RBNZ not jumping at inflation shadows

The RBNZ have managed to surprise again, this time in a dovish direction. They did not revise up their rate projections, still seeing rates on hold through to around Q3-2019. In his press conference, Governor Wheeler said rates are expected to be on hold for the foreseeable further. Despite a rebound in headline inflation to 2.2%y/y in Q1, above the RBNZ’s 2% inflation target, well above its February MPS forecast of 1.5%, the RBNZ did not revise up its path for inflation over the three-year forecast horizon. Wheeler said, “we are not seeing the build-up in inflation pressures that some other commentators are seeing”. The RBNZ continues to see sluggish global core inflation pressure and low wage outcomes containing the recovery in inflation, even though the RBNZ measure of overall economy capacity is largely used up. The RBNZ notes that slowing house price growth is also expected to help contain inflation. The impact of its LVR macroprudential restrictions on mortgage lending are working to slow the housing market, banks are self-regulating to some extent to contain lending, and the RBNZ is progressing with adding DTI limits to its macroprudential toolkit, should that be required to subdue the housing market. The NZD fell sharply following the dovish statement, 2yr swap rates are 8bp lower. The NZD has become more sensitive to its narrowing yield advantage in a rising global yield environment. The RBNZ reluctance to dance with inflation shadows suggests NZD may join AUD as a weak currency, especially if US yields continue to firm.

Not jumping at inflation shadows

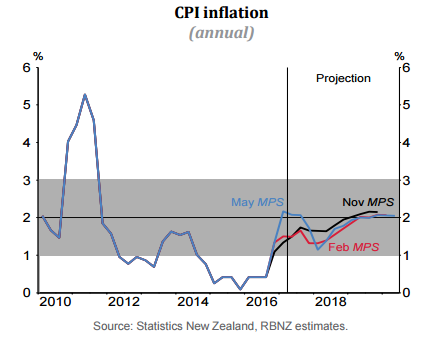

Despite the jump in headline inflation in Q1 to 2.2%y/y, rising above the mid-point of the 1 to 3% target, well above the 1.5%y/y forecast made in the February MPS, the RBNZ has made little adjustment to the path of inflation in its three-year projections. It has forecast it to fall back to 1.1%y/y in Q1 next year, rising to its 2.0% target in Q2-2019.

In his press conference, RBNZ Governor Wheeler said that “we are not seeing the build-up in inflation pressures that some other commentators are seeing.”

In particular, the RBNZ and Wheeler see little inflation pressure coming from abroad. The Monetary Policy Statement (MPS), “assumed slowing in the pace of recovery in global oil prices and a subdued outlook for global inflation more broadly.”

Wheeler sees low wage inflation a global conundrum, even where labour markets have tightened. He said, “We have seen little sign if wage inflation. And the same is the case in many countries that have full employment: Japan, Germany, and the US arguably – you’re not seeing significant wage inflation coming through. Some of them are struggling to explain why wage inflation is so low.”

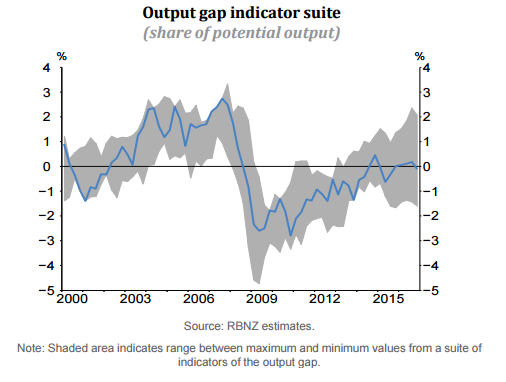

Despite a number of special factors that suggest the Q4 GDP report significantly underscored the strength in the economy, the model drive RBNZ downgraded its assessment of used capacity in the economy (its output gap).

Wheeler said, “Output growth in the second half of last year was weaker than what we were expecting… so we think there may be a bit less capacity pressure than we thought.”

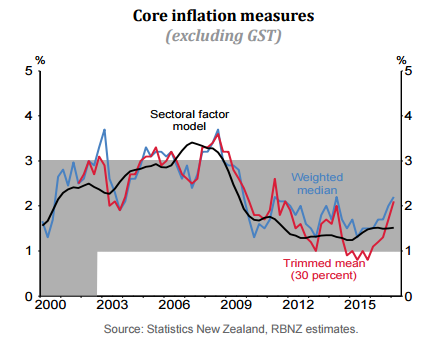

In discussing underlying inflation trends, the RBNZ paid less attention to the rebound in the trimmed mean and weighted median. It paid more attention to the more stable ‘sector factor model’

Wheeler said, “If you look at core measures of inflation, they are running around 1.5 to 2.2. The measure that we put quite a lot of emphasis on is the factor model, which is at 1.5 and it has been at 1.5 for some time.” (it has been stable at this level for 5-quarters since Q4-2015).

