The USD bears the brunt of Trump’s credibility gap

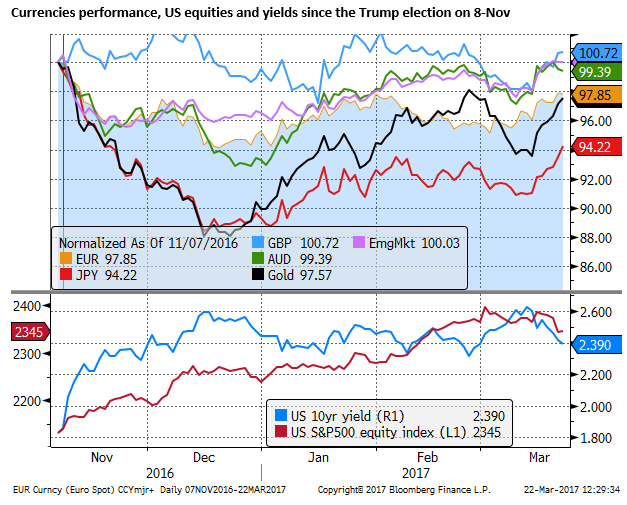

Doubts over Trump’s capacity to provide leadership for the Republican-controlled Congress have been creeping into the market fueled by lingering allegations his campaign had links to Russia and its efforts to influence the USA 2016 election, and Trump’s shrill bombastic style including wild claims of wire-taps. The Russia rumors are set to hang over Trump for the foreseeable future as the FBI confirms an investigation has months to run. Trump’s leadership faces a crucial test on Thursday – the House of Representatives vote on the healthcare bill endorsed by Trump. Passage in the House is necessary to keep the USA equity market focused on Trump’s deregulation and tax policy agenda, and bolster Trump’s reputation as a deal-maker. The bill is reported to hang in the balance; passage will see a relief rally in US equities, bond yields, and the US dollar. A vote against the bill may see a further significant fall in US equities, yields, and the US dollar. Creeping Trump doubts have had a much bigger impact on US assets and the US dollar than other markets and currencies. There has been relatively little broader contagion, with strong gains in dollar alternatives – JPY and gold, and only a mild fallout to emerging market equities and currencies. A weaker Trump presidency in many ways poses less threat to global growth and trade. The global economic recovery has established a firmer footing and policy inertia in the USA may result in a stable albeit more moderate USA growth outlook. Less Trump policy action may keep the Fed on a benign gradual policy tightening cycle, and see capital flow from expensive US equities to global asset markets.

Trump needs a House victory to hold back creeping doubts over his Presidency

There is much discussion in the market that the fall in US equities, US yields, and the US dollar relate to the vote on Thursday in Congress for the new US healthcare plan to replace Obamacare. The argument goes that if the Republicans can’t pass healthcare, they are going to struggle to pass more growth-supporting policies including tax reform. The so-called Trump rally is retracing.

There is also growing disquiet over alleged collusion between the Trump election campaign and the Russian government. And Trump’s shrill claims on various matters such as wire-tapping by Obama that either suggests he is trying to blow smoke over the Russia links or reveal an unhinged leader. Apart from an inner core of advisors, the fear may be that more conventional cabinet members and the broader Republican movement start to distance themselves from Trump. In which case, Trump may struggle to bring together Republicans in Congress to vote for his policies.

US equities, yields, and the USD lost ground early in the week as FBI Director Comey and NSA Director Rogers testified in Congress over investigations related to Russian actions to influence the US election. At the hearing, Comey confirmed for the first time that the FBI is investigating links between the Trump campaign and Russia, as part of a broader investigation into Russian attempts to influence the election outcome. It has been underway since July last year and could continue for months according to Comey. The market must ponder this issue lingering over the Trump Administration for the foreseeable future, continuing to distract and undermine Trump’s Presidency.

Trump tweeted in the hours ahead of the hearing attempting to discredit the claims and blow smoke over the issue, suggesting Democrats had links to Russia and had somehow prevented the FBI from looking into it. He has also tried to shift the controversy to how leaks about contacts with Russian officials have made it to the press (information that should be classified).

