The USA’s late-cycle fiscal adventure kicks-in

US yields are kicking to new highs as the US late-cycle fiscal adventure, and America First (tariff and sanctions) policy tighten their grip on the economy and markets. We expect this to push the USD to new highs in coming months, even if it points to longer-term risks for the US economy. US Inflation pressure is a major risk for global asset prices, and the CPI data on Thursday may set the tone for the market as it contemplates further evidence of a tightening labor market. Trade policy remains a weight on China and Asian markets. There is no new news on Nafta, but a three-way deal with Canada still seems a likely outcome, helping support the CAD. The market expects no change in the ECB policy outlook. Economic activity and inflation have been stable in recent months. However, European bank shares are significantly weaker, and Draghi is likely to display caution when facing probing questions on the multiple risks facing the region.

Late-cycle fiscal adventure

US yields are kicking to new highs as the US late-cycle fiscal adventure and America First (tariff and sanction) policy effects seep more clearly into the economy and markets. They tend to both boost growth and inflation expectations in the near term.

They may have longer-term damaging effects on the US economy that is causing some hand-wringing; evidenced by a flattening in the US yield curve. But that doesn’t appear to be troubling US consumers, businesses and predominantly bullish equity investors.

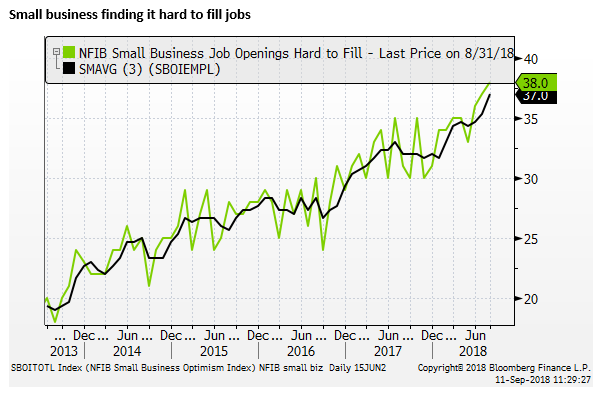

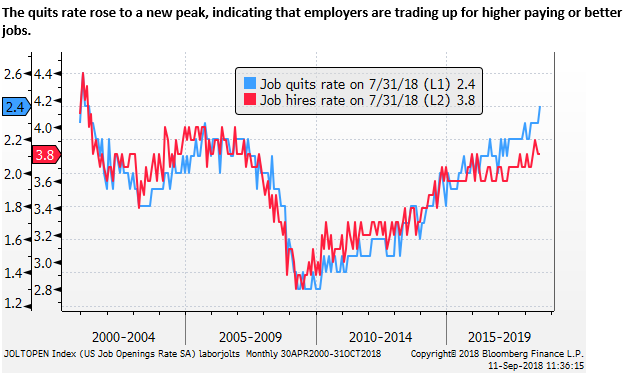

Jobs are abundant, wage pressures are emerging, and if and when tariffs are broadened on Chinese goods, they will add to already increasing inflation pressure.

The Rise in US rates and yields is generally increasing the USD yield advantage and supporting the USD. The USD has not exactly been closely correlated with its rising yield advantage over recent years. But higher US yields have contributed directly and indirectly to tighter credit conditions abroad, contributing to weaker EM currencies and some contagion to the EUR and commodity currencies.

We expect that the upward pressure on US yields will tend to support the USD, potentially driving it to new highs in coming months, notwithstanding increasing political risk in a polarised US electorate, approaching November mid-term elections and an ongoing Mueller investigation.

Inflation in focus

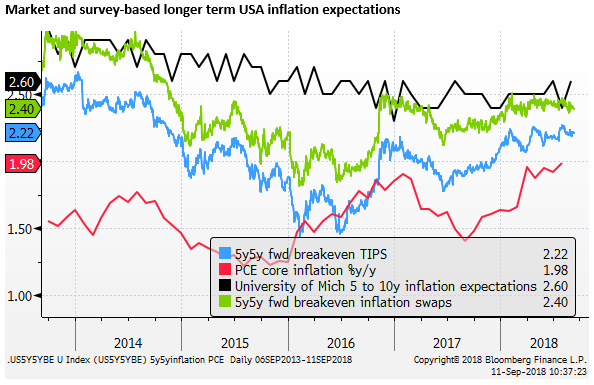

It appears that there has been little increase in long-term inflation expectations in the US. Market-based measures reached their lows in 2016, and have risen in recent years, but have been largely unchanged in 2018 to-date. The University of Michigan survey of inflation expectations has been stable in recent years around 2.5%.

Stable near historically low long-term inflation expectations allows the Fed to move gradually on rate rises, even if near-term inflation picks up.

