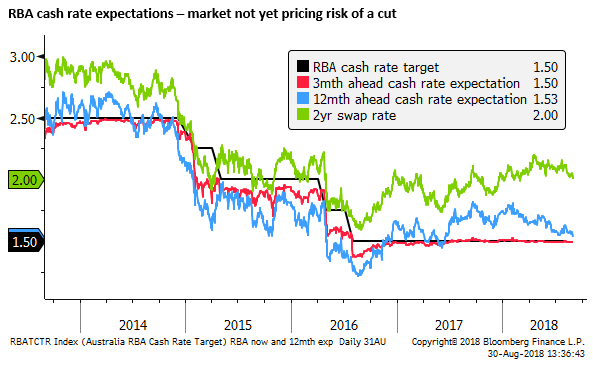

RBA rate cut may soon be back on the table

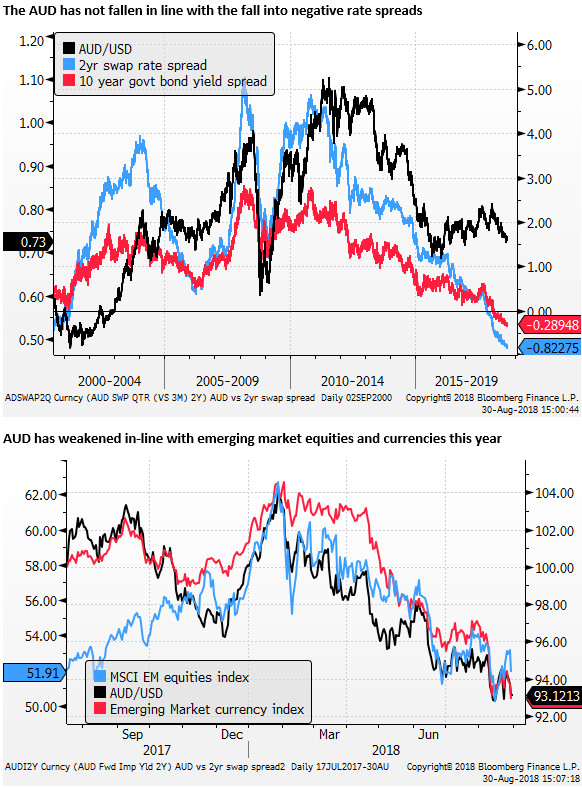

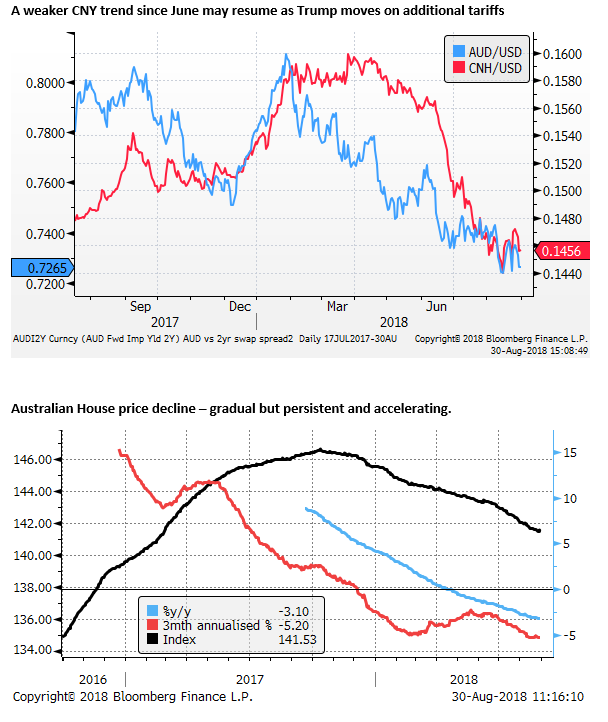

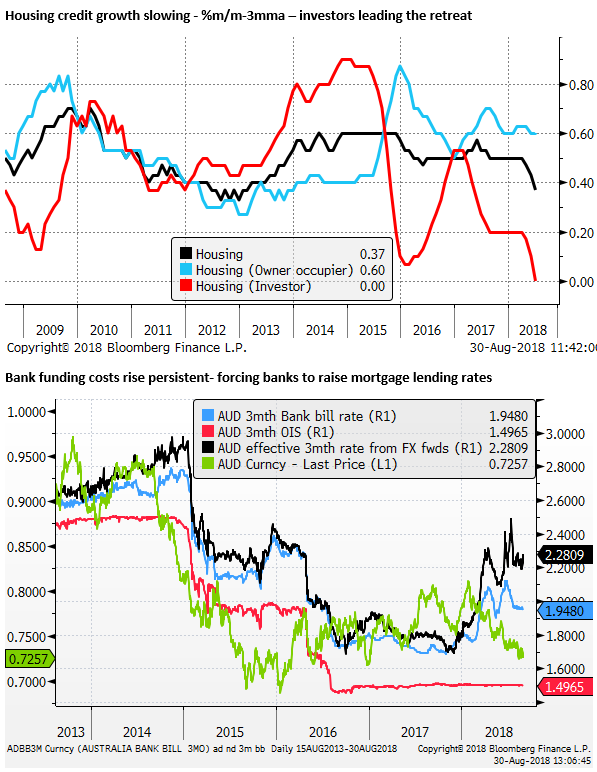

In our view, downside risk for Australian interest rates and the AUD have increased significantly. The persistent increase in bank funding costs that has led Westpac to raise mortgage rates is a further tightening of monetary conditions and comes at a precarious time for the housing market. Australian political risk has increased as an election approaches in around six months. Recent economic data suggest some moderation in activity. US inflation pressure continues to build, and US rates are set to rise further. The Trump administration is intensifying its trade and economic pressure on China, dampening the outlook for the CNY, and Asia region assets. Emerging markets globally are demonstrating heightened vulnerability to rising US rates which has, and is likely to continue to, spill over to a weaker AUD. The RBNZ may also surprise the market and cut rates before year-end.

Mounting risks for the Australian economy

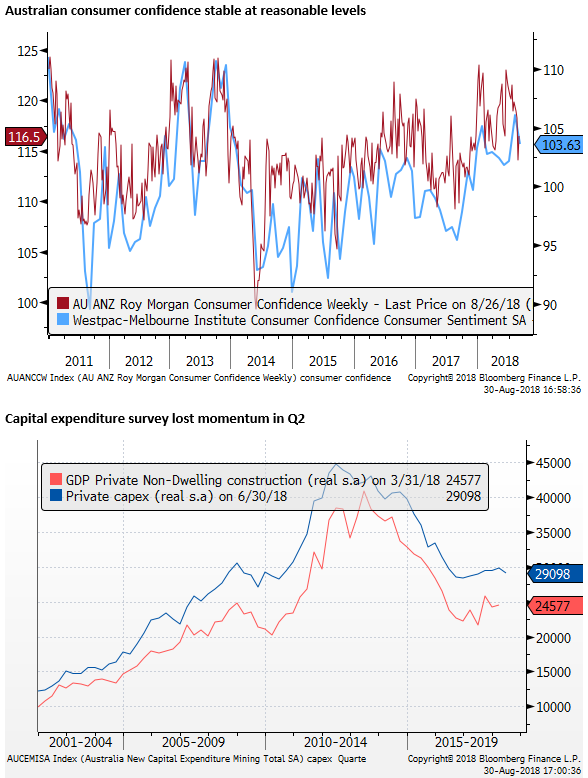

Australian business and consumer confidence have been resilient to the risks building from a weak housing market, political uncertainty, and US trade policy.

The RBA has been the biggest cheer-leader, expressing confidence that with the goodness of time, the labour market will tighten, slack in the economy be absorbed, and inflation will rise back to target.

However it is hard to see consumers and businesses remaining sanguine, or the RBA single-handedly boosting everyone’s spirits with their chipper she’ll be right attitude.

Risks to growth include:

- out of cycle increases in mortgage rates.

- An accelerating decline in house prices over the last three months, now in a year-long decline in prices.

- Tighter credit conditions that will continue to hit households as two-thirds of interest only loans fall due to be refinanced this year and over the next two years. These borrowers, many investors in buy to let housing, will decide to sell into a falling market as they find the cost of carrying these investments has increased.

- Broader political uncertainty and paralysis as we head into an election in about six months, directly undermining business and consumer confidence.

