Risks mount for a more severe period of global risk aversion

The US stock market is exhibiting the weakest signals since the 2008 Global Financial Crisis. We see substantial risk that it breaks the lows set in Aug/Sep relatively soon and triggers a more severe period of global risk aversion. China may step-in to stabilize its markets after sharp deterioration so far this year. But this may provide only a short term reprieve for global asset markets. The USD and US rates are unlikely to fall quickly enough to provide a significant fail-safe break for a US equity sell-off. A more severe period of global risk aversion is likely to weigh on commodity and EM currencies, further strengthen the JPY near term, and further delay a return to a weaker trend in the EUR.

Weaker US equity technical signals

Technically, the US stock market is exhibiting evidence of a longer term topping pattern. It has failed to make new highs in the recovery from the lows last year. And it had lost momentum through the first half of 2015, creating an appearance of ‘rolling over’ for the first time since the 2008 GFC. If it were to break the lows in Aug/Sep last year, this would be a significantly bearish signal, creating a clearer indication of a down-trend.

S&P500 weekly bars

As this is coming at a time when the Fed has initiated a tightening cycle and the USD is at a relatively strong level, both working against the stock market, it seems more likely that the US stock market may struggle for some time. Over the last month, just as the Fed has started to tighten, many US growth and demand indicators have deteriorated suggesting that the US economy has lost momentum.

The strongest indicators remain in the service sector and employment. But the down-turn in the manufacturing sector suggests that it is at its weakest pace of expansion in the recovery since the Global Financial Crisis (GFC) in 2008. The service sector and housing market continue to grow but appear to have lost some moment. Unemployment claims remain very low but have lifted a bit in recent months.

It remains to be seen if moderation in the US economy will take much strength out of the USD. It might if the economy slows significantly enough to push the US Fed tightening cycle into a long wait-and-see mode, but it is hard to make a strong argument to buy other currencies.

Both the Eurozone and Japan are entrenched in QE policies that should work against their currencies in periods of moderate risk appetite. So even though their economies are now showing a firmer trend, especially in the case of the Eurozone, their currencies should remain relatively weak for some time.

Commodity currencies are struggling with a large terms-of-trade shock, and Chinese market uncertainty and weaker currency trend is working against emerging market currencies, particularly those in Asia.

As such, it appears that there is little prospect of a significant fall in the USD that might improve its tradable goods and services sector and re-ignite a stronger economic outlook. This suggests that the pressure may well continue to build on the US equity market.

The sharp fall in US equities in recent days, down around 5% year-to-date, over the last week, still leaves the market at relatively high levels from a longer term perspective, still up by 23% from the peak in 2007 before the GFC. As such, even though stocks are looking wobbly the market will not quickly look for the Fed to reverse course on its policy tightening cycle.

Certainly the market does see less risk of much higher US rates in the current environment. However, the fall in US rates to date from recent peaks around end-2015, still leaves 2yr swap rates above levels prevailing before December. Rates are stickier than is often the case towards the downside, less reactive to equity market weakness and softer data at this time, tending to support the USD and keeping down-ward pressure on US equites.

This suggests that the risk is high that the US S&P500 index will break its lows in Aug/Sep relatively soon and set up the market for a period of more severe risk aversion for the first part of the year.

The implications for currency markets are probably more weakness in commodity and EM currencies, strength in JPY and perhaps some more near term interim strength for the EUR.

The payrolls figure at end-week is always an important number that may trigger market upheaval. The labor market indicators are still looking in good shape. The ADP employment report was stronger than expected and unemployment claims, while up a bit recently, are still historically quite low.

A strong number, however, may serve to unsettle the equity market by underpinning US rates and the USD. A weak number might also fuel concerns that the economy is slowing and contribute to weakness in equites.

Focus today remains on the Chinese markets. It may be the case that the Chinese authorities step-in today to support the market with quasi-official buying, and it may also stabilize the currency for a time. Even if they are prepared to leave the market to trade more freely this year, it would not surprise to see some actions to stabilize conditions after rapid falls in both to start the year

However, this may prove to be only a short term reprieve for global equity markets and global risk appetite.

