Political risk ebbs in Europe, rises in the USA

Much of the risk premium related to the French election has been unwound contributing to a surge in European asset prices. EUR is higher, but has stalled around the previous peaks set after the less dovish than expected 9 March ECB meeting. The rally in EUR still appears modest compared to other Eurozone assets. European economic surveys have continued to rise in April to their highs since around 2011, despite French election uncertainty. Global growth indicators have also strengthened further. Expectations of any change in policy guidance have been dampened by ECB comments in recent weeks, but it is under pressure to remove its downside bias on economic risks and interest rates in its policy statement and press conference on Thursday. Trump may have bitten off more than he can chew this week with a tough road to pass a funding bill complicated by his pressure for including funding for a border wall, passage of a Healthcare bill, and announcing tax policy. Trump appears more focused on shoring up support from his true believers than passing bills. He may be pushing ahead with pursuing tougher trade deals; including tariffs on steel imports, fueling fears of trade wars, while confidence in his ability to deliver tax reform or infrastructure spending may be fading. Passage of a funding bill this week may be crucial for maintaining economic confidence in the USA. Failure will bring into question the government’s capacity to deal with the debt ceiling, delivering tax reform and tough budget negotiations ahead of the next fiscal year in October. EUR may not only benefit from less political risk in Europe, but rising political risk in the US and a potential flare-up in geopolitical risk, such as heighten risk of a US conflict with North Korea.

Govt funding bill a test, Debt-ceiling looms later in the year

The White House has high ambitions for this week. It would like to pass a government funding bill that is required by 29 April to prevent a so-called government shutdown. It hopes to pass new Healthcare legislation (to repeal and replace Obamacare), and Trump has said his team will announce its tax reform plans on Wednesday.

28 April is the expiration date for the current Continuing Resolution bill (passed on 9 December 2016). This extended funding from the previous continuing resolution (passed on 28 September).

The US Congress did not pass a full-year Appropriations bill for the current fiscal year that began 1 October. It is running on short-term continuing resolutions. It needs to pass another bill to keep funding government spending, presumably an Appropriations bill that will run through to October.

A failure to pass a new appropriations bill or roll-over into a new continuing resolution will start the government shut-down process, risking disruption of government services.

However, this is not as severe for markets as the other kind of government shut-down that follows hitting the debt ceiling. The debt ceiling has resulted in significant investor risk aversion; the most severe occurred in 2011.

The Debt limit was reintroduced on 15 March this year (after it was last suspended in 2015). As such, the US Treasury is already restricted from issuing net new debt, and is running on so-called extraordinary measures. Using these measures, the government is expected to be able to fund normal spending until October or November.

If Congress does not raise the limit by October, the market may become nervous that the USA is flirting with defaulting on its government debt. Once its extraordinary measures run out, the government can only spend revenue that comes in, and some of that must go to interest payments to avoid a default. So another kind of government shut-down that is more problematic for markets could ensue if Congress does not agree to raise the debt limit before then.

Nevertheless, the funding bill this week is an important test for the Trump administration. A period of disruption to government services would make government appear dysfunctional and reduce confidence it can achieve meaningful reform, including tax reform and infrastructure spending promised by the Trump administration. A prolonged disruption to government spending would also directly dampen consumer and business confidence in the economy.

A delayed funding bill this week would also increase worry that government may not be able to smoothly navigate the debt ceiling problem that looms in October. Not only will the debt ceiling problem come to a head in October, Congress is also likely to be negotiating another funding bill to allow the government to operate from the beginning of the next fiscal year, and the debate over the Trump tax plan and long-term budget plans should be in full swing. The combination could significantly undermine investor confidence.

Trump administration risking its reputation

Many are scratching their heads as to why Trump is trying to do so much this week. He may be over-burdening Congress by pushing for passage of a healthcare bill to repeal and replace Obamacare and releasing tax cuts plans in the same week as the deadline for a funding bill. If divisions over the healthcare and tax policy are brought to the foreground, it may limit the ability of Congress to make compromises necessary to pass the funding bill. Trump is likely to take the blame if the funding bill fails to pass.

Furthermore, Trump has indicated that he wants some funds in the new funding bill for the Mexican border wall. Democrats are unlikely to support any bill that directly funds the wall.

Republicans have a majority in both houses of Congress. However, the Democrats have enough seats in the Senate to force a filibuster on the funding bill, preventing it being called to a vote. 41 seats in the 100 seat Senate are all that is required to prevent a vote on bills.

