RBA Governor Lowe sets a steady course, prepares for risks ahead

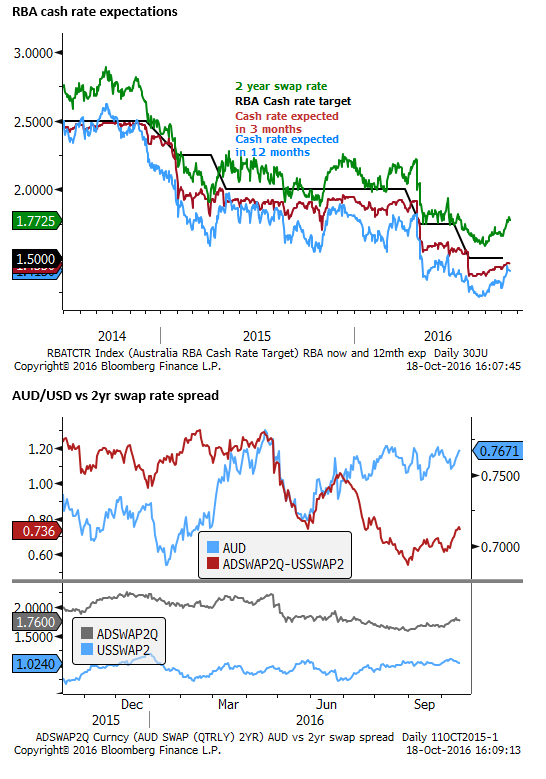

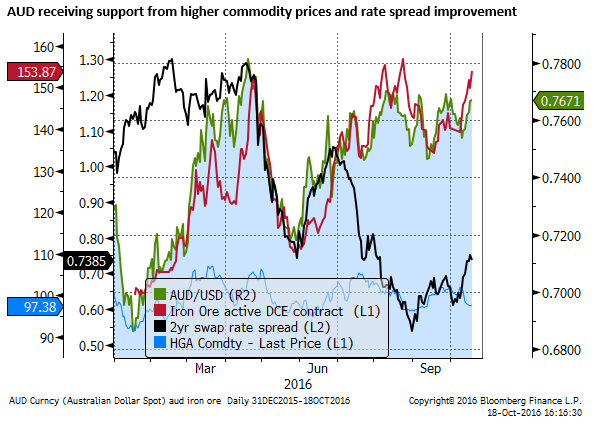

RBA governor Lowe is a month into his new job and has already signed off a new policy targets agreement, fronted parliament, chaired his first policy meeting, released a financial stability report and given his first public speech with Q&A. He has emphasized a flexible approach to policy suggesting he is willing to live with below-target inflation for some time. He has revealed a discomfort with cutting rates further, seeing a diminishing net benefit, and called on the government to consider facilitating more infrastructure spending. A bias to cut remains with slack in the labour market and mixed housing market conditions, but there is early evidence that the drag from the mining investment downturn is abating and commodity prices have rebounded sharply this year boosted by stronger demand from China and cuts in its production of commodities. Lowe is reluctant to leave unchecked a further decline in inflation, and may respond to a significant downside surprise to Q3 inflation next week, but on balance, rates appear on hold for the foreseeable future. Some downside risk for rates remains with an apartment supply overhang fast approaching and worsening financial stability risks in China. The AUD should continue to benefit from stable rates and stronger commodity prices in the near term.

RBA Governor Lowe stamps his mark

The New RBA Governor, Dr. Philip Lowe, has had the opportunity to stamp his mark on the Australian landscape since taking over from his predecessor, Glenn Stevens, on 18 September. He has agreed to a new Statement on the Conduct of Monetary Policy with the government which raises the importance of maintaining financial stability on 19 September. He has fronted parliament on 22 September (Hansard Transcript) further emphasizing the flexibility of the RBA approach to inflation targeting. He has overseen his first monetary policy meeting and released a statement and minutes that were more granular in describing what the RBA has seen and is monitoring, released the semi-annual Financial Stability Report and delivered his first speech as governor.

The RBA was already best in class for providing sufficient policy guidance without risking its credibility by offering specific forecasts on its rates outlook, and consistency of message. RBA Governor Lowe is the third career RBA official in a row to rise through the ranks after a distinguished career to take the top job, under the ethos of – if it ain’t broke don’t fix it. The RBA commands vaulted credibility in Australia and increasingly internationally that allows it to stay above the fray of politics and even guide the government towards more sensible policy.