Economic News in the last week

Australia:

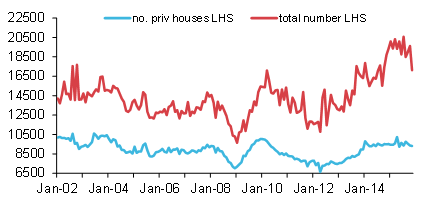

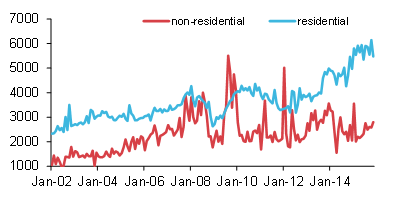

Building Approvals fell 12.7%m/m in Nov, weaker than -3.0% expected. Core private house approvals fell 0.5%m/m, the third fall in a row; they are down 1.8%y/y. The volatile apartment approvals fell 24.0%m/m and are down 15.0%y/y. Non-residential approvals by value rose 7.2% for the first time since August. The building recovery that has helped support the economy through the mining down-turn is likely to fade towards the end of 2016.

Number of Residential Building approvals

$Am Value of Res and Non-Res approvals

Source: Bloomberg, ABS, AmpGFX

Trade Balance was $A-2.91bn in Nov, a bit narrower deficit than -2.99bn expected, and revised down a bit from -3.31bn to -3.25bn in Oct. The deficit remains significantly wider than average levels over recent years reflecting the sharp fall in export prices. Averaging -2.6bn this year vs. -0.8bn in 2014.

PMI Services: 46.3 in Dec, down from 48.2 in Nov, declining recently from a peak of 55.6 in August. This index is volatile but the recent fall takes some steam out of the recent services recovery story.

Japan

PMI Services edged down to 51.5 in Dec from 51.6 in Nov, relatively stable since April.

USA

Jobless claims 277K last week, down from 287K the previous week. 4-week average 275.8, rising recently from a long term low of 259K in October. Still around its average for the year, a long term low.

ADP employment rose 257K in Dec, above 198K expected, up from 211K in Nov (revised down a bit from +217K)

ISM non-manufacturing 55.3 in Dec, weaker than 56.0 expected, down from 55.9 in Nov; at a low since Apr-2014. Three month average (56.8) at a low since Jun-2015.

Markit PMI Services 54.3 in Dec, at a low since Jan-2015

ISM manufacturing 48.2 in Dec, below 49.0 expected, down from 48.6 in Nov, a low since June 2009.

Markit PMI manufacturing 51.2 in Dec, down from 52.8 in Nov; the low in data back to 2013.

Trade balance $-42.4bn in Nov, narrower deficit than -44.0bn expected, narrower than -44.6bn in Oct. Three month average (-43.1bn) narrowest since Feb-2015. Exports fell 0.9%m/m and -7.1%y/y in Nov. Imports fell 1.1%m/m and -4.9%y/y in Nov.

MBA weekly mortgage approvals for house purchase fell to 196.2 last week from 220.8 the previous week, to a low since early-Nov. The 4wk average (217.4K), a low since early-Dec, but around the highs since 2010.

Pending home sales fell 0.9%m/m in Nov, weaker than +0.7% expected. Sales have been trending down since a peak in May; still up 5.1%y/y.

Construction spending fell 0.4%m/m in Nov, weaker than +0.6%expected, below +0.3%m/m in Oct, revised down from 1.0%m/m. Non-residential spending fell by 0.8%m/m in Nov and rose 10.2%y/y; Residential spending rose 0.2%m/m in Nov and rose 10.9%y/y. Construction may be losing momentum after reaching its highest level since 2007. Non-residential spending has stalled since May after a rapid jump from Feb to May. Residential spending has been growing at a steady pace in 2015, with a bit of slowing momentum in recent months.

Vehicle sales fell to an annual rate of 17.22m in Dec, below 18.0m expected, from 18.05m in Nov. Three month average of 17.80m at around the long term cyclical peaks seen before the 2008 GFC. Up-trend in place since 2009.

Weekly consumer confidence firmed in the last read for Dec to 43.6, relatively stable in 2015, around the high since 2007.

Eurozone

Retail sales +1.4%y/y in Nov, below 2.0%y/y expected, down from 2.4%y/y in Oct. Three month average of 2.3%y/y, down from a more than decade high of 3.1% in Sep.

PMI Retail 49.0 in Dec, up from 48.5 in Oct, down from a peak of 54.2 in July, at a low three month average (49.6) since April.

