RBNZ to cut and 50bp is not out of the question

The RBNZ “Economic Update” released on its website today significantly expanded its views on the NZD exchange rate, suggesting that it will cut rates at its next policy meeting on 11 August in an attempt to offset or weaken the currency.

It said today, “The trade-weighted exchange rate is 6 percent higher than assumed in the June Statement, and is notably higher than in the alternative scenario presented in that Statement. The high exchange rate is adding further pressure to the dairy and manufacturing sectors and, together with weak global inflation, is holding down tradable goods inflation. This makes it difficult for the Bank to meet its inflation objective. A decline in the exchange rate is needed.”

This expands on its briefer less pointed statement made on 9 June,

“The exchange rate is higher than appropriate given New Zealand’s low export commodity prices. Together with weak overseas inflation, this is holding down tradables inflation. A lower New Zealand dollar would raise tradables inflation and assist the tradables sector.”

Furthermore, the RBNZ today made it clear that its “outlook for inflation has weakened since the June Statement”

In addition, it firmed its policy guidance from “Further policy easing may be required” to “it seems likely that further policy easing will be required” (replacing “may” with “likely…will”).

On 19 July, the RBNZ released a “consultation paper” outlining proposed enhancements in its LVR restrictions on housing loans. It proposed that they be introduced on 1 Sep.

These changes are likely to be viewed as a significant step-up in the measures employed by the RBNZ, expanding the LVR restrictions across the country to all borrower types, with tighter restrictions on investors.

Reserve Bank consults on new nationwide investor LVR restrictions – RBNZ.govt.nz

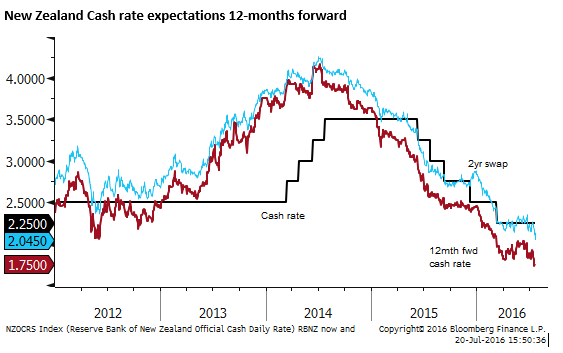

The market is currently pricing in an 85% chance of a 25bp cut on 11 August, and is discounting a further rate cut by March next year (Rates are currently a record low 2.25%).

We think the odds are close to 100% of a cut on 11 August, with a high chance of a follow up cut before year end, especially if the NZD remains resilient. A cut of 50bp on 11 August is now a possibility in our view.

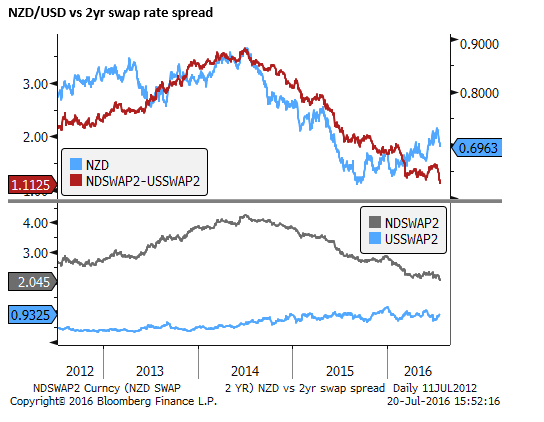

The chart below shows that the NZD/USD 2-yr swap rate spread has moved to a new long term low. The NZD has been trending higher, despite a narrowing interest rate differential over the year, in the context of diminishing yields across the globe.

In the last week, the USD has started to respond more positively to a modest pick-up in its yields, and the NZD/USD is at risk of breaking its uptrend and respond to a likely further fall in NZD yields.