Short-term USD up-cycle clashes with approaching long-term down-cycle

The FX market is likely to keep swinging from short-term cyclical strength in the USD to a desire to look over the cycle to building longer-term weakness in the USD. For the most part, this year has been characterised by short-term cyclical factors boosting the USD. But in the last two weeks, the market is again trying to see the US economy peaking and re-engaging in global assets. However, there are a number of risks with this strategy. The market may still be under-estimating the building inflation pressure in the USA and the peak in US rates. Pockets of emerging markets remain vulnerable to higher US rates. Italy remains a threat for the EUR. The US is moving towards more tariffs against China. We think it best to remain light on your feet.

Peering over cycle parapet, again.

Global risk factors remain elevated. These include rising US rates and pockets of stress in emerging markets, tough US trade policy towards China with a further expansion of tariffs still planned, and Italian government debt spreads are elevated.

However, riskier asset markets have recovered significantly in the last two weeks in most parts of the world from lows triggered by the collapse in Turkish assets in mid-August.

USD rates have been rising again recently, but it appears that the market is trying to look beyond the peak in US rates again and seeing reasons to expand its portfolio beyond the USD and US assets.

The USD has fallen significantly against many major and emerging currencies in the last two weeks. However, some of the weaker EM currencies remains depressed. New lows have been reached by the ARS and BRL, gains in the MXN have stalled, despite the US-Mexico trade agreement announced on Monday. The RUB, INR, IDR and MYR also remain near remain near recent lows.

Longer term cycle peak

We have sympathies with the view that the USD may be approaching a medium-term peak in the next year or two. We note a Bloomberg news report on Deutchebank FX strategists (Ruskin and Saravelos) calling for deep falls in the USD in 2019 and 2020 to EUR 1.30 and 1.40, and JPY 108 and 100. Bloomberg quoted the duo calling for “a big USD cycle inflection point” in H1-2019 as the US rate cycle matures, the EUR rate hiking cycle begins and China growth recovers.

And they note that the fiscal induced above-trend growth will dissipate by 2020 when the USA fiscal accounts will be “in their most precarious state” since WWII. They write that “This is the worst of all worlds for the USD – a sharp reversal towards easing rates, occurring as the larger external deficit poses a more evident funding problem.”

Such long-range forecasts are subject to extreme uncertainty. We are not prepared to make a call when the USD will reach a medium-term peak. The US economic recovery is not showing any real signs of stalling. But we agree that risks are building for the USD. Once the market appears to see the US rate cycle at its peak, it may indeed turn its attention to the wide US twin deficits, a lack of any plan to rein in a growing fiscal deficit, and the prospect of a deeply partisan Congress that may prove far less capable of dealing with the challenges of an economic downturn.

The battle of the cycles

It does appear that at various times over the last two years that the market has tried to look over the edge of the US rate cycle, resulting in periods of USD weakness. The USD peaked at the end of 2016. The USD has also been weaker at times because investors were seeing more synchronised global growth encouraging investment in emerging markets and Europe even as US rates were still rising.

However, for the most part, this year, the USD has strengthened as rising US rates have contributed to more volatile global asset markets. Higher USD borrowing costs have triggered financial market upheaval in several emerging markets with weak fiscal and or current account balances, reliance on USD debt finance, and troubled political environments. Chinese economic growth has cooled as its efforts to control shadow-bank finance and excesses in corporate debt have caused some financial stress.

US trade policy and increasing use of sanctions against Iran, Russia and Turkey have further undermined global growth confidence, while the US economy has powered up on massive fiscal stimulus via tax cuts and higher government spending. Global growth synchronisation that was apparent through last year has reverted, at least partially, to clear US growth leadership.

Too early get behind a weaker USD view

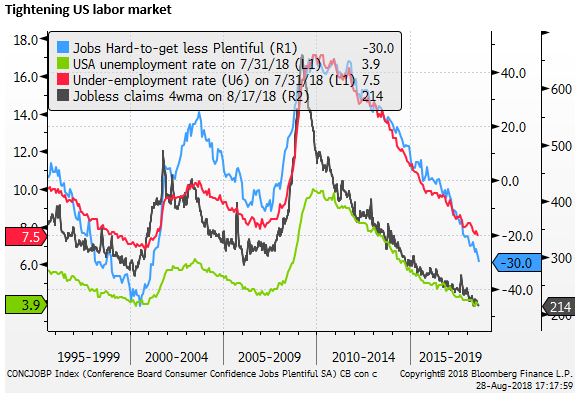

At this stage, it is hard to get behind a weaker USD view when US economic growth indicators remain buoyant, and the Fed is set to continue on a steady rate tightening path. Data this week includes a rise in consumer confidence to a new high. The survey showed further evidence of tightening in an already tight labor market with a fall to new lows in the balance between the jobs-hard-to-get index and jobs-plentiful index since 2001.