RBA Governor Lowe has been careful to take over command by steering the ship on the same course at the same speed, so as not to unnerve the passengers, but appears more keenly aware of the risks that lurk ahead, providing more clarity to observers on what is the game plan.

Cares deeply in a force for good

He looks in charge, highly capable, confident and guided by intellectual honesty. He is not afraid to tell it how he sees it but is thoughtful and balanced, prepared to act on the balance of risks without regret and an eye on the medium term goals.

Lowe cares deeply about the institution he works for and believes it is a force for good. In his speech on 18 October he recited the words inscribed on the wall in the RBA headquarters entrance hall at 65 Martin Place that he passed every day when he still caught the bus to work. He said, “The medium-term inflation target is pursued as a way of achieving our broad goals as set out in legislation. This legislation, which was passed in 1959, states that the Reserve Bank Board must exercise its powers in a way that best contributes to: (i) the stability of the currency of Australia; (ii) the maintenance of full employment in Australia; and (iii) the economic prosperity and welfare of the people of Australia. These are lofty goals and, in my new position, I feel the weight of them.”

Flexible mandate

In several of his recent remarks, Lowe has been keen to emphasize the flexibility in the inflation mandate. The implication is that he is not panicked by the current below target inflation rate, and is prepared to take quite some time for it to move back into the 2 to 3% target zone.

Provided that taking time is “in the public interest”. There is no specific time-frame for achieving the inflation goal, only that over the medium term, on average, it is in the zone.

Lowe said, “The general starting point is to ask” what is in the public interest?” And, “when thinking about the issue, there are two factors that have particular prominence. These are employment and the stability of the financial system.”

He said, “When we find ourselves with inflation that is either lower, or higher, than normal, we want to feel confident that, over time, inflation will return to more normal levels. There is, however, always a choice about the exact path we take. When thinking about that choice, developments in the labour market and in balance sheets in the economy have particular importance.”

Lowe notes that this is not a new approach, but one that “has served Australia well for more than two decades now.” Nevertheless, Lowe has chosen to throw a spotlight on the flexibility in this approach, and thus we should see more prominence given to the state of the labour market and housing market (the most important driver of balance sheets in the economy) in assessing the outlook for rates.

In the past the RBA has stated that low inflation afforded it “scope for easier policy”, it might be more accurate to say that if rates were cut again, a more subdued housing market provided the scope to cut rates.

An easing bias remains

The flexible approach suggests that Lowe is not rushing to cut rates again, but there are still reasons why he might. The housing market is more mixed and an apartment oversupply, particularly in Melbourne and Brisbane is fast approaching. Some excess is also expected in Sydney, although more so a year away. Related to this has been some tightening in lending standards, mainly to this sector of the housing market. Furthermore, there is still significant slack in the labour market. So in the public interest, lowering rates again might support higher employment growth without significantly exacerbating financial stability risks, and of course, help lift inflation.

However, the current state of the Australian economy is nuanced and there are reasons to be patient. A steady hand for a while might be appropriate to see how various parts of the puzzle come together.

Lowe thinks rates are already low

For a start, rates are already very low, and Australia, like most parts of the world, is seeing diminishing benefit from further easing policy. Savers are already feeling the pinch, there is an uneasy ‘reach for yield’ forcing investors to take more risk which may undermine confidence, while failing to awaken the animal spirits of investors. A rate cut might help lower the exchange rate, but each rate cut from the current 1.5% level would be done with a sense of trepidation while expecting little boost to growth.

It is perhaps no coincidence that the Australian Treasurer (a senior cabinet minister in government) Scott Morrison recently said that globally monetary policy has “exhausted its effectiveness” and that he “did not detect any great sort of enthusiasm for further easing” by the RBA.

RBA Governor Lowe also expressed his view to parliament on 22 September that government should step in to use the low rate environment to increase spending on infrastructure and use its planning capacity to facilitate and encourage private sector spending in infrastructure. He noted that in international meetings he attends the global central bank community laments that not enough is done “in the G20 growth agenda and in the government facilitating infrastructure spending.” He said that, “A point that is made at almost every international meeting that I go to is that we do have options here and too much globally has been relied on for the monetary option.”

One might conclude that Lowe and the RBA are reluctant to cut rates further and thus need clearer evidence that it is necessary.

On this front there are some indicators that suggest a cut is not necessary, and given some more time, progress may be made towards stronger employment growth without further policy easing.

