This Time Trump? – Scope for USD rebound

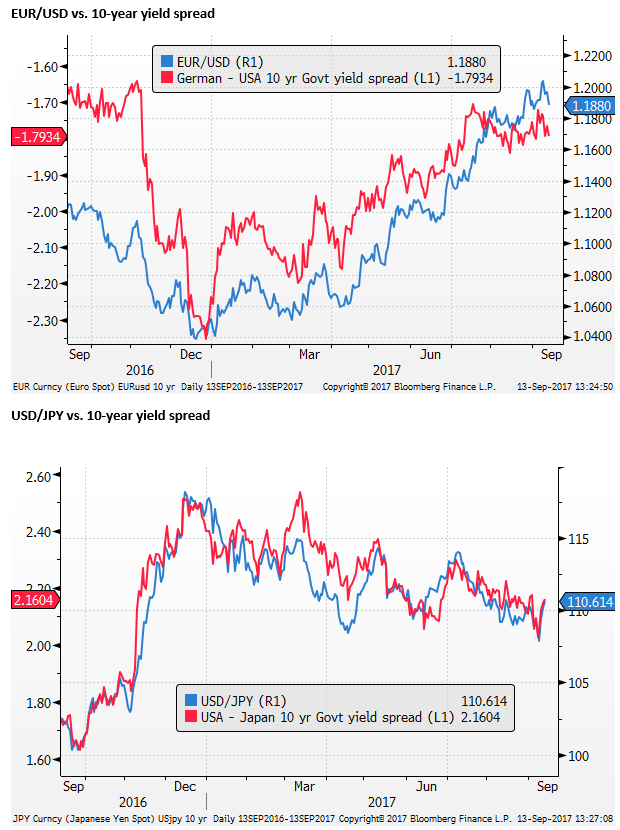

The US administration is all about tax reform, sending a disciplined message, and approaching Democrats to gain more bipartisan support for its agenda. US yields have rebounded from a low for the year at the end of last week. They may continue to rise in light of the stronger than expected US economic data in recent months that has not been given much consideration due to a variety of home-grown and global distractions. Low yielders, JPY and EUR may be particularly vulnerable. EUR may be in correction mode from an over-extended and excessively consensus bullish view. The ECB will continue to emphasize a slow removal of monetary accommodation.

This time Trump?

The political news in the USA has taken a decidedly better turn. The Trump administration is reported to have begun a highly coordinated public-relations exercise to build support for tax reform. The positive news includes Trump efforts to court Democrats.

Trump visited North Dakota last week, accompanied by its Democratic senator, Heitkamp, and spoke to a rally on broad-brush feel good tax policy. He is reported to be planning visits to 13 States over the next seven weeks, including in particular six that he won in the election, but currently, have Democratic senators that are up for re-election at next year’s mid-terms.

Bloomberg News reports that the Trump administration has moved to organize its communication strategy better. He has allies prepped to spread the news in the press, including some prominent economists.

Trump met for dinner at the White House three Democrat senators and has invited Democrat leaders in Congress Pelosi and Schumer to dinner tonight. He appears to be working more closely with Democrats to help pass tax and other legislation.

Republican House leader Ryan has announced that a tax plan outline will be released in the week of 25 September.

In the last week, Trump was able to negotiate Hurricane relief funding and push the debt ceiling debate out until at least December. With replenishment of extraordinary measures, some are estimating the drop-dead date for raising the ceiling will be pushed into some time in Q1 next year. While this issue remains a potential flash point for political gridlock, the immediate threat has eased; further evidence of Trump seeking to work across party lines.

Can Trump stay on message? Will he spin off on a tangent and start attacking Congressional leaders, or let his Alt-Right agenda get in the way again? Will he be baited by the Mueller investigation into Russian meddling in the election? Will North Korea distract the administration from tax reform?

The market will remain wary of the Trump Administration and the ability of Congress to agree on tax reform. However, political uncertainty is coming from an extreme level and it no longer appears to be the case that the market has any significant tax reform built into the USD or US rates curve.

As such, if Trump can stay on message, there is scope for some of that optimism to be built back into the dollar.

Trump steps up talks with Democrats on taxes as timetable set – Reuters.com

Republicans Plan to Release Tax Overhaul Details Week of Sept. 25 – WSJ.com

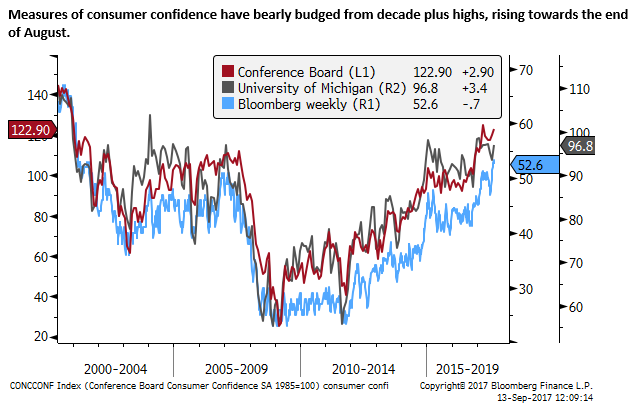

US economic confidence

The aftermath of the hurricanes will cloud US economic outlook. However, there are some indicators that suggest it has improving momentum.

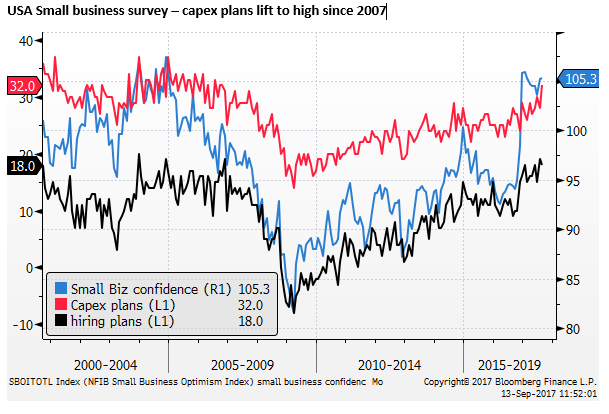

Small business confidence crept higher in August and remains around the high since 2005. Small business capital expenditure plans rose in August to a high since 2006, and hiring plans remained around the high since 2006.

