RBA may cut reluctantly

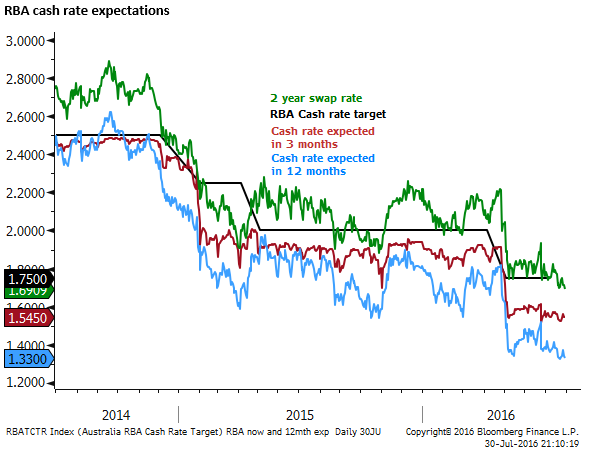

We expect the RBA to cut this week, but are not convinced and agree with the 60% chance of 25bp cut priced into the market. A cut this week is consistent with the policy prescription set out in the RBA Statement on Monetary Policy in May when the RBA cuts rates for the first time this year to address its low inflation outlook. We are now three months on, past the election, and on the eve of the RBA’s next forecasting round. It more-or-less predicted that it would cut again by now in May and not enough has changed to suggest it should hold back. The outlook for inflation remains low for the next few years. However, the RBA may feel less compelled to act with global inflation trends low and doubts that a rate cut now will do much good anyway. The domestic economy is tracking close to trend at this time with some positive evidence in business surveys. Given the risks to the outlook the RBA may think it best to keep its limited space to ease conventional policy up its sleeve for now. On the other hand, not cutting is likely to generate uncomfortable gains the AUD given the lackluster performance of the USD over the last week, further undermining the inflation outlook.

RBA may cut reluctantly

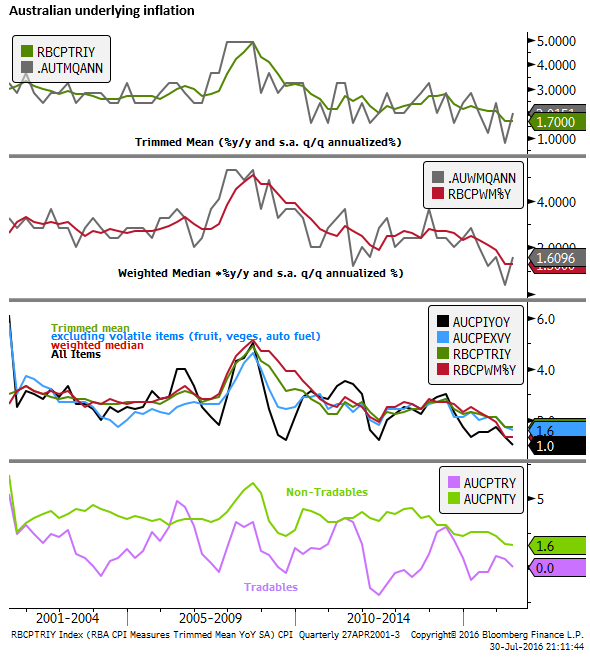

The RBA cut in May in the most part because inflation was much worse than expected in Q1. It stabilized in Q2, but remains well below the bottom of the RBA 2 to 3% target band with little prospect over rising much in the year ahead.

Underlying inflation in Q2 came in roughly where the RBA forecast in its May Statement on Monetary Policy (1.5%y/y). At that time the RBA only forecast inflation rising back to 2%, the bottom of its target band, at the end of its forecast period in June 2018. This forecast was made on the assumption that rates would fall further in line with market expectations. The market was then and is still anticipated one to two more cuts over the year ahead. As such, a risk assessment of possible inflation outcomes suggests that the RBA would be advised to ease policy further if it were purely driven by its inflation targeting regime.