Signs of improvement in the economic outlook

In his speech on 18 October, Lowe noted that the end of the downswing in mining investment was now in sight. He said, “The economy is continuing to adjust reasonably well to the downswing in mining investment. This downswing still has some way to go, but the end is now in sight. And recently, commodity prices have picked up, which is a marked change from the large declines in prices we have seen for some years. Measures of business and consumer sentiment are also slightly above average.”

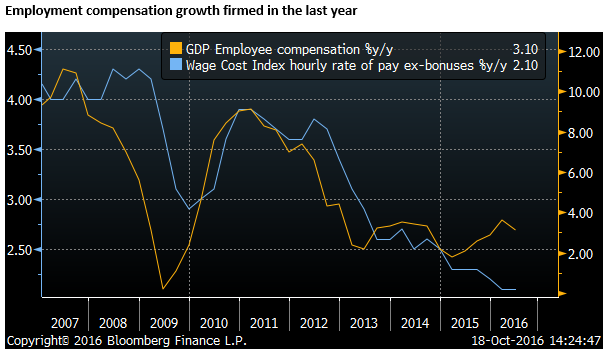

He also noted some evidence that the downward pressure on wages may also be coming to an end. He said, “Wage pressures remain weak, although there are some signs that the downward pressure on average wages from workers moving out of high-paying mining-related jobs might be coming to an end.”

The October RBA Policy minutes put some flesh on this. It said, “Growth in average earnings per hour recorded in the national accounts – a broader measure of earnings than provided by the wage price index – had picked up over the past two-quarters, to be 3 percent over the year to the June quarter.”

A complex housing market

In the 18 October speech, Lowe said the housing market is a “complex picture”. It has eased from last year, and the RBA did cut rates twice this year, in part because this afforded it scope to cut and respond to lower than expected inflation outcomes. However, Lowe noted that “[House] Prices seem to be increasing quite briskly again in some areas.”

The housing market now appears far more variable depending on region and segment. Some parts are hot, others like apartments in inner city zones now look weak. A cut in the next month or two might only wave the flames in hot sectors, but be too soon to effectively offset emerging problems in the apartment sector.

A higher forecast for terms of trade

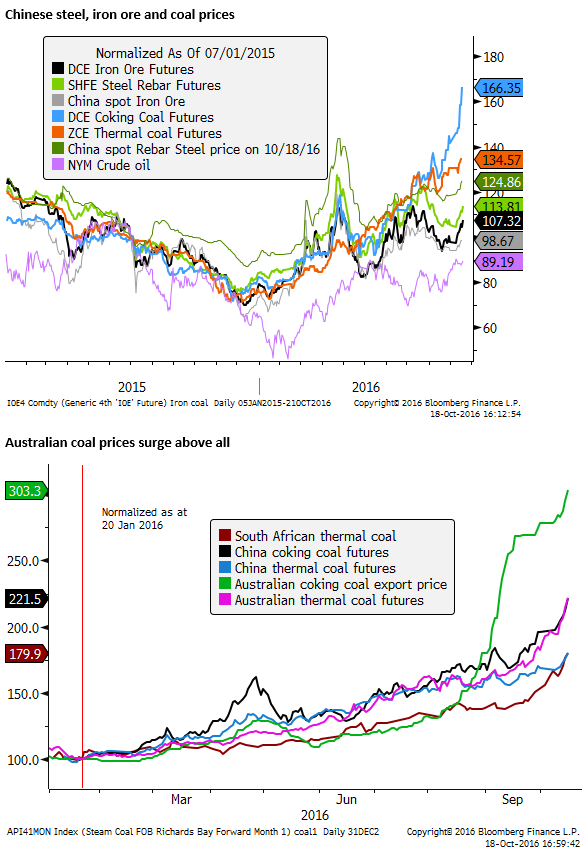

The October RBA policy minutes said that “commodity prices were well above the lows recorded earlier in the year.” And, “Members observed that the forecast stabilization in the terms of trade around current levels would see an end to the drag on incomes from the persistent decline in the terms of trade over recent years.”

This implies that the RBA is set to project a sustained up-lift in the terms of trade in its next quarterly statement to coincide with the next policy meeting on 1 November (released in the same week on 4 November). Recent commodity prices are in fact considerably more buoyant than this more positive outlook with coking coal prices surging in the last two months and firming iron ore and thermal coal prices. Gas prices are also likely to respond to firming trends in oil.

The RBA is in fact forecasting some retracement in coal prices and can see medium-term risk of another slowdown in China. But for now, the price developments and recent economic activity data from China are more supportive for the Australian economy.

