RBNZ may steal the march on the RBA

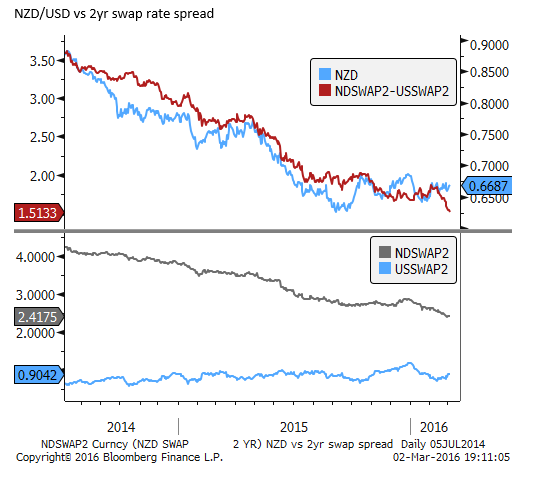

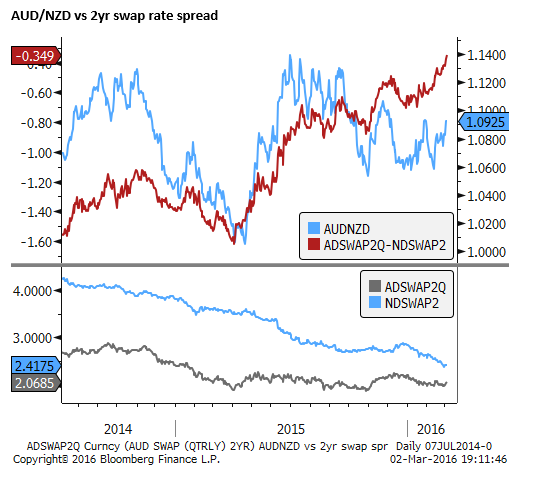

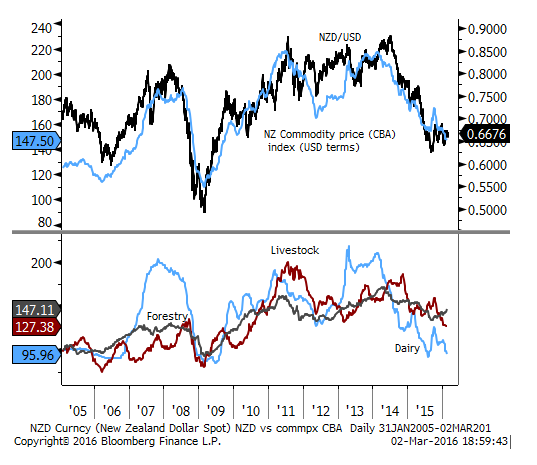

The RBNZ have had a clearer easing bias than the RBA and have called for a weaker exchange rate. After the RBA proved ambivalent this week, the RBNZ may seize its opportunity next week to gain an advantage in its little currency war with the RBA and move up its timetable to cut rates. The dairy industry outlook has weakened further, New Zealand domestic inflation indicators, including wages, have weakened and inflation expectation surveys have moved to new lows.

RBNZ might see a strategic advantage in cutting ahead of the RBA

We’ve heard from the RBA this week, and they were still in wait and see mode. This bolstered the AUD somewhat, and it got a shot in the arm from stronger than expected GDP, rebounding metals and energy prices, and stronger global risk appetite.

I am not convinced that the rebounding AUD is sustainable with US interest rates rising and US inflation pressure more apparent, weaker global growth indicators at odds with the recovery in commodity prices, Australian data early in 2016 suggesting that the solid recovery in 2015 may be stalling, an election looming, and mixed evidence from the housing market that looks over-cooked.

Next week, we hear from the RBNZ and the odds are significant that it cuts rates. The RBNZ would be happy to see the NZD fall and might see a strategic advantage in easing policy, contrasting with the ambivalent RBA.

A key point of difference is that New Zealand has enacted more significant macroprudential polices that are working more effectively in the country’s property hotspot Auckland to cool investor demand. The RBNZ may feel it has in place a set of macroprudential policies that are working.

In the meantime, inflation pressures remain very low, too low with declining inflation expectations. If the RBNZ feels that it is likely to need further rate cuts this cycle, then there is no time like the present to act.

The RBA’s statement suggested that it is more certain that inflation remains low

The RBA statement was very close to the statement in made a month earlier in February on every aspect of its assessment. The message was that the RBA is still is a watch and wait mode, prepared to cut again, but not sure that it needs to.

One change in the statement related to low inflation and the scope it provides to cut rates again. In Feb it said it “may provide scope”, In March it said it “would provide scope”. This suggests that it is more convinced that inflation will be subdued for the next year or two, and thus it may be more inclined to cut (if thinks the labour market improvement is likely to stall).

