RBNZ antes-up in the currency wars, NZD risk to downside

The NZD rallied sharply in an extraordinary reaction to a rate cut on Thursday. Even though the cut was fully anticipated, I cannot recall such a powerful perverse response to an RBNZ rate decision. It illustrates the lower liquidity in FX markets in recent years around key events as banks and the wider market rely heavily on electronic platforms and bank trading desks recoil from taking risk. It also reflected the global scramble for diminishing yield, pent-up demand for emerging markets and a degree of capitulation in USD long positions, many of which may have been established after the rebound in US payrolls data. I have read some analysis that the RBNZ made a so-called hawkish rate cut. However, this is far from the case. They have projected one and more likely two more 25bp rate cuts by mid-2017. While some may say this is not enough to weaken the NZD, it fails to recognize that the RBNZ has based this projection on a steady decline in the NZD exchange rate. Its alternative scenario is that it cuts much deeper by more than 1 percentage point to a low in rates near 0.75% if the exchange rate remains unchanged. It has clearly linked its rates outlook with the exchange rate and suggests that it will cut rates much more deeply if the NZD does not fall. The central bank has reiterated that a lower exchange rate is not just desired but “needed”. It is heading down a path of much tougher macroprudential measures and its banks are more than willing to comply by tightening lending standards, increasing scope for the RBNZ to cut much more deeply in pursuit of a weaker exchange rate. Australia is also seeing tightening bank credit for housing and its housing market slowing. As such the RBA too many consider cutting rates to prevent appreciation of the AUD, although it is much less strident than the RBNZ in calling for a weaker exchange rate. We may finally be near the juncture where AUD/NZD is ready to make its much anticipated recovery.

RBNZ elevate its inflation target

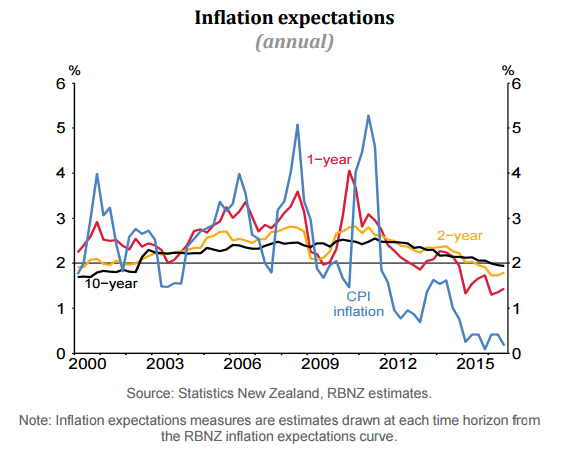

The RBNZ rate cut decision on Thursday was justified mainly by concern that persistent low headline inflation is dragging down inflation expectations and threatening to become more imbedded in longer term inflation outcomes.

It said, “A further sustained decline in inflation expectations would be concerning. Dampened wage- and price-setting behavior would weigh on future inflation, particularly over the time horizon relevant for monetary policy, and would make it difficult to meet the inflation target.”

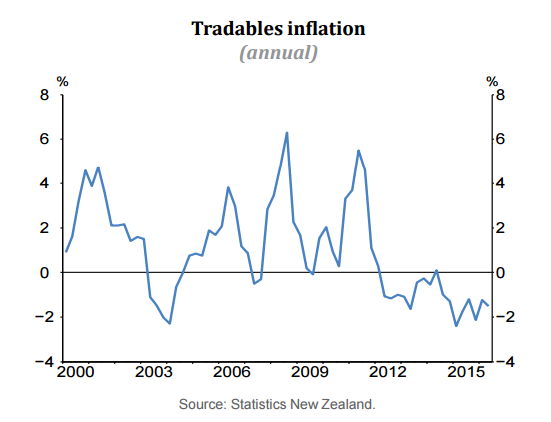

The RBNZ lays the blame for low headline inflation on persistently low (negative) tradables inflation resulting from a relatively strong NZD exchange rate and low global inflation.

The RBNZ is aiming to run the economy significantly above its long run potential to increase domestic inflationary pressure. It forecast growth of 3.4% in each of the next two years, above potential projected at 2.7%.

The discussion re-emphasizes the RBNZ’s intention to aim for its inflation target of 2% over the medium term. Its recent steps to enhance the macroprudential measures to dampen currently high and still rising house prices are seen as providing the RBNZ scope to lower cash rates in pursuit of the CPI inflation target.

This is significant in light of a growing concern among many global commentators that it is futile and generates excessive financial stability risks to pursue the same old inflation targets within the same medium term horizons (generally considered to be around three-years) when the rest of the world is experiencing persistently low inflation.