Manufacturing surveys have been mixed in August, but several showed further or ongoing strength, and there is little reason to expect much decline in the already elevated ISM or strong labor market reports next week. Durable goods for core capital goods rose more than expected on Friday last week.

The personal income and spending data are expected to show further solid gains for July, reported on Thursday. And the Fed’s most-watched inflation indicator, core PCE deflator, is expected to tick up to meet the Fed’s inflation target of 2.0%.

US yield curve reveals long-term market doubts

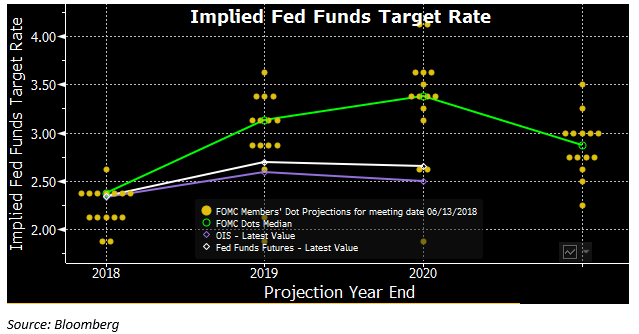

Nevertheless, the shape of the US yield curve does reveal underlying market doubts that the fiscal driven expansion will permanently lift potential growth. Perhaps perversely the US yield curve also does not see a significant uplift in US inflation (it should be one or the other). Long-term yields remain subdued below the current GDP growth rate, and even short-term rates are predicting little more than three further hikes this cycle and rates peaking in 2019, still below the recent pace of economic growth around 3%.

These doubts, essentially a stilted expected rise in either short-term, and perhaps more significantly, low longer-term yields, resulting in a relatively flat yield curve, are helping to prevent a clear acceleration in the USD strength that peaked so far in 2016.

Inflation threatens to catch the market off-guard

A conundrum in the marketplace is that the US labor market now appears tight. The Japanese labor market is perhaps even more critically tight, and labour markets in Canada, The Eurozone and the UK are also quite tight. However, wage growth, while picking up, has not done so convincingly.

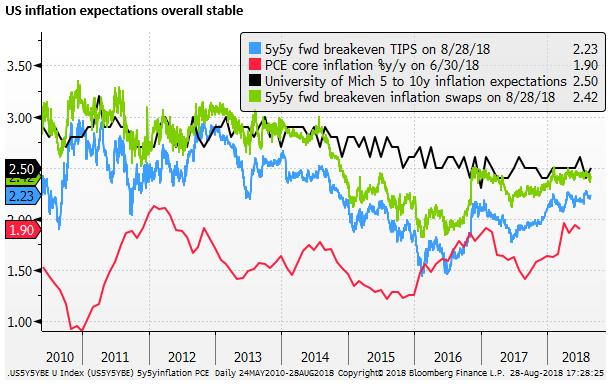

USA business surveys, the Fed Beige book and reports from the Fed minutes suggest that regional liaison is showing cost pressures and tight labor markets, and building evidence that companies are finding it easier to pass on higher prices. Inflation has picked up in the USA and is now running near the Fed’s 2% target. However, there appears little fear of an inflation breakout.

One might conclude that inflation risks are rising, especially with the recent tariff increases and threats of expanding these to $200bn of Chinese imports. However, inflation and wage expectations remain contained. Market-based measures of long-term inflation expectation have eased recently, and surveys have been stable.

Fed’s Powell glib inflation remarks

Fed’s Powell glibly repeated a message he has delivered several times this year in his Jackson Hole Speech that, “While inflation has recently moved up near 2 percent, we have seen no clear sign of an acceleration above 2 percent, and there does not seem to be an elevated risk of overheating.” This was interpreted as dovish and appeared to help propel some further retreat in the USD on Friday.

While we have some sympathies with Powell’s apparent lack of confidence in medium-term forecasts for potential growth, NAIRU and neutral rates, and can understand his ‘suck it and see’ approach to policy, we think it a bit disingenuous to say he sees no clear sign of inflation.

It is already evident that inflation has been slower to accelerate this cycle, but the anecdotal evidence from the Fed’s own liaison, business surveys, and any sensible assessment of tariffs suggests inflation will accelerate. It appears that Powell is not prepared to accept any evidence other than higher actual inflation which is hardly pre-emptive.

We might conclude that the Fed will not be rushing to accelerate rate hikes if inflation rises above its target. The target is symmetrical, and inflation has spent a lot of time below target, so a bit of time above the target might even be helpful in anchoring medium-term inflation expectations at the target. Such considerations might encourage a stronger US stock market and be applauded by President Trump.

However, current US rates market pricing might be too low if inflation does start to move above target. Consequently, we see upside risk for the USD on what is an increasing risk of accelerating US inflation.

