Rising US yields to lift USD/JPY; CAD and NZD vulnerable

The rise in US long-term yields may continue, supported by Fed QT, ECB taper, rising oil prices, solid underlying recovery in the USA, solid global growth, diminishing uncertainty from geopolitical risks and hurricane season, and now a clearer focus on tax reform. The USD/JPY is likely to mirror any further rise in yields. The Bank of Canada walked back rate hike expectations. NZD/USD may succumb to yet further narrowing in its razor-thin yield advantage with diminishing reasons to explain its strength.

US yields shaking the bear trend

US 10 year yields rose above their recent on 21-Sep high, continuing a rising trend since a low for the year on 7-Sep. It is yet to convincingly shake-off the declining trend this year, but the move up may be the start of a larger rebound. Higher yields may be supported by higher oil prices, solid global growth, Fed plans to begin QT in October and a likely further QE taper by the ECB from next year. And renewed momentum towards tax reform in the USA that will include massive tax cuts and bigger fiscal spending and, therefore, a bigger supply of government bonds.

Yields hit their low for the year in the midst of hurricane and North Korean uncertainty and USA government dysfunction. We have seen a better performance in recent weeks from Trump and Congress. Geopolitical risks continue to buffer the long bond yield, but market reaction to North Korea rhetoric and tests may be becoming shallower and shorter in duration.

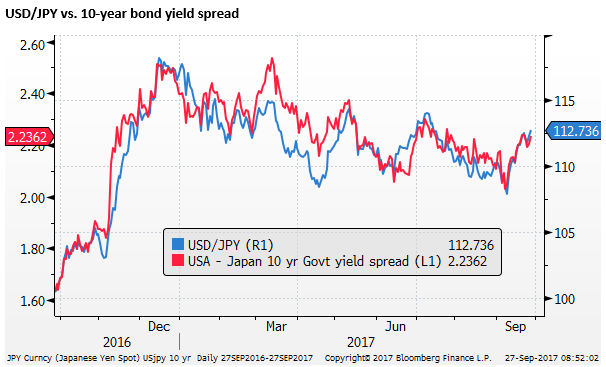

USD/JPY has most to gain

Yield curve control remains firmly in place in Japan, and rising US and global bond yields are likely to result in a weaker JPY. US bonds and JPY have been in close correlation over the last year (77%).

US economy showing solid underlying trend

US economic data is starting to become messy, related to hurricane disruption in the second half of August into September. Pending home sales fell more than expected, but durable goods orders were stronger than expected.

Capital goods orders may have been boosted a bit by hurricane replacement, but core capital goods orders are probably more indicative of the underlying trend. These appear to have gained momentum in recent months, building on a rising trend since a low in May last year.

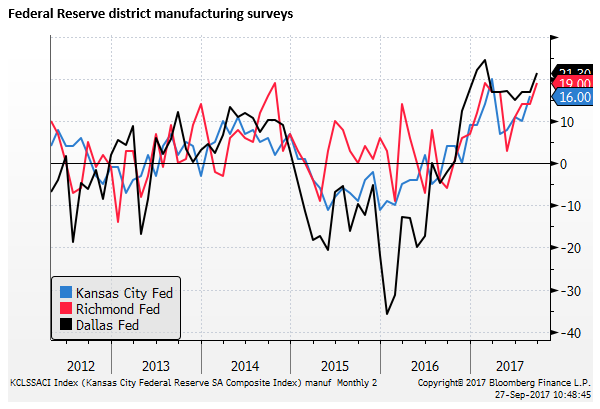

Recent US manufacturing surveys also point to a robust underlying economy. The Richmond Fed index rose to +19, equaling peaks in recent years (released on Tuesday). The Dallas Fed index rose to 21, around long-term highs (released on Monday).

