Spreads, Basis, and the USD and AUD

What does the widening in USD and AUD LIBOR/OIS spreads and higher cross-currency swap basis mean for their exchange rates? Some have argued that the implied tightening in financial conditions in their home countries may delay central bank rate hikes and undermine their exchange rates. But this seems to ignore the fact that the spread widening has placed direct upward pressure on the effective carry from holding long positions in the USD and the AUD against other currencies. We look specifically at the carry for 3mth and 2yr terms for the EUR/USD and AUD/USD. Overall, FX markets remain difficult to call, and patience is required as the market grapples with tariffs, political uncertainty, and volatile equity markets.

Spreads, basis and the USD

The wider LIBOR/OIS spread means that some of the Fed’s tightening has been done for it, and it may deliver fewer hikes than otherwise. However, the wider LIBOR/OIS spread has been reflected already in the effective carry in the FX forward market, and thus might be considered to be a factor that should already be supporting the USD more than otherwise.

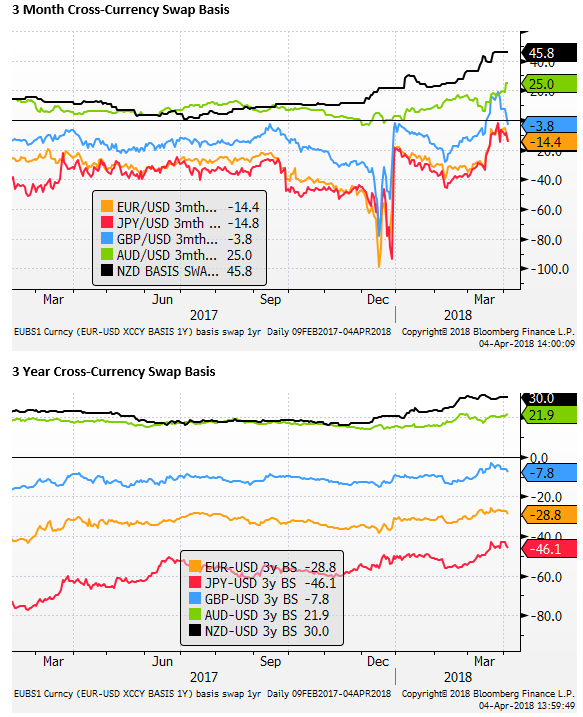

Working somewhat the other way is the narrowing (increasing) foreign currency to US dollar cross-currency swap basis. This is tending to lower the carry for being positioned long USD and short foreign currencies.

The charts below illustrate the changes in the carry for the EUR/USD exchange rate.

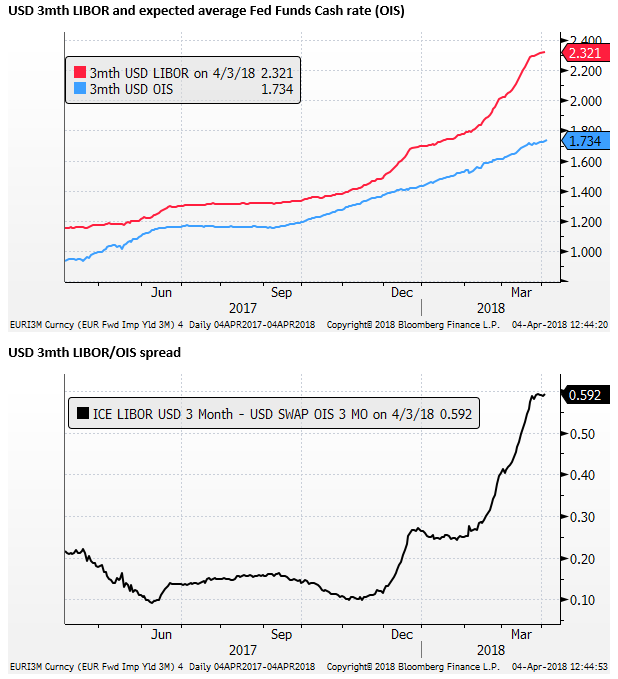

The first chart shows how USD LIBOR has increased as a result of both a higher expected Fed funds cash rate (OIS) and a wider spread between LIBOR and OIS. Since the end of last year, OIS is 20bp higher, reflecting a higher expected Fed funds rate over the coming three months, and the spread between LIBOR and OIS is 32bp wider.