German Factory orders rose 2.1%y/y in Nov, stronger than 1.1%y/y, up from -1.6%y/y in Oct. Domestic orders +6.2%y/y, Foreign orders -0.7%y/y

Unemployment rate of 10.5% in Nov, stronger than 10.7% expected, down from 10.6% in Oct, revised down from 10.7%; at a low since Oct-2011, down from the peak of 12.1% in Mar-2013. Average since of 1998 of 9.6%, low of 7.2% in 2008 before the GFC, average from 1998 to 2007 (prior to the GFC) of 9.0%

EC Economic confidence survey at 106.8 in Dec, above 106.0 expected, up from 106.1 in Nov; around a high since 2011, in a rising trend during 2015.

PMI services 54.2 in Dec, up from 54.0 in Nov. Three month average 54.2; stable around this level since March, the highs in data back to 2013.

PMI manufacturing 53.2 in Dec, up from 52.8 in Nov, rising since a recent low of 52.0 in Sep, at a high since Apr-2014.

CPI core 0.9%y/y in Dec, below 1.0%y/y expected, unchanged from Nov, down from the recent peak of 1.1% in Oct. Three month average stable at 1.0%y/y, up from the record term low of 0.65%y/y in Apr/Mar.

Euro-Area private credit impulse +4.2%y/y in Dec, stable around this level since March, at a high since 2008, around the long term cyclical peaks. Loans to business rose 0.9%y/y in Nov, up from 0.6%y/y in Oct, at a high since 2011. Loans to households rose 1.4%y/y in Nov, up from 1.2%%y/y in Oct, at a high since 2011.

UK

Car regos +8.4%y/y in Dec, average over three months 3.7%y/y, average over six months 5.4%y/y, trend growth in a gradual decline.

Halifax house price index +9.5% 3mth/yoy in Dec, stronger than 9.0% expected, in a firming trend in 2015.

Mortgage approvals 70.4K, above 69.8K expected, up from 69.9K in Oct; firming trend during 2015.

PMI Services 55.5 in Dec, a bit below 55.6 expected in Nov, down from 55.9 in Nov; up from a low in Sep of 53.3, at a low six month moving average (55.4) since May-2013.

PMI Construction 57.8 in Dec, above 56.0 in Nov, up from 55.3 in Nov. Three month average at 57.3, stable around this level over 2015.

PMI manufacturing 51.9 in Dec, below 52.8 expected, down from 52.5 in Nov, revised down from 52.7. Reversing a spike to a high for the year in Oct of 55.5, reverting to levels prevailing from Apr to Sep, around the lows since early-2013.

BRC Shop Price Index -2.0%y/y in Dec, up a bit from -2.1%y/y in Nov. Non-food -3.0%y/y, up a bit from -3.3%y/y in Nov; both around lows in the series back to 2007.

Canada

Trade balance $C-2.0bn in Nov, a narrower deficit that -2.6bn expected, narrower than -2.5bn in Oct, revised narrower than -2.8bn. Exports rose 0.4%m/m, auto exports rose 5.9%, metals exports rose 20.4%m/m, and forestry rose 5.5% m/m. Energy exports fell 6.6%m/m, down 40.4%y/y. The non-energy exports helped improve the deficit, but the average year-to-Nov (-2.1bn) is the widest on record since 1997.

PMI manufacturing 47.5 in Dec, down from 48.6 in Nov. A low in data back to 2013.

Canadian Federation of Independent Business (CFIB) Business survey 55.7 in Dec at a low since Apr-2009.

China

Caixin PMI services 50.2 in Dec, down from 51.2 in Nov. At the lowest three month average since Feb-2014. Throws doubt on the service sector holding up overall demand growth as heavy industry declines.

Government PMI non-manufacturing rose to 54.4 in Dec, up from 53.6 in Nov; rising for a second month, at a high since June-2014. Noticeably stronger read that the Caixin services measure.

Caixin PMI manufacturing 48.2 in Dec, weaker than 48.9 expected, down from 48.6 in Nov. firmer that lows in Sep of 47.2, but at a new low six month average of 47.9.

Government PMI manufacturing 49.7 in Dec, a bit lower than 49.8 expected, a bit firmer than 49.6 in Nov; three month average 49.7,steady at the low since 2009.

Westpac Consumer confidence index at 113.7 in Dec, relatively stable around this level since mid-2014, around the lows in the series last seen in 2011.

Hong Kong: retail sales fell 6.0%y/y by volume in Nov, weaker than -2.9% expected; declining trend since May; around lows since July-2014. Mainland visitor arrivals fell 15.5%y/y in Nov, total visitors down 10.4%y/y. visitor numbers falling since around Q1-2015, around low growth since 2009.

