Reviewing a complex period since Brexit, FX uncertainty remains high

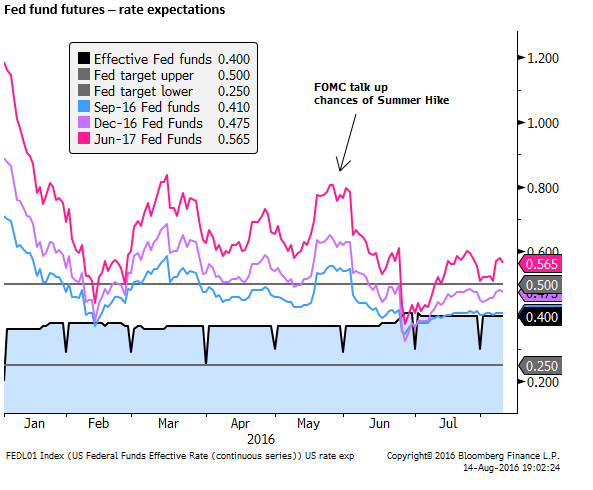

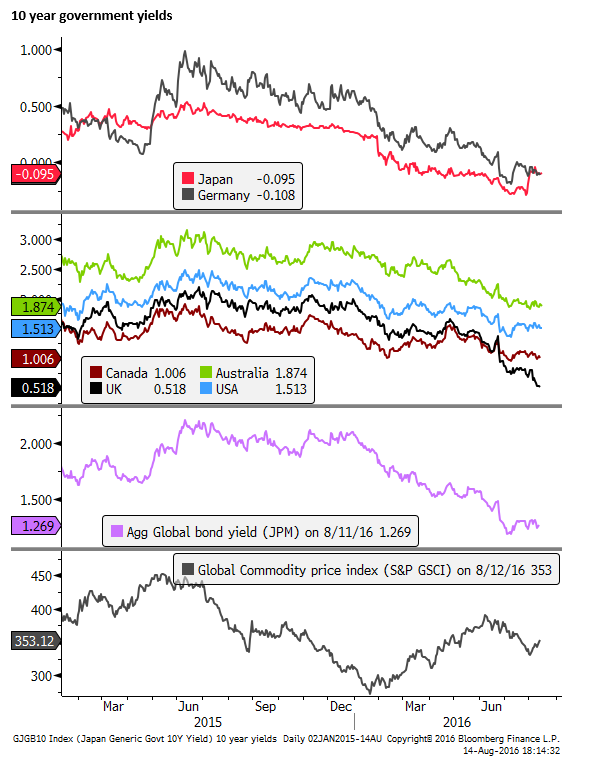

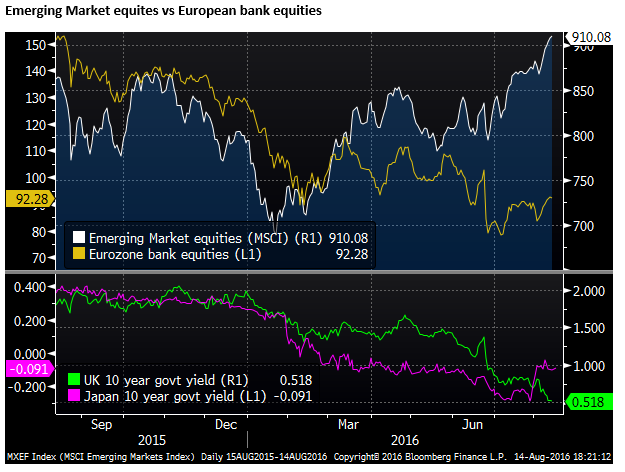

It has been a complex period in currency markets since the Brexit vote. The USD has been unusually weak considering the lift in its yield advantage. JPY has been volatile and uncertainty over its direction remains high. It has stalled recently as the market struggles to guess the BoJ’s next step. Funds have flowed to emerging markets with renewed vigor in what began as a rebalancing away from the UK and Europe, supported by falling global bond yields, forcing markets to chase higher yielding assets. The USD appears to have fallen as the default funding currency. At the end of last week, surprisingly weak Chinese data interrupted an otherwise improving outlook for emerging market assets. The GBP resumed its fall and may be again holding down the EUR. The market has remarkably little probability priced-in that the Fed hikes rates either in coming months or over 2017. This suggests there is risk of higher US rates and a rebound in the USD if the Fed suggest that the outlook is more balanced in Fed minutes and Fed President speeches this week or Chair Yellen speech next week. However, if the Fed shows any ambivalence the market may continue to dismiss the risk of higher US rates and resume its demand for higher yielding assets.