The second chart concentrates on the LIBOR less OIS spread. The LIBOR/OIS spread widening started early in December rising above the 10 to 15bp over recent years to 26bp by the end of last year. The spread is now 59bp, over 45bp wider than recent years. This spread widening has added to the additional carry from the USD, over and above the expected and delivered rate hikes by the Fed.

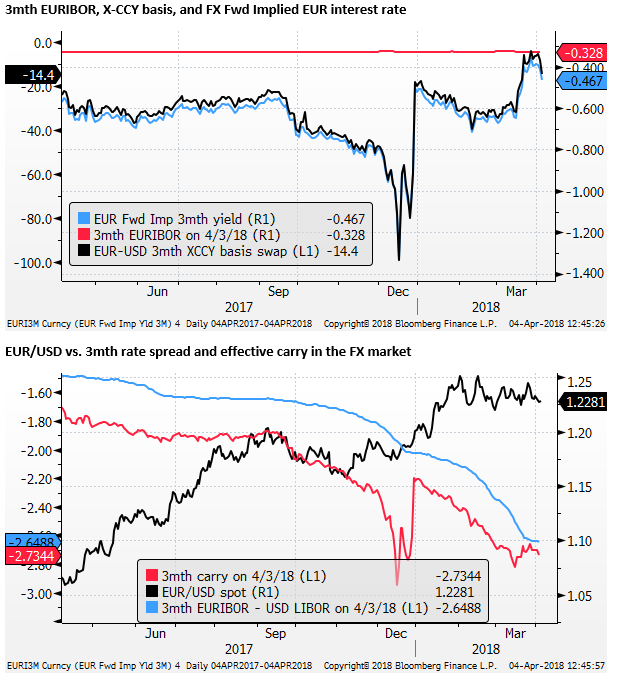

The third chart shows the effective EUR 3mth interest rate implied from the FX fwd market (-0.466%), somewhat below the EUR 3mth interbank interest rate (EURIBOR) at -0.328%. The difference is essentially the EUR/USD cross-currency swap basis shown on the left scale (-13.8bp).

Because the cross-currency swap basis has narrowed since mid-March from around -31bp to -13.8bp, the effective EUR 3mth interest rate implied by the FX forward market has increased from around -0.64% to -0.466%.

The narrower cross-currency swap basis (narrower by around 17bp in the last few weeks) has reduced the additional carry from a short EUR/USD position. But the USD LIBOR/OIS spread widening by 45bp over the last four months has increased the carry, over and above the Fed Funds rate that has also increased in recent months further boosting the USD carry.

The final 4th chart below shows the overall carry (negative for a long EUR/USD position) compared to the EUR/USD exchange rate. It shows that holding a short EUR/USD position over three months will return a sizeable 2.73% annualised in carry. As such, the EUR/USD exchange rate would need to appreciate by around 87 FX points (for example by 0.0087 from 1.2300 to 1.2387) over three months to wash out the carry from a short EUR/USD position.

This is certainly not out of the question, but it still presents a good reason for investors to hedge EUR investments back to USD (sell EUR/USD forward), if they have little reason to expect appreciation in the EUR. As such, you might expect this widening in the USD carry to help boost the USD and push down the EUR/USD exchange rate (to the point where the market does expect further appreciation of the EUR).

This is exchange rate analysis 101, explaining why exchange rates tend to follow interest rate spreads. It also illustrates how the cross-currency swap basis and LIBOR/OIS spreads may influence the cost of carry in FX markets.