Otherwise, the guidance with a modest easing bias was essentially the same. It said, “Over the period ahead, new information should allow the Board to judge whether the improvement in labour market conditions is continuing and whether the recent financial turbulence portends weaker global and domestic demand. Continued low inflation would provide scope for easier policy, should that be appropriate to lend support to demand.”

The other key point was that the RBA decided to stay with its same neutral view on the exchange rate. It repeated, “The exchange rate has been adjusting to the evolving economic outlook.”

RBNZ message has been more dovish

Compared to these RBA views on rates and the exchange rate, the RBNZ had a more dovish view in its January statement.

On rates it said, “Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range. We will continue to watch closely the emerging flow of economic data.”

This is arguably a clearer easing bias than that expressed by the RBA, although it still uses the words “may be required”, rather than “likely to be required”; the latter has been used in the past usually one meetings before a cut is delivered. As such, most analysts still favour a cut mid-year rather than next week. Nevertheless a cut next week is widely considered a distinct possibility.

RBNZ will be more eager for a lower NZD

On the exchange rate the RBNZ said in January, “A further depreciation in the exchange rate is appropriate given the ongoing weakness in export prices.”

At the time of this statement on 28-Jan, the NZD was near its low for the year. Like other EM and commodity currencies it was hit by the turmoil in global markets in January.

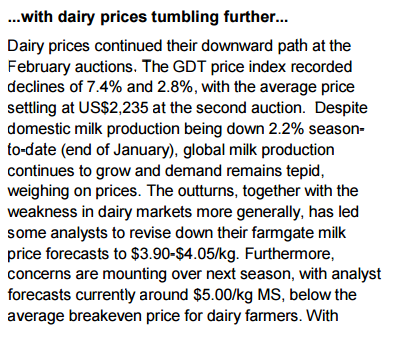

The NZD has firmed modestly since then, although not as much as the AUD or CAD. Furthermore, New Zealand’s main commodity exports, chiefly dairy, but also livestock, have weakened further this year. As such, the RBNZ should have no qualms calling for a lower exchange rate again next week. In fact the weaker commodity price trends will add to the case for a rate cut to help renew downward pressure on the NZD.

The case for a cut has strengthened

Since last year, the outlook for the dairy industry appears to have deteriorated further, inflation expectations have fallen further, the underlying inflation impulse is also threatening to fall, and the RBNZ can be more confidence that its macroprudential policies are doing a reasonable job.

One reason why the odds of a cut next week are high is that this is also a quarterly monetary policy statement. A time when the central bank updates its forecasts for the economy over the next three years. As such, it often crystalizes the case for or against cutting rates. If the RBNZ thinks a cut is now more likely, then it is a short step to then decide now is as good a time as any to deliver that cut.

Dairy industry concerns deepen

The Monthly Economic Indicators (MEI) report from the NZ Treasury released on 28 February made the following observation on dairy:

Underlying inflation impulse weakening

The MEI also noted lower construction costs in the Canterbury region (until recently running hot due to the earthquake related reconstruction). This has been an important component holding up underlying/non-tradeable inflation.

Rapid immigration has further cooled wage growth

Rapid immigration is contributing to strong overall demand growth in New Zealand and higher house prices. However, it is also keeping a lid on labour costs, a factor that appears to be weighing more significantly on RBNZ policy decisions in recent years as inflation persistently undershoots its target.

Despite a tightening in the labour market in Q4, New Zealand labour cost index and average hourly earnings data were below already subdued expectations. The MEI made the following comment.

Inflation Expectations fall to new lows

The NZD and rate cut expectations got a jolt on 14 February when the RBNZ inflation expectations survey plumbed new lows of 1.6% two years ahead. The drop in this survey in early 2015 to 1.8% appeared to be a significant factor contributing to the RBNZ’s decision to cut rates in 2015, reversing its rate tightening cycle that began only a year or so earlier.

The further sharp decline in this survey suggests inflation expectations are threatening to become entrenched below the 2.0% target.

The recent ANZ business survey released on 27 Feb showed one year ahead inflation expectations also dropping to a new low of 1.4% in February.

The RBNZ could dismiss these surveys as being short term, and influenced by the most recent low inflation outcomes. However, the 2 year ahead data is consistent with the low wages data and persistently low inflation over recent years, pointing to lower medium term expectations. As such the RBNZ task of lifting inflation back towards target appears to have gotten harder.

The MEI commented on this data:

Why wait?

When the RBNZ discusses its policy direction, it may well come to a firmer conclusion that additional rate cuts are likely to be required. Once in this frame of mind the discussion moves to why wait?

In most respects, the RBNZ has little to lose by cutting now; it will still leave them with ammunition if an emergency arises, it will contrast with the RBA and thus potentially generate significant selling pressure on the NZD, and get in just ahead of the ECB that might otherwise steal their thunder.