RBNZ easing bias despite improved domestic outlook, Fed has lost visibility

The Fed has lost visibility and is in wait-and-see mode; a hike in March looks unlikely given the recent weaker growth trend in US data. This should contain the USD. EUR’s strength is a bit surprising in light of still low inflation expectations and ECB policy guidance. We are favoring short EUR vs commodity currencies and expect EUR/JPY to fall if BoJ’s policy statement is neutral, as we expect. The RBNZ reinstated as easing bias, but its policy statement still upgraded the domestic economic outlook. It appears concerns over dairy and a strong desire to get inflation back to target are key drivers in RBNZ policy direction. We see modest further gains in AUD/NZD.

Lost Visibility

The Fed more or less admitted that it had lost visibility on the outlook for the US economy and has stepped back into a wait-and-see mode amidst greater global uncertainty.

The data flow over recent months in the USA has been weaker, and the chances of a hike in March appear very slim. The labor market remains the main plank in the Fed’s optimism, and how it goes in in coming months will be an important ingredient in setting expectation for the year ahead.

But the reaction in the US rates market was relatively muted since it had already lowered the outlook for US rate rises significantly this year. Nevertheless, the news flow and Fed statement should act as a restraint on dollar gains.

EUR firm, but for how long?

We have seen solid gains in a number of EM and commodity currencies in recent sessions, consistent with a more stable outlook for US rates, a partial rebound in oil prices, Chinese leaders and media outlets stepping up jawboning aimed at restoring confidence in their economic and currency management, and more dovish views expressed by the ECB and BoE. The BoJ is up on Friday, although we expect little change in its policy assessment at this stage.

The EUR has performed relatively well in light of the ECB’s firm easing bias and the improvement in global risk appetite. Perhaps it is benefiting to some extent from a more dovish Fed and a recovery in oil prices, dampening prospects of more aggressive ECB action.

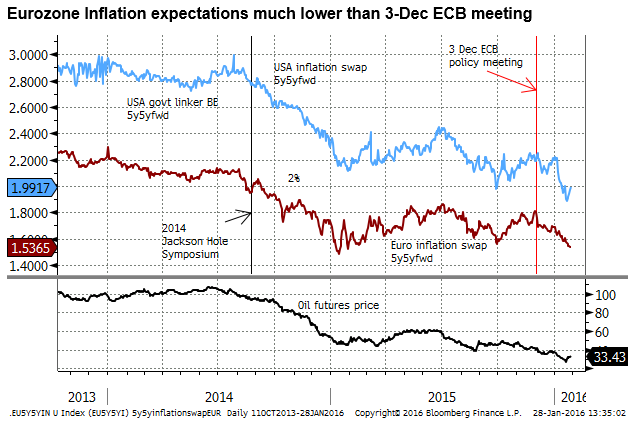

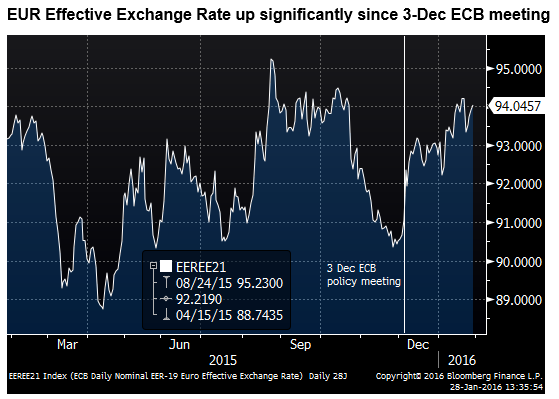

However, we fail to see a case for ongoing improvement. The EUR effective exchange rate has risen significantly since the ECB 3 December policy meeting, and inflation expectations implied by 5y-5yr forward inflation swaps remains low. Both significant touch points for the ECB.