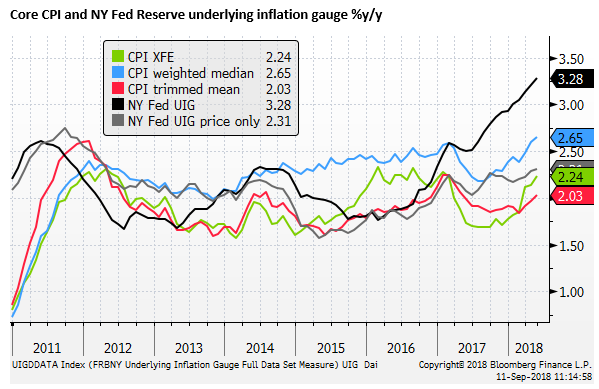

Nevertheless, core inflation has been creeping higher this year and is now around the Fed’s 2% target. If inflation continues to rise it should place upward pressure on US yields and firm up expectations that the Fed will keep raising rates even as they move close to their perception of neutral rates.

Fed Chair Powell indicated in his Jackson Hole speech that he has limited confidence in academic models of neutral rates or NAIRU (r and u-star), and the Fed will be watching closely for clues in the economic data rather being guided by the stars.

The CPI data on Thursday is an important variable for the market. Expectations are for core-CPI to remain steady at 2.4%y/y in August. Higher wage growth and tariffs may place upward pressure on inflation in the months ahead, but the starting point for inflation is already now on target, raising risks that inflation becomes more of an issue for US policymakers and global financial markets.

Higher inflation will increase expectations that the Fed will move policy into a restrictive stance in the coming year or two, increasing downside risks for global asset prices, including US equities.

According to the Federal Reserve Bank of New York underlying inflation gauge, incorporating a wide array of price, activity and financial data, inflation pressure is at a high since 2006. The prices only measure is at a high since 2012.

Confidence at new highs

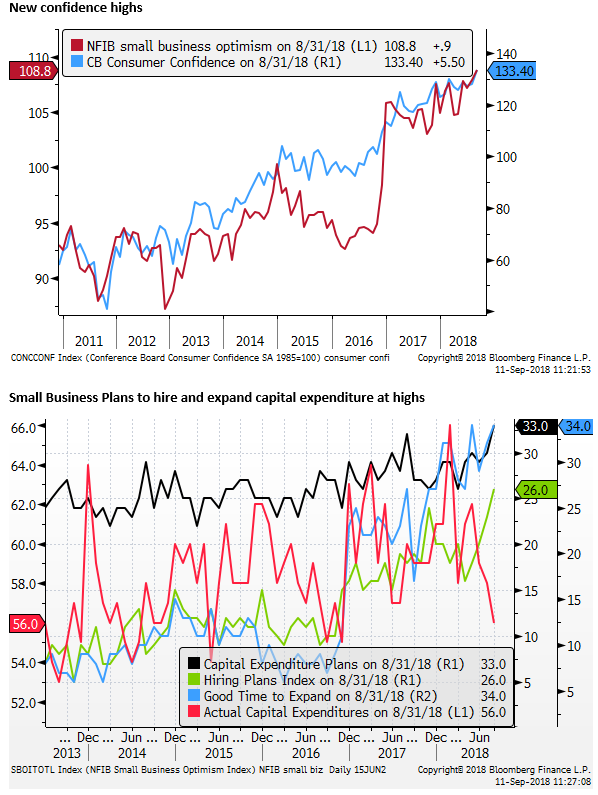

Confidence in the economy remains high with the NFIB small business survey concurring with the Conference Board consumer confidence survey, rising to new highs in August, despite the turmoil in global EM.

Eurozone struggling to recover

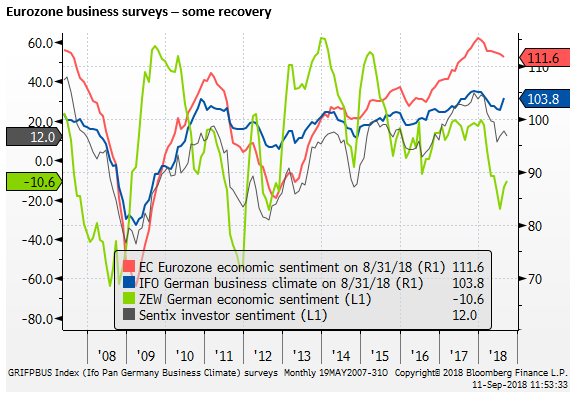

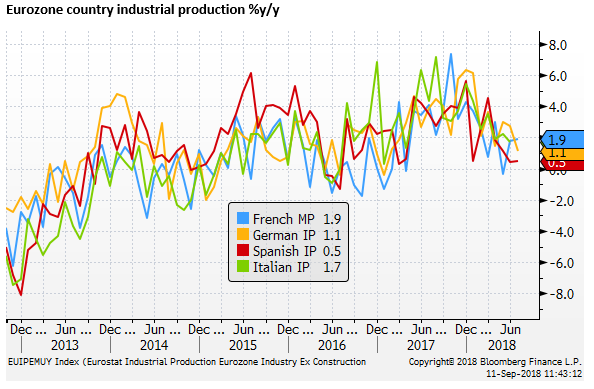

While US economic confidence and labour market indicators are hitting long-term cyclical peaks, Eurozone economic reports are struggling to recover from their fall in the first four or five months of the year.

