RBNZ Governor Spencer thrown into the deep end

The RBNZ must revamp the monetary policy outlook this week facing a political minefield. The starting point for inflation is significantly higher than previously forecast, and it is now close to target. The exchange rate has fallen to a low since mid-2016 and is likely to place some upward pressure on inflation. The economy is sending mixed signals with booming employment growth, and a tightening labour market, but a slump in business confidence generated by political uncertainty and a weaker housing market. Retail sales have been surprisingly weak, even though consumer confidence has remained solid. The new government has proposed more spending on infrastructure and affordable housing, but wants to slow immigration and further dampen the housing market. The RBNZ may feel wary of antagonising the new government as it prepares to change the RBNZ mandate and add a monetary policy board with outside directors. You might say the new ‘Acting’ Governor Spencer, leading his first MPS and press conference, has been thrown in the deep-end. He may need to bring forward rate hike forecasts modestly and risk unwanted appreciation in the NZD.

New Zealand Labour market tightens

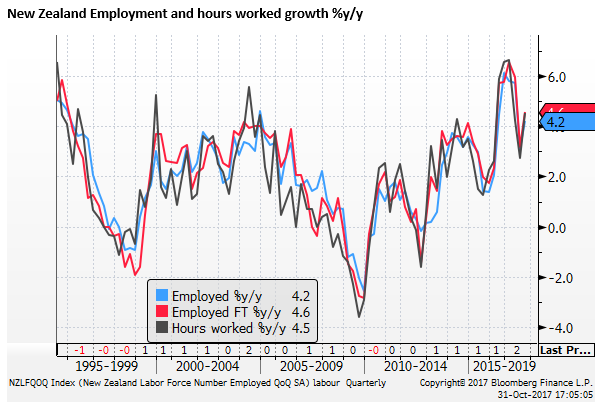

The New Zealand Q3 employment report, released on 1-Nov, was strong, showing a 2.2% q/q rise in employment, well above an expected rise of 0.8%q/q, up a booming 4.2%y/y.

From a year earlier, full-time jobs rose 4.6%y/y and hours worked rose 4.5%y/y.

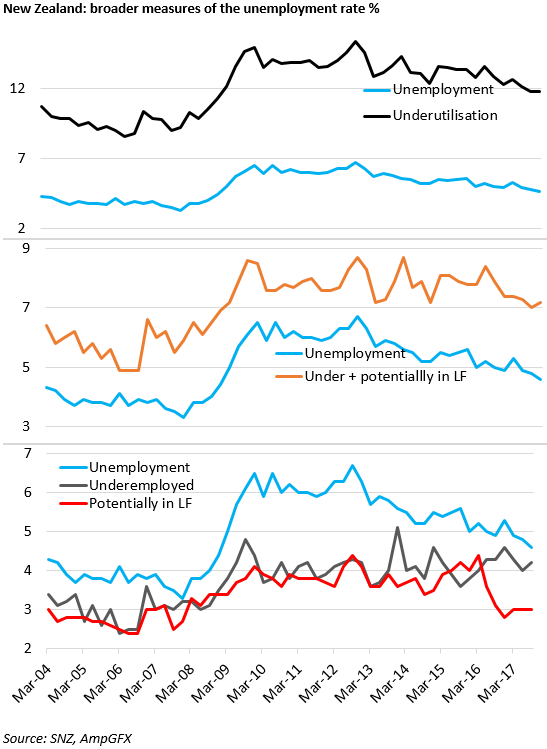

The unemployment rate fell from 4.8% to 4.6%, stronger than 4.7% expected. This is the lowest level since Q4-2008.

The RBNZ does not have a clear view of what level of unemployment is consistent with full-employment, and unemployment tends to be more volatile in NZ than other major economies, but the former RBNZ Governor Wheeler mentioned 5% as a rough guide during a press conference earlier this year. As such, the labour market is starting to look relatively tight.