Reverting back to stronger global confidence

However, while we await a possible uplift in US inflation or other factors that may lift the USD, e.g. pressures on emerging markets, US tariffs on China, or Italian budget blues, the market appears to be reverting back to seeking growth in markets and currencies outside the USA.

This may reflect an over-sold condition in emerging markets, driven to a nadir two weeks ago by the blow-up in Turkish assets. Since then the market appears to have revised down its fear that problems in Turkey could be a big drag on the Eurozone.

China reintroduced its counter-cyclical factor into its daily currency fix, interpreted by the market as a sign that it will prevent a further significant decline in the CNY. While trade tensions appear to have limited the rebound in Asian markets, they have recovered as the CNY has stabilised. The market may also be presuming that China will enhance efforts to underpin its domestic economic growth to compensate for the risks to its exports to the USA.

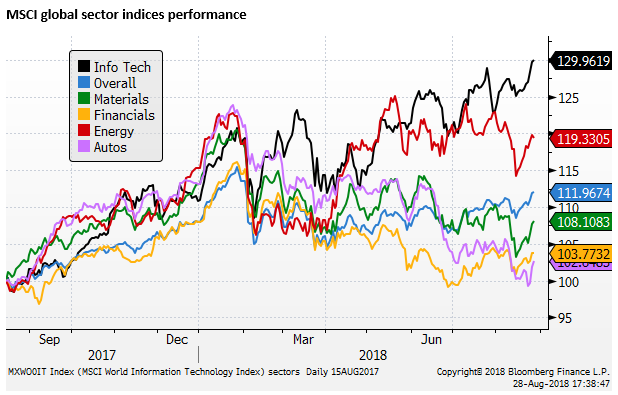

The US-Mexico trade deal has triggered a significant rebound in global auto shares. Notwithstanding Trump’s threatening comments towards Canada and China, the market sees the Mexico trade deal as a sign that the US may not move forward with broad tariffs in the auto sector that might hurt Europe and Canada.

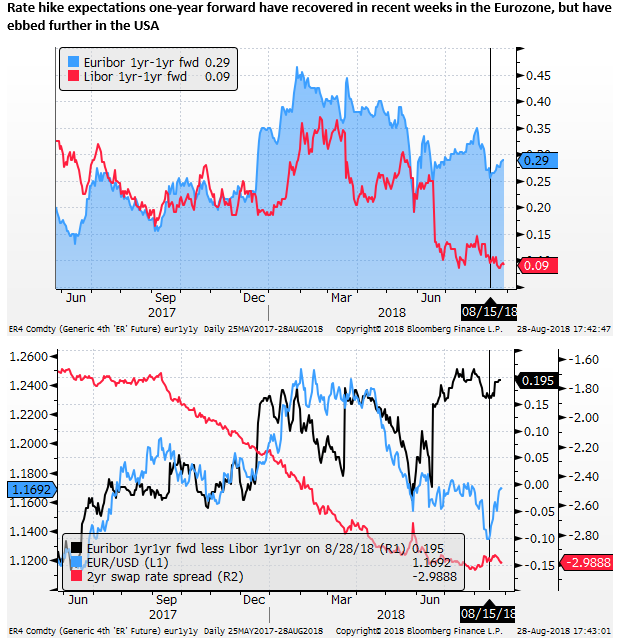

Recent Eurozone economic data suggests that the region has also regained its feet after a stumble early in the year. Forward rate hike expectations in the Eurozone (one-year-forward from one-year-forward) have recovered somewhat in the last week, whereas US forward rate expectation on the same basis have flattened.

Eurozone inflation and unemployment data later this week, starting with German and Spanish CPI data on Thursday and Eurozone data on Friday, may set the course for the EUR.

An unhinged President

One wonders if the USD may also be undermined by an increasingly erratic President and the approaching mid-term elections. The President has twice in recent months openly criticized the Fed, lamenting rate hikes, and called China and the Eurozone currency manipulators.

Trump and the right-winged media have stepped up claims of an FBI/Justice Department conspiracy. And today Trump is propelling conspiracy theories that big internet search engines are biased against him and other conservatives.

Trump is battling against a Mueller investigation that appears to be closing in, and threatening again to fire his Attorney General Sessions. The Trump circus is in full swing, and the market may be wondering how this affects the mid-term elections. A strong showing by Democrats might seem to unhinge the President.

In broad strokes, Trump appears adept at, even revels in, the chaos and media circus around him. And we doubt that Democrats will successfully move an impeachment of Trump forward to a conviction in the Senate, even if it is revealed, as we suspect it will, that Trump’s campaign knew Russians had hacked the Clinton Campaign and DNC before it was WikiLeaked. Being informed about it is still not clearly collusion.

As such, we see the political turmoil as more noise than signal for the USD. In a long-term sense, the Trump legacy may be weaker international relations, heightened partisanship and a distracting internal culture war that will make it more difficult for US policymakers to dig itself out of a fiscal hole. This could over the longer term weaken the USD.