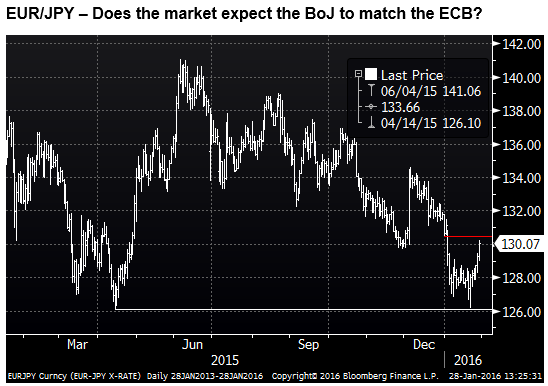

EUR/JPY has bounced significantly reversing its fall since the beginning of the year. It appears that the market expects BoJ policy easing guidance or action to match that of the ECB. If The BoJ fails to respond on Friday the cross may revert to its recent lows.

RBNZ re-instate easing bias

The AUD/NZD has strengthened since the RBNZ policy statement on Thursday. The statement re-inserted an easing bias that was essentially removed in the previous meeting on 10 December (albeit after the central bank cut rates for a fourth time in 2015 to 2.5%, returning rates to record lows).

The statement on Thursday said, “Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range.” In the previous statement in December the RBNZ said, “We expect to achieve this [inflation returning to target] at current interest rate settings, although the Bank will reduce rates if circumstances warrant.”

The easing bias was not a huge surprise to the market that was already pricing in one more rate cut by the RBNZ, spurred on to some extent by the lower than expected Q4 CPI release two weeks ago. However, it did bring the timing of a cut a little sooner and contributed to some further tightening in the rate spread between the AUD and NZD.

The market is pricing in 44% chance of a 25bp cut at the RBNZ’s next meeting on 10 March, at which time the Bank will release its quarterly Monetary Policy Statement and hold a press conference. Over 12-months, 29bp of cuts are priced in, a full cut of 25bp is not fully priced until Q3.

On Thursday, Westpac Bank’s NZ economists announced they had added a second rate cut this year to its forecast, starting in March, followed by another in June.

RBNZ Statement not all negative – upgrades to domestic conditions

While the RBNZ is leaning toward a cut, the economic data has not been too bad: PMI manufacturing 56.7 in Jan was a high since Oct-2014; PMI services 58.9 in Jan dipped a bit from Dec to be the second highest level since 2007; Job ads resumed growth at a solid rate over the last four months to December; The ANZ business confidence survey, own-activity index rose for the last 4 months of last year.

In its December policy statement, the RBNZ said, “Growth in the New Zealand economy has softened over 2015”. The statement on Thursday said, “The domestic economy softened during the first half of 2015”. This appears to acknowledge that the recent data, in the second half of last year, had started to improve again.

The RBNZ statement yesterday said, “Growth is expected to increase in 2016 as a result of continued strong net immigration, tourism, a solid pipeline of construction activity, and the lift in business and consumer confidence.”

This was a fairly optimistic assessment of domestic growth, and appears more emphatic than that expressed in December, where it said, “Combined with increases in the labour supply from strong net immigration, the slowdown has seen an increase in spare capacity and unemployment. A recovery in export prices, the recent lift in confidence, and increasing domestic demand from the rising population are expected to see growth strengthen over the coming year.”

RBNZ still focussed on boosting inflation

An important consideration in the RBNZ’s decision to re-instate the easing bias may have been the lower inflation outlook. The RBNZ has seen it as something of a failure that inflation has remained well below target for so long (headline inflation has been below the 1 to 3% target band since 2012).

It revamped its thinking in 2014 to pursue overall easier policy and a weaker exchange rate to promote faster economic growth, worried that prolonged low inflation was seeping into inflation expectations. It also began to pay more attention to the dis-inflationary impact of faster immigration holding down wages, rather than its earlier focus on the inflationary impact of net immigration on boosting domestic demand and the housing market.

In its statement on Thursday, the RBNZ said that inflation is expected “to take longer to reach the target range than previously expected.”

While the RBNZ is more eager to get inflation back to target, the underlying inflation measures for Q4 were no lower than Q3, and perhaps even a little higher.

The RBNZ appeared to make this point in its statement on Thursday, it said, “Headline CPI inflation remains low, mainly due to falling fuel prices. However, annual core inflation, which excludes temporary price movements, is consistent with the target range at 1.6 percent. Inflation expectations remain stable.”

