Super-Tuesday for AUD and NZD

On Tuesday, Fonterra’s GlobalDairyTrade biweekly dairy auction results are released around 14:00 to 15:00 GMT, the Q4 New Zealand labour data is due at 21:45 GMT and the RBNZ Governor discusses the economic outlook and the policy targets agreement 2:15 hours later at 00:00GMT. These events have the capacity to set the tone for the NZD and must be viewed in the context of the easing bias re-instated in the RBNZ policy statement last week. Ahead of these events, the RBA releases its latest rates decision at 03:00 GMT Tuesday morning. With a number of traders focused on the AUD/NZD, and several banks recommending trades in this cross (mostly long AUD/NZD), these events bear close attention. Dairy prices remain mired at low levels and Fonterra sees excess supply weighing on prices for some time. Low dairy prices contributed to four rate cuts last year in New Zealand and a weaker NZD in recent years. However, the New Zealand domestic economy has recovered solidly in recent months from a down-turn in the first half of 2015, this may result in a stronger than expected Q4 employment report. The RBNZ Governor ultimately may set the tone. After reinstating an easing bias last week, he will presumably sound dovish. But it remains to be seen how dovish; the market is already close to 50% priced for a rate cut in March. We see some risk that he firms up the case for acting sooner rather than later. As discussed yesterday (AmpGFX – RBA may outline a more dovish agenda; 1 Feb) the risk is that the RBA surprises with a more dovish assessment in its policy statement earlier on Tuesday. The combination of these events suggests that there is a risk of whippy trading in AUD/NZD early this week. We have squared up, and will evaluate these events for trading opportunities.

Market eyeing a rate cut in New Zealand, possibly in March

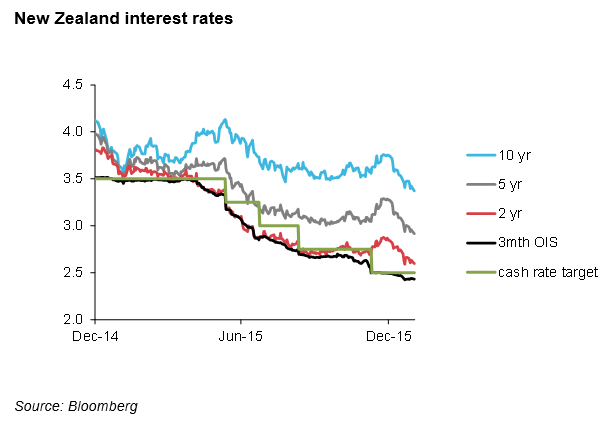

New Zealand releases its quarterly labour market report on Wednesday for Q4. This report is interesting in light of the RBNZ re-insertion of an easing bias in its policy statement last week, increasing the odds in the market that the RBNZ delivers one or more rate cuts this year. The RBNZ already cut rates four times in 2015 to 2.5%, returning rates to a record low, reversing a policy tightening in 2014.

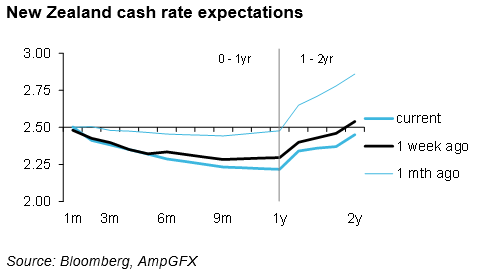

The chart below shows the expected cash rate over the next year using the overnight interest rate swap market and the bill futures market from 1 to 2 years. The market is pricing the cash rate to fall by 30bp over 12 months. It has a 46% chance that the RBNZ cuts rates by 25bp at its next meeting on 10 March. A 25bp cut is almost fully priced by the 9-June policy meeting.

However, while the RBNZ has raised the prospect of a cut to address low inflation and risk factors including a more uncertain global economy and weaker dairy price, it also managed to essentially upgrade its domestic economic outlook. (As we discussed in our report: AmpGFX – RBNZ easing bias despite improved domestic outlook; 29 Jan.)

The New Zealand Treasury also noted a pick-up in the second half of the year in their monthly economic indicators. It said, “Improved business and consumer sentiment, reduced drought risk, and ongoing increases in migration, tourism and construction activity suggest growth over 2016 may accelerate to around 2.5%, a little higher than expected in the Half Year Update.” (Monthly Economic Indicators – treasury.govt.nz)

It appears that the RBNZ has thus set policy guidance to address what it sees as the risks to this more up-beat outlook, eager to see inflation return to target relatively sooner after a long period of undershoot, and willing to see the economy grow faster above trend to achieve that end.

Governor may set the tone for March

The RBNZ agenda may become more apparent after RBNZ Governor Wheeler delivers a speech on Wednesday local time two and a quarter hours after the quarterly labour market data is released. Wheeler is slated to speak at the Canterbury Employers Chamber of Commerce. His speech is titled: “The Global Economy, New Zealand’s Economic Outlook, and the Policy Targets Agreement”.

The topic lends itself to a full discussion of what may drive the RBNZ rate decision. Balancing the inflation target against the financial stability goals will probably be addressed. He will presumably sound relatively dovish. He may argue that the macro-prudential measures are helping contain the financial stability risks arising from the housing market, and rates policy may be freer to address the persistently lower inflation outcomes over recent years.

He is likely to reiterate the key points in the policy statement released only last week; including:

“Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range.”

And, “A further depreciation in the exchange rate is appropriate given the ongoing weakness in export prices.”