The unemployment rate reached all-time lows below 4% from Q3-2004 to Q2-2008, but this was widely regarded as a tight labour market during a period of high wage growth.

Still some slack in under-employment

However, as is the case in many countries, broader measures of underemployment suggest that there still may be some slack in the labour market. SNZ said that the “under-utilisation rate” was steady in the quarter at 11.8%, down from 12.3% a year earlier.

SNZ offers data on this underutilization measure back to 2004. The chart below looks at this data. Like the unemployment rate, it too is at a low since Q4-2008, but the improvement in this rate is less significant since the Great Recession in 2008/09.

The second chart below shows the gap between the unemployment rate and the underutilization rate. This gap includes “under-employed” (those working part-time that would like to work more hours) and those that are marginally attached to the labour force (denoted as ‘potentially in LF’). The rate for this group rose in Q3 from 7.0 to 7.2%. The trend in this group is less clearly sloping downward.

The third chart breaks this gap down into the ‘under-employment’ and ‘potentially in LF’ rates. It shows that the main source of under-utilisation comes from those that are working part-time but would like to work more hours (the ‘under-employed’). The rate for this group rose during the great recession from around 3% to above 4%, and has not improved since. However, the ‘potentially in LF’ group has fallen quickly, relatively recently, from a peak in Q1-2016 of 4.4% to 3.0%; perhaps closer to tight levels.

The higher level of under-employment may reflect structural changes in the labour market occurring globally. People in this group may be part of the gig economy and may have less power to demand higher wages, and might contribute to the low wage outcomes.

Labour participation looks stretched

Preventing a more rapid fall in the unemployment rate has been rapid immigration and a sharp rise in the participation rate that jumped to 71.1 in Q3 from 70.1 in Q2, a new record high.

However, The recent surge in participation at the same time as the marginally attached to the labour force (‘potentially in LF’) rate has fallen may suggest there is less scope for jobs to be filled from outside the current labour force, pointing to approaching limits in labour supply.

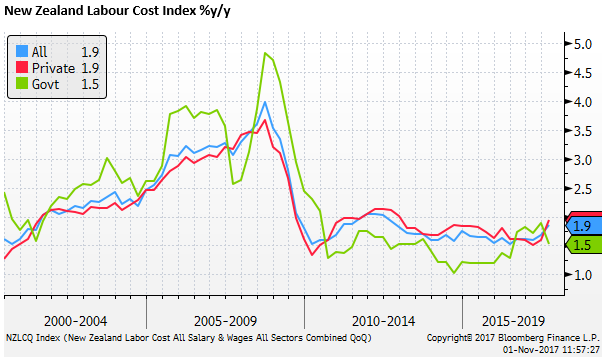

Wage growth received a one-off boost

The wages data rose significantly in Q3, although this was largely expected, and due to the “Care and Support Workers (Pay Equity) Settlement Act 2017” that provided a one-off boost for workers in this industry. SNZ said, “The settlement for 55,000 care and support workers was a key driver for the latest quarter’s wage growth,”

It said, “Had wages that were affected by the care and support workers’ pay equity settlement remained constant in the September 2017 quarter, LCI wages and salaries would have increased 1.6 percent over the year rather than the 1.9 percent increase.”

The Labour Cost Index, a measure of wages that adjusts to maintain the composition of employment constant, referred to in the above comments by SNZ, rose from 1.6%y/y to 1.9%y/y for private sector workers.

The rise in the growth rate is encouraging, but it was driven by a one-off increase for one group of workers. And even at 1.9%y/y, wage growth is only around the top of the range in the low growth period since the great recession in 2008/09. The evidence is still lacking that the tightening labour market is generating higher wage inflation.

The strong Q3 labour market data places a tick in the column that brings forward rate hikes. However, this is balanced by recent indicators that have weakened in recent months.

