RBA has been trying to hold the AUD beach ball under water; its time may be up

It might be odd to suggest that the AUD will rise just at the point when the RBA has gone to max-dovishness. But yet we are. RBA dovishness is matched by the Fed. The global pivot to easier policy is boosting EM and commodity currencies, and the AUD has lagged its peers, suggesting upside risk. Australian equities are outperforming, reflecting both external factors and positive news at home. Just as the RBA, investors, and Aussies get themselves in a funk, the news has got better, quite a bit better. The LNC was returned surprisingly and emphatically. They plan tax cuts and are likely to respond to increasing pressure to further boost infrastructure spending. The housing market is stabilising, boosted by regulatory credit easing and the return of the market-friendly government. The AUD is way underdone relative to commodity prices, the external balance is at a generational high, and the government budget is in rude health. The focus on US-China trade relations and RBA policy has hit the AUD, but may have had maximum impact. The Xi-Trump meeting next weekend could go either way, but if talks resume and further tariff increases put on hold, we expect some modest further rise in risk appetite and upside for the AUD.

Deep rate cuts expected in Australia

Perhaps it is time to consider buying the AUD/USD. It seems odd that I would be saying that when the market is pricing in two more RBA rate cuts this year that would take the cash rate to 0.75%, making for a total of three cuts from 1.5% since May, and significant odds of a fourth in the first half of next year.

In a speech on 20 June, RBA Governor Lowe said that, “The most recent data – including the GDP and labour market data – do not suggest we are making any inroads into the economy’s spare capacity. Given this, the possibility of lower interest rates remains on the table.”

The speech outlined a seemingly fresh view by the RBA on the labour market that it has significantly more spare capacity than previously thought, and full employment might now be achieved if the unemployment rate fell from 5.2% to around 4.5%. RBA governors rarely get more pointed than that when it comes to guiding policy, and the market pricing of a follow up 2-July rate cut rose from around 50 to 80%. The market is now fully pricing in two further cuts by the 5-Nov policy meeting (0.75%), and lower to 0.62% by the middle of next year.

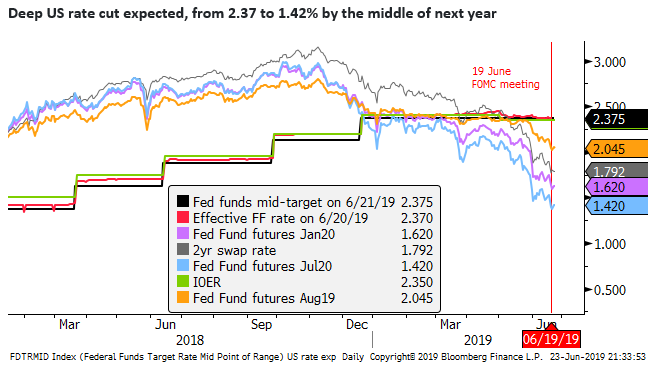

The Fed is expected to begin its own significant policy easing

However, the AUD/USD has been firming since a low on 14-June on the back of a weaker USD. The market moved to fully price in a rate cut by the Fed at its next policy meeting on 31 July after the FOMC meeting on 19 July (in fact it is pricing in over 20% probability of a larger 50bp cut). In particular, the press conference by Chair Powell seemed to send a strong signal that the Fed was ready to cut rates.

The Fed has shifted from a tightening bias at the end of last year, after it hiked for a fourth time in 2018, to a patient stance early in 2019, to an easing bias. The message is that the Fed wants to sustain a solid pace of growth in the US to keep upward pressure on inflation that has failed to meet its target consistently for several years. The market presumes this means it is now prepared to cut rates significantly even if there is only a modest retreat in economic growth.

