had removed some of the downside risk in the Bank’s forecast of wage growth.”

Less downside risk for wages growth may be another reason to see some lift in the bottom of the range of forecasts, and thus the appearance of a higher midpoint projections for growth and inflation.

The RBA July minutes, also included in their final paragraph that, “Members regarded the improvement in the world economy over the preceding months as a welcome development.” An upgrade to the global outlook, which has been accompanied recently by higher commodity prices, is also like to result is some upward revision to growth.

Exchange rate rise may feature in statement

The RBA may be debating whether it should sound more concerned on the level of the exchange rate. For some time it has said, “The depreciation of the exchange rate since 2013 has assisted the economy in its transition following the mining investment boom. An appreciating exchange rate would complicate this adjustment.”

Since the beginning of this year, the RBA has said “would complicate”; throughout 2016 it said “could complicate”

In the Q&A after his speech last week on 25 July, Lowe said, “it would be better if the exchange rate were a bit lower than it currently is.”

Compared to 2013, the exchange rate is still a lot lower, and the RBA is still likely to say that this has assisted the economy in transition.

However, it is also the case that, following its surge in the last month, the exchange rate is at a high since December-2014 in trade-weighted terms. It is not all that much higher than in was in Feb/March this year, but the AUD/USD is more significantly higher than it was at this time and psychologically this has an impact as well.

Some of its rise reflects a weaker USD. Commodity prices have also firmed in the last month. As such, the RBA may not want to sound too alarmed. Nevertheless, the RBA may choose to alter its statement on the exchange rate in an attempt to dampen its appreciation; especially if the rest of the statement sounds more upbeat.

It is likely to at least acknowledge in its statement that the exchange rate has appreciated recently. It could then follow this by reiterating that an appreciating exchange rate would complicate the adjustment in the economy. This would signal that the RBA is aware the currency has appreciated and further appreciation might influence their policy outlook more significantly.

A somewhat more direct attempt to dampen the currency could be to say that the recent appreciation of the exchange rate complicates the adjustment under way. This might cause some knee-jerk selling of the AUD, signaling that the RBA is more concerned over the recent appreciation of the AUD, suggesting it may pursue a lower path interest rates if the AUD were to rise further.

Guidance-light

The RBA has provided little guidance in its policy statements since in cut rates twice in 2016. It has said in recent policy statements that, “Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.”

The market is not exactly pressuring the RBA to change policy with only a small chance of a hike expected until around May next year when a hike is around 50% priced in. As such we doubt that the RBA will change this wording; they prefer to provide less guidance than most other central banks, presumably to allow them more flexibility to react to shifting conditions.

However, Governor Lowe and Deputy Debelle felt compelled to say that policy does not need to automatically respond to policy normalization abroad in recent speeches, and slack remains in the labour market. The exchange rate did rise after the RBA July policy minutes were released, and they may be concerned that the market is too influenced by global policy developments. As such, the RBA could revert to guiding the market towards no change in policy for some time. It could say that a period of stable interest rates is the most prudent course.

This would be a significant surprise to the market. Coupled with a more direct statement on the exchange rate, it would generate knee-jerk selling in the AUD.