We don’t have a strong view at this stage – it may be getting late in the game to sell the USD given the risks China may pose to the upswing in emerging market assets. However, emerging markets have been in recovery mode since January, punctuated in May/June by Brexit uncertainty and Fed overtures towards a summer hike. It would be premature to say their recovery is mature. JPY is still in a strong trend this year and the BoJ has proven incapable of reversing this trend. This may keep the market focused on selling USD in favor of higher yield currencies, and willing to ignore Fed rate hike risks unless the FOMC send a clear message that a hike is likely in coming months. Uncertainty over BoJ policy is likely to increase as we approach the 21 September BoJ meeting (the same day as the FOMC meeting). Every BoJ meeting this year has generated increased FX volatility.

It has been a year of falling yields, rising asset prices and increased uncertainty and correction in FX markets. Global growth confidence overall remains low. In this environment we have frequently looked to gold to outperform most currencies. Perhaps we are again at that juncture where increased uncertainty but low yields drive up gold. And yet gold fell back to the bottom of its recent range on Friday and appears to be struggling to maintain its upward momentum since the Brexit vote.

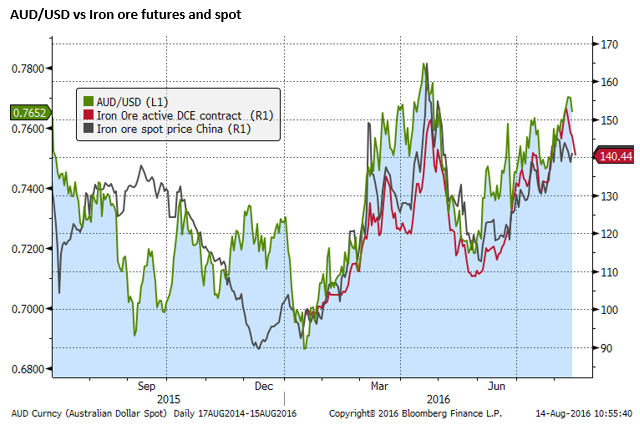

AUD and Iron ore price more tightly correlated

The AUD appeared to fall late last week after the weaker than expected Chinese data and a retreat in iron ore process in China.

Both AUD and the active iron ore futures contract on the Dalian Commodity Exchange slumped together in the evening session on Friday. Both may have taken their cue from the weaker than expected Chinese data for July reported on Friday.

As the chart below shows, iron ore and AUD have been more closely aligned this year.

It may be the case that iron ore has become a more speculative market since become more widely traded on the futures market. As such, like AUD it is becoming something of a proxy for confidence in the Chinese economy rather than a guide to supply and demand in the steel market. Nevertheless, we should continue to pay it close attention in deriving our outlook for the AUD.

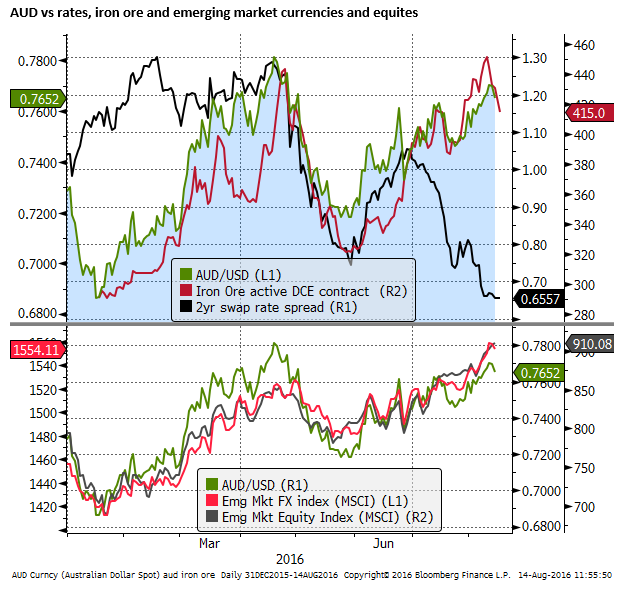

The weaker Chinese data last week came against an otherwise improving backdrop for emerging markets. It may serve to temper enthusiasm somewhat for renewed flows in emerging markets, but this remains to be seen. Much of the renewed appetite for EM assets appears to have come from extremely low yields forcing investors to seek higher yielding assets and as an alternative to UK and European equities in the wake of the Brexit vote. In which case the market may attempt to look through a weaker set of Chinese data and continue to pursue investments in other EM markets, leaving China as a laggard.

