RBA play it cool, this time

RBA play it cool this time, probably to keep a lid on the AUD and to monitor recent rises in interest-only mortgage loan rates. But recent economic indicators have strengthened (labour, retailing, and non-residential building). News of the death of the Australian housing market are greatly exaggerated. Inflation has firmed since last year, and a spike in electricity prices early in the year adds a unique dimension to Australia’s inflation outlook. Business surveys remain strong, capacity utilization has tightened further, state and federal infrastructure spending is moving forward. Rates in Australia are still at emergency levels and the RBA like other major economies might be advised sooner rather than later to prepare its domestic market for possible rate rises. Chinese PMI data firmer, iron ore and steel prices stronger recently, while dairy prices have eased, and NZ macroprudential measures continue to slow NZ house price growth; the recent pull-back in AUD/NZD may be an opportunity to buy.

RBA play in cool

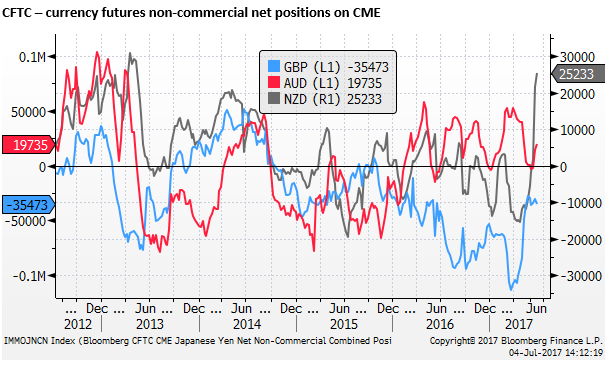

The RBA statement was very close the one preceding it in June. This was probably not unexpected, but the market went into the meeting wary that the RBA might join a shift in mood that has occurred in several other major economies’ central banks in the last month, starting with the Bank of Canada. The fall in the AUD after the statement probably reflects some unwinding of speculative and cautionary long positioning taken just in case the RBA made some less dovish/more hawkish noises.

The RBA statement may reflect a degree of cautiousness by the RBA, purposely keeping the wording in the statement little changed, to signal that it is not part of some global shift, and wants to prevent a further appreciation of the AUD for the time being.

Recent data suggests that the RBA could have sounded more upbeat about the state of the economy and outlook for inflation, but certainly fragilities remain and it would have been unhelpful if the currency had appreciated.

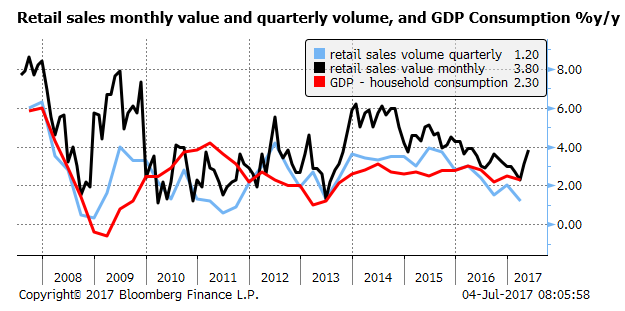

Retail sales recover

Retail sales rose strongly for the second month in a row in May, extending a rebound from a weak Q1; rising from 2.3%y/y in March to 3.8%y/y in May. The RBA said in its policy statement that, “consumption growth remains subdued, reflecting slow growth in real wages and high levels of household debt.” But recent data question this assessment.

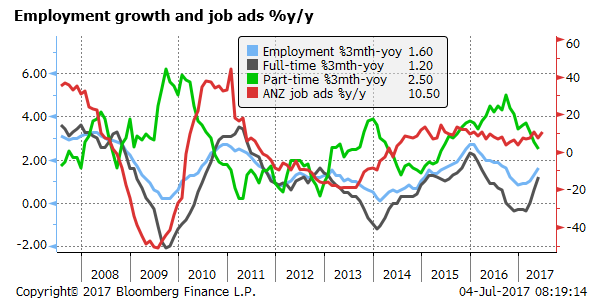

Labour market recovery

ANZ job ads rose a strong 2.7%m/m in June, up 10.5%y/y, pointing to further recovery in the labour market that has posted strong employment gains in the three-months to May (+1.6% 3mth-yoy).

The RBA said, “Indicators of the labour market remain mixed. Employment growth has been stronger over recent months. The various forward-looking indicators point to continued growth in employment over the period ahead.” This was similar to its previous statement in June, but it dropped its mention of “growth in total hours worked remains weak”, which have also picked up in recent months.

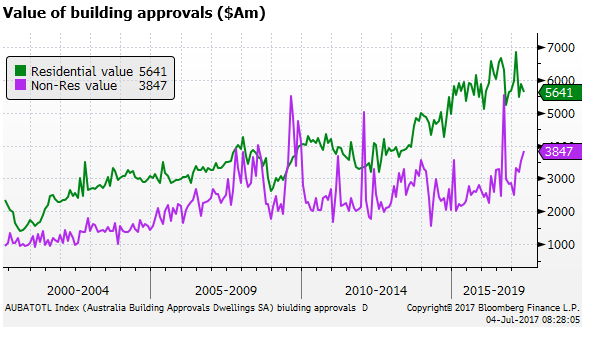

Apartment approvals fall, non-residential strengthening

Residential building approval, led by apartments, were weaker than expected, down 5.6%m/m in May and -14.1%y/y. It does appear that the peak was 2015/2016 and this sector will detract from growth in coming years.

