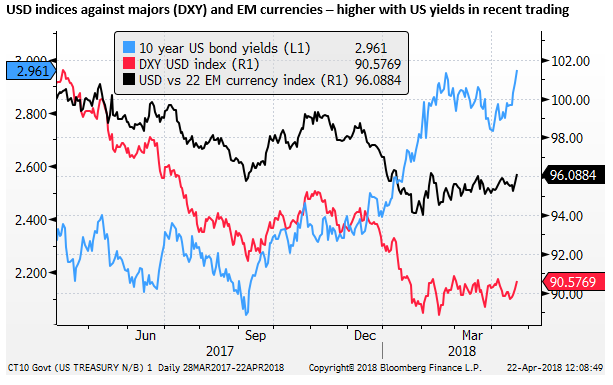

A pervasive rise in yields may propel further USD gains

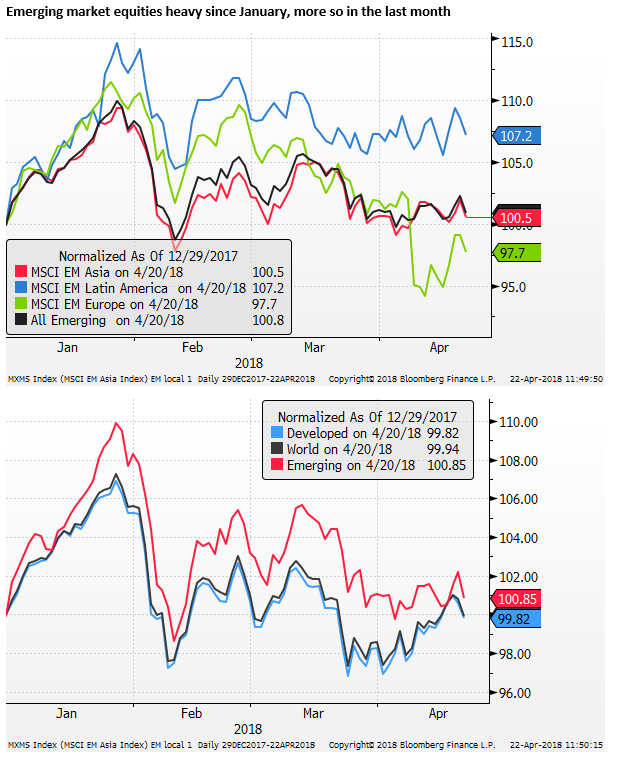

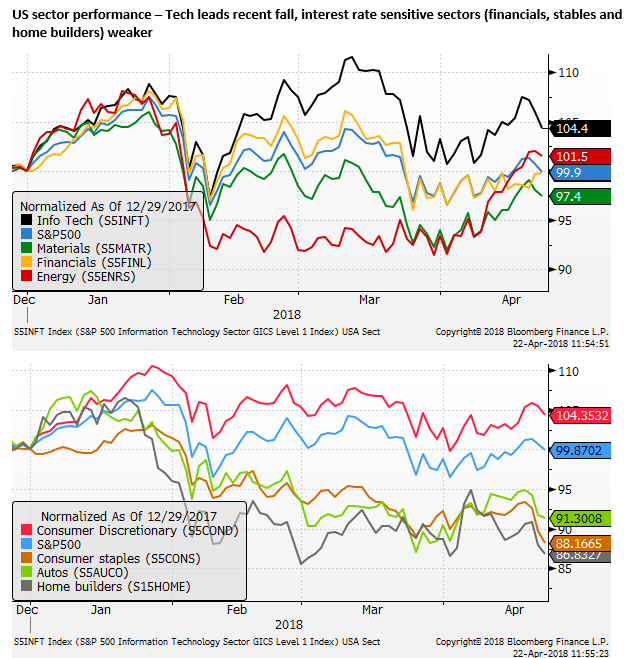

We see the recent resurgence in US yields as potentially the most important driver in the coming week or longer. The resumption of the rise in US yields in the last week appears related to a more persistent underlying trend. It has been supported by a rise in commodity prices, but occurred despite weaker confidence in global growth and equity markets, suggesting it may be a more pervasive trend likely to influence other markets, rather than be influenced by them. The USD reaction to higher US yields has hardly been straightforward in the last year, but it did strengthen broadly in-line with higher yields in the last week. This may reflect troubles in the tech sector and broader geopolitical uncertainty undermining EM markets. EM equities and currencies have underperformed developed markets in the last month. Some easing in trade tensions over the weekend may help stabilise EM currencies and global equities. However, concerns over the tech sector are starting to run deeper and may prevent their recovery. If US yields rise significantly further, they may also cap equities more broadly, and undermine EM currencies, especially high yielders