AUD divergence from yield spread widened since Brexit Vote

The chart below shows that the greatest divergence between AUD/USD and the 2yr yield spread began in late-June, after the 23 June Brexit vote. Even as the AUD/USD yield spread fell relatively sharply to a low since 2006, AUD and iron ore both rallied in line with resurgent emerging market assets and currencies.

A review of Post-Brexit currency drivers

It has been a complex period in currency markets since the Brexit vote and it is worth reviewing developments to assess what factors may be setting direction.

Post-Brexit bond yields fell globally as the market anticipated BoE and BoJ policy easing, and a delay to policy tightening in the USA. The decisive Abe led LDP upper house election results on 10 July boosted hopes of a bigger Japanese fiscal stimulus package and firmed expectation for more easing by the BoJ.

Lower yields globally, an increased outlook for fiscal stimulus and a rebound in US payrolls data in the first weeks after Brexit contributed to a rebound in global risk assets, over-powering fears of Brexit economic fallout.

July was also characterized by increased volatility in the JPY and JGB yields. This did not have a lasting impact on global asset markets, but it did add to uncertainty over the direction of the JPY. This discouraged the traditional use of the JPY as a funding currency for high beta asset and currency investment, shifting more selling towards the USD to fund investment in emerging market currencies.

Despite stronger emerging markets, July was not characterized by a marked increase in economic optimism. Emerging market assets strengthened more in response to a rebalancing away from the UK and Europe, undermined by Brexit uncertainty. Lower yields globally also pushed funds towards higher risk asset assets offering some yield. Furthermore, emerging market assets were still in recovery mode from a weak 2015 and January 2016. Pre-Brexit jitters interrupted their recovery, which resumed with renewed vigor in recent months.

A rise in Japanese government bond yields and rebound in JPY after the 29 July BoJ policy meeting and significant falls in European bank stock prices in the first days of August had limited negative fallout to emerging markets, emphasizing that flows to these markets were much about rebalancing from Europe.

The BoE policy easing on 4 August and decline in UK gilt yields that followed offset the impact of a jump in Japanese yields and set the market more clearly on a path towards seeking higher yield assets in emerging markets. The second strong US payrolls data in a row on 5 August again did more to bolster emerging markets than rate hike expectations in the USA.

Since the BoE policy easing on 4 August there has been a more synchronized rise in global asset markets in a more traditional risk-on asset market rally supported by falling UK yields, holding down global bond yields.

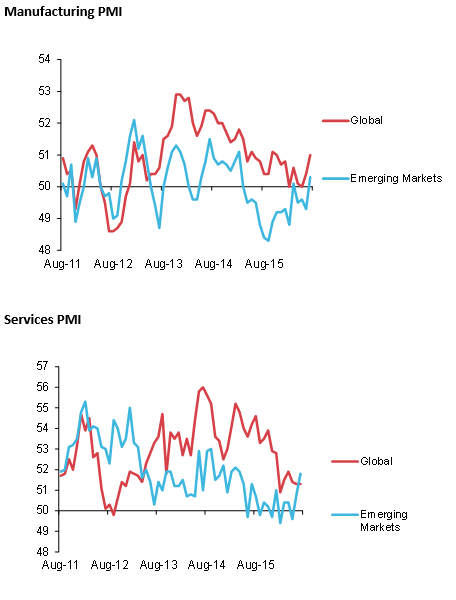

There has been some better data in emerging markets to help support the rally, including a lift into positive growth territory in emerging market PMIs. The Emerging Market manufacturing and services PMIs rose to their best readings in July for over a year and closed the performance gap to developed markets.

Lukewarm Fed

US yields at the front of the curve have increased modestly since the Brexit vote, supported by strong equities and much stronger than expected US payrolls reports for June and July. On 27 July the FOMC statement was less dovish saying, “Near-term risks to the economic outlook have diminished”.