However, as chart 4 below shows, in fact, the EUR/USD exchange rate has paid little attention to the rising effective carry in favour of the USD over the EUR. Nevertheless, the sharp improvement in the USD carry in recent months does suggest it will be harder for EUR/USD to appreciate further.

Two Year EUR/USD carry

When we evaluate the impact of interest rates on exchange rates we often focus on 2-year swap rate spreads to give a somewhat longer perspective on expected changes in central bank cash rate policy. The current and expected LIBOR/OIS spreads both for the USD and foreign currencies are already embedded in these swap rates.

We often ignore the cross-currency swap basis in our charts comparing interest rate and yield spreads to exchange rates, since the cross-currency basis tends to be stable or at least mean-reverting.

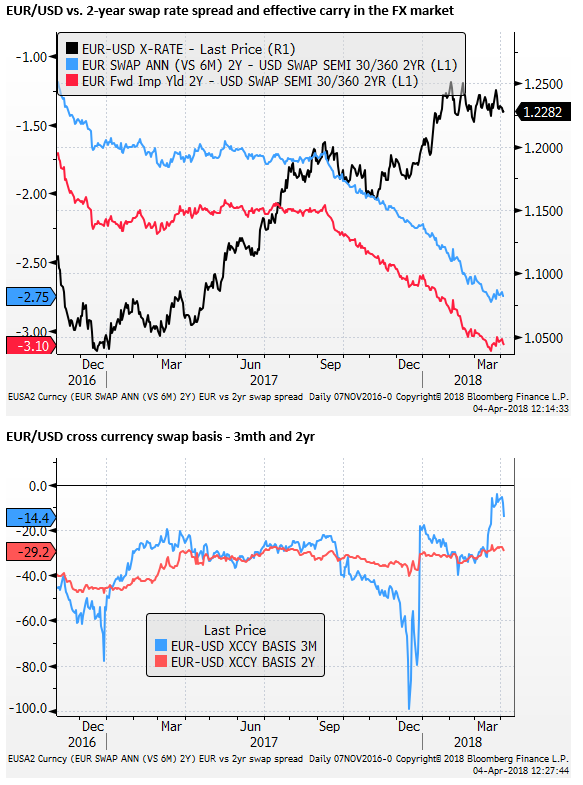

However, to give a perspective on the impact of the cross-currency swap basis over a 2yr term (analogous to the 3mth term analysis shown above) the chart below uses the Bloomberg series that directly calculates an implied foreign currency interest rate from the FX forward market.

It shows both the direct 2yr swap rate spread, and the effective 2yr carry that incorporates the 2yr cross currency swap basis. The effective 2yr carry of 3.10% in favour of short EUR/USD position is greater than the direct 2yr swap rate spread of 2.75%.

The second chart below shows the cross-currency swap basis for 3mth (used earlier) and the 2yr term that accounts for the spread between direct 2yr swap spread and the effective 2yr carry. The 3mth cross currency basis is much more volatile. For instance, it widened sharply in December reflecting excess USD term funding pressure that often occurs over the turn in the calendar year.

The main point is that no matter what term you are looking at, there is a formidable positive carry from short EUR/USD positions. This carry has been enhanced significantly by the widening LIBOR/OIS spread. While the cross currency basis swap has narrowed somewhat recently, more so for shorter maturities, it has not changed the picture much.

Tighter monetary conditions

The wider LIBOR/OIS spread has effectively tightened monetary conditions in the USA. To the extent that most short-term costs of funds for business are benchmarked to or correlated with LIBOR, this effective additional tightening (over and above the actual Fed fund rate hikes) is equal to as much as 45bp.

It is probably not quite this much in effect, since forward markets (FRA/OIS spreads) predict that the LIBOR/OIS spread will ease back from 58bp to around 37bp by Q3, still above its levels of a year ago between 10 to 15bp. As such, we might surmise that spread-widening in the US interbank market has done the work of around one Fed Funds rate hike. In which case, if the Fed were inclined to hike four times in total this year, they may step that back to three.

