Populist pandering hurts the dollar; Emerging Markets powering on

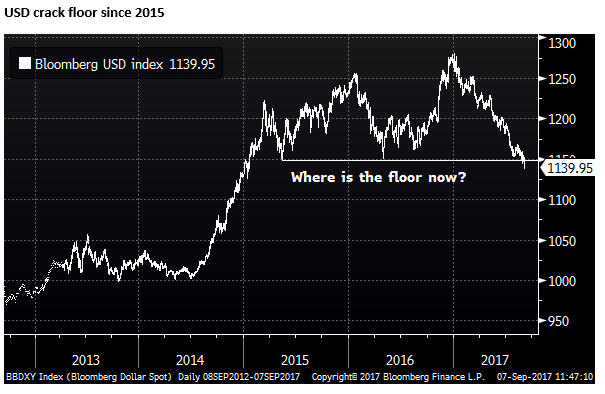

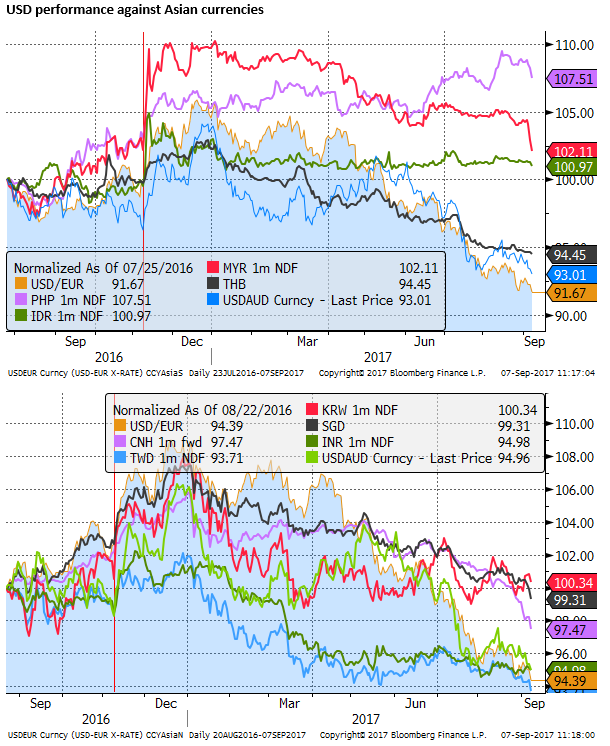

USA politics appears to be descending steadily into a quagmire of dysfunction, contributing to a weaker and more uncertain US economic outlook. The USD has clearly broken its base since 2015, leaving investors wondering where the bottom is. The sliding USD has developed a life of its own that may be hard to stop. The ECB tried to talk down the EUR today and failed. While the market appears to be grabbing for safe havens (gold, Treasuries, JPY), the market is not necessarily feeling bad about the global economy. In fact, it is feeling pretty good about emerging markets. Global economic indicators are robust, and commodity prices are rising. A number of Asian currencies have broken steady ranges to make new highs. The MYR and THB are both stronger along with their equity markets.

A Quagmire of dysfunction

The USD is extraordinarily weak across the board. Naturally, we are inclined to search for reasons why, and in doing so we risk trying to mold the story to fit the facts. But the USA political narrative appears to be descending steadily into a quagmire of dysfunction.

Remarkably, a Republican Administration, Senate and House majority can’t seem the get anything done. At various times through the year, hope has sprung up that it might achieve something, only to be quickly dashed. There is no semblance of certainty over any issue that is coming out of Washington.

Part of the issue is that the President is playing populist politics, pandering to his Alt-right/ economic nationalist base rather than trying to bring Congress on board with a reasonable legislative agenda. The events in Charlottesville appear to have been an inflection point for the political and economic outlook, turning sentiment from bad to worse.

The market got a short lived and modest bounce on news that the President had done a deal with Democrats to kick the debt ceiling can two-feet down the road and get some Harvey relief funding. However, in the process, he further embarrassed his own party’s leaders in Congress, and only delayed a debate on the debt ceiling by a few months. Everyone feels off-kilter; unable and unwilling to guess Trump’s next political turn.

None of the big issues have been resolved, such as will Trump demand wall funding. The Debt ceiling debate will still, perhaps even more so, interfere with tax reform debate. No other country has a debt ceiling issue, and the USA just can’t get past it. Trump has now thrown into the mix the need for Congressional action on DACA, further burdening an already dysfunctional Congress. For what reason? Probably to use it as a bargaining chip in his divisive Alt-right agenda.

The division in US politics and society are wide and widening. Virtually no one is trying to bridge the divide. You can’t get a sensible debate in the ridiculously biased media. Trump was forced to disband his business leader groups, and many major company CEOs are openly critical of Trump’s agenda. It feels like the whole country is at each other throats.