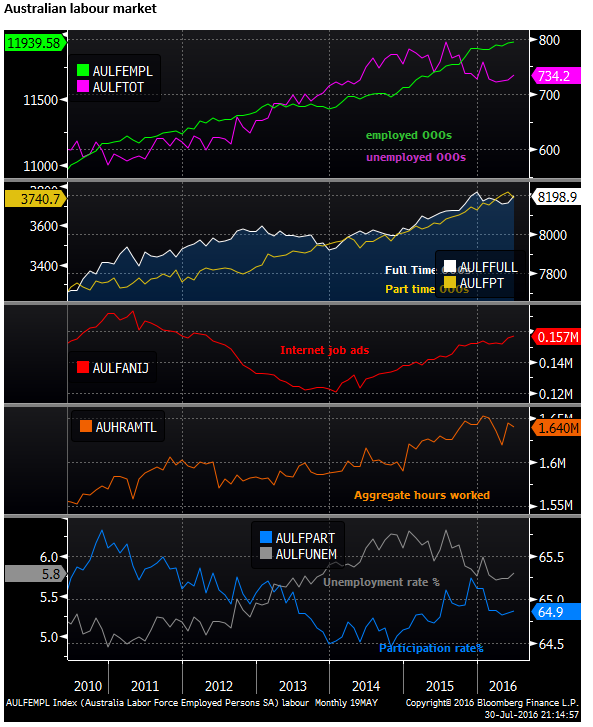

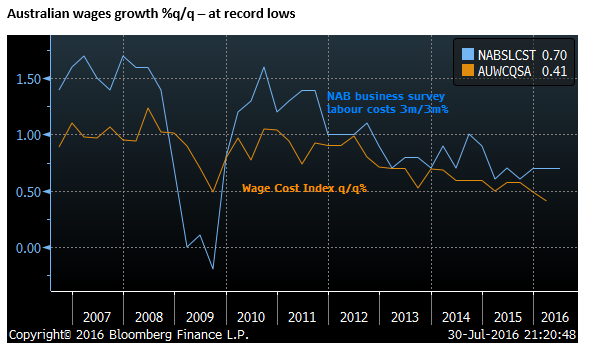

Labour market indicators have lost some momentum this year, after surprising strength last year. Slack in the labour market remains and it is in unclear whether there has been further progress towards tightening this year with a slower pace of jobs growth, more so for full-time jobs.

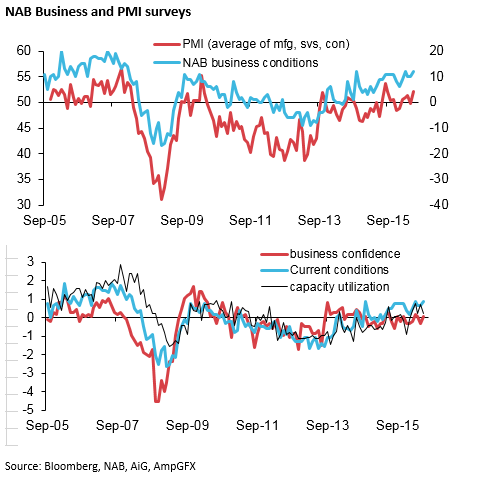

However, business confidence surveys suggest there is no reason to panic that the economy is losing momentum PMI and business conditions surveys are stable or firming slightly, somewhat above long run average levels. Confidence is understandably lower around average levels, and capacity utilization is only a modestly above average levels. Probably not sufficient to confidently lift inflation and wages for the foreseeable future, but perhaps giving the RBA more time to assess conditions if it chooses.

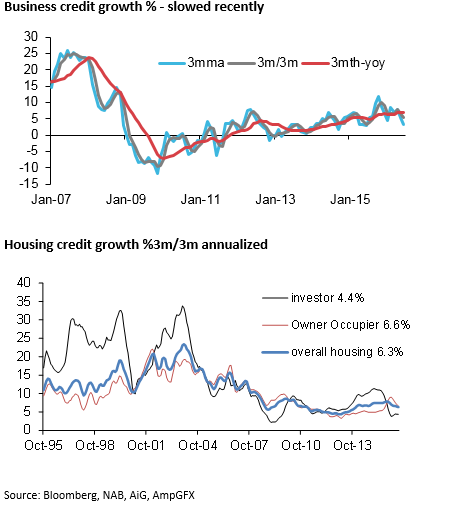

However, the case to ease is supported by some recent slowing in credit growth.

As the RBA pointed out in its July policy meeting minutes, “Considerable supply of apartments was scheduled to come on stream over the next few years, particularly in the eastern capital cities. At the same time, however, housing credit growth had eased, in line with a lower turnover of housing and the earlier tightening in banks’ lending standards following the announcement of supervisory measures. Various state government measures and changes to bank lending requirements were likely to temper foreign investor demand for housing.”

As such it might fear less that lowering rates will spur further excess demand in the housing market. Although at this stage prices still appear to be rising relatively rapidly. So equally it could decide to keep rate cuts up their sleeve for use if confidence in the housing market and broader economy were to deteriorate.