The RBNZ has been thought to be battling with the decision to push harder to achieve higher inflation, especially with record immigration placing excessive upward pressure on its housing market. This policy statement is dovish in that is comes down clearly on the side of doing more to lift inflation.

RBNZ targeting a lower exchange rate and prepared to cut deeper

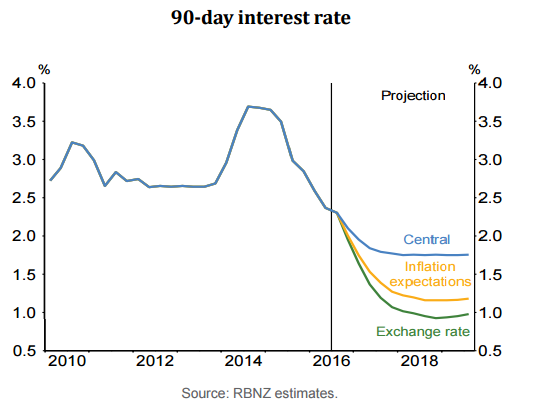

The RBNZ revised down its projected 90-day bank bill rate expectations from mid-2017 onwards to the end of its three-year forecast horizon from 2.1% to 1.8%.

In neutral conditions, in past years, this rate has been 15bp above the official policy cash rate, but recent pricing it is closer to 25bp above, perhaps due to the shifting regulatory framework as banks in New Zealand adjust to the rollout of Basel III and pressure to secure more stable funding sources, including deposits.

As such, the RBNZ is projecting that it will cut rates at least once more from the current 2.00% rate with a high probability that they will cut twice further to 1.5%. (They typically do leave their projections between two possible rate outcomes, emphasizing the uncertainty in these projections).

However, the RBNZ explicitly warned that it will cut rates further if the NZD exchange rate does not fall, elevating the importance of the NZD in its rates outlook.

The RBNZ is projecting the exchange rate (TWI) will fall steadily to 73 over its three-year horizon. The TWI was 76.3 just ahead of the RBNZ policy meeting and 25bp rate cut, and it rose to 77.0 after the decision, more than 5% above its projection for the exchange rate in three-years. The RBNZ highlights that the longer the TWI glides above its downward sloping forecast, the greater the risk that it will cut rates more than projected.

In fact, the RBNZ offers a projection that, if the TWI remains unchanged, it will cut its policy rate to around 1.0% by end-2017 and below 1.0% in 2018 and 2019 to a low near 0.75% (from 2.0% currently). The green line in the chart below provides the alternative 90-day bank bill rate projection).

This is one of the most dovish rate scenarios that the RBNZ has ever projected, offering a path for rates that is highly dependent on the exchange rate and is far below its base-line forecast.

The chart above also shows an alternative lower path for rates if the RBNZ sees longer term inflation expectations falling much below its 2% target; another key focal point of RBNZ policy.

New Zealand Banks hold back from passing on the cut

In the wake of the RBNZ rate cut, ANZ bank, the biggest lender in New Zealand, announced that it was passing on only 5bp of the rate cut to its variable mortgage rate (to 5.59%), and will actually increase rates for some term deposit rates by up to 30bp (to 3.60%). It will cut business rates by 15bp.

Westpac Bank cut its variable mortgage rate by 10bp to 5.65%, and raised a six-month term deposit rate by 50bp to 3.50%.

After the cut ANZ New Zealand CEO David Hisco said, “We are sending a strong signal today to New Zealanders that at a time of record low interest rates, it is more responsible to pay down home loans and save, than borrow more. New Zealanders need to consider changing their financial strategies.”

New Zealand Banks self-regulating and tightening lending conditions

ANZ CEO Hisco penned an opinion piece on 21 July saying his bank will voluntarily tighten lending conditions for property investors, calling on greater cooperation across the country to deal with two key problems of “overcooked” Auckland property prices and New Zealand dollar. (ANZ CEO David Hisco argues several levers must be pulled to take heat out of the property market and put the NZ economy on a firmer footing – interest.co.nz).

He called for even tougher RBNZ macroprudential measures, raising the deposit requirement for investors to 60%. On 19 July, the RBNZ proposed lowering the LVR threshold from 70% in Auckland to 60% and applying it nationally, such that no more than 5% of new investors can have a deposit lower than 40%. (Reserve Bank consults on new nationwide investor LVR restrictions – RBNZ.govt.nz).

The RBNZ announced today that the new tougher LVRs will be delayed one month to 1 October. However, it also noted that banks are already essentially complying, illustrating a degree of self-regulation (LVR start date deferred until 1 October 2016 – RBNZ.govt.nz).