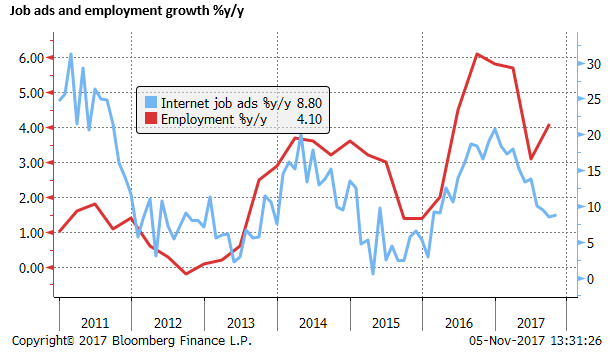

Job advertisements growth stabilized

Job ads growth has slowed this year after growing rapidly in 2016. Ads growth peaked in Dec-2016 at 20.7%y/y, and has slowed to 8.8%y/y in October. This suggests that rapid employment growth may also slow in coming months. However, in the last few months, ads growth is showing signs of stabilising, suggesting that the labour market is still likely to be tightening.

Business Confidence slump

On 31 October, the ANZ business outlook survey showed a second sizeable fall in a row in October. The own activity index fell to 22 in Oct from 30 in Sep, 38 in Aug, and a peak this year of 43 in June. It is now below its long-run average (around 30) and below its average since the 2008/09 great recession (around 35).

The fall in business confidence in recent months appears to be related to election uncertainty. The election on 23 September was a hung parliament, and on 19 October, a change of government from National to a Labour-led coalition with NZ First, and the Greens was announced.

Most of the survey responses for the latest survey came before 19 October, so it does not reflect the actual change in government. One might expect the outlook to remain weak, if not weaken further, in the next survey given the change of government may be regarded as generating greater risks for the economic outlook.

The employment component fell to 14 in Oct from 15 in Sep, down from a peak of 26 in July, suggesting the strong employment report in Q3 may not be repeated in Q4. The more modest job advertisement growth also suggests that employment growth should moderate.

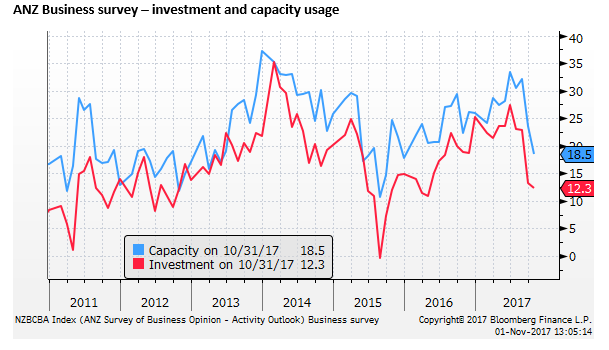

The investment component fell to 12 from 13, and is down from a peak this year of 27 in June.

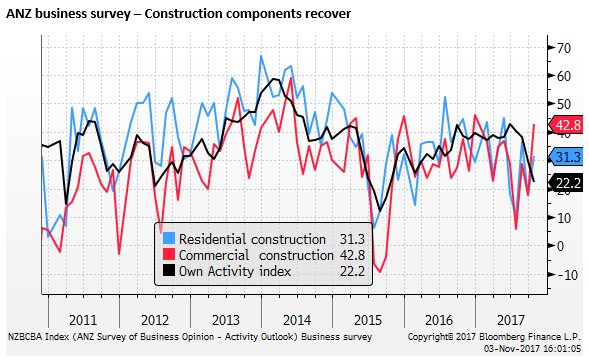

However, the survey showed increases in the residential and commercial construction components. These indicators were weaker around mid-year and have recovered recently (although less so for residential). Perhaps this reflects the increased focus of both major political parties, moving into the election, to fund affordable housing and infrastructure projects. The Labour/NZ First Coalition government has reinforced this message since taking power, and thus we may see confidence in these sectors hold up or rise further.

