Political risk for a number of currencies (AUD, NZD, GBP and CAD)

It is getting harder to know where to turn with political risk in the UK palpable. A dual citizenship debacle in Australia, NAFTA negotiations hanging over the CAD outlook, a significant change in policy direction in New Zealand, German coalition negotiations, and political uncertainty has never been far from mind in the US in the Trump era. Japan is a source of stability, supporting its equities, not its currency.

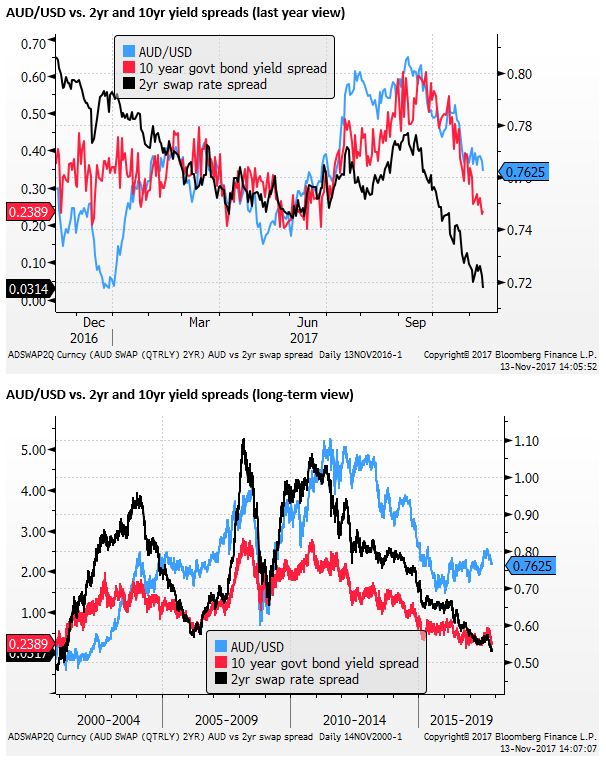

Australia’s dual citizenship debacle

Australia is in the midst of a Dual Citizenship crisis that has reduced the Governing Liberal National Coalition (LNC) to relying on independents for its survival in the lower house of parliament. The latest polls show that on the preferred Prime Minister question PM Turnbull is down to a new low of 36%, still just ahead of the opposition Labour Party leader Shorten at 34%.

Australia’s trust in either side of politics is at a low point. Perhaps more concerning for the government is the polls show LNC now trails Labor by 45% to 55% in a two-party preferred vote, predicting a change of government if there were a national election.

Newspoll: Malcolm Turnbull in horror poll slump – TheAustralian.com.au

The future of the current parliament is not clear. A number of members of parliament are under questions over their dual citizenship on both sides of politics. This will result in bi-elections already for two LNC lower house members that have resigned, and may result in several more next year. Effective government is diminished until this issue is resolved and the market cannot be sure the current LNC government will survive through the election cycle.

The government is currently around halfway through its current three-year term, but with the need for a half senate election, the most likely last feasible date for a national election of both houses is 4 August 2018. As such, the poor standing of the government and the likelihood of national election later in the next year, and an uncertain number of bi-elections in coming months that will be seen as a litmus test for a national election, if not change the balance of power to Labor before a national election, are creating significant and unusual political uncertainty.