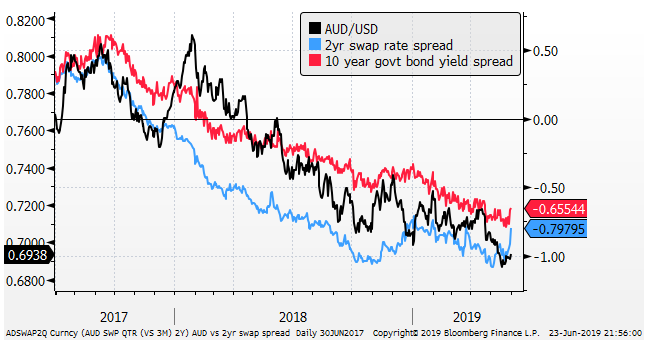

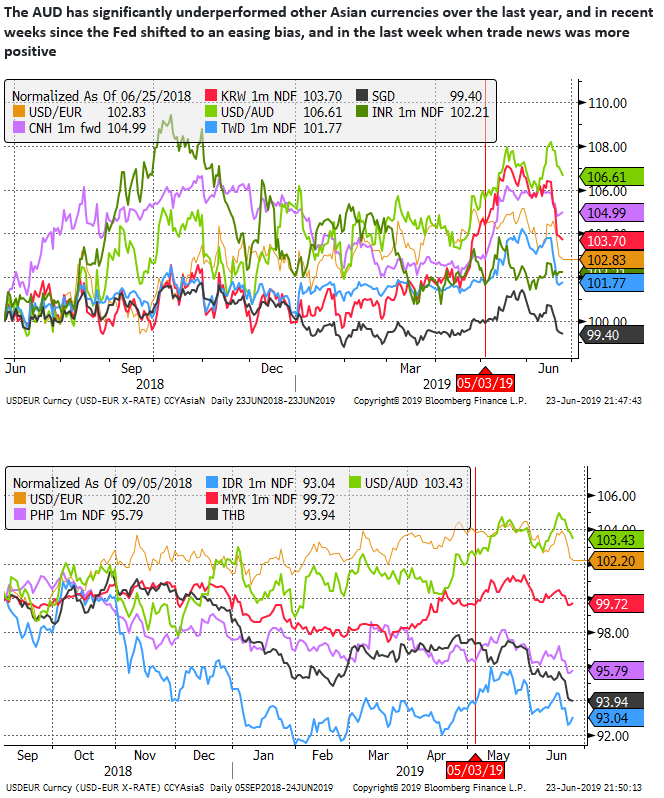

The dovish tone by the Fed has helped broadly weaken the USD, especially against emerging and commodity currencies, but also against the EUR and other major currencies. The AUD has also lifted, but more modestly than most, reflecting the efforts by RBA Governor Lowe to talk down both rates and the AUD.

RBA talking down the AUD

The RBA has more pointedly than in the past attempted to link the AUD to rates. It said in the June policy minutes, “Members recognised that, in the current environment, the main channels through which lower interest rates would support the economy were a lower value of the exchange rate, reduced borrowing rates for businesses, and lower required interest payments on borrowing by households, freeing up cash for other expenditure.”

RBA Governor Lowe also led with the exchange rate when discussing the stimulative influence of rate cuts in his speech on 20 June. It’s hard to miss the message that the RBA does not want the AUD to rise and would welcome a further decline.

Trump is talking down the USD

The RBA is lucky that these comments appear to have slipped under the radar of US President Trump that wasted no time in chiding the ECB’s Draghi after he hinted at more monetary policy stimulus (without a word about the exchange rate) in a speech on 18 June.

Trump tweeted: “ECB officials see Rate Cut as primary tool for any new stimulus.” followed by “German DAX way up due to stimulus remarks from Mario Draghi. Very unfair to the United States!”

I guess Australia is not quite big enough to be seen as a competitive threat in monetary policy stakes, but the US administration appears to want a weaker USD.

Trump-Xi meeting raised hopes

The AUD also appeared to get a boost from news from President Trump in a Tweet, later confirmed by the Chinese government-run media, that he had spoken to Chinese President Xi, and they had agreed to meet around the 28-29 G7 Summit (probably next weekend).

The news via Trump’s tweet came just before he chided the ECB on 18 June. It was a busy day!

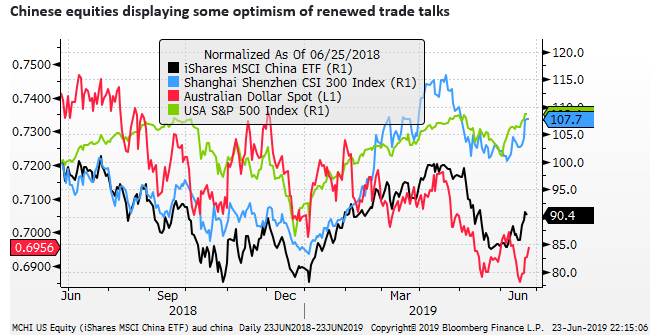

There has been a solid recovery in US and global equities since 4-June, when the Fed Chair Powell first hinted in a speech that the Fed was prepared to ease policy to help support the economy. They rose further after news last week that the Xi-Trump meeting was on, lifting expectations of some easing in the trade dispute.

RBA trying to hold a beach ball underwater

So the AUD rose in the last week or so, despite increased expectation that the RBA would cut deeper and sooner, because the Fed has also indicated that it will soon cut rates; the market presumes it will cut several times in the coming year. And the Trump-Xi meeting suggests that trade talks may resume. You might say the RBA has been attempting to hold the beachball under water in the last week.