However, Fed speakers have been at best lukewarm to the idea of a rate hike. On 31 July, New York Fed President Dudley said, “It is premature to rule out further monetary policy tightening this year”, but spend most of his speech explaining why rate hike expectations have fallen this year, arguing that policy is only modestly accommodative and the Brexit vote would have a medium term (long-lived) fallout to the UK and European economies that needs monitoring.

Besides strong US payrolls, other US economic data has been mixed, including much weaker than expected GDP in Q2 and downward revisions over the last year released on 29 July, and on Friday last week, 12 August, USA retail sales were also significantly weaker than expected.

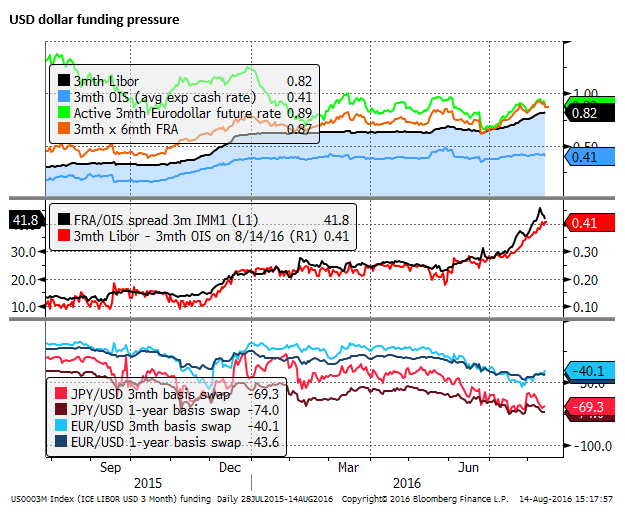

Some dollar funding pressure

There has been additional upward pressure on term money market rates in the US since early June related to new SEC rules that start in October designed to make US Money Market Funds safer and more transparent. This picked-up from around mid-July and added around 20bp to 3mth US LIBOR since mid-year. However, there has been surprisingly little impact on the USD, despite the increased cost of hedging USD investment or using the USD as a funding currency for higher yield investment such as in emerging markets.

Overall, the rise in US rates and yields at the front of the curve has been insufficient to support the USD. It has not deterred investment in emerging markets or reverted attention in the market to using alternative funding currencies such as the JPY or EUR.

Pause for reflection in US dollar ahead of Fed minutes

The USD recovered a little on Friday, shaking off an initial sell-off after the soft USA retail sales data. The recent run-up in emerging market currencies may have sent them into a short-term overbought position. The weak Chinese economic reports on Friday may have reignited some concern over the drag on other emerging market economies. The GBP renewed its downward trend, spilling over somewhat to the EUR. JPY has stalled recently, albeit near its highs for the year, awaiting the outcome of the BoJ’s review of its monetary policy to be tabled at the BoJ policy meeting on 21 September (just ahead of the next FOMC meeting). The recent run-up in US money market rates, although stalled on Friday by the soft US data, may have helped stabilize the USD.

The market may pause to reflect on the outlook for US rates in the coming two weeks. It will be looking for clues in the minutes from the 27 July policy meeting released this week on Wednesday 17 August. There will be speeches and press briefings by Fed Presidents Dudley, Williams and Kaplan on Thursday 18 August. And much attention will fall on the speech by Fed Chair Yellen speech the on 26 August.

The market seems to think the Fed will be in no rush to hike rates on 21 September and with an election on 8 November, a hike at the 2 November meeting seems unlikely, making the last meeting for the year on 14 December the next most viable date for a possible hike.

If the Fed were seeing a hike in September as likely based on recent events, then it needs to send that message in the next two weeks to give the market time to adjust to this likelihood. As such Fed minutes and speeches in the next two weeks will be seen as quite important.

The market has only 16% chance of a hike priced-in for September, slightly higher for November and less than 50% priced in for December. Remarkably a full 25bp of hikes is not priced-in until early-2018.

This seems complacent to the risk of stronger economic data in the US demanding that the Fed hike policy over the course of the next year. This seems to point to upside risks to the USD if the Fed were to highlight that the outlook for the economy is more balanced.

However, the market appears more responsive to signs of weakness in the data, and inclined to believe that the Fed is more talk than action. Any ambivalence by Fed speakers, such as that shown by Dudley on 31 July, will suggest that the Fed is likely to wait at least to December before considering a hike, in which case we may see a resumption of the weaker USD trend.