Everything appears to be overly politicized, including the Federal Reserve. Fed Chair Yellen has been trying to keep the debate in favour of financial regulation on banks, in line with global trends, but she must feel under attack. Her time may well be up in February. Fischer is leaving in October, after Tarullo left early this year; both key supporters of recent reforms in banking oversight.

Until he expressed his disappointment over how Trump handled Charlottesville, Economic Advisor Cohn was tipped to take Yellen’s spot. But even that would have appeared to be a highly politically motivated appointment, altering a long pattern of economic academic leadership.

Confidence in the Fed as a stabilizing institution for the US remains high, but it is diminishing fast, with four outstanding board positions unfilled, a balance of power that has swung to regional presidents, highly politicized appointments feared, and no certainty over leadership next year.

On top of this dysfunction, the US economy is forced to cope with Hurricane disasters. And the Administration is grappling with major geopolitical issues, while trying to balance this with renegotiating trade deals and threatening restrictions on major trading partners.

Not to mention the ongoing investigation into Russian meddling in the last election, tainting the administration and contributing to erratic Trump behavior and harder drift to the Alt-right.

None of this passes the smell test, and this may be a key factor undermining confidence in the USD. Investors like certainty and it has never been more wanting in the USA.

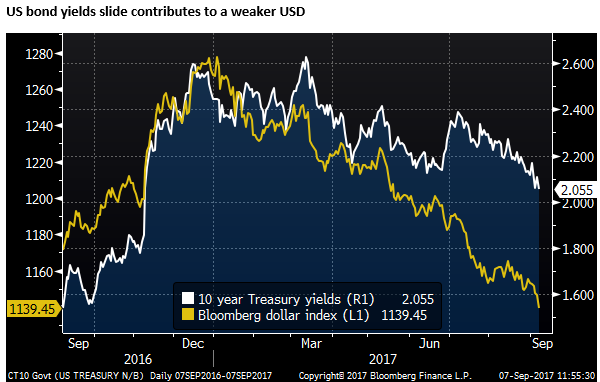

Safe havens in the market are out-performing; including US Treasury bonds, gold, and JPY. The search for safety in part reflects broad economic and political uncertainty in the USA. With hurricane Irma bearing down on Florida, likely to add to the short term economic disruption.

How important is politics for the USD? It is hard to say, the economy still seems to be relatively resilient. But it is certainly not helping. The USD falling trend has developed a degree of self-momentum.

There is no sugar-coating it, the USD on broad indices has busted the lows since 2015, and investors now have to consider that it is in the process of unwinding its 2014/2016 uptrend.