If it was the actual number of Fed Fund hikes that influence the USD exchange rate, fewer hikes might weaken the USD. However, what should really matter is the effective carry in the FX market. Spread widening in the USD funding market has increased that carry, and effectively delivered at least one additional hike already.

Rising Australian bank funding costs

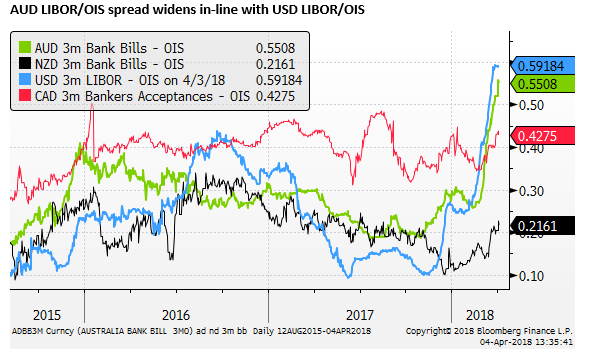

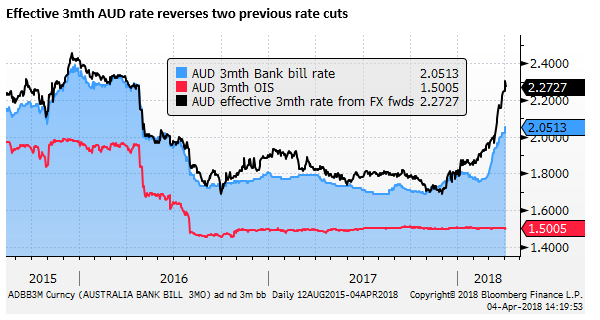

One of the few other currencies to experience the same widening in LIBOR/OIS as experienced in the USA (for the USD) is in Australia (for the AUD). The spread between AUD 3mth bank bills and the expected RBA cash rate (AUD 3m OIS) has widened more or less in line with the 3mth USD LIBOR/OIS spread.

What’s more, the AUD-USD cross-currency swap basis has also widened similar to that seen in EUR-USD cross-currency swap basis.

Australian Banks rely on International Capital Markets

Both AUD/USD and NZD/USD have a positive cross currency swap basis, as opposed to a negative basis for EUR/USD and JPY/USD. This is indicative of the nature of Australian and New Zealand banks. They have a large amount of domestic mortgage loan assets, more than can be funded by domestic deposits. And they need to issue/borrow in international money and bond markets to fill the funding gap.

For Australian banks, they need to raise around 40% of their balance sheet from domestic and international money and bond markets. As such, they have a significant net demand for swapping foreign currency funding back into AUD term funding, and are the dominant payers in the AUD-USD cross-currency swap market, tending to push-up the swap basis.

The rise in the AUD/USD cross-currency basis may itself be partly responsible for the rise in the AUD bank bill/OIS spread. Since the higher cost of swapping foreign funds into AUD term funds has encouraged banks to issue more bank bills, placing upward pressure on their yield.

Higher carry from long AUD positions

Are the implications positive or negative for the AUD? There has been commentary from the street suggesting that this is negative since it is making banks less profitable, squeezing their net interest margins and it may further delay an RBA cash rate hike.

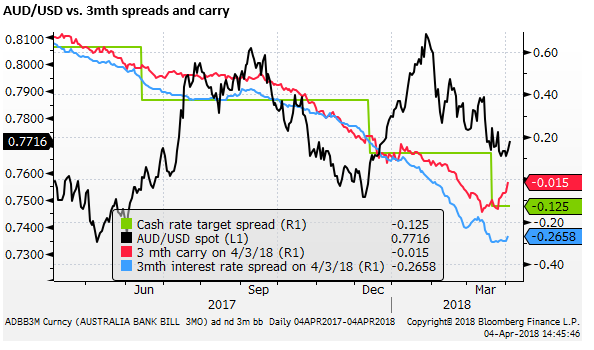

However, the rise in Australian bank bill rates over OIS and the rise in AUD/USD cross-currency basis are both directly increasing the carry for AUD in the foreign exchange market.