more susceptible to US yields. USD/JPY may initially benefit from higher US yields, but equity performance may limit gains. EUR has been able to shake off a more significant slowdown in Eurozone economy momentum to date, underpinned by capital flows from SEK, CHF and RUB, but these have likely peaked.

A Pervasive rise in US and global bond yields

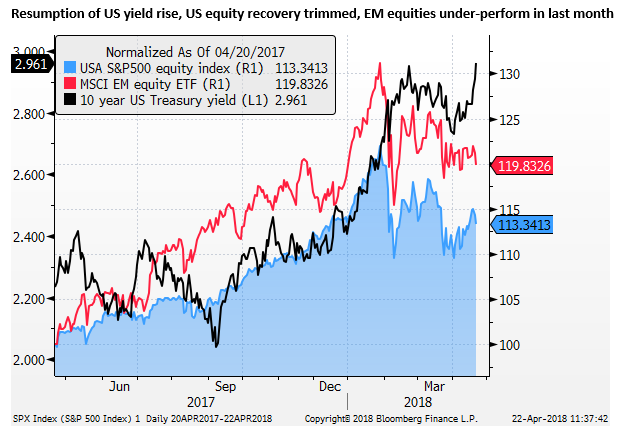

US bond yields have risen sharply in the last week or so, a move that began in January through early February, and helped trigger a major correction in global equities.

This poses one of the biggest threats to stability in global equity markets. The timing of the rise in US yields cannot be entirely explained. US economic data has largely met expectations, inflation readings are higher, but only as expected.

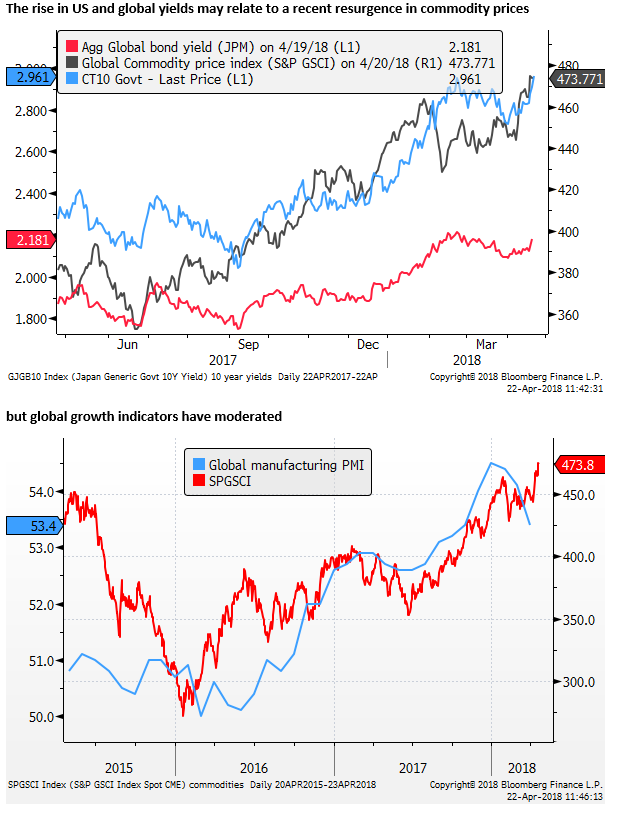

It may be related to a resurgence in commodity prices, but these rises reflect supply disruption concerns rather than increased demand. In fact, global growth indicators have moderated in the last month or so.

Emerging market and tech sector equities have also been under pressure recently due to trade protectionist rhetoric, Chinese government actions preventing the Qualcomm purchase of NXP, and US government actions to ban US component and software sales to Chinese company ZTE.