The Republicans invoked the so-called nuclear option to force a vote on the confirmation on Gorsuch to the Supreme Court, but it would be much more controversial and essentially out of the question to do so on legislative bills, including funding bills, especially on the first try.

As such, Trump and the Republican Party still need some Democratic support to pass funding bills. The same is true for all bills; including those required for the passage of tax reform and healthcare. And Democrats could hold the government hostage over funding bills or raising the debt ceiling; in the same way that Republicans essentially did at times during the Obama administration.

The Democrats might not want to be blamed for government shutdowns or market disruption, and thus will tend towards voting for funding bills, but only if they do not include significant and controversial policies. The Mexican border wall is likely to be a sticking point. It is possible that Congress could navigate around this issue by providing a modest increase in funding for border security.

Republicans Prepare To Lose On A Government Funding Bill – HuffingtonPost.com

Trump may also be damaging the possibility of easy passage of bills this week by resuming his antagonizing Twitter feed. He tweeted again that “Mexico will be paying, in some form, for the badly needed border wall.” But suggested that he wants funding to start the wall this week.

He also commented on the reporting on opinion polls calling “much of the media” fake and he “Would still beat Hillary in a popular vote” (He lost the popular vote?). And jabbing at Democrats with “ObamaCare is in serious trouble. The Dems need big money to keep it going – otherwise it dies far sooner that anyone thought.”

Democrats are less likely to support a funding bill if Trump is politicizing these contentious issues (border wall and Healthcare).

Trump remains focused on shoring up the true-believers

It appears that Trump is concentrating on shoring up support from his voter base with these tweets. The polls show that his overall net approval rating is down and relatively low compared to past administrations at this stage of his presidency. However, he never started with a high net approval rating after a divisive election in which he lost the popular vote, and he has never been able to build support from those that voted against him in the election that are turned off by his moves on immigration, border security and climate policy.

His strategy is to keep support from his conservative voter base – mentions of beating Hillary this far into the administration, attempts to lay blame for Healthcare on Democrats, persisting with Mexico paying for a wall – are for consumption by his true-believers. The news polls did show that most of those that voted for him in the last election still supported him.

Further in this theme, Trump is to address the National Rifle Association Institute for Legislative Action (NRA-ILA) convention on Friday. He will be the first President to do so Since Ronald Regan.

This is also apparent in his posturing around bringing back jobs for coal mining, steel, and manufacturing. These issues appear more important to Trump that passage of bills in Congress.

Trump trade policy risks

While the market appears more sanguine on Trump’s trade policy disrupting resurgent global trade, tougher USA trade policy aimed at boosting US industry fits with the Trump focus on delivering for his true believers.

Somewhat lost in the focus on French elections, Trump threatening to introduce tariffs on steel imports. Trump announced last week a national security investigation on steel imports. Trump said, “Steel is critical to both our economy and our military. This is not an area where we can afford to become dependent on foreign countries”. (FT 20 April)

A tariff on steel imports would appear aimed at reducing imports from China, and it may undermine confidence in the Chinese steel industry, where the government is already dealing with over-capacity. There may also be a fallout to suppliers of steel-making material to China – Australia.

US Commerce Secretary Wilbur Ross has been meeting with the three big US Trade deficit countries, China, Japan and the EU. Dealing with the USA deficit may return as one of the main policy issues for the Trump administration. It plays well with Trump’s main support base.

Trump tax policy announcement may struggle to gain traction

Trump has said he plans to announce tax policy this week. But the market is beginning to focus on how policy will be passed in Congress and is less influenced by shiny baubles of big tax cuts. At issue will be how tax cuts will be funded.

Trump’s own Treasury Secretary Mnuchin has downplayed the prospect of a tax reform package passing the Senate by August.

Mnuchin told IMF MD Lagarde during an aired interview last week that tax reform would be long-term deficit neutral. But this is expected to rely on stronger economic growth forecasts and involve a near-term rise in the fiscal deficit. Passage of a tax plan that results in a bigger deficit, and relies on optimistic growth forecasts to be budget neutral over the long term is going to struggle to find support from deficit hawks, mostly in the Republican party.

Will the tax plan include a border tax? The size of tax cuts may depend on including of a border tax. Many will doubt a tax plan will find sufficient support if it includes a border tax.

Without a healthcare bill, the size of tax cuts and passage of tax cuts is also in question.

So it is hard to see much detail in any tax plan announcement this week, and the announcement, if there is one, may raise more questions than it answers.