Some reversal in the AUD/USD rates spread

Significant rate cuts are now expected in both Australia and the USA. Similar amounts, in fact somewhat more in the USA over the year ahead. The US may well retain a positive rate spread over the AUD, and this may limit the recovery in the AUD. However, the rates spread between the two has moved in favour of the AUD recently, increasing the risk of a further period of recovery in the AUD.

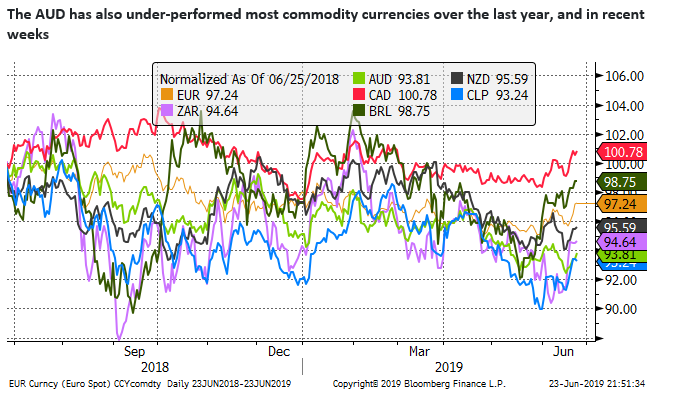

AUD has significantly underperformed peers

Further suggesting the AUD may have some upside potential, is that it has significantly underperformed other Asian currencies and commodity currencies over the last year and in recent weeks. The domestic focus in rate cuts has prevented the AUD from responding as much as other currencies to recent weakness in the USD. But it may be the case that the rate cuts are now largely priced into the AUD

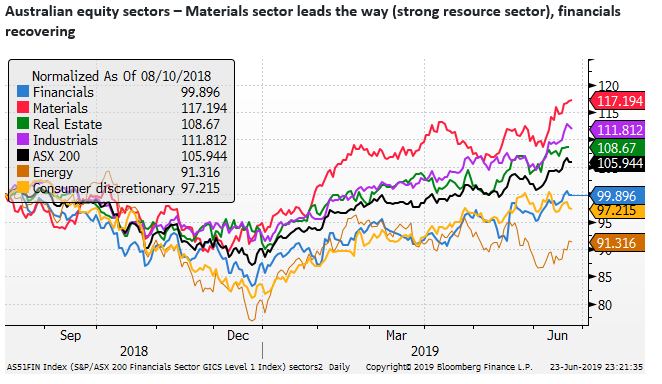

Equity markets suggest Australia is in better shape

Equity markets also suggest that the Australian economic outlook may be better than it seems. The local share market has significantly out-performed other markets over recent months. This reflects higher commodity prices and a lower AUD boosting materials equities. A return to government of the LNC has also taken pressure off the housing market. The lower rates outlook, both weakening the AUD and supporting the housing market, has helped revive bank share prices. As has some easing in regulatory pressure on banks lending standards.