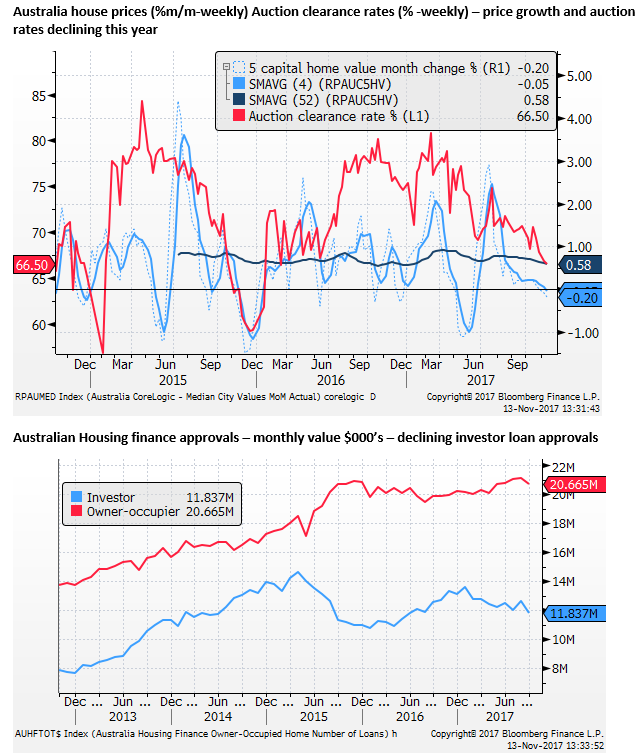

One of the big policy differences between Labor and LNC in the July 2016 election was that Labor wanted to make significant changes to tax policies that affect housing investment. Their policy remains to reduce the negative gearing tax deduction benefit, restricting it to new dwellings, and reduce the capital gains tax discount on investment property.

Similar to the policy agenda of the recently formed New Zealand Labour/NZ first Coalition government, the tax changes are intended to reduce leveraged investor demand for property to help make property more affordable.

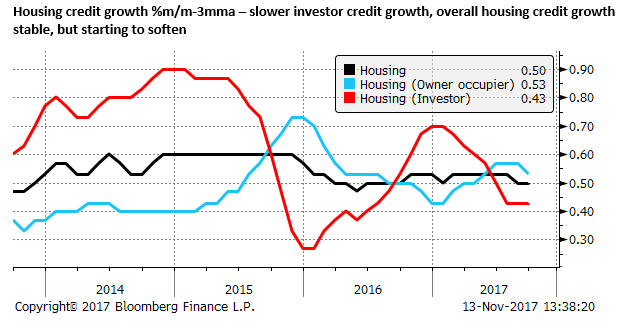

Housing Investor demand is already under pressure from prudential measures forcing banks to limit lending to this sector, and the Australian housing market has lost momentum. The political uncertainty in Australia should be causing more nerves for Australian property investors.

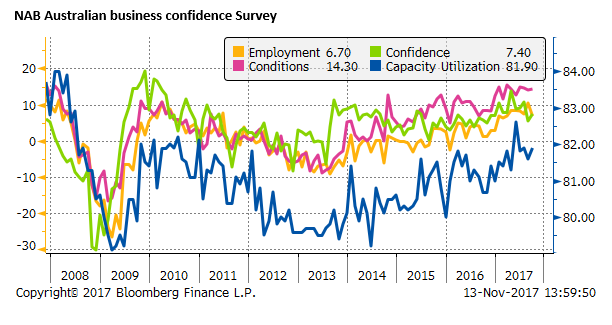

The broader lack of political leadership may also weigh on business confidence that has been quite strong this year supported by a global recovery and strong government infrastructure spending.