Lowe expressed concern over low inflation expectations

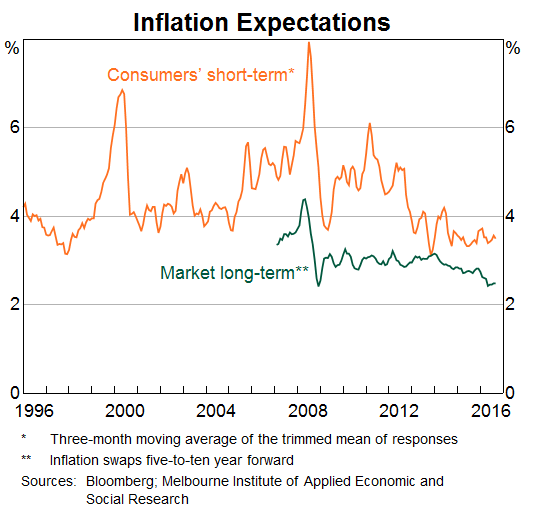

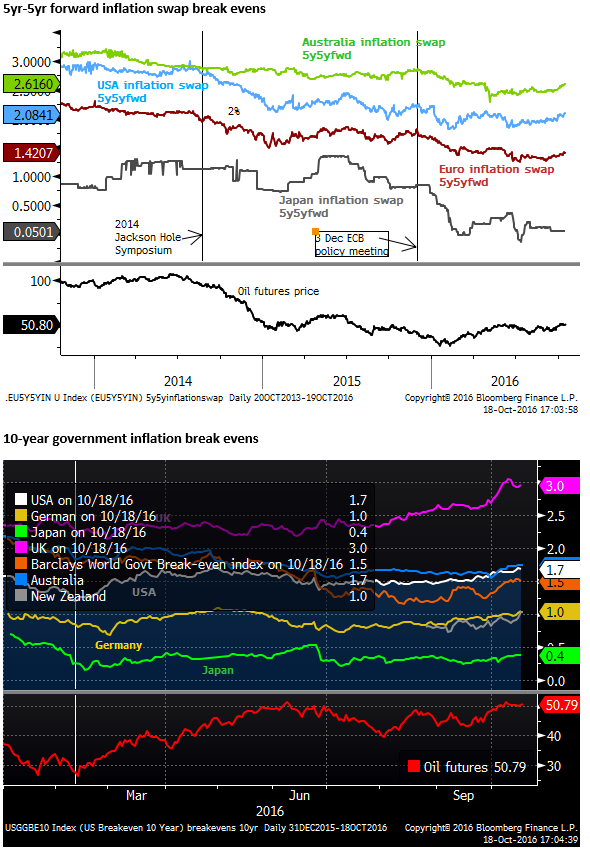

Lowe did express his concern over declining inflation expectations. He said, “In terms of inflation, we have been looking carefully at the various measures of inflation expectations, which have clearly declined, although not to unprecedented levels. The experience elsewhere suggests that we do need to guard against inflation expectations falling too far, for if this were to occur it would be more difficult to achieve the inflation target. Of course, one of the key influences on inflation expectations is the actual outcomes for inflation. We will get an important update next week, with the release of the September quarter CPI.”

However, the most recent trend globally, including in Australia, has been an improvement in market-based measures of inflation expectations. Some of this pressure to respond to a low inflation outcome is thus lessened.

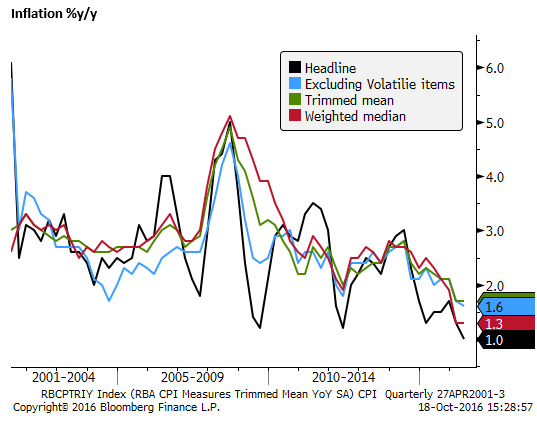

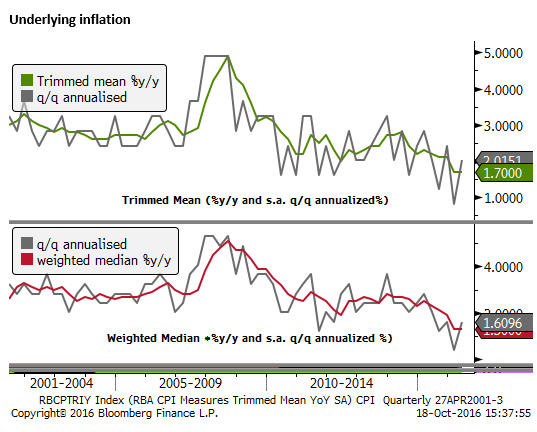

Underlying measures of inflation are on average 1.5%y/y, significantly below target, after falling significantly in the first half of this year. The RBA is likely to cope with it remaining around this pace for another year, provided it felt that it would then be more likely to start rising again.