Hisco called on New Zealanders to start paying down their debts, and said, “I doubt banks can keep lending at the current huge volumes anyway.”

As the head of the largest bank, his opinion is likely to be quite influential. It suggests the banks themselves are working to limit lending growth and opens the door for the RBNZ to rely more on macroprudential tools to control the housing market.

The implication is that the RBNZ may have increasing scope to cut rates in pursuit of a weaker exchange rate that is so crucial for lifting its inflation outlook.

Funding costs rise for Australian and New Zealand banks, so official rates may be cut more

Australian banks last week also passed on only a relatively small part of the RBA rate cut on 1 August to their variable mortgage banks, and raised their term deposit rates. The big Australian banks are the parent of subsidiary banks in New Zealand, so it is often the case that bank developments in the two countries follow each other.

Similar to the response in New Zealand, the four major banks in Australia cut their standard variable mortgage rates by between 10 and 14bp after the RBA cut its cash rate target by 25bp to 1.50% on 1 August. And they also increased term deposit rates.

The failure to pass on the full measure of the rate cut to borrowers, and offer a higher deposit rate to lenders, implies that Banks are responding to higher funding costs. This seems odd in light of the recent trend towards narrowing credit spreads and falling yields globally that should be helping reduce funding costs.

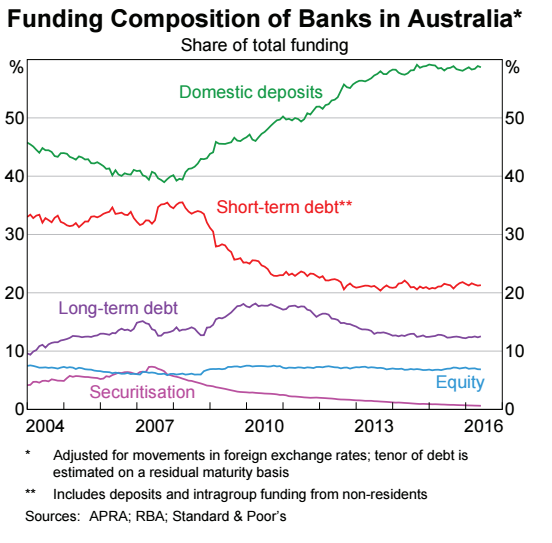

Banks are becoming more conservative on where they source their funding as they respond to the rules being implemented by regulators (APRA in Australia). APRA raised banks’ capital requirements overall and specifically on mortgages in 2015 to reflect the roll-out of the Basel III framework globally and the recommendations made by an Australian government Financial Systems Inquiry tabled at end 2014.

The regulatory framework also includes the Liquidity Coverage Ratio since 2015 and the Net Stable Funding Ratio scheduled for 2018, forcing banks to seek more stable and longer term funding sources, including bank deposits.

Australian banks significantly increased their use of deposit funding after the 2008 financial crisis; it has hovered at just under 60% of total funding in the last two years.

As such, Banks are keen to retain deposit funding, and thus may be raising term deposits to some extent to reflect competitive pressure from alternative investments such as equity and property.

Australia and New Zealand are still large net debtor countries’, and the major share of that net debt reflects household mortgages exceeding their deposits, such that necessarily banks are significant users of foreign funding sources. The chart above illustrates that banks’ funding is also made up of short term debt (around 21%) and long term debt (around 13%). A major share of these funding sources are foreign capital markets.

On 4 August, Karen Maley reported in the Australian Financial Review that the recent fall in demand for short term commercial paper in the USA, also reflected in higher USA LIBOR rates over expected cash rates, has been felt by Australian banks that raise funds in this market. As we discussed in our report (AmpGFX – Fed Credibility Gap and rising USD borrowing costs, 28 July) this reflects regulatory changes being implemented by the SEC in the USA to make money market funds safer. (The real reason why banks aren’t passing on the full rate cut – AFR.com).

The 5 August RBA Statement on Monetary Policy also noted that “Secured rates in the repurchase agreement (repo) market have also risen relative to OIS rates in recent months. This widening appears to reflect heightened demand for secured funding from market participants responding to arbitrage opportunities in the bond futures and foreign exchange (FX) swap markets. Bond futures have been trading at higher implied prices than the basket of bonds that underlie the futures and, in response, some investors have sold the futures and bought the bonds using repo funding. In the FX swap market, Australian dollars can be lent against yen at a relatively high implied Australian dollar interest rate; in response, some investors have been borrowing Australian dollars under repo to lend against yen in the swap market at a higher interest rate.”