However, in value terms, non-residential approvals have risen this year, helping offset softer residential approvals

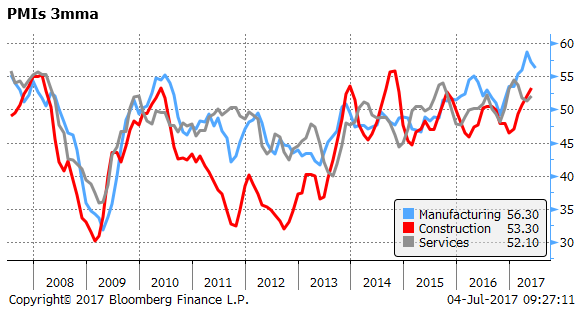

Business surveys solid

Business surveys are quite solid. The manufacturing PMI released on Monday was 55.0 in June, at 56.3 on a three-month average, down from a high in April, but above previous cyclical peaks. All three sector PMIs are above 50, the service sector PMI is due on Wednesday.

The RBA said, “The Australian economy is expected to strengthen gradually, with the transition to lower levels of mining investment following the mining investment boom almost complete. Business conditions have improved and capacity utilisation has increased. Business investment has picked up in those parts of the country not directly affected by the decline in mining investment.” This was a repeat from their June statement.

The outlook for business investment appears to be improving, and infrastructure investment, already underway by state governments, and planned by the federal government, should also boost confidence.

Inflation firmer, electricity prices hikes to feed through

Underlying inflation measures are running below the RBA’s 2 to 3% target range, but have picked up from the lows last year, and monthly indicators suggest that they remain stable in Q2. The surge in Australian electricity prices in Q1 (almost doubling in some states) has not eased much in recent months, and is an inflationary pressure not apparent in other countries.

The RBA said, “Wage growth remains low, however, and this is likely to continue for a while yet. Inflation is expected to increase gradually as the economy strengthens.” This is similar to the June statement, although in June the RBA also said,” Slow growth in real wages is restraining growth in household consumption.” Maybe less so now that employment growth has picked up in recent months.

Life in the housing market

News of the death of the Australian housing market is greatly exaggerated, with a rebound in house prices in the last month (up 2.0% in the month to 2-July in the weekly CoreLogic report and firmer auction results, albeit still down from highs early in the year.

The RBA said, “Conditions in the housing market vary considerably around the country. Housing prices have been rising briskly in some markets, although there are some signs that these conditions are starting to ease. In some other markets, prices are declining. In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years. Rent increases are the slowest for two decades.” This was a repeat from the June statement.

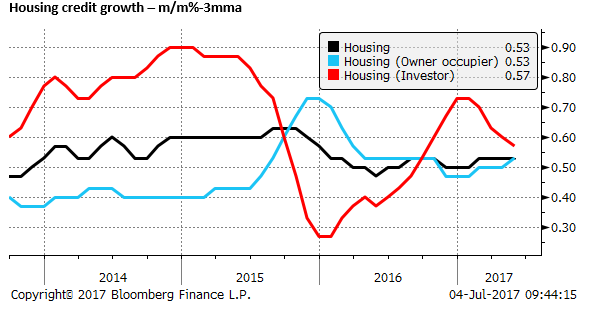

Borrowing conditions, mainly for investors, have tightened up this year due to regulatory measures designed mainly to limit growth in interest-only loans, favoured by investors. Lending for property investment (as opposed for owner-occupier lending) has moderated this year after a resurgence late last year, into January this year. However, it is still significant at a 7.1% annualized pace over the three months to May. Owner-occupier loan growth is running at a stable 6.5% annualized pace. Overall housing debt is still growing faster than household incomes.

The RBA said, “Growth in housing debt has outpaced the slow growth in household incomes. The recent supervisory measures should help address the risks associated with high and rising levels of household indebtedness. Lenders have also announced increases in mortgage rates for investor and interest-only loans.” This was also essentially a repeat from the June statement.

RBA caution over household debt

The RBA has expressed considerable concern over the high level of household debt (190% of income), more so since Governor Phil Lowe took the reins last year. This has prevented them from cutting rates further over the last ten months. The case for cutting rates has faded as this year has progressed; with a recovery in the global economy and improvement in domestic activity indicators. However, doubts remain over how Australia will cope with higher rates. High indebtedness and high house prices make the economy more vulnerable than most to higher interest rates. As such, the RBA is likely to proceed cautiously when it comes to possible rate hikes in future.

Nevertheless, recent indicators suggest that high indebtedness and some moderate increases in loan servicing costs are not unduly dampening overall activity. The RBA may need to float some trial balloons as the year progresses, raising awareness that rates may be raised sooner rather than later.

They chose not to this month, perhaps aware that the market was ready to pounce on even subtle shifts in stance, in light of the sudden rise in global yields in recent weeks, albeit still from low levels. The RBA is still hoping that rate rises abroad, particularly in the USA, will help cap the AUD. Should the AUD fall, they might be more comfortable warning.

AUD/NZD view

The RBA succeeded in knocking the AUD down a bit, perhaps providing a buying opportunity. Perhaps AUD/CAD is starting to look like a buy. CAD has surged as the Bank of Canada has suggested it is preparing to reverse its rate cuts delivered in 2015 to address an oil price shock. But you may think it better to wait at least until the first hike is delivered, probably on 12 July.

It may also be worth considering buying AUD/NZD. However, arguably the RBNZ has also been avoiding a necessity to lay the groundwork for a rate hike. Nevertheless, AUD/NZD appears relatively low and good value.

The latest QV NZ house price data showed inflation down sharply from 9.7%y/y in May to 8.1%y/y in June; down from 13.5%y/y in Feb, to a low since March-2015. It appears that a significant toughening in macroprudential measures in NZ are having an effect. The prospect of even more, if required, as the RBNZ has started work on adding debt-to-income limits to its tool set, may also be dampening activity.

Iron ore and steel prices in China have strengthened recently, whereas dairy prices have eased somewhat.

CFTC market positioning data also suggests that the market has extended NZD long positions.