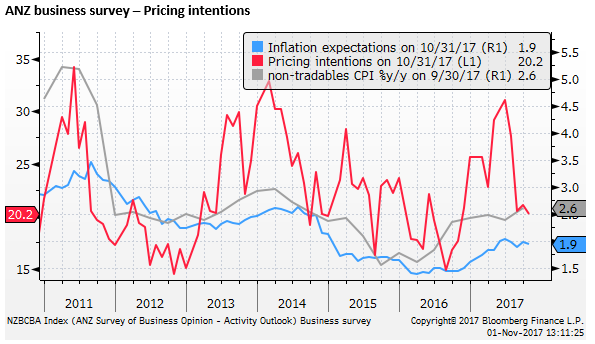

Pricing intention edged down to 20, around this level for the last three months, down from 31 in June. This may point to modest inflation pressure, but as discussed below, inflation appears significantly higher than previously forecast, and the weaker exchange rate should help sustain higher inflation in the RBNZ’s projections.

Housing Market weaker

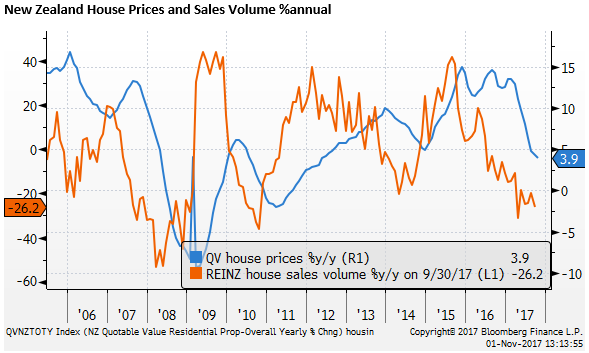

On 2 November, QV New Zealand national house price inflation data fell from 4.3% in Sep to 3.9% 3mth-yoy in Oct, a low since 2010. Earlier in October, the REINZ reported house sales volume down 26%y/y in Sep, the lowest number sold in Sep for six years.

Building Permits rising trend

Building consents for September, released on 31 October, dipped and were revised down in Aug. However, the rising trend resumed earlier this year.

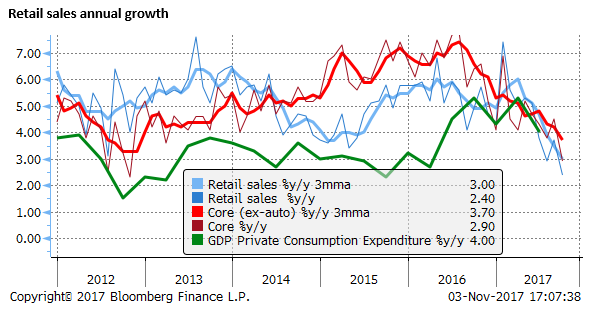

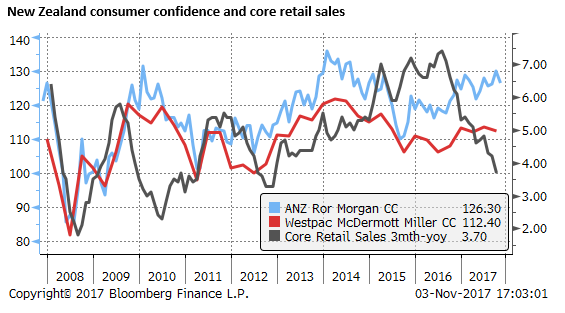

Weak Retail sales despite still solid consumer confidence

The next Retail Sales data are due the day after the RBNZ monetary policy announcements on Thursday this week. These data have been surprisingly weak this year. Card-based core retail sales (ex-auto) slowed from around 7.5% annual growth in mid-2016 to 2.9%y/y in September.

The fall in retail sales looks excessive compared to still strong consumer confidence. However, high household indebtedness, low wage growth, and a softer housing market may be weighing on consumer spending.