India:

PMI services 53.6 in Dec, up from 50.1 in Nov, a high since Fed-2015.

PMI manufacturing 49.1 in Dec, down from 50.3 in Nov, a low since Aug-2013

Industrial output from eight infrastructure industries -1.3y/y in Nov, a low in records back to 2005; three month average +1.7%y/y

Philippines:

CPI core measure rose 2.1%y/y in Dec, above 1.9% expected, up from 1.8%y/y in Nov, up from a low of 1.4%y/y in Sep.

Korea:

Current Account surplus $9.4bn in Nov, remaining in a rising trend over the last five years since 2011.

PMI manufacturing 50.7 in Dec, up from 49.1 in Nov; rising trend since June, at a high since Feb.

Exports -13.8%y/y in Dec, below -11.7% expected, lowest six month average since 2009. Imports down 19.2%y/y in Dec, lower than -18.0%y/y expected.

Taiwan:

CPI +0.14%y/y in Dec, weaker than +0.45% expected, down from 0.53%y/y in Nov

PMI manufacturing 51.7 in Dec, up from 49.5 in Nov, rising since a low of 46.1 in August.

Malaysia:

Exports rose 6.3%y/y in Dec, weaker than +12.0%y/y, down from +16.7%y/y in Oct.

PMI Manufacturing 48.0 in Dec, up from 47.0 in Nov; stable since around June.

Thailand:

Consumer confidence rose to 76.1 in Dec from 74.6 in Nov; rising for a third month.

CPI core 0.7%y/y in Dec, lower than 0.8% expected, down from 0.9% in Nov.

Indonesia:

Consumer confidence rose to 107.5 in Dec from 103.7, recovering from around the lows since 2010.

CPI core 4.0%y/y in Dec, lower that 4.2% expected, down from 4.8% in Nov; at a low since Dec-2014.

PMI manufacturing 47.8 in Dec, up from 46.9 in Nov, stable since around June.

Singapore:

Car license auction prices falling to around the lows since 2011.

Nikkei PMI whole economy 52.1 in Dec, around the high since Feb-2015.

Singapore Institute PMI manufacturing 49.5 in Dec, firming from 49.2 in Nov. Electronics PMI 48.9 in Dec, dipping from 49.0 in Nov

GDP rose 2.0%y/y in Q4, above 1.2% expected, up from 1.8%y/y in Q3, revised up down from 1.9%.

This week and next

USA

- 8 Jan – Non-farm payrolls, unemployment rate

- 8 Jan – Consumer credit

- 11 Jan – Labor Market Conditions index

- 12 Jan – JOLTS Job openings

- 13 Jan – Beige Book

- 15 Jan – Retail sales, PPI, IP/CU, UoM consumer sentiment

Australia

- 8 Jan – PMI Construction, Retail Sales

- 11 Jan – Job Ads

- 13 Jan – Job Vacancies

- 14 Jan – Employment/ unemployment

- 15 Jan – Housing finance

New Zealand

- 11 Jan – Building permits

- 11 Jan – REINZ house sales

- 14 Jan – Retail sales card spending

- 20 Jan – CPI

Eurozone

- 12 Jan – IP

- 14 Jan – ECB account of the monetary policy meeting

- 15 Jan – new car regos, Trade balance

Germany

- 8 Jan – IP, trade balance/CA

UK

- 8 Jan – trade balanced

- 11 Jan – BRC retail sales monitor

- 12 Jan – IP, NIESR GDP estimate

- 15 Jan – construction output

Canada

- 8 Jan – Building permits

- 8 Jan – employment/unemployment

- 11 Jan – Housing starts, BOC business and bank survey

- 12 Jan – Finance Minister Morneau speech, “Growing our Economy to Strengthen the Middle Class

- 13 Jan – House prices

- 14 Jan – New Home sales

- 15 Jan – Existing Home sales

- 20 Jan – BoC rate decision

- 22 Jan – CPI

Japan

- 8 Jan – Labor cash earnings

- 12 Jan – Current account, bank lending, Ecowatchers survey

- 14 Jan – Machine orders

China

- 10 Jan – CPI

- 10-15 Jan – Aggregate social financing

- 13 Jan – Trade balance

- 18 Jan – Property prices

- 19 Jan – IP, Retail sales, Fixed asset inv., GDP Q4.