The RBA may be less inclined to hike, but only because there has been an effective hike in money markets and this should already be supporting the AUD exchange rate.

The chart below shows that the effective 3mth AUD rate in the FX forward market has risen significantly this year, reflecting a combination of a wider AUD BB/OIS spread and higher AUD/USD cross currency swap basis. The combination has contributed to a reversal of the two rate cuts in 2016; at least in terms of its effect on 3mth AUD carry in the FX market. Presumably, this should help support the AUD/USD exchange rate.

The AUD/USD, like many currencies, has not reacted much to a narrowing yield advantage over the last year or so. As such, we should not necessarily expect the recent improvement in its carry to boost the AUD, but the spread developments in money markets are not particularly good reasons for the AUD/USD to fall.

The chart below compares the AUD/USD to the 3mth direct LIBOR rate spread and the effective 3mth carry.

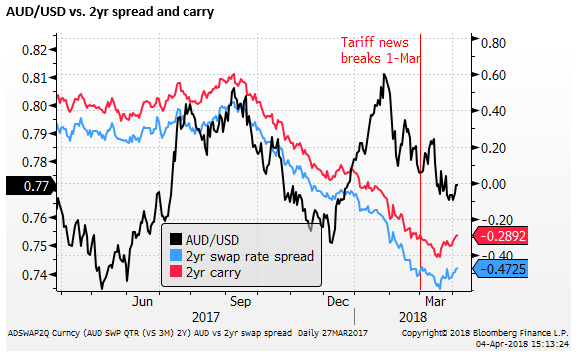

The chart below shows the 2yr swap rate spread and the effective carry (including the cross-currency basis swap). The carry has improved from the recent low since 2000, due mainly to relative improvement in the 2yr swap rate spread.

Is spread widening symptomatic of global stress?

Arguments that the spread widening in Australia should be negative for the AUD seems to ignore the fact that it is already pushing up the AUD carry, the same way that an RBA rate hike would.

To make this argument, you need to see the spread widening as symptomatic of other fundamental developments that might undermine the AUD.

If it represents a significant weakening in global risk appetite, tightening credit conditions globally, then there might be reason to be negative for the AUD. Given that it appears to be driven by USD money market spread widening it does suggest that there is tightening in global credit conditions that are likely to filter more broadly through credit spreads and potentially to weaker equity markets. This could be seen as a negative risk for currencies like the AUD that depend more than others on access to global capital markets and commodity prices.

In this event, if it were severe enough, the RBA might actually cut cash rates to help bring down overall effective bank funding costs, and the effective carry for the AUD. But the fact is that the tightening in global capital markets is not seen as severe enough, to date, to have a meaningful impact on RBA cash rate expectations. The market response suggests that the outlook for the Australian economy is robust enough to suggest that it can cope with higher effective rates.

There are reasons to see downside risks for the AUD. These include: The developing trade war between the USA and Australia’s largest export destination- China; Increasing focus in China on addressing excesses in its credit markets; The Australian Royal Commission into misconduct in the banking and financial service sector that is expected to place pressure on the industry to tightening mortgage lending conditions; The recent slowing in the housing market; Risks of a change of government early next year that may accelerate pressures on the housing market and generate broader uncertainty.

However, at this stage, there is little evidence that the rise in bank funding costs is having any direct impact on key mortgage lending rates in Australia or relates to China, the housing market, or any other risks.

It might, to some extent, be drawing more attention to risks in the banking sector related to its heavy exposure to the housing market and highly indebted households in Australia. But these risks are hardly new. And, presumably, if they were severe, there would be talk of RBA rate cuts developing. This is not apparent.

Furthermore, recent Australian business surveys suggest activity and confidence are well above average, and in fact have lifted to long-term highs. The strengths of these surveys make it harder to see a bigger risk premium related to housing, China, banks and politics making a decisive case one way or the other for the AUD exchange rate.