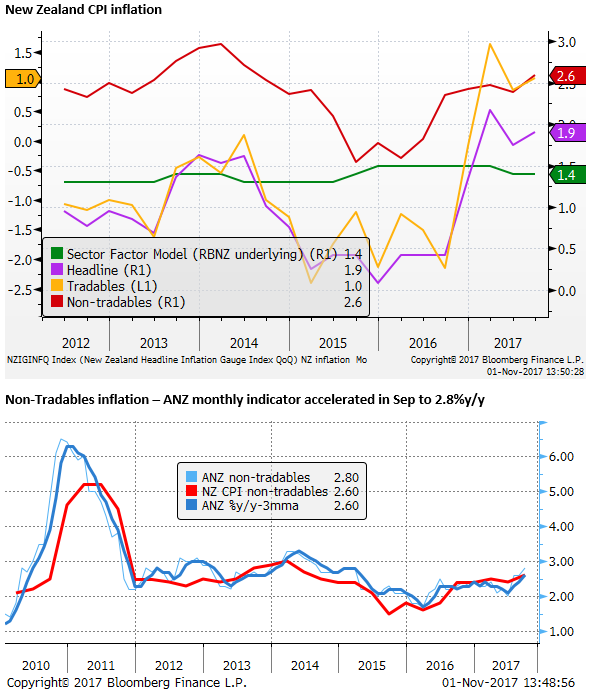

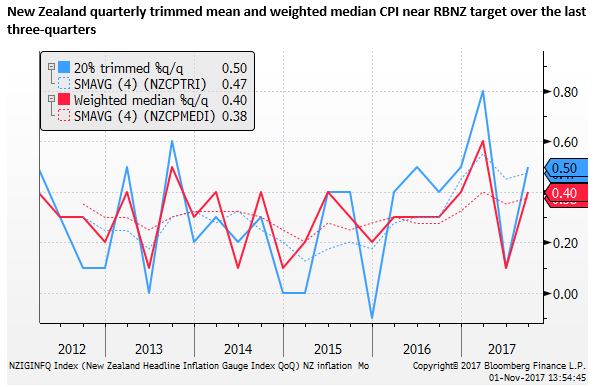

Inflation now close to target

The inflation data in Q3 was firmer than expected, released on 17 October. The headline CPI rose from 1.7 to 1.9%y/y, above 1.8% expected. The underlying measures were mixed. The RBNZ’s preferred Sector Factor Model fell from 1.5% to 1.4%. However, the trimmed mean and the weighted median rose 2.0%y/y, right on the RBNZ target; and both have averaged around this level for the last three-quarters.

The headline inflation (1.9%) and non-tradables (2.6%) outcomes in Q3 are significantly above the RBNZ projections made in their August MPS of 1.6% and 2.4% respectively. The RBNZ, in fact, projected a further fall in inflation into Q4 and Q1 next year before rising back to its 2% target around mid-2019.

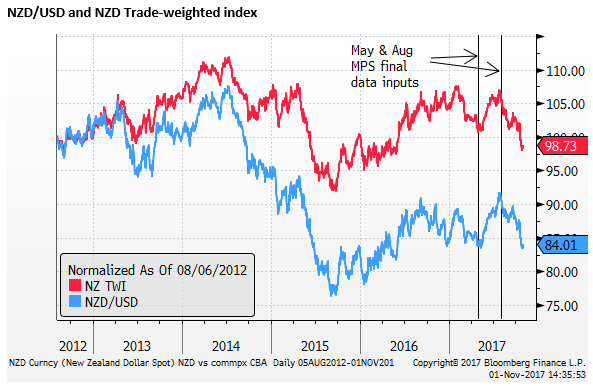

NZD exchange rate new low since mid-2016

Part of the reason for this lower inflation forecast was a rise in the NZD exchange rate between May and August. However, more recently the exchange rate has fallen back to around its lows for the year in May. In fact, the trade-weighted index, more relevant for the RBNZ inflation outlook, has fallen to a new low since mid-2016.