The German IFO survey for August and ZEW survey for September show business confidence is starting to improve, but overall, surveys for the region remain well down on their peaks at the end of last year.

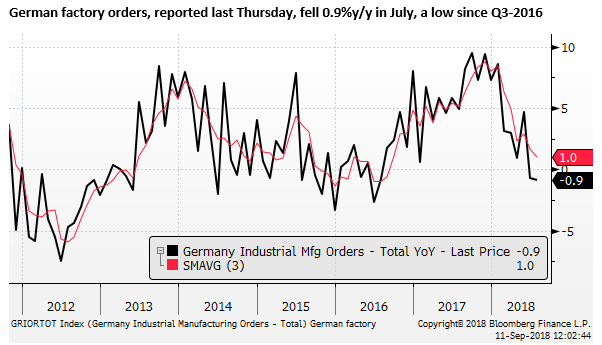

Key activity indicators for July remain soft; German industrial production was significantly weaker than expected in July, reported last Friday, up 1.1%y/y, below 2.6% expected.

German exports, reported on Friday, fell 0.9%m/m in July, weaker than +0.3% expected, slowing to 4.5%y/y, relatively flat since a peak export value at the end of last year. German imports were more encouraging suggesting demand in Germany remains robust, up 9.8%y/y. The data suggests that demand outside of Germany, in its export markets in Europe and overseas is weaker.

ECB to stay on message

The ECB monetary policy meeting and press conference on Thursday is not expected to make any changes to its policy outlook; i.e. for a further tapering of its asset purchase in October from EUR30bn to 15bn per month, and to zero in January, and no rise in its negative rates “at least through the summer of 2019.”

The economic activity and inflation data in recent months are stable overall and suggest that there will be little change in staff projections for growth and inflation.

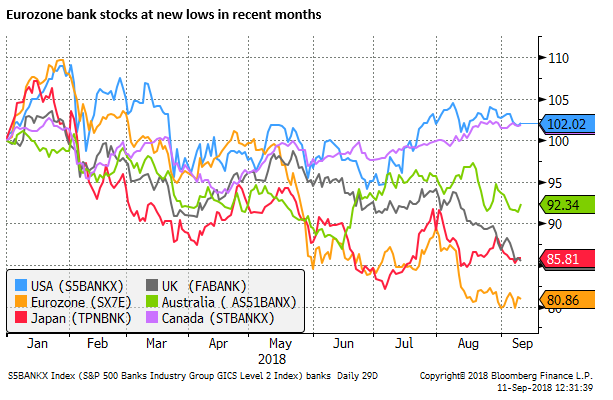

However, market indicators are weaker, including a significant further decline in European equities, particularly bank share prices, reflecting weaker EM markets and Italian bonds.

As such, we should expect ECB President Draghi to continue to sound cautious and highlight risks to the outlook, even though the text in the opening statement is likely to retain a “broadly balanced” view of risks around growth and inflation.

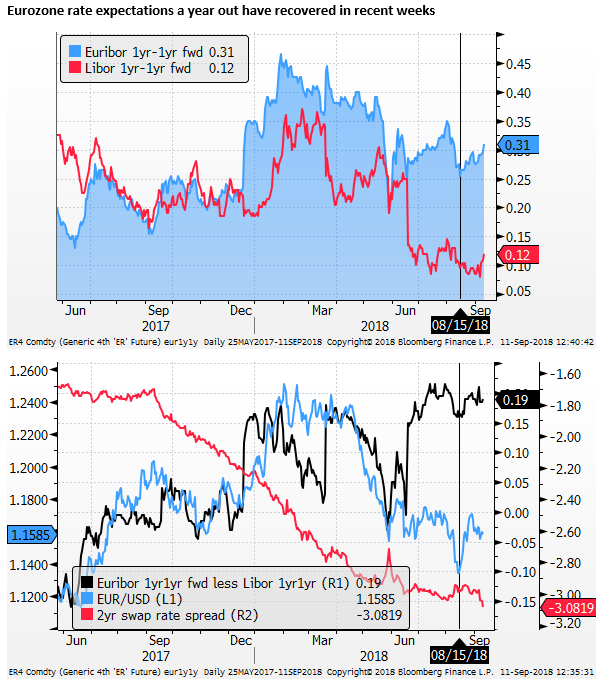

The EUR/USD 2yr swap rate spread has fallen further into negative territory, weighing on the EUR. However, since mid-August, rate hike expectations for the Eurozone one-year from now, for the next year forward, have recovered and risen more than in the US, helping support the EUR.