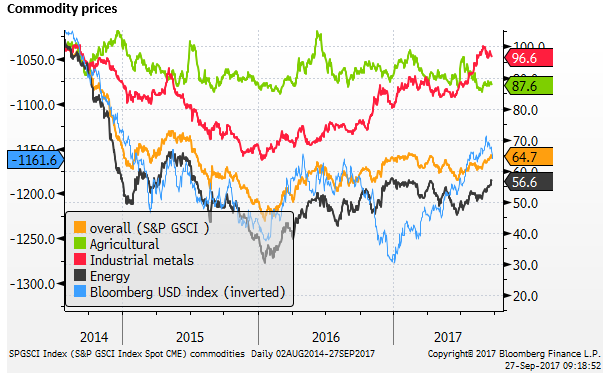

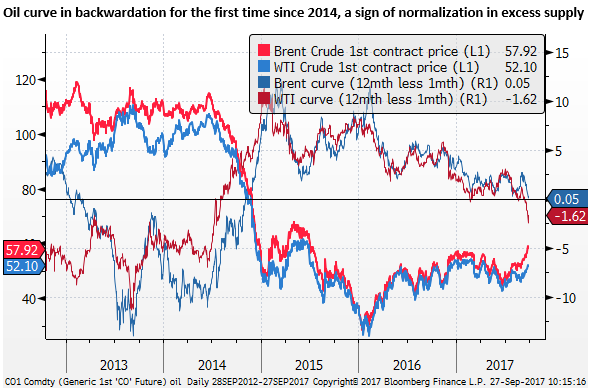

Oil price recovery looks more resilient

The key determinant of commodity price inflation – oil prices – have shown more consistent improvement since mid-year. They are testing around their highs for the year. Higher commodity prices, more generally, appear to be supported by a global economic recovery.

Backwardation developing in the oil futures market suggests excess supply and inventory has been significantly reduced.

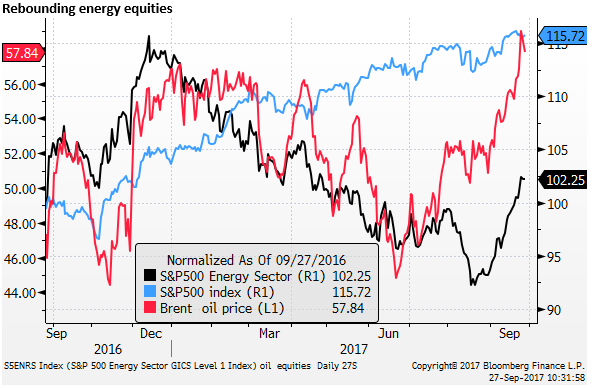

Confidence in the outlook for oil prices might also be reflected in the recent recovery in energy sector equities from a low in mid-August. Until August, energy sector equities were significantly under-performing an otherwise strong global equity market, and also under-performing oil prices.

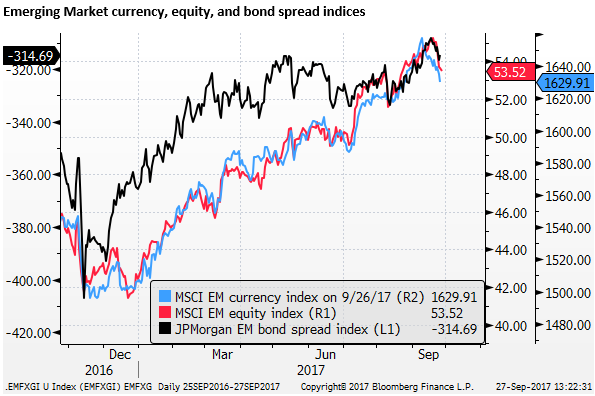

Emerging market correction

Strong global growth indicators continue to make a case for emerging market investment. In Asia, China industrial profits rose 24.0%y/y in August; a high rate since 2011. Taiwan’s monitoring index (a broad economic indicator) rose from 22 in July to 24 in August, rising from a recent low in May. Singapore recorded a 19.1%y/y increase in industrial production in August.

However, the prospect of higher US yields, and an improving USD trend, appears to be contributing to some profit-taking and correction in EM markets. It remains to be seen if this is a short-term correction; the market is yet to be tested on its rising trend this year.

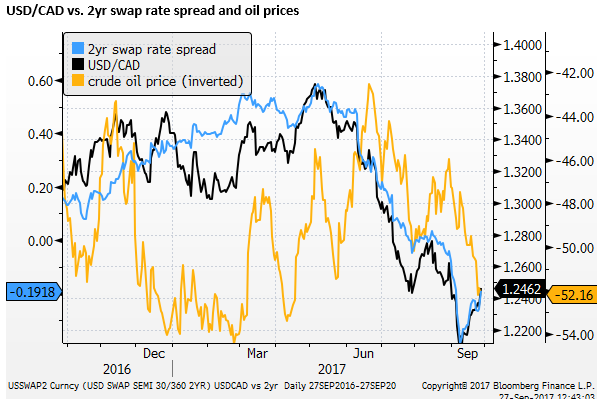

Poloz walks back rate hike expectations

CAD weakened further after the speech by BoC Governor Poloz on Wednesday. Poloz emphasized that policy is a touchy-feely thing and the bank can’t just rely on its economic model.