There has also been some increase in international commodity prices (oil and metals) since the August statement that should help lift the RBNZ inflation outlook somewhat. Overall, it seems that the RBNZ will need to significantly raise its inflation forecast, and this may also encourage them to bring forward their rate hike expectations. In August they retained a forecast that rates would begin to rise in the second half of 2019, towards the end of their forecast horizon.

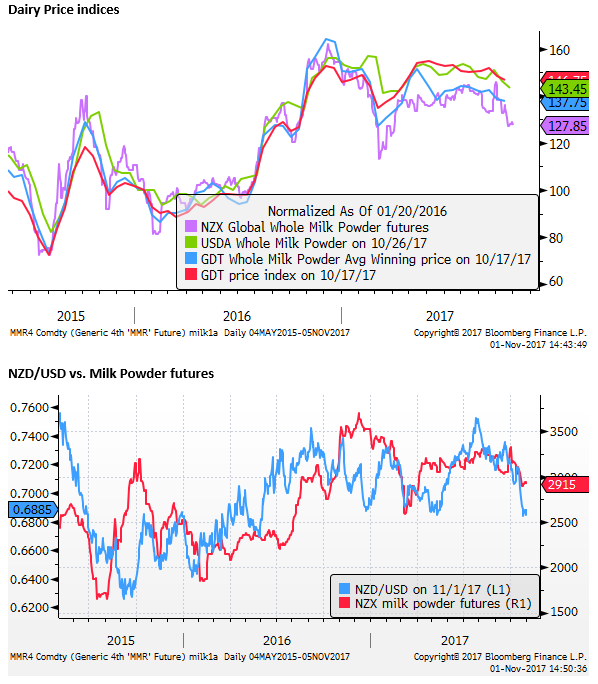

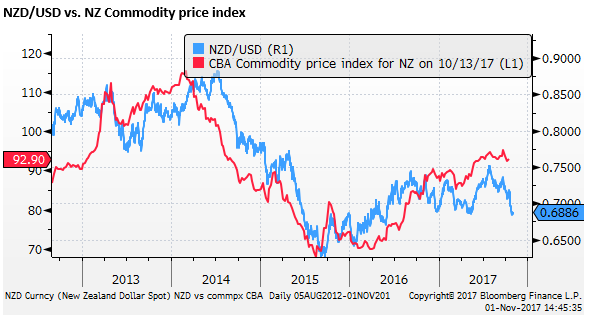

Some fall in New Zealand’s commodity export prices

New Zealand commodity export prices have eased modestly in the last month. This might argue for a lower NZD, although the fall in the NZD has been more significant.

The RBNZ to welcome the lower exchange rate, but not call for more

In the last RBNZ rates policy announcement on 28-September, the RBNZ said, “The trade-weighted exchange rate has eased slightly since the August Statement. A lower New Zealand dollar would help to increase tradables inflation and deliver more balanced growth.”

Considering that the TWI is now at a new low since mid-2016, the RBNZ is unlikely to call for a lower exchange rate. It may revert to the language it adopted in May, where it said the fall in the exchange rate “is encouraging and, if sustained, will help to rebalance the growth outlook towards the tradables sector.”

Considering that New Zealand commodity prices are only down modestly in the last month, and are still higher over the last year, the RBNZ is unlikely to call for a still weaker exchange rate.

RBNZ mandate and leadership shakeup coming

The RBNZ must itself be wondering about its future. Former Governor Wheeler stepped down when his term ended in September, and Grant Spencer, the former deputy, has been Acting Governor since 27 September. He has been given this job until 26 March 2018, to allow time for the new government to appoint a replacement.

However, the New Labour-led government has even bigger plans. It intends to appoint a monetary policy board, including outside of RBNZ members, and add an employment mandate to the RBNZ current inflation and financial stability mandate.