It’s not an insignificant risk that the Russia connection at some point leads to impeachment proceedings against Trump. Let’s say 5 to 10% for argument’s sake. Alternatively, it could be an issue that just never goes away and contributes to a divided Republican movement that struggles to stay focused on economic reform that the financial markets have anticipated.

The market must also wonder how Trump will handle relationships with North Korea and other geopolitical risks, and trade relations with other countries. The USD was shaky early in the week after the USA forced the G20 finance ministers to drop from its statement language that renounced trade protectionism over the weekend.

Since the weekend, other leaders including Germany’s Merkel and Japan’s Abe have reaffirmed their commitment to stronger trade relations with each other and broader support for free trade. It appears that world leaders are viewing the USA as a maverick that can no longer lead global cooperation and they will increasingly seek greater commerce and relationships that exclude the USA.

There is also the spectacle of a President that responds to setbacks by attacking the “fake” media, blames and insults those that oppose him, grabs hold of new conspiracy theories to distract attention, and resorts to election campaign-style rallies to stir up his public support. His leadership style and credibility are starting to wear thin.

World leaders may only pay lip-service to appease the Trump administration, support their existing trade relations with the USA, but do little to cooperate with the USA on its global agenda, such as paying more for USA’s NATO contribution.

The USA equity market has narrowed its focus to Trump’s business friendly deregulation and tax cut agenda. Some of this optimism is based on his business experience and reputation as a deal-maker.

The leaders of Republican Party in Congress, in particular, House Speaker Ryan, have worked hard to support the President’s key policy agenda in Congress on health reform and tax policy. They are crucial for keeping the party on a message that promotes confidence in the economy and stock market.

On Thursday, the House of Representatives vote on the Trump endorsed healthcare bill is a crucial test of the control Trump and Republican leadership have over their party. It is not the final hurdle for the bill that must also pass the Senate, but a failure in the House will be a major setback for Trump, and market confidence.

At this stage, the outcome of the vote is thought to hang in the balance. There are currently 430 members, 237 Republicans, and 193 Democrats. The Democrats will all vote against the bill, requiring at least 216 out of 237 Republican members to vote for the bill for it to pass. As such, only 21 Republican members can vote against the bill for it to pass. In recent days there have been said to be 26 members against the bill, but last minute horse-trading and adjustments are likely to be offered to get it over the line.

A vote for the bill is likely to see a relief rally in US equities, yields, and the USD. Attention will then turn to if the bill can pass the Senate, probably a week later. There are a number of Republican Senators that also say they oppose the bill. There are 100 Senators, 52 are Republicans. However, it is the demonstration factor that most matters to the market, and bringing enough Republicans together in the larger and more unwieldy House is more important. Passage of the bill in the House will be seen as pressuring the Senate to find a way to pass the bill, albeit potentially with more tweaks.

The USD bears the brunt of Trump credibility gap

The significant pullback in USA equities on Tuesday ahead of this vote did spill over to global markets and generated more generalized risk aversion with some weakness in emerging market currencies and equities.

However, it appears that emerging and other markets outside of the USA are not reacting all that much. Most of the fall has occurred more specifically in the USD, with larger gains in alternative dollar havens – JPY and Gold. Many other currencies have barely budged.

Weakening confidence in Trump’s capacity to provide strong leadership for the Republican-controlled Congress is doing more to undermine the USD than it is to undermine confidence in the global economy.

It may encourage capital to leave the US equity market to seek opportunities elsewhere rather than dampen confidence in the global economy.

US equities may already be seen as relatively expensive, economic indicators have improved in many parts of the world, and global growth may appear to depend less on the strength of the US economy than it has in the past. The US economy, in any case, has continued to grow at a stable rate for a number of years and appears on a reasonably robust footing.

Trump’s America First agenda, including anti-free trade policies, represent risks to the global economy. If doubts grow over his capacity to lead, the concern that he will achieve disruption to trade may also seem less worrisome.

If Trump struggles to implement tax reform, including a border tax, it may mean a more moderate growth path for the USA, less reason for Fed rate hikes, and less disruption to international trade and less upheaval in the US economy. It may be consistent with a more modest but also more stable outlook for the US economy. A benign outlook that sees capital move towards assets outside of the USA.