As such, the RBNZ appeared to say that there was no need to over-react to the lower than expected headline inflation data.

RBNZ, like the FOMC, expressed greater uncertainty

Not dis-similar to the views expressed by several other major economy central banks, including the BoE, ECB and FOMC, the RBNZ expressed greater concern over the state of the global economy.

Like the FOMC, the RBNZ also raised the overall level of uncertainty in its outlook. It said, “There are many risks around the outlook. These relate to the prospects for global growth, particularly around China, global financial market conditions, dairy prices, net immigration, and pressures in the housing market.”

RBNZ still jawboning NZD lower

The RBNZ noted that the NZD exchange rate had fallen since the 10-Dec policy meeting and market interest rates had declined, easing financial conditions. But it repeated its views on the currency that, “A further depreciation in the exchange rate is appropriate given the ongoing weakness in export prices.”

RBNZ sees housing strength outside of Auckland

On the housing market, the RBNZ maintained the same views on Auckland as in December, it said, “There are signs that the rate of increase may be moderating.” In other words it sees its policy of limits on high-LVR loans for investors doing its job. But the Bank also expressed more optimism on housing outside of Auckland. It said, “House price pressures have been building in some other regions.”

RBNZ easing bias, but urgency to act is not clear

The RBNZ statement re-instated an easing bias, but it still had a couple of upgrades to its domestic economic outlook. It alluded to improvement in activity in the second half of 2015 and it noted more strength in housing outside of Auckland.

You would have to conclude that these improvements were not enough to mitigate the increased risks to global growth, broader uncertainty and ongoing weakness in dairy prices.

The RBNZ remains eager to get inflation higher and appears influenced by a more prolonged period of very low headline inflation.

However, monetary conditions have eased since Dec and underlying inflation was stable and even a bit higher on some measures in Q4. As such it is not clear that the RBNZ will cut rates again in March. Nevertheless, if the RBNZ were inclined to juice the economy and inflation a bit more, there is not much reason to wait.

Dairy prices weaker

A key concern for the economy, that was not touched on in much detail in the RBNZ statement is the prolonged weakness in dairy prices. On the same day that the RBNZ re-instated its easing bias, Fonterra Cooperative Group lowered its payout forecast for dairy farmers from NZ$4.60 per kgms to between NZ$4.40 and 4.55.

It also made some negative comments, It said, “There is still an imbalance between supply and demand which continues to put downward pressure on global milk prices.”…. “although New Zealand farmers have responded to lower global prices by reducing supply, this has yet to happen in other regions, including Europe, where milk volumes have continued to increase.”

It highlighted the ongoing ban in Russia on EU dairy imports (related to sanctions the EU imposed on Russia over its incursions into Ukraine) and a slow recovery of dairy imports to China.

While the world is focused on the excess supply in oil, the same problem appears to be weighing on New Zealand’s key export market of dairy.

Persistently low dairy prices remains an overall drag on the New Zealand economy, dampening income and investment growth and generates financial stress in the farm sector.

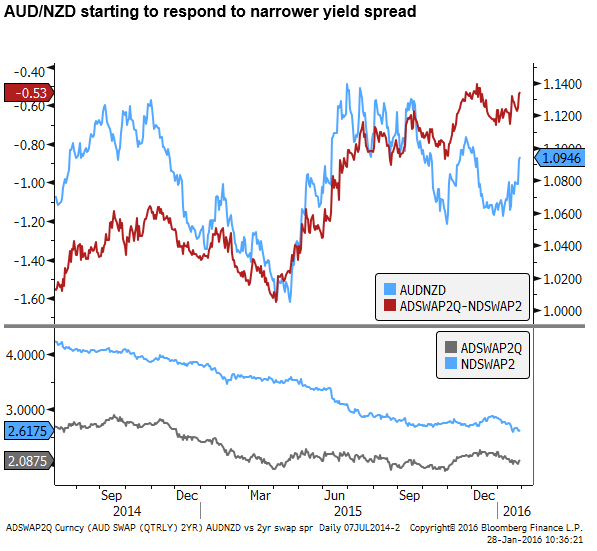

Further modest gains in AUD/NZD expected

We have advised some recovery was probable for AUD/NZD related to the pick-up in economic growth in Australia, and narrower interest rate spread. This may carry the cross above 1.10 to revisit highs seen in November, in the lead-up to the RBNZ’s rate cut on 10-December.