He may also discuss the inflation outlook in more detail, and address the urgency and risks he is prepared to take to push inflation higher. He may give the market a clearer indication of his willingness to cut rates as soon as March.

Employment report – upside risk

Ahead of the Wheeler speech, the Q4 labour data is released.

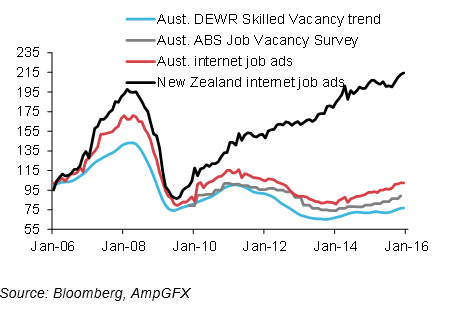

The ANZ New Zealand job ads series had declined from Jan to Aug, albeit after reaching new record highs for internet adverts, but it rebounded strongly in the last four months of last year to a new record.

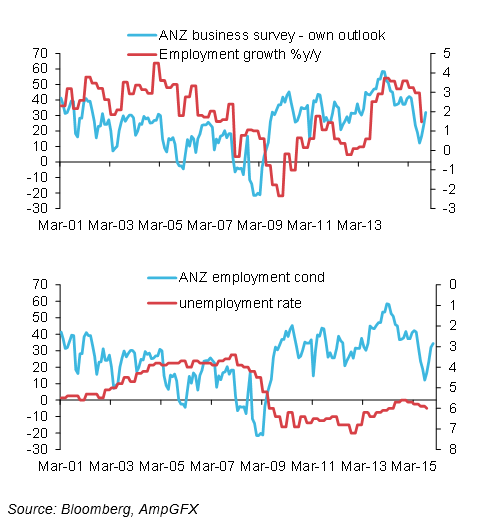

The ANZ monthly business survey has also recovered significantly in recent months. The own-activity index slipped to a low in August last year (+12.2) since 2009, supporting the case for rate cuts. However, it has rebounded relatively sharply over the last four-months to 34.4 a level consistent with a moderate to solid rate of economic growth. The employment component of the same survey recovered from a low in August of +2.8 to +20.1 in December.

While the recovery in these indices occurred through Q4, and employment conditions may have remained soft in the first part of the quarter, the rebound in job ads and business conditions suggests that the labour market may have tightened in Q4.

In contrast, the Bloomberg survey of employment data is for a continuation in the softening trend in the labour data (unemployment rate and employment growth) in place for the preceding 4-quarters. As such we see a higher risk that the data are stronger than expected.

The market median predicts that the unemployment rate will rise from 6.0% to 6.1%, and job growth will slow from 1.5%y/y in Q3 to 1.1%y/y in Q4

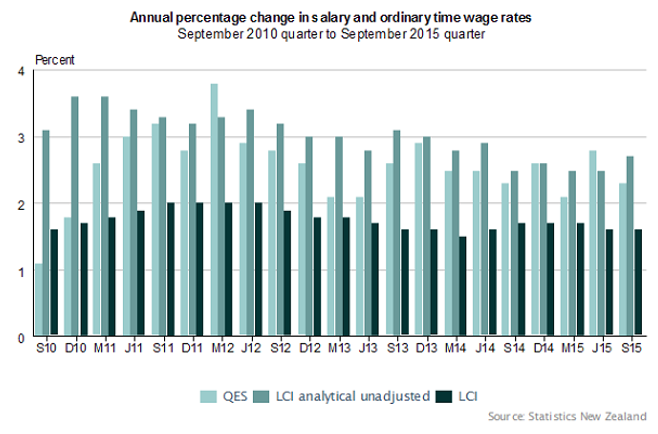

Another key part of the labour market data are the wages reports. Wages growth has remained very low in New Zealand. To the surprise of the RBNZ, wages failed to pick up much during the year up to mid-2014 as the labour market was tightening in response to the Christchurch earthquake reconstruction. However, it later concluded that the rapid immigration was helping keeping a lid on wages growth.

The most closely watched Labour Cost Index is adjusted to ignore wages increases that might arise from increased quality of employment (e.g. from promotions or a greater cohort of higher paid workers). It has trended down for the last year, after a very mild rise in 2014. It was up only 1.6%y/y in Q3. The unadjusted series is higher at 2.7%y/y and the average ordinary-time earnings series that comes from a different survey was 2.3%y/y. These latter two measures have been more volatile with little discernible trend over the last two years. Overall the picture has been of benign wage pressure and there is little reason to doubt this will change.

Dairy Auction

Another key development for the NZD may be the biweekly Fonterra Global Dairy Auction that tends to set the tone for the global dairy market. The results will be released in the offshore session ahead of the Labour data and Wheeler speech, at mid-day GMT or UTC on 2 Feb.

The GlobalDairyTrade price index fell to a record low in August last year (in data back to 2004), suggesting dairy prices were around their lows in over a decade. Clearly this was contributing to a weaker NZ economic outlook.

Prices rose quite solidly from these lows up to early-October, albeit only reaching back to around the average from Q4-14 to Q1-15. They have eased back below Q1-2015 levels again in recent months, and remain at relatively depressed levels now for over a year, ratcheting up financial pressure on the New Zealand dairy industry.

How this auction goes can influence NZD trading. Fonterra edged down its payout forecast for dairy farmers last week for the current financial year and released a number comments to suggest a supply over-hang is likely to persist for some time and depress dairy prices. Fonterra revises 2015/15 Forecast Milk Price – fonterra.com