North Korea risks

The risk of some imminent military action related to North Korea may have been reduced by reports that China is willing to place more pressure on North Korea via is trade and political relations with its Neigbour.

USA’s Secretary of State Tillerson and Vice President Pence have said that the era of strategic patience with NK is over, but they are willing to give diplomatic channels a chance to work in curtailing NK’s nuclear ambitions.

However, US Aircraft Carrier USS Carl Vinson is reported to belatedly be nearing the Korean Peninsula. Korea has detained a third US citizen. There is widespread speculation that NK will conduct a nuclear test on Tuesday timed to coincide with a celebration of its military founding anniversary. NK hathreatened to sink the US Aircraft carrier. All of which has prompted China President Xi to urge Trump to exercise restraint, according to the Chinese media. Ominously, Trump has said nothing new on NK.

European assets rebound

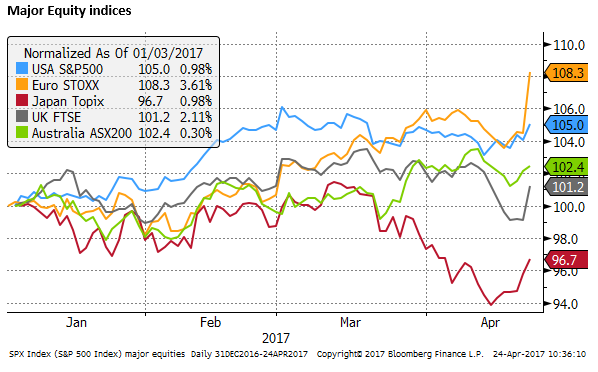

The market is most focused on the French election relief rally in equity markets on Monday, driven by European equities that has moved to the top-performing equity market this year; up 3.6% on Monday.

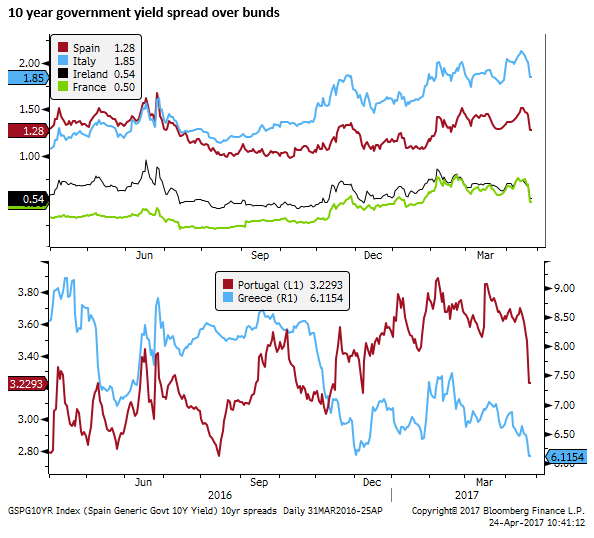

Eurozone governed bond spreads over German bunds also fell back sharply. The French 10-year spread has fallen to a low since January.

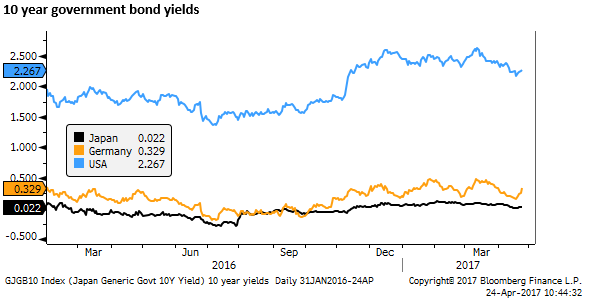

German 10 year yields rose significantly (+7.6bp). US yields rose initially but have retraced around half their gains during US trading, perhaps indicative of the Trump policy risks domestically and towards North Korea.