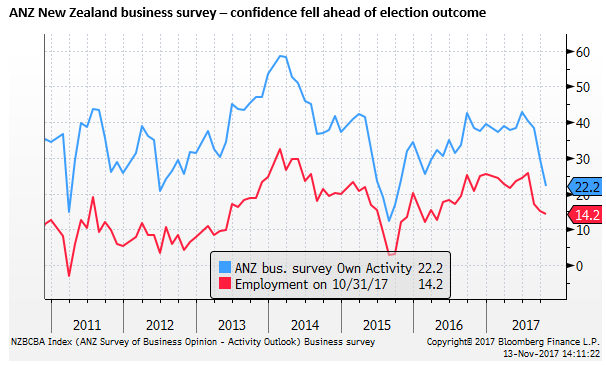

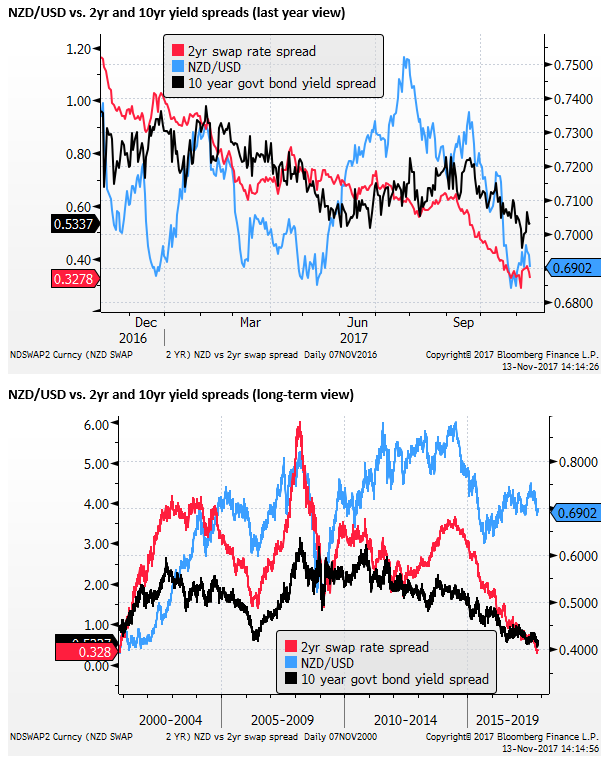

New Zealand charts new course

New Zealand political risk in Q3 has essentially materialized with a change in Government since 19 October. The new government has announced a ban on foreign investment in existing residential property and may toughen conditions for foreign investment in land and businesses. It plans to remove tax concessions on housing investment, cut immigration, increase spending on building affordable houses and infrastructure, and it has changed course on personal income tax (higher) and benefits (higher) from the previous government. The outlook for the economy amidst the policy upheaval afoot is more uncertain. Already business confidence has fallen sharply in recent months.

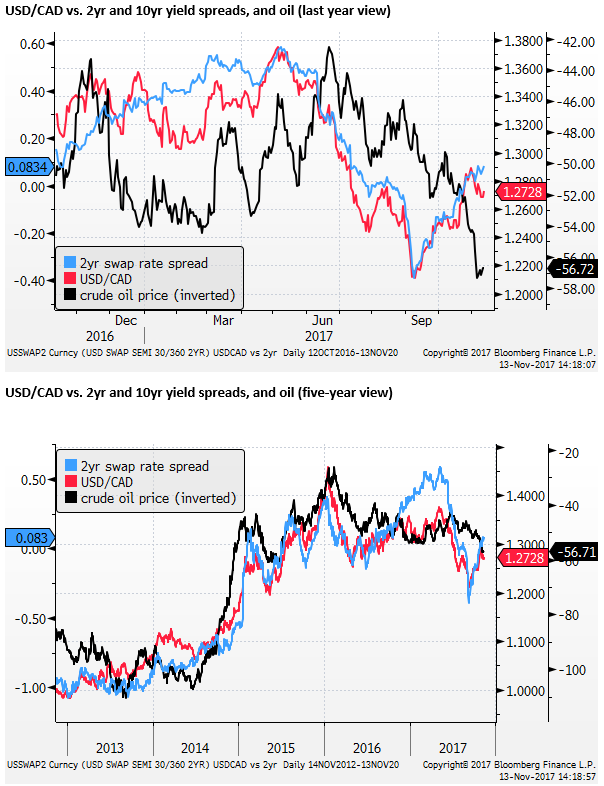

NAFTA negotiations a risk for CAD

Canada might seem a good refuge from political risk. However, it faces the fifth round of the NAFTA negotiations on 17-21 November after the fourth round did not end well on 17 October.

The Bank of Canada identified uncertainty around the NAFTA negotiations as a risk for their economic and policy outlook. It does not appear that NAFTA uncertainty has affected CAD much to date, which in itself is a worry since the risk is that there may be a negative reaction ahead.

After insufficient progress in the round four negotiations, the talks were extended into next year. But in doing so, this will bring them into the election cycle in Mexico (Presidential election on 1 July) and the US mid-terms in November. The US administration also only has its current authority to renegotiate trade deals until July.

