pro-EU side gains ascendancy in UK parliament

Risk aversion on uncertain events from the US-China truce to Brexit and various other issues; including the OPEC meeting, and uncertainty over the global economy dominated markets on Tuesday. However, the Fed has softened its tone, the US and China have restarted negotiations, Pro-EU members of the UK parliament appear to have gained ascendancy, and Italy is trying harder to reach a budget accord with the EU. There seems more reason for US, UK, EU and Asian asset markets to recover rather than falter.

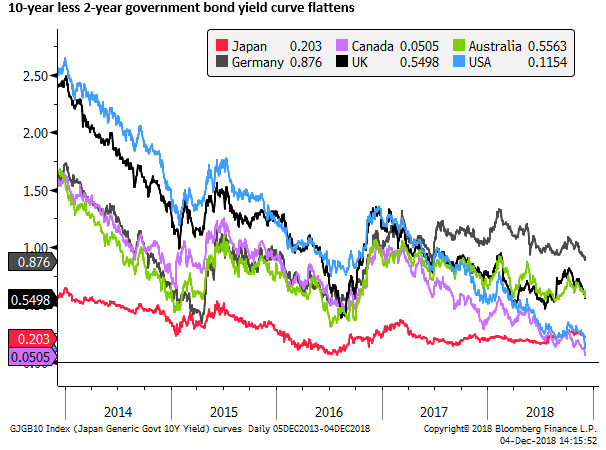

Long-term yields slide

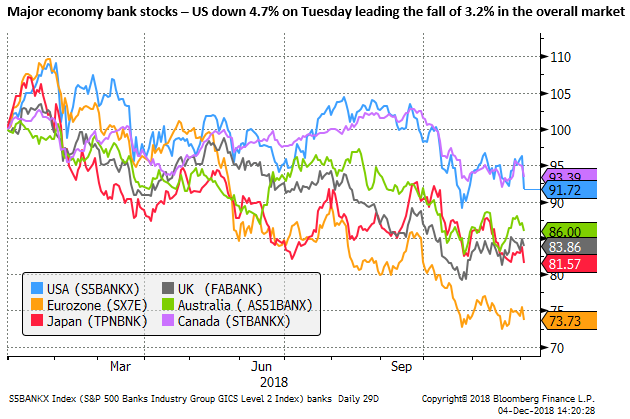

A fall in long-term yields, resulting in curve flattening in global bond markets contributed to sharp falls in bank stocks, and added to a sense of concern over the global economy. Curves are at their flattest since 2007.

Pro-EU UK MPs gain ascendancy

The GBP slumped after earlier rising sharply, spilling over into volatility in other currencies, including the EUR and AUD.

The debate in the UK parliament on the UK-EU divorce deal set to culminate in a vote on 11 December has accentuated the volatility.

The GBP fell after the UK parliament voted to hold the Conservative government in contempt for the first time in UK history over its refusal to publish its legal advice on the divorce deal negotiated by PM May, on which the parliament is set to vote on 11 December, next Tuesday. This legal advice will now be published.

May ordered to release Brexit legal advice – FT.com

However, it seems unlikely that this document will increase the chances of the UK crashing out of the EU in a disorderly no-deal Brexit. It may make it harder for May’s divorce deal to pass a vote next week, by firming the position of those on either side of the debate. But most see the passage of the deal as highly unlikely anyway.

The market should be starting to consider what happens next, and in that respect, two other developments on Tuesday appeared to increase the odds of the UK reversing course and avoiding a Brexit all together, or at least avoiding a no-deal crash in March next year.

As such, the drop in GBP seems surprising. It might be explained by heightened nerves so close to the vote on 11 December alongside the intense uncertainty over what happens next. However, arguably, the market should be buying the GBP seeing a higher probability of a Brexit reversal or the ascendency of the pro-EU MPs and their capacity to prevent a no-deal crash.

The GBP did rise to its highs earlier in the day on news that the European Court of Justice Advocate General, Manuel Camps Sanchez-Bordona, wrote in his opinion: “There is nothing, in my view, in Article 50 which envisages it as a ‘one way street with no exits’, pursuant to which all that a Member State could do, after notifying its intention to withdraw and subsequently reconsidering its decision, would be to wait two years to leave the European Union and immediately ask to rejoin.”

In other words, the UK could simply say it has changed its mind, and end the whole Brexit process (ie. reverse Article-50) This is not a final ruling by the ECJ, but it is a good indicator of which way it would decide.

ECJ’s top legal adviser says UK can unilaterally end Brexit – FT.com

In a further boost to pro-EU MPs,, the UK parliament voted on Tuesday to support a motion that it should get to debate and vote on a plan-B if May’s divorce deal is voted down on 11 December.

Theresa May suffers double defeat on Brexit deal – FT.com

This is likely to lessen the odds of the no-deal crash-out since there are not the numbers in parliament for a hard or no-deal Brexit. Combined with the prospect that the UK could reverse article-50, it would seem to provide a way to halt the no-deal crash should parliament remain hopelessly divided. It could remove the problem of a March 2019 deadline, and allow more time if required to hold new elections or another referendum.

On the whole that pro-EU MPs appear to have gained the ascendency, lessening the odds of a no deal or hard Brexit. In this respect, the slide in GBP may be short-lived.

Hold your nerve

Looking back to last week, the Fed message softened, laying out the potential for it to pause its rate hikes for a prolonged period to assess economic and financial developments in the US and globally. And the US administration agreed on a truce with China for at least three months to negotiate a trade deal.

Today, pro-EU UK MPs appear to be gaining ascendancy in the UK parliament. The Italian government also appears to be softening its tone on its budget, more willing to find an accord with the EU that might avoid sanctions.

Overall there seems more reason for US, EU, UK and Asian markets to improve not falter as we have seen on Tuesday.

The price action on Tuesday appears to reflect back-filling after the rebound in asset prices and a weaker USD last week. Investors may have preferred to sit on the sidelines given the heightened uncertainty around key events. These include US payrolls later this week and the Fed rate decision on 19 December.

However, we are seeing the case increasing for a weaker USD on less Fed hikes, positive news developments on Brexit, Italy and China.

The curve flattening has accentuating market nerves, but this development will weaken the resolve of the Fed to persist with its rate hikes.

There may be bigger global economic challenges lurking below the surface, and heightened uncertainty around big events dampening investor confidence, but recent developments suggest the path may be clearer towards stronger global asset markets and a weaker USD in the near term.