Emerging Markets are helping drive the dollar demise

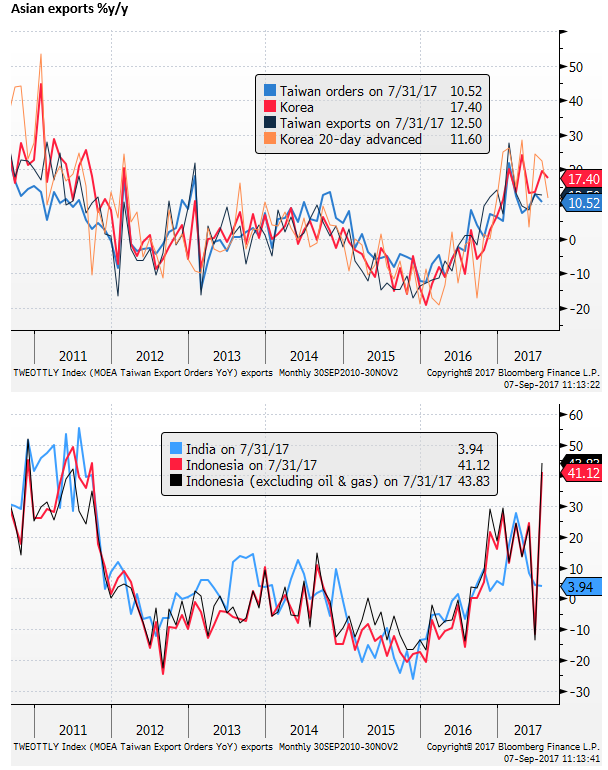

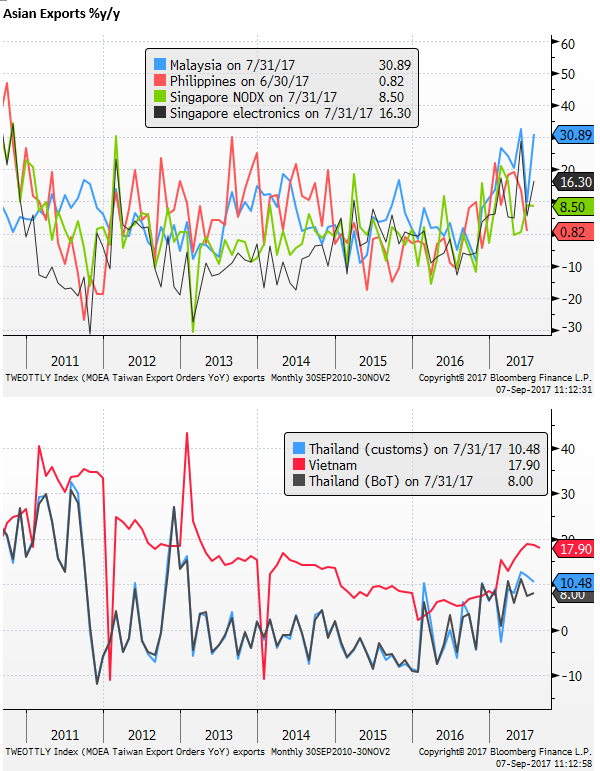

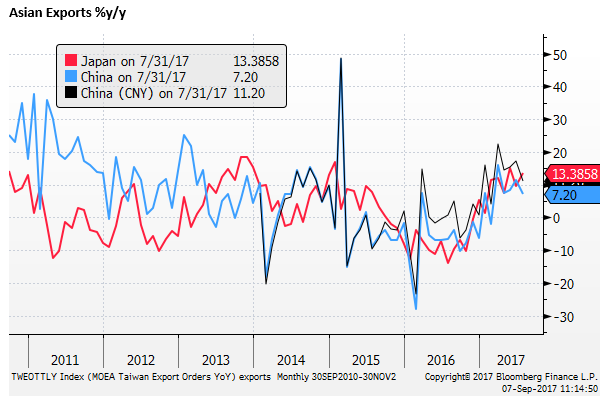

While there is a bid for safe havens, the market is not necessarily feeling bad about the global economy. In fact, it is feeling pretty good about emerging markets. Global economic indicators are robust, and commodity prices are rising. A number of Asian currencies have broken steady ranges to make new highs. The MYR and THB are both stronger along with strong equity markets.

Asian countries are broadly experiencing stronger export growth. Malaysia reported 30.9%y/y growth in exports in July, led by its electronics sector.

The strength in emerging markets is helping drive the weaker USD trend.

Draghi failed to halt the EUR rally

The EUR is the other power-house in reversing the USD trend. The ECB tried valiantly to halt that trend today, but had little effect. The market knows that the ECB will not be raising its negative rates for the foreseeable future, and it has had plenty of time to prepare for a taper from next year. It knows that the strength in the EUR will slow the return to target inflation. It just doesn’t care. The EUR is in a rising trend, and it not clear exactly what will stop it.

A key factor in the USD’s recent fall is the rapid fall in US 10-year bond yields. There may be some short term factors accelerating this fall. Increased economic uncertainty related to hurricanes. Uncertainty over North Korea. A lack of clear evidence that inflation will turn up in the USA. As mentioned above broader political uncertainty.

Draghi currency jawboning

The Draghi Press conference was more upbeat on economic growth and noted some moderate uptick in underlying inflation recently, which helps account for the EUR strength in response to the ECB policy statement.

However, the statement did insert concern over the strength of the exchange rate, suggesting that Draghi and the Governing Council are trying to jawbone against further appreciation.

Draghi said when pushed that he does not comment on the level of the exchange rate and it is not a target. However, the press release statement and his comments are designed to calm the gains in EUR.

Very high up in the statement, in the second paragraph, it said, “the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring with regard to its possible implications for the medium-term outlook for price stability.”

And it also noted that the higher exchange has resulted in slightly lower inflation forecasts. It said, “Compared with the June 2017 Eurosystem staff macroeconomic projections, the outlook for headline HICP inflation has been revised down slightly, mainly reflecting the recent appreciation of the euro exchange rate.” These forecasts are: HICP inflation at 1.5% in 2017, 1.2% in 2018 and 1.5% in 2019.

Deputy Victor Constancio confirmed that the exchange rate used in these forecasts is around its mid-August level (1.1750ish). So already the exchange rate is higher.

No announcements were made on a taper. The statement said, “This autumn we will decide on the calibration of our policy instruments beyond the end of the year”. Draghi confirmed in Q&A that key points would be announced at the next meeting in October.

The EUR rose sharply into the meeting and further after, seeming to pay little heed from to the press statement that the currency matters. The USD is under pressure broadly and the statement was more confident on growth, and the downward revision in the inflation outlook was slight.

The ECB might have hoped its jawboning would have had more effect. We should be more cautious buying EUR, these comments may get more airing and emphasis going forward.