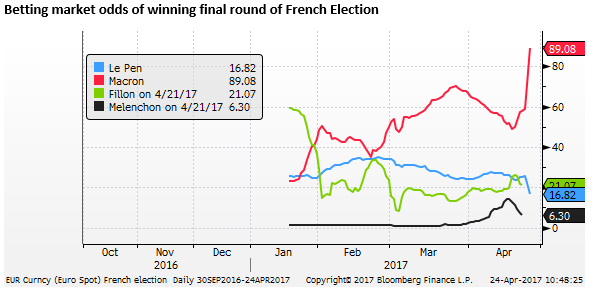

The betting odds of a Macron victory in the final round of the French election have jumped to 89%, Le Pen’s have fallen to 16.8%

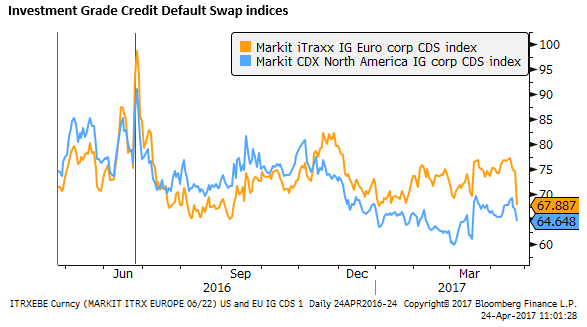

The CDS market has seen a sharp fall in Eurozone IG corporate default risk, closing the spread over US corporate default risk to a low since January.

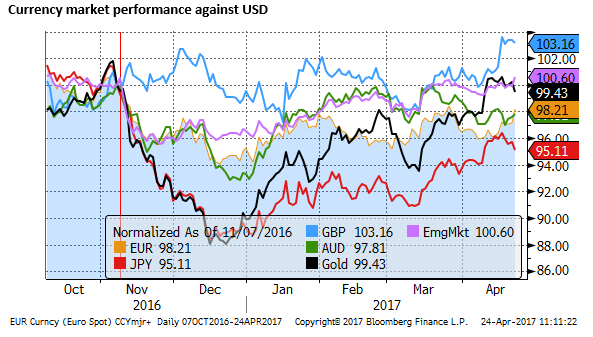

The currency market reaction has been a bounce in the EUR to revisit the highs seen following the last ECB policy meeting in March. Risk havens JPY and Gold have weakened, but emerging market currencies have generally strengthened, particular those in Europe. Commodity currencies are mixed, giving back some earlier gains.

One might argue that the rebound in EUR is still modest in comparison to European equities and retracement in risk premiums in bond markets. There may be some apprehension to buy EUR ahead of the ECB meeting on Thursday.

ECB will be pressured on Dovish guidance

Over recent weeks, Key ECB Council members discouraged thoughts that the ECB would shift its QE and rates policy guidance in the meeting this week, countering some comments from ECB member policy hawks in late March that they might support a shift in guidance.

The key phrases in the introductory statement to the press conference currently in place are:

“We continue to expect [key interest rates] to remain at present or lower levels for an extended period of time, and well past the horizon of our net asset purchases.”

“If the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, we stand ready to increase our asset purchase programme in terms of size and/or duration.”

“The risks surrounding the euro area growth outlook have become less pronounced, but remain tilted to the downside and relate predominantly to global factors.”

In the 9 March policy meeting, the ECB conceded some ground to the hawks by removing one phrase from its statement. It removed the part that said, “The Governing Council will act by using all the instruments available within its mandate” (if warranted).

Draghi acknowledged this change in his press conference as a response to a reduction in downside risks, contributing to a rise in EUR following the 9 March policy meeting.

The current guidance on rates is still quite dovish (at present or lower levels for an extended period, well past the horizon of net asset purchases).

However, it is somewhat contradictory to the removal from its statement that it will use all instruments in its mandate, suggesting lower rates are no longer on the table.

The introductory statement is not expected to change, but there is some risk that the ECB tweaks it again. (Such as describing risks as more balanced, or removing the “or lower levels” from its rates policy guidance).

Draghi will presumably lean heavily on the lower core inflation reading in March as supporting the case for maintaining its dovish policy guidance. The latest CPI inflation reading will be released the following day on Friday this week.

But he will also be called on by the media to respond to evidence of improvement in the European economy, the global economy and rebound in investor confidence following the French election.

The market is increasingly focused on the timing of a shift towards normalizing policy. At the 9 March press conference, the market reacted to any slight wavering in the Draghi commitment to persisting with low rates beyond the QE program end. He may attempt to deflect any questions by saying normalization of policy were not discussed at the meeting, but it will be difficult for Draghi to unequivocally commit to the current policy guidance.