However, the case for a much higher cross is not clear, and much depends on how the two economies evolve. The recent trends in domestic activity indicators in New Zealand have improved. Australian activity while noticeably improved over the last year, may have stalled a bit recently. The Australian CPI data released last week recorded underlying inflation measures still at the bottom of the RBA 2-3% target. As such the RBA should retain its easing bias in its policy statements next week.

The RBA appears less inclined to ease policy further than the RBNZ. It has said only that, “Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand.” This contrasts with the RBNZ which is essentially guiding the market to expect a cut, saying, “Some further policy easing may be required over the coming year.”

The market is still pricing in 28bp of rate cuts in Australia over the next 12 months, although a full 25 bp cut is not fully priced until Q4-2016. This is not too different to the outlook for New Zealand. Judging by the two policy statements, the odds lean towards the RBNZ acting sooner and the RBA staying in watch and wait for several months.

In the news

Oil

Oil Climbs on Hopes for Production Cutback – WSJ.com

IMF and World Bank move to forestall oil-led defaults – FT.com

Oil slump’s impact on industrial stocks unnerves US economy – FT.com

Pouring oil on troubled stock markets – FT.com

Chinese Premier Li Keqiang

“While expanding aggregate demand in an appropriate way, we will vigorously pursue structural reform, particularly supply-side structural reforms”.

The premier said China will continue to implement a proactive fiscal policy and prudent monetary policy, push forward the innovation-driven development strategy, and encourage mass entrepreneurship and innovation to unleash people’s enthusiasm and creativity.

When talking about the RMB exchange rate, Li stressed that the Chinese government has no intention of boosting exports by devaluing the yuan. Still less would China go for a trade war. The fact is the RMB exchange rate has remained basically stable against a basket of currencies. And there is no basis for continuous depreciation of the RMB.

“We will press ahead with the reform of the RMB exchange rate formation mechanism in line with the principles of independence, gradualism and controllability, enhance communication with the market, and keep the RMB exchange rate basically stable at an adaptive and equilibrium level,” he said.

China’s economic leaders struggle to explain thinking to world – FT.com

Japanese political risks

Blow for Shinzo Abe as Japan economy minister Akira Amari resigns – FT.com

Masatoshi Honda, a professor of politics at Kinjo University said, “Politically, this will stabilize the government. If Mr Abe had left him in place then the scandal would have gone on and on in parliament,” said Masatoshi Honda, a professor of politics at Kinjo University.

“But economically, Mr Amari was a pillar of Abenomics. Within the cabinet, finance minister Taro Aso was on the side of fiscal consolidation and Mr Amari was on the side of growth — together they struck a good balance,” Mr Honda said.

Mr Amari will be replaced by Nobuteru Ishihara, a former environment minister, who ran against Mr Abe in the 2012 contest for leadership of the ruling Liberal Democratic party. Mr Ishihara is the son of controversial former Tokyo governor Shintaro Ishihara.

Mr Amari is the fourth minister to resign from Mr Abe’s government, although none of the others were as close to the prime minister. Two high profile female ministers, Yuko Obuchi and Midori Matsushima, were forced to quit over similar political funding scandals in 2014.

Mr Abe must decide later this year whether to go ahead with a rise in consumption tax from 8 per cent to 10 per cent. When he last raised consumption tax in 2014, it drove the economy into recession and stalled any momentum towards the Bank of Japan’s goal of 2 per cent inflation.

Polls taken since the latest allegations broke suggest little immediate damage to the government’s approval ratings, but much will depend on whether there are further claims. Upper house elections are due this summer, with speculation that Mr Abe could call a simultaneous election for the more powerful lower house.

The chance of a so-called “double election” will fall if Mr Abe’s approval ratings decline in the wake of the scandal.