There is also intensifying political uncertainty in the US. On Friday the Democratic National Committee brought a lawsuit against Russia and the Trump campaign, ensuring the politicisation of the Mueller investigation remains a hot-button for the mid-term elections.

However, despite these concerns, US yields have risen abruptly. This may reflect a broader underlying trend arising from:

- A rising US fiscal deficit;

- Still solid underlying US growth, and a tight US labor market;

- Evidence that inflation pressures are building from a weak USD, more stable global growth, and higher commodity prices;

- A realisation that Fed rhetoric has not backed away from its steady policy tightening outlook, US rates and yields that are still well below the FOMC rate projections, especially beyond this year; and

- A steady reduction in QE underway in the USA, and expected to be curtailed later this year in the Eurozone.

Easing Trade and Geopolitical tensions may propel US yields higher

If the rise in US yields represents a shift in the underlying trend, it will be more persistent and may continue this week, especially as some of the risks to global markets appear to have eased.

US Treasury Secretary Mnuchin said he is planning a trip to China to help negotiate a deal on trade, Chinese central bank Governor Yi Gang made more conciliatory comments on trade and investment policy and met with Mnuchin at the IMF meetings last week, and Chinese official comments welcomed such a trip.

U.S. Hints at China Truce as World Warns of Trade-War Threat – Bloomberg.com

Trump and Japanese PM Abe met last week, and a planned state visit by French President Macron to the US this week may also turn down trade protectionist rhetoric.

If tensions related to trade are turned down, it may give the green light for more gains in US yields.

If so we might expect any rebound in global equities to be muted as the market begins to worry about higher yields attracting investment capital and curtailing some of the strength in the US and global economy.

USD rises this time with higher US yields

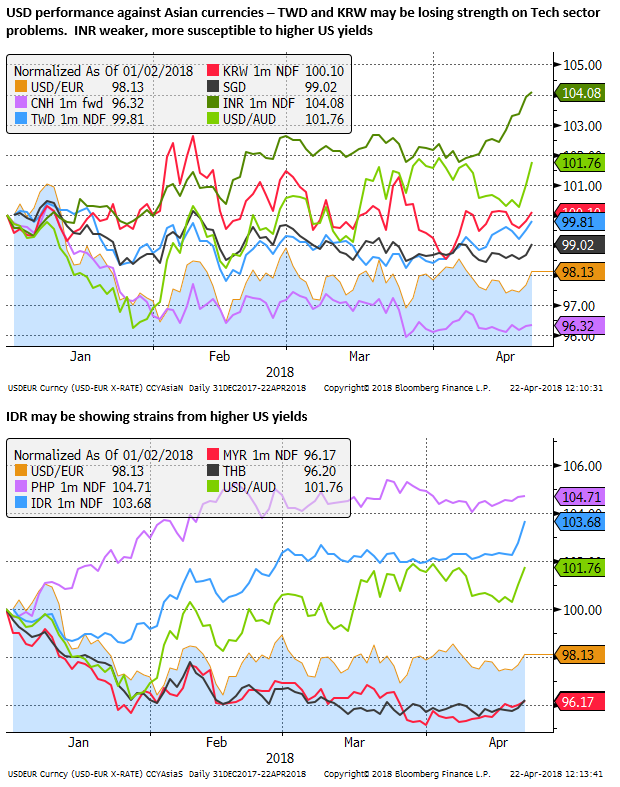

The FX market response to higher US yields has not exactly been straightforward in the last year. However, the USD did rise more broadly in line with US yields last week. In part, this may reflect the poor performance of EM markets, particularly in Asia as the market worried more about the tech sector and trade protectionist policies.

High tech sector woes may extend beyond protectionist trade fears

While turning down the heat on trade protectionist policy concerns may help stabilise EM markets, higher US yields may continue to weaken them. Higher US yields may matter more with concerns over the tech sector extending beyond protectionist trade issues to concern that the global demand for smartphones may be slowing.