Nafta Talks’ Extension May Make for Slow, Painful Demise; 17 October – NYTimes.com

Trilateral Statement on the Conclusion of the Fourth Round of NAFTA Negotiations – USTR.gov

UK political risk is Palpable

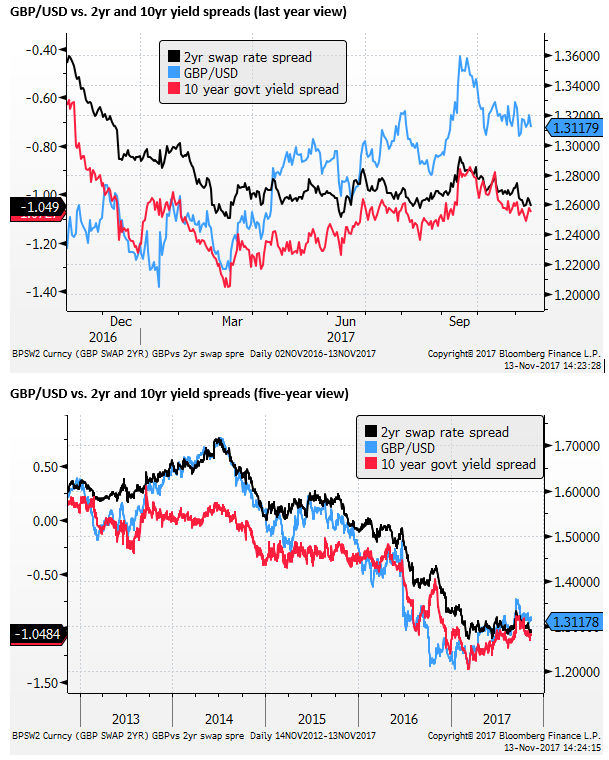

The GBP fell on Monday on reports that 40 Tory party members (out of 314) are prepared to vote to remove the current leader of their party and Prime Minister, May. PM May has been under pressure since she called an early election in June and lost outright majority for her party in parliament. The Tory party has shown little discipline under her leadership with a variety of incidences which have challenged May’s authority. The party remains in disagreement on the form of Brexit it wants to negotiate. A lack of stable UK leadership is delaying progress on Brexit negotiations. To date, there has been little significant progress.

Business leaders are becoming increasingly anxious that a deal on trade and other important matters will not be made by the March 2019 Brexit date. Crucial for many business leaders is a transition period beyond March 2019 that will allow them some degree of certainty to plan and invest.

UK has 2 weeks to clear Brexit logjam, say EU business leaders – FT.com

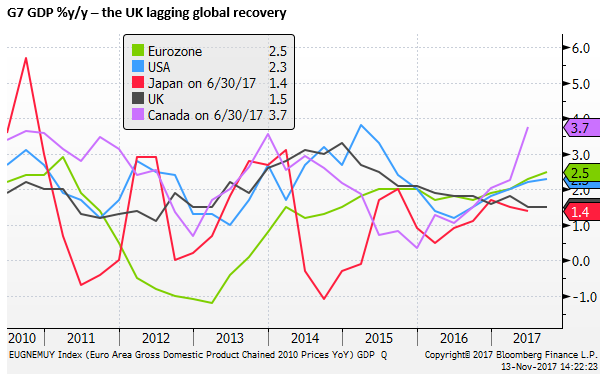

Brexit and political uncertainty may be rising to a new level that will drag the UK economy further behind its peers and threatens a new round of GBP declines after a period of recovery this year.