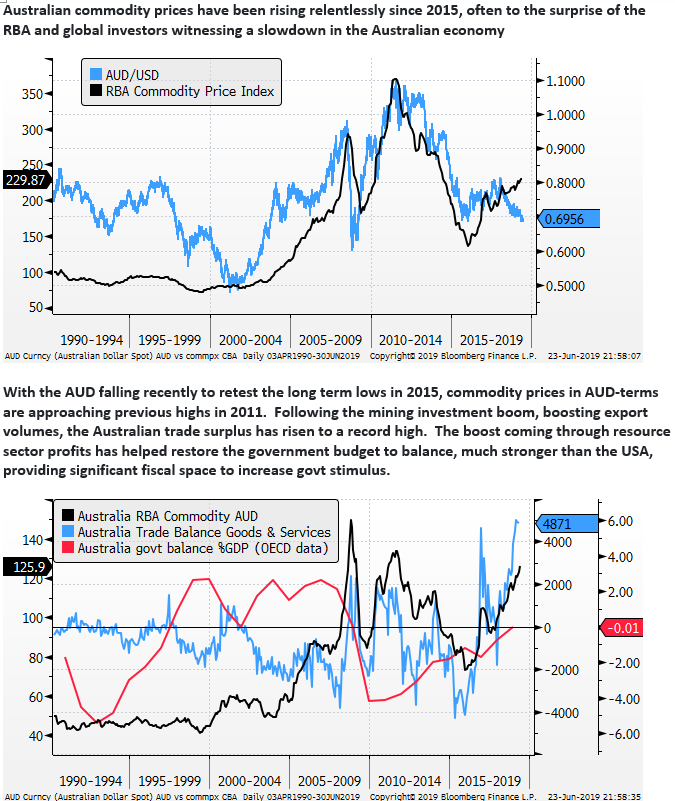

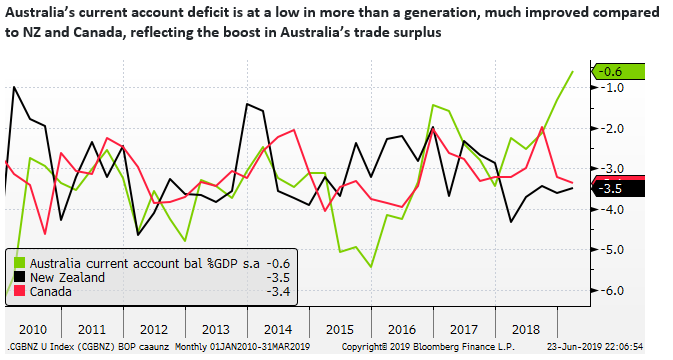

External and government balance in rude health

Australian commodity prices have been rising relentlessly since 2015, often to the surprise of the RBA and global investors witnessing a slowdown in the Australian economy. With the AUD falling recently to retest the long term lows in 2015, commodity prices in AUD-terms are approaching previous highs in 2011.

Following the mining investment boom, boosting export volumes, the Australian trade surplus has risen to a record high. The boost coming through resource sector profits has helped restore the government budget to balance, much stronger than the USA, providing significant fiscal space to increase govt stimulus.

The strength of the government budget position has allowed the government to promise tax cuts and there is still considerable room to ease fiscal policy. This should limit the downside risk for the Australian economy, and the need for the RBA to ease policy

Australians are in a funk just as the news flow turns positive

Just at the point when the RBA has started to cut rates (arguably six-months too late), the news flow on the domestic economy has got better.

The Liberal-National Coalition has beaten the odds and been returned to power on a platform to deliver significant tax cuts in the short and medium term. Very soon, Australian consumers are going to get or expect to get more disposable income.

The no-change in government has further given a boost to the housing market. Instead of sinking rapidly and dragging down household confidence, house prices should be expected to stabilise and begin rising.

The housing market is to get a boost from lower mortgage rates, and some easing in credit conditions as APRA and the Banking Royal commission takes the foot off the throat of banks.

The RBA Governor has gone into overdrive in pressuring government to deliver more infrastructure spending. He has suggested that monetary policy easing alone cannot be relied upon to restore the Australian economy to sustained health.

State and Federal government have already been increasing spending, and this had been something the RBA had previously been leaning on for its reluctance to cut rates. With everyone looking at government to boost spending, the likelihood is that they make further announcements as the year progresses.

Trade tensions and Xi-Trump meeting remain a near term risk

The US-China trade tensions remain a downside risk for Australian market investor sentiment. However, China has been stimulating the economy and the beneficiary appears to be Australian commodity prices.

Looking into the G20 summit, it is difficult as usual, to predict the outcome. The market might be excused for keeping optimism in check. Over the weekend, Trump’s tweets explain that he loves tariffs, and five more Chinese tech companies were added to the US entity list, potentially banning them from trade with the US.

The market does not have well-defined expectations of what it expects from the G20 meeting. The result from the December meeting of Trump and Xi was that the further tariff increases were put on hold and negotiations restarted. Perhaps this is the baseline case for the meeting this weekend.

If this is the outcome, we expect there will still be some further lift in global risk appetite, because it will reduce the immediate tail risk of further deterioration.

The outcome could be either much better than this or worse. The two sides could come away with no commitment to continue talks and US plans to further increase tariffs. This would be a significant disappointment.

The outcome could be that the US reverses the recent increase in tariffs as a good faith measure while talks are resumed. This would be seen as a significant positive for risk appetite.

We expect the AUD will rise along with EM and commodity currencies if the trade talks are put back on after the Trump-Xi meeting and further tariffs are put on hold.

The politics of this meeting are complex, and the outcome is hard to guess. Trump might like to get Xi’s help with North Korea, and this might be a bargaining chip for China. However, the US bans on Chinese high tech companies may be a major stumbling block for a trade deal. Iran may also feature in the discussions.

Trump has appeared to want to portray a close and constructive relationship with Xi, despite the tough actions taken against China. The pattern so far has been consistent that he has praised Xi, and comes away from their meetings with renewed hope for cooperation.

The market may remain sceptical that renewed talks will yield results, but it should at least generate some optimism in global markets if talks are renewed, especially now that major central banks appear on a track to deliver further policy easing.