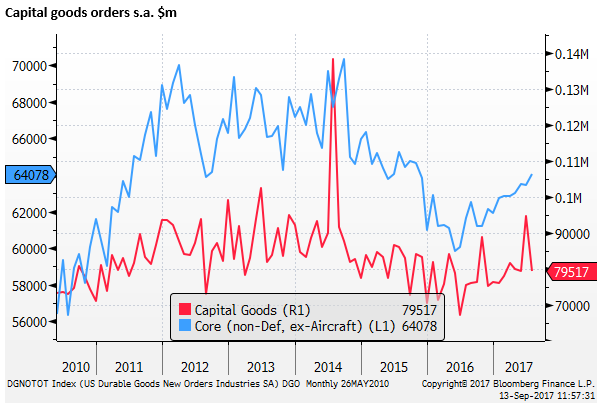

The recovery in small business capex may continue to support the recovery in capital goods orders. Core capital goods orders rose 6.3%y/y in July (revised on 5 Sep).

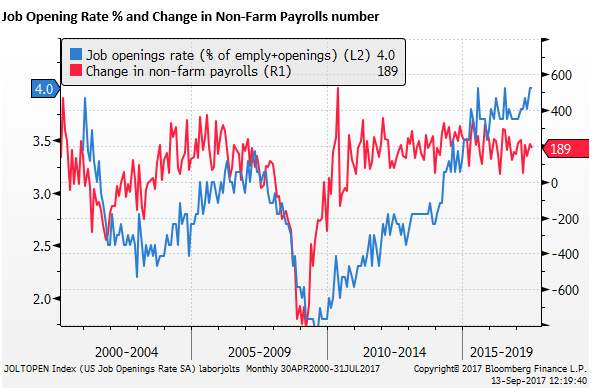

Job openings rose to a record high in July. As a percentage of employment and openings (the job-openings rate), they were 4.0%, equaling the highs in recent years. This suggests that the very modest slowing in payrolls growth may have more to do with a tightening labor market that weaker demand for labor.

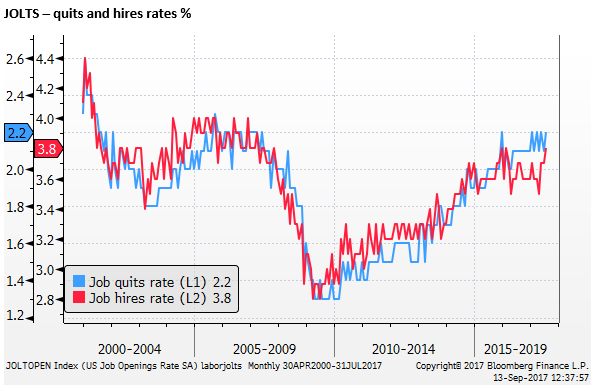

The quits rate ticked up to remain at the top of the range since January this year, and the hires rate also rose; both are equal to the high since 2007, a sign of dynamism in the labor market. It suggests people are quitting to take higher paying or better jobs and companies are being forced to hire to replace workers.

Mortgage applications for purchase of property rebounded 10.9% last week, reversing recent declines, tending to confirm other sold residential housing market data.

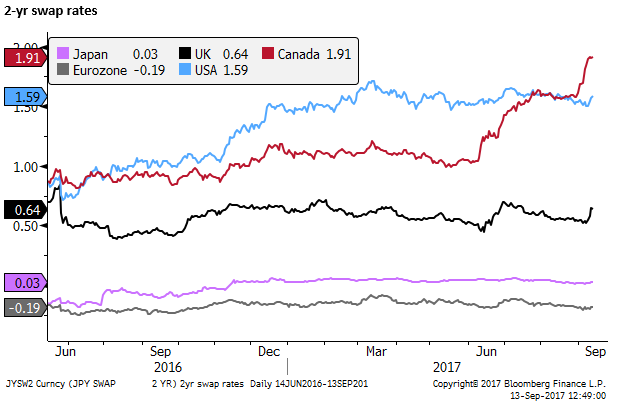

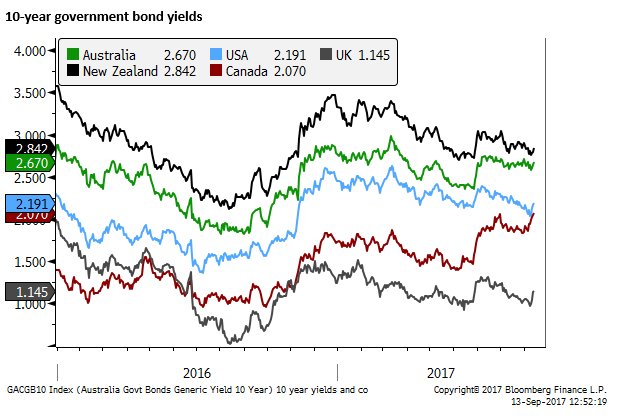

US yields normalizing from low for the year

US yields had retreated to lows for the year at the end of last week. They were not, it seems, responding to the recent improvement in US economic data. This week, US yields have lifted significantly across the curve, rebuilding lost yield advantage.

The easing of political risk, focus on tax reform and the passing of hurricanes has supported a recovery in yields. Recent stronger than expected US economic reports may help sustain a recovery in US yields.