European political issues remain

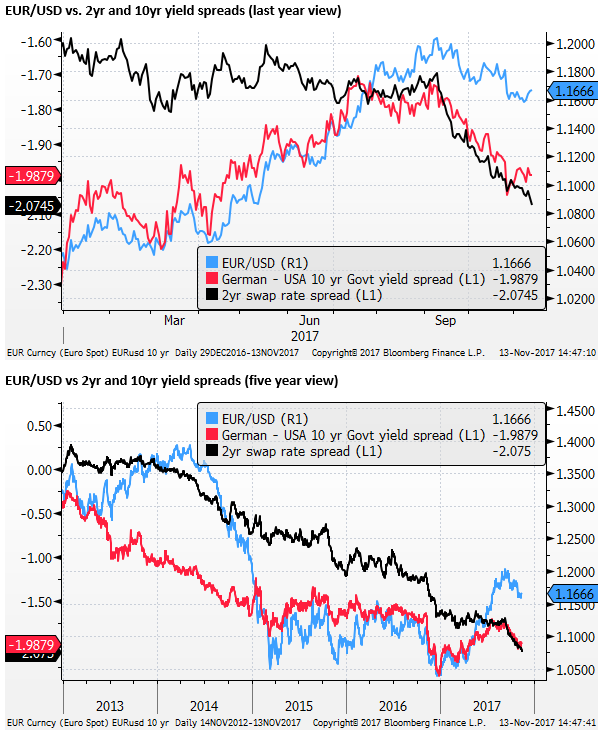

Political uncertainty is also apparent in Europe. In Germany, Angela Merkel’s Christian Democratic Union (CDU) has been in negotiations for weeks with its close coalition partner Christain Social Union (CSU), the right-winged Free Democratic Party, and left-wing Green Party, hoping to form a so-called Jamaica coalition. The negotiations are contentious with significant policy differences between the parties over refugees, climate, and reforms in EU. The parties have set a deadline for Thursday only to produce an agreement that will pave the way for formal coalition talks.

The National Spanish government has been forced to clamp down on a successionist movement in its region of Catalonia. Italian is heading for a hotly contested national election due by 20 May next year. Recent Sicilian elections point to diminishing support for the ruling Democratic Party. The Anti-establishment Five-Star Movement is currently ahead in the polls, but several other contenders will make for a multiparty parliament that may be much less stable.

US political uncertainty a constant this year

US political uncertainty has been apparent all year, contributing to a weaker USD. The Mueller investigation remains a risk to the survival of the Trump administration. Infighting in the Republican Party between the established leaders like McConnell and Ryan, and the Alt-right lead by Breitbart News Executive Chairman Bannon that has been a growing force, including generating much of the support base behind the election of Trump, threatens political stability.

The selection of Roy Moore as the Republican representative in the special election for the Alabama Senate seat scheduled for 12 December represented a win for the Alt-right Bannon lead forces. The pressure for Moore to withdraw over allegations of sexual assault, which he denies, is fueling divisions the Republican Party.

There has been no major legislation in Congress achieved this year, with a notable failure over healthcare. The stability of government relies much on a passage of tax reform. Tax reform with significant tax cuts is going to be difficult, but Republicans do appear to be making significant progress.

At least, in the USA, it appears that political risk has already weakened the USD this year, as such there may be scope for the USD to find positive news in coming months.

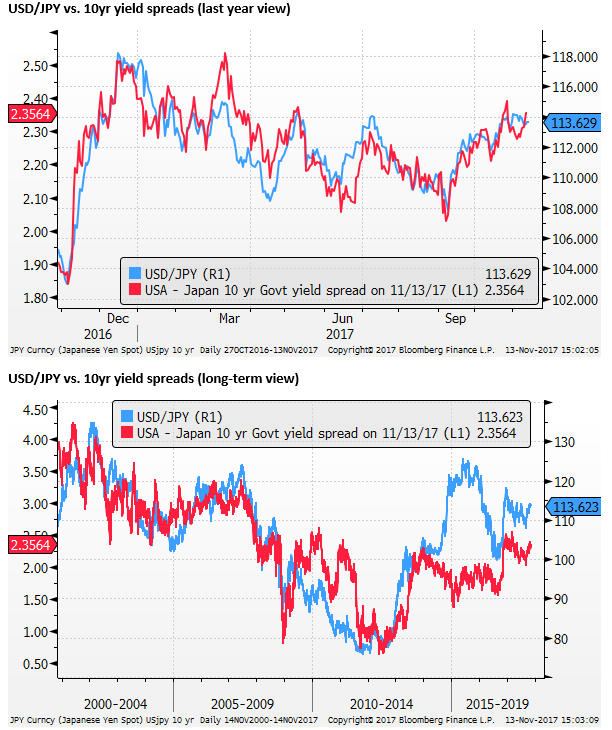

Japan has a strong political hand

Japan may seem to be holding a strong hand with respect to political risk with the decisive election win by PM Abe and the LDP in the election on 22 October; retaining a two-thirds super majority, with coalition partner Komeito. This may well be supporting the strong outperformance in the Nikkei stock index. However, the election win tends to support the continuation of the BoJ’s ultra-easy monetary policy for longer, tending to weaken the JPY.