Chipmakers’ Rout Widens After TSMC Ignites Smartphone Fears – Bloomberg.com

A number of EM markets that are more susceptible to higher US yields (INR, IDR, and PHP) have potentially broken to the weak side and may continue to fall this week if US yields continue to rise.

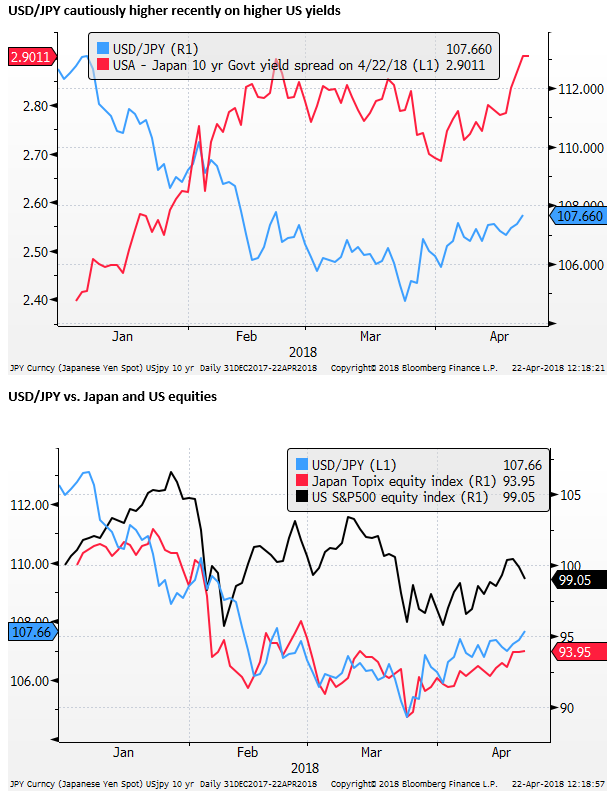

USD/JPY facing mixed outlook; may respond to higher yields first

The USD/JPY has firmed in line with US yields, although the gains have been muted by the weakness in global equities. Its outlook is mixed, but if US yields rise further and trade protectionist concerns ease for the time being and global equities tend to stabilise, then USD/JPY mat rise further in the near term.

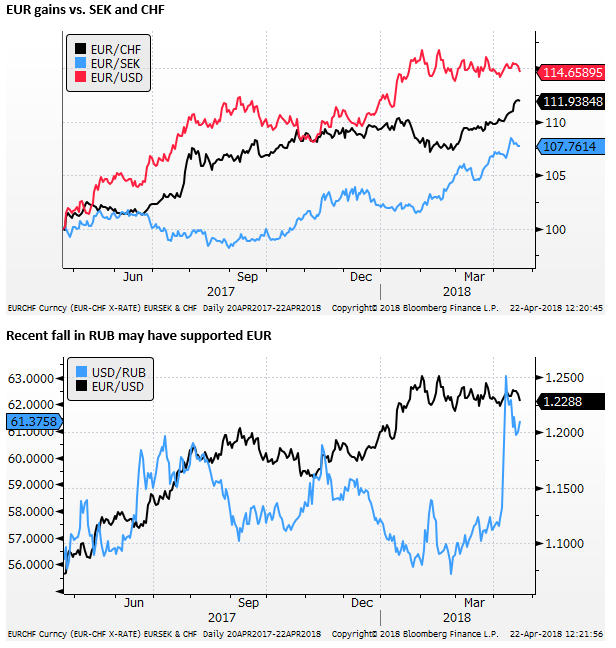

EUR may lose support from regional inflows

EUR has been surprisingly resilient to a more significant slowdown in Eurozone economic indicators than most other countries. This may reflect capital flows moving from CHF and SEK to EUR over recent months, unwinding long-held safe haven positions taken during the Euro crisis and ECB moves into QE. EUR may also have benefited from a recent move in capital from RUB to EUR on US sanctions that hit Rusian Aluminium producer Rusal.

However, these flows may have peaked and are now diminishing. As such there is more scope for EUR to fall.

EUR/CHF has returned to near the crucial 1.20 level that once served as the SNB floor before 2015. SEK is now extraordinarily weak. The decline in SEK and CHF has pushed rate hike expectations in both ahead of the ECB.