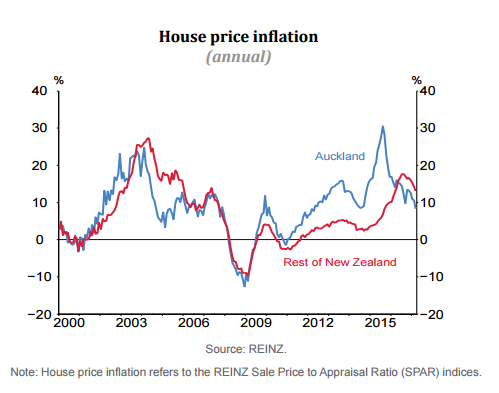

Wheeler added that, “Non-tradable inflation is rising only slightly at this point, and we have seen a significant slowdown in house price inflation.”

“All of that suggests we are not going to see a burst of inflation in this economy.”

“That’s the main reason why we have kept the neutral stance, we just don’t see the need to change that stance at this point.”

“We are neutral on monetary policy and for the foreseeable future we expect to see the OCR stay at its current level.”

Assistant Governor, John McDermott added that “we still think that underlying inflation is moving very slowly.”

Macroprudential measures working

The subdued RBNZ view on inflation does depend on a continuation of the recent significant moderation in house price growth. This in part reflects the impact of the expanded LVR limits on loan growth implemented October last year, and some tightening in bank lending conditions in part directly related to the macroprudential framework.

Loan-to-valuation ratio restrictions – RBNZ.govt.nz

Wheeler said that New Zealand banks had tightened credit for some developers, more so the lesser established ones, and had cut back lending to property investors. (These are most affected by the LVR restrictions). Wheeler noted that the value of new loan commitments was down 9% in Q1 from a year earlier, down 21% for investors, and flat for others.

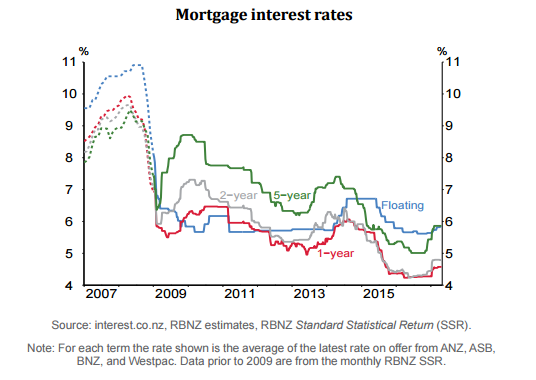

Wheeler noted that mortgage rates had risen from last year due in part to higher funding costs. He said, some banks are approaching their internally set limits on offshore wholesale borrowing, leading to increased competition for deposits, and an increase in deposit rates. He said that he expects that competition for deposits to “continue quite significantly in coming months.”

With rapid immigration and a tight housing market, there is clearly a risk that the LVR restrictions lose impact and house price growth picks up again later in the year.

Should house price start to reaccelerate, the RBNZ is still readying new measures (Debt to Income – DTI limits) to deploy next.

RBA Governor Wheeler Said, “We expect to be going out with a consultative document in the next 2 to 4 weeks about DTIs.”

“This will include the cost-benefit analysis requested by the government, we’ve largely completed the draft, and discussing it with Treasury, we’ll give it to the Finance Minister, he will look at it for a couple of weeks, and then we will put it out.”

Presumably, this paper will help contain bank enthusiasm for lending. The RBNZ does not expect to immediately implement this policy, and even after this first consultative paper is released, a second more detailed policy proposal consultative paper would need to be prepared.

RBNZ Deputy Governor Spencer said, “It would still be some way off, I would not put an exact time on it.”

The RBNZ’s macroprudential policies have been working and allow them to maintain record low interest rates. It may feel the addition on DTI limits to its toolkit, late this year or sometime next year will allow them to hold rates low for some time yet.

Capacity used, up but wage inflation to remain low

While the RBNZ have downplayed the risk of inflation it still sees capacity in the economy as largely used up. Its low inflation forecasts rely much on a sense that low wage growth, low global inflation trends, lower house price inflation and low and stable inflation expectations will see a very gradual rise in core inflation.

Assistant Governor McDermott said that it is almost impossible to estimate a neutral, non-inflationary level of unemployment in New Zealand, and the RBNZ relies on an entire economy, output gap framework for assessing inflationary pressure.

He said, we estimate that capacity is just about used up, but there is a range of estimates, and that range is quite large.

Governor Wheeler added that our forecasts show is that the unemployment rate falling to around 4.5% and inflation rising to around 2%, suggesting that 4.5% might be thought of as the neutral unemployment rate (compared to 4.9% in Q1).

The record low wage inflation in the face of rapid employment growth suggests the rapid immigration, and record labour force participation is contributing to low wage outcomes. Wheeler and McDermott’s discussion on this suggests that they see wage inflation risk still quite low. However, the MPS is forecasting a moderate recovery in wages over the year ahead.