This is interesting since the Bank used its model approach more than most central banks to explain why it hiked rates twice in a row this year, despite significantly lower inflation outcomes.

Poloz discussed the risks in the outlook that may not be picked up in its models. These include structural factors in the global economy that may be subduing inflation and wages growth, just as has been seen in most parts of the world. And the high level of household debt that may make Canadians more sensitive to interest rate rises.

He said, “In such an environment, we simply cannot rely mechanically on economic models. This does not mean we are abandoning our models. It does mean we need to use them with plenty of judgment, informed by data, sentiment indicators and intelligence, as we go through the delicate process of bringing inflation sustainably to target. We will continue to watch all the data closely, as well as developments in financial markets, in terms of their impact on the outlook for inflation. We recognize that the economy may act differently than in previous cycles. We will not be mechanical in our approach to monetary policy.”

He also suggested that the rapid rise in the CAD exchange rate this year and jump in long-term yields might be a reason to raise rates more cautiously.

He said, “Let me quickly make one final point. Among the financial market developments that we watch closely are movements in longer-term interest rates and the exchange rate. Changes in interest rates naturally lead to movements in the Canadian dollar. However, currencies can move for many other reasons, including external factors, and these movements can affect our inflation outlook, depending on their cause, size and persistence.”

He suggested that the two hikes this year were the easy part of the decision, removing the emergency cuts delivered in 2015, but hiking rates further from here will require more careful judgment.

He said. “The economic progress we have seen tells us that the moves we took to ease policy in 2015 were the right thing to do. At a minimum, that additional stimulus is no longer needed. But there is no predetermined path for interest rates from here. Monetary policy will be particularly data dependent in these circumstances and, as always, we could still be surprised in either direction. We will continue to feel our way cautiously as we get closer to home, fostering economic growth and keeping our inflation target front and centre.”

In Q&A after his speech, Poloz continued to emphasize the uncertainty in policy direction, implying that the Bank is in a more wait-and-see frame of mind. He said that bank models tend to over-estimate inflation in this part of the cycle since they don’t tend to account for increases in supply/capacity growth.

In most respects, this speech appeared to be designed to walk back market expectations of further rate hikes in Canada. Canadian two-year swap rates fell around 5bp in response to the speech, reversing about a 2bp rise earlier in the day, to be about 3bp lower, against a 2.5bp rise in US rates.

As the chart below shows, the rates differential has been highly influential in setting the tone for USD/CAD exchange rate this year.

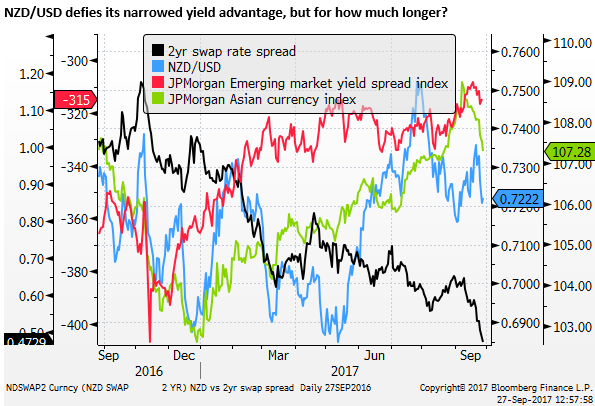

NZD/USD may succumb to narrowed yield advantage

The NZD/USD exchange rate has been buffeted by election uncertainty in the lead-up to, and following, its election last week. Nevertheless, it has been surprisingly resilient in recent days to a further significant decline in its now very slim interest rate advantage over the USD, weak emerging market assets, a much weaker business survey, and ongoing political uncertainty as NZ First consider which side of politics he will support.

The NZD/USD has done a good job of ignoring its narrowing interest rate advantage over recent years, but it is getting harder to identify reasons why this should continue to be the case.