- The probability that falling house prices and higher debt funding costs undermine consumer spending.

- The increasing risk of a Labor Government that has said it will remove tax breaks on real estate investment.

- Risk of weaker demand for goods and services from Asia as China grapples with the economic and financial challenges arising from intensifying pressure on its economic model and trade coming from the USA.

- An ongoing lull in Chinese and Asian demand for Australian real estate resulting from tighter capital controls in the region as it grapples with these challenges.

- The likelihood of a weaker CNY and Asian currencies and equities resulting from an expansion of the USA’s tariffs to cover an additional 200bn in Chinese goods.

- The extended period of time the RBA anticipates before reaching its inflation target itself poses a risk that inflation expectations fall more permanently below target and undermines economic confidence.

Moving the RBA needle

Notwithstanding its upbeat view on sustained above-trend growth, the RBA is not forecasting inflation returning to its 2-3% target range mid-point within its forecast horizon out to Dec-2020. And this is after spending the last three years below target.

They are already being accused of not living up to its inflation target. If economic confidence ebbs even modestly, the RBA will risk losing its credibility if it does not respond by cutting rates.

The RBA already revealed its stripes by essentially talking the exchange rate lower. RBA Governor Lowe recently said in testimony to parliament that “some further modest depreciation would be helpful.”

Considering the tightening in financial conditions in the last year related to the fallout from the Hayne Royal Commission into financial services sector misconduct, and increased scrutiny from regulators, the RBA might fear less that cutting rates would further fuel household debt. Housing credit growth has fallen significantly in recent months as the housing market downturn has intensified.

RBNZ showing the way

The RBNZ has shown the way. Since Governor Orr took over the reins earlier this year, the RBNZ has said that it is prepared to cut rates again. In fact, judging by the fall in NZ business and consumer confidence that began after the change in Government last year, the RBNZ may surprise the market and pull the pin before year end.