This also suggests some upward pressure on short term Australian bank funding pressure. It appears to reflect in part the increasing demand by Japanese investors to hedge their foreign investments, driving up their effective demand for borrowing foreign currencies in the cross-currency swap market, including in AUD. We also discussed this in our report (AmpGFX – Fed Credibility Gap and rising USD borrowing costs, 28 July) as a factor raising the effective USD borrowing cost, and thus carry return on the USD. The same appears to be the case in AUD.

These two factors – higher borrowing costs in short term USA money markets and higher Australian repo rates – both rising relative to cash rate expectations – appear to have raised short-term funding costs for Australian banks, and presumably also for their subsidiaries in New Zealand.

As such, these banks have placed a bit more emphasis on securing deposit funding (raising rates) and limited the pass-through of central bank cash rate cuts to their mortgage customers to protect their profit-margins.

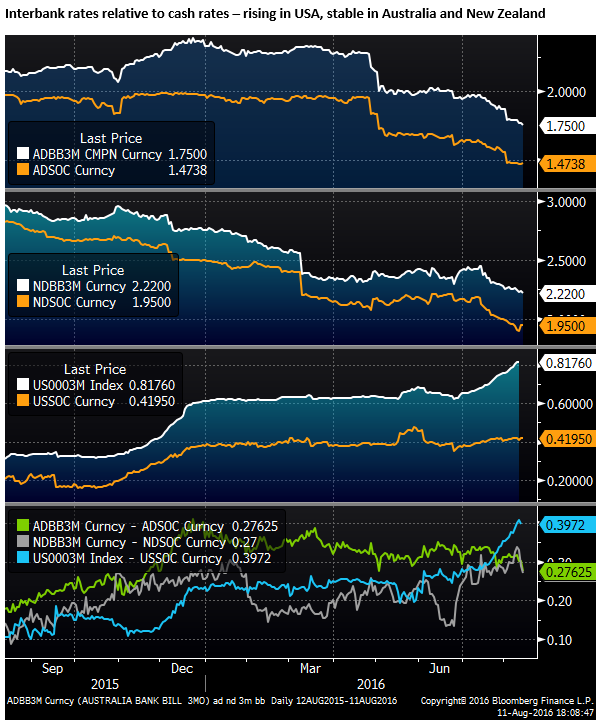

However, this funding pressure has not been so severe to place significant upward pressure on interbank borrowing costs in Australia or New Zealand, with the spreads in bank-bill rates over expected cash rates (OIS) relatively stable. In contrast to the USA where these USD borrowing costs have increased relative to OIS. (chart below)

The essential point is that the carry returns on AUD and NZD have not experienced the same upward pressure as seen in the USD from recent money-market developments. But external developments have meant that Australian and New Zealand banks have not passed through much of the recent central bank rate cuts to household borrowers, although savers may receive a bit more. In essence, this has dampened the stimulative effect of these policy steps on their respective economies. Therefore, both the RBA and the RBNZ might be more inclined to cut rates further.

Housing markets much less a restraint on further rate cuts

The RBA noted in its recent statements that Australian banks were tightening lending conditions, housing lending growth had slowed, house price growth had slowed, housing turnover had slowed and rental vacancies were higher. In particular, banks have virtually halted lending to foreigners without domestically sourced income and tightened lending standards for apartments acknowledging risks related to a developing oversupply in this sector.

In New Zealand, the RBNZ is about to significantly enhance macro-prudential measures that will mandate tighter lending conditions and its banks are already self-regulating, tightening lending standards. The RBNZ is also working on further macroprudential measures (Debt to Income ratio limits) that it expects to have available next year. As such, both in Australia and New Zealand, the strength of the housing market is becoming less of an impediment to cutting rates further.

Both countries see limited direct benefits from cutting rates on their economies. As in most cases around the world rates are considered already low and extremely accommodative. However, both countries may consider cutting rates again for the purposes of pushing their exchange rates lower.

RBNZ more dovish on exchange rate

New Zealand in particular have made an explicit connection between its cash rate projections and the exchange rate. It has said “a decline in the exchange rate is needed” and it will cut rates even deeper than projected fall if the NZD TWI does not start to fall and relatively soon. As such, we see a substantial risk to buying NZD for its higher yield.

The RBA is not as strident in its call for a lower exchange rate. It points to the lower exchange rate since 2013 as helping the traded sector, and says only that “an appreciating exchange rate could complicate” the rebalancing in the economy.

As such, it does not appear that the RBA will respond quickly to an appreciating currency. The RBNZ is readying another cut and may keep going towards year end and into 2017 if the exchange rate does not fall.