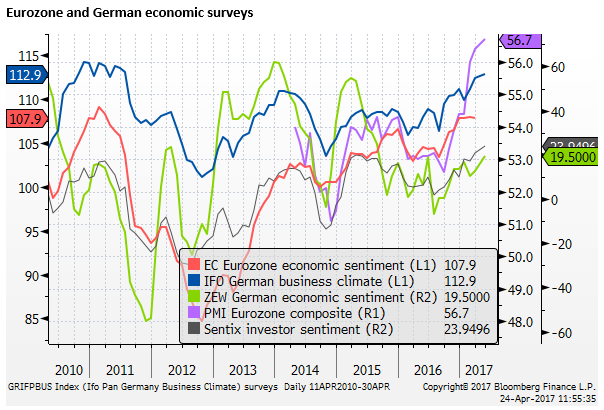

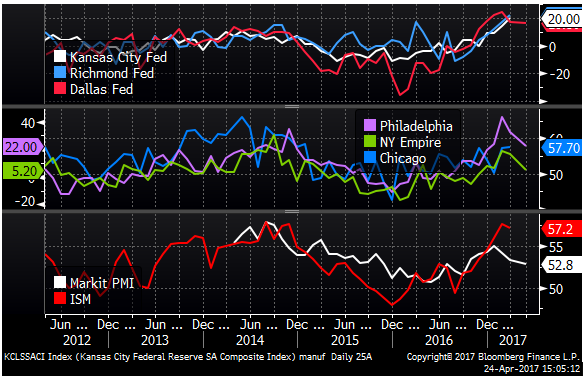

In recent days, the Eurozone PMI data rose to a new high, and the German IFO business climate index rose to a new high in April since 2011.

Confidence in the US economy may fade

While confidence in the Eurozone recovery is gaining momentum (even before the French election that may further support confidence), Confidence in the US economy may be ebbing. USA economic confidence may be much influenced by progress made by Trump in delivering tax reform.

It is widely recognized that the surge in confidence surveys following the Trump election has so far not been matched by a recovery in economic activity indicators. The Atlanta Fed GDPNow projection is for an anemic 0.5%q/q SAAR growth in Q1.

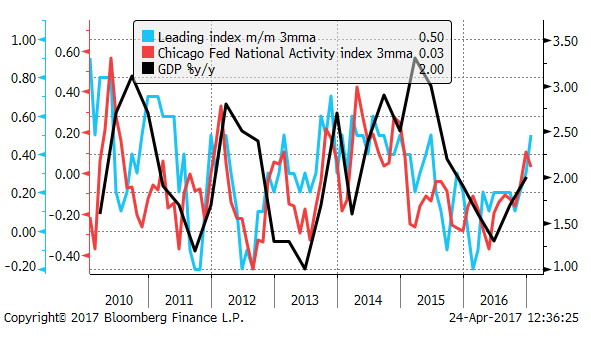

There has been a tendency for weak Q1 outcomes for US data in recent years, suggesting there may be some residual seasonality that biases this data down. Earnings season is so far showing solid results, and some more forward looking indicators are positive, the Conference Board Leading Index and Chicago Fed National Activity index are pointing to above trend growth.

Nevertheless, some more recent survey data have lost some momentum, including manufacturing surveys.

The failure thus far for confidence surveys, such as the NFIB small business confidence and consumer confidence, to flow through to activity indicators may reflect a wait and see attitude to Trump policies.

Companies may be waiting for clearer indications on what the tax implications are for new capital investment. For instance, one budget proposal was accelerated depreciation. In anticipation, companies may decide it is wise to wait until such tax benefits are in place before spending.

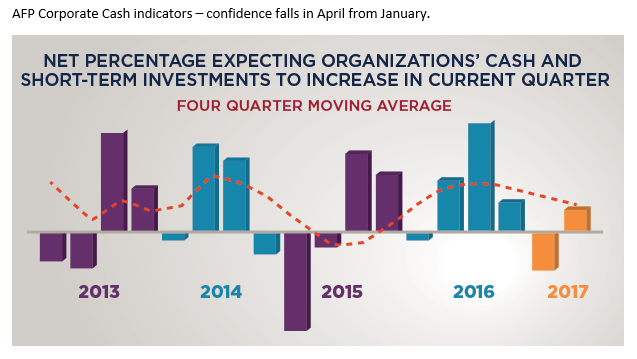

A quarterly survey by the Association of Finance Professionals (AFP) – its Corporate Cash Indicators – found that despite a net 10% of respondents surveyed in January expecting to reduce cash holdings (an indication of economic confidence and willingness to spend cash on capital expenditure), a net 15% did the opposite and raised cash holding over the three months to April.

And for the next three months a net 3% of respondents in April expect to raise their cash, a reversal in the optimism shown in January.

AFP Corporate Cash Indicators – AFPonline.org