The two key underlying measures – trimmed mean and weighted median – both drop out a relatively low outcome from Q3 last year of 0.3%q/q from their annual increases in the data next week (25 October). This provides a pretty low bar for the next quarterly inflation outcome to beat

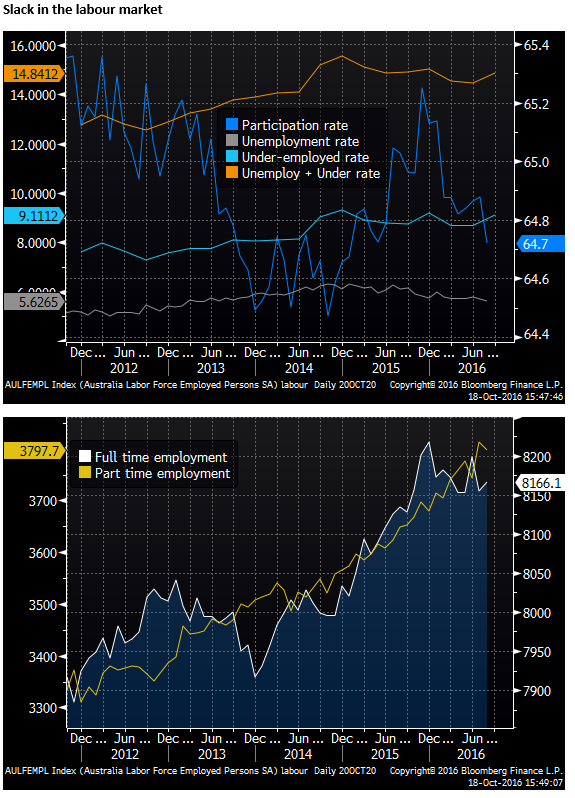

Slack in the labour market, moderate employment growth

The employment data is due this week. The RBA acknowledge slack in the labour market, including the fact that all the net increase in jobs this year has been in part-time work, leaving the underemployment rate stable even as the unemployment rate has eased.

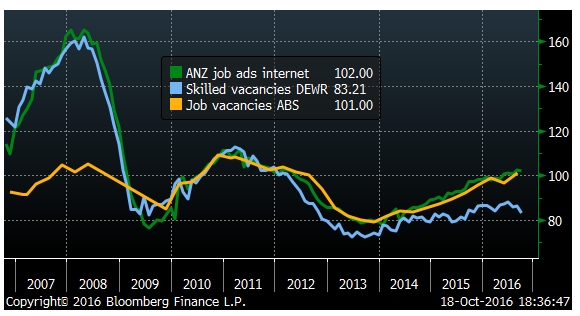

The RBA minutes from the October meeting said, “Looking ahead, the increase in job vacancies and advertisements was consistent with moderate employment growth in the coming months.” Although the skilled vacancy report today was weaker.

The labour data is, of course, important. However, the recent trend is mixed and the data this week will only provide so much additional information. Alone it is probably not enough to swing the outlook much in the near term.

Policy on hold for the foreseeable future, but risks on the horizon

The outlook from the RBA and Governor Lowe now appears balanced with a slight easing bias. The current conditions including stronger commodity prices, moderate improvement in Chinese activity, a mixed housing and labour market, business and consumer confidence somewhat above long run averages and early evidence that the drag from the mining investment down-turn is abating suggests policy is set to remain on hold for the foreseeable future.

There are risks on the horizon from an over-hang of inner city apartments. And China’s financial stability appears to be deteriorating, suggesting another potentially more severe economic down-turn in China is possible in coming years. However, the current trend is towards higher commodity prices, indicative of stronger Chinese demand and reduction in its domestic production of steel-making commodities, increasing income for the Australian economy.

The rate market is probably about right in its assessment that rates are likely to remain on hold, with a small and recently diminished probability of a further cut.