Internally, at least, the RBNZ should be preparing for how this new mandate might affect its policy approach. It might argue it is not a big change with the RBNZ taking a medium-term approach to inflation targeting, but it will have to convince the government that it is taking employment into consideration. It may need to come up with clearer measurements of what constitutes full employment.

Government policy uncertainty

An immediate difficulty for the RBNZ is incorporating the new policy direction of the new government. In its three-year projections. However, it must be careful not to antagonise the government by over-playing the risks to growth.

Key policy announcements include more fiscal spending on infrastructure and affordable housing. The Labour government has committed to overall fiscal control. But the New Finance Minister Robertson has said that the government would pursue a national debt target of 20% of GDP in five years, up from the previous government’s target of between 10 and 15%, (down a bit from the current level around 22.5%). This implies that the Labour/NZ First government will run narrower budget surpluses, giving it headroom to pursue higher fiscal spending. As such, the RBNZ might view this as raising the growth outlook.

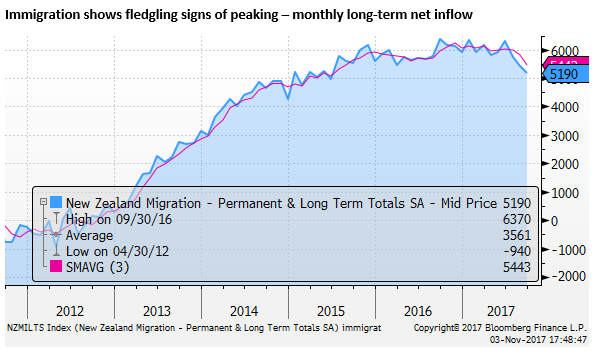

The government has also said it plans a 20 to 30K reduction in annual immigration from the recent levels of around 70K per year. Lower immigration may reduce demand in the economy, and weaken growth. However, rapid immigration has helped hold down wages, so the RBNZ would view this as a double-edged sword, potentially lifting wage inflation pressure, while reducing demand growth and price pressure elsewhere in the economy, including on the housing market.

The most recent data suggests that immigration may already be easing from record levels. This might be consistent with a stronger global growth environment generating more opportunities for workers abroad.

The RBNZ must also weigh the impact of the government’s policies designed to slow or even weaken house prices to make them more affordable. This includes ending foreign investment in existing homes. The government also plans to end negative gearing tax deductions, and, in time, introduce a capital gains tax. It also plans to lengthen the ‘bright-line’ test for sales from 2 to 5 years (before which housing sales profit is treated as taxable income).

Such measures may take time to be implemented, but they may have a more immediate impact on investor sentiment in the housing market. The housing market has been weakening in response to macroprudential measures, but perhaps also reflecting expectations of tougher government policy. The Labour/NZ First government’s policies may accentuate these concerns and further weaken the housing market.

The RBNZ must then consider the potentially bigger dampening impact weaker house prices might have on household confidence and spending.

Facing leadership upheaval, the RBNZ might be reluctant to upset the government by predicting that its housing market policies might undermine consumer confidence, or that that limiting immigration might weaken economic growth and raise wages. It might seem more reasonable for the RBNZ to say that its infrastructure spending plans may provide support for the medium term outlook for the economy.

The safe play may be to say little about the government policies at this stage, but this could seem a bit disingenuous. Nevertheless, it will be difficult to be too forthright until after a new Governor has been appointed in March next year, and a new Monetary Policy Board appointed.

The RBNZ will probably play it safe and focus more on the broader underlying trends in place. It may not over-play the recent weakness in the business survey. It may tend to stick to its growth outlook as outlined in the August statement. It may lean on the recent further softening in the housing market and fledgling signs of the softening immigration to balance this against more fiscal spending on infrastructure.

It will welcome the recent uplift in inflation and fall in the exchange rate. It is likely to raise its inflation forecast, and the risk is that it will bring forward its rate hike outlook modestly. But in doing so, it risks placing unwanted upward pressure on the exchange rate.