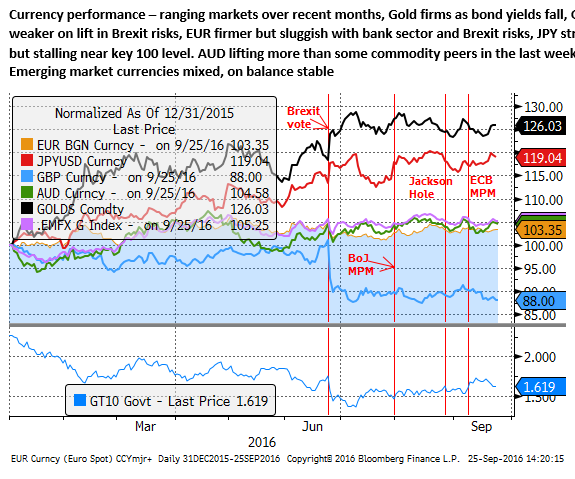

Tough currency markets await key events

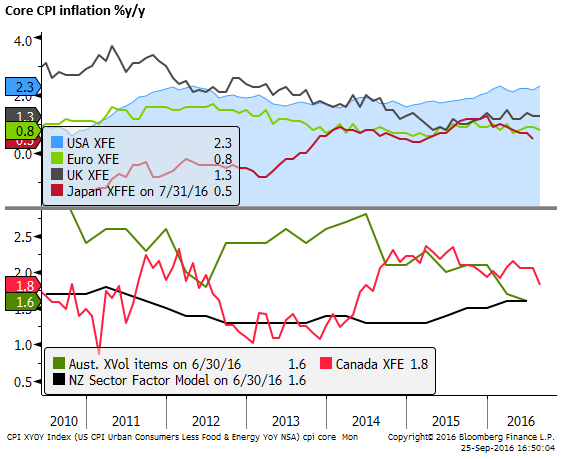

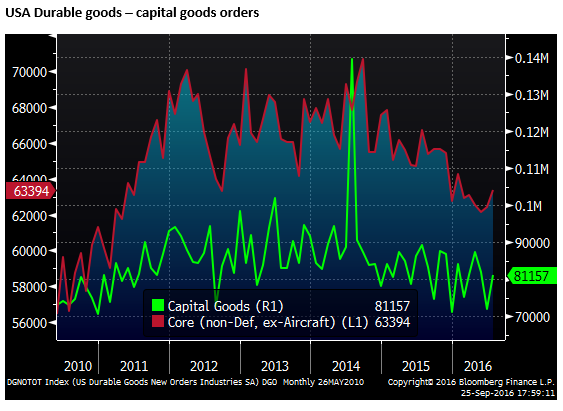

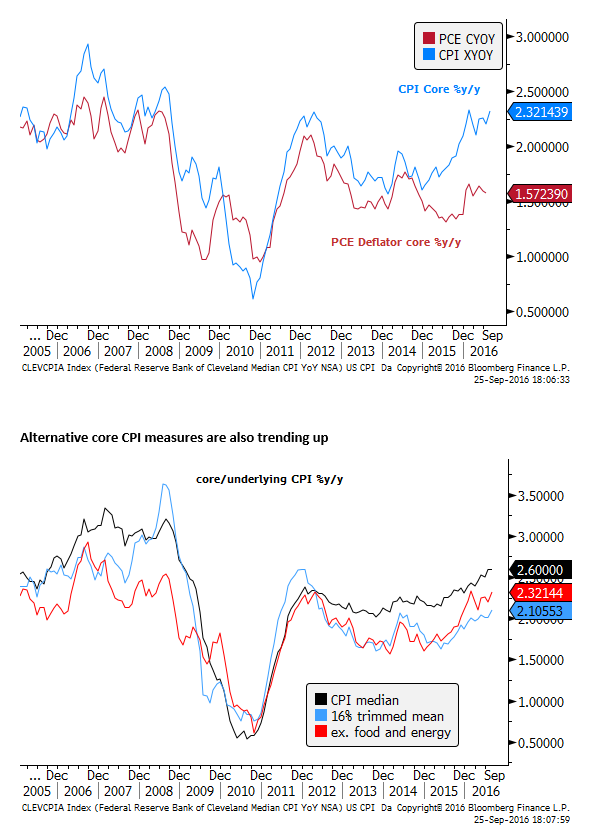

Currency markets have been mixed, choppy and in most cases exhibiting no trend over recent months. There are few clear opportunities and a number of risks to consider. Two key data points this week in the USA include PCE inflation and durable goods orders. The Fed has forecast a subdued outlook for inflation, but it is not far below target, and the CPI measure is trending higher and above target. Capital investment has been weak, but there has been a lift-off in orders in the two months to July, it will be important to see if this can build further. However, recent broad activity indicators have been weak.

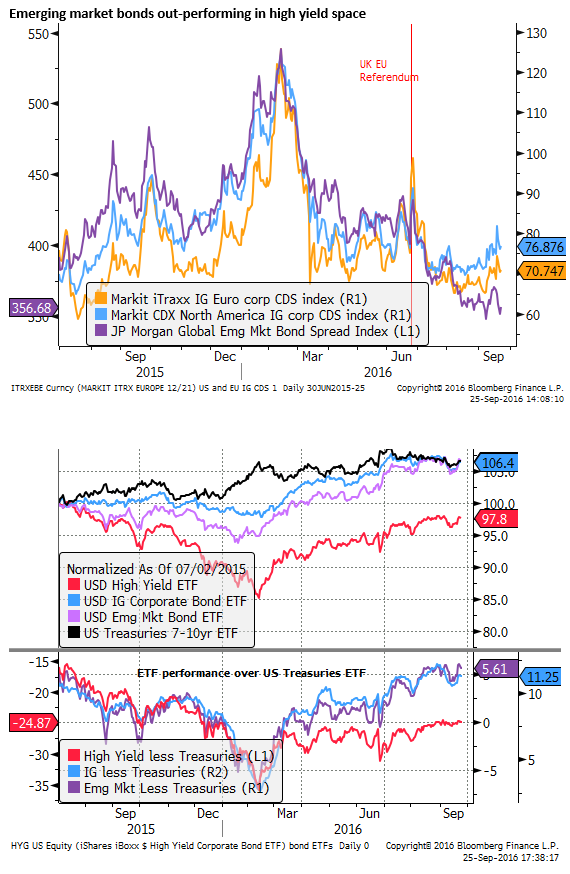

The forecast for a more gradual and shallow hiking path by the Fed helped lift some EM and commodity currencies last week. The BoJ policy meeting also contributed to a drop in long term yields back into their previous range, contributing to a rebound in equities and gold. EM bonds and equities led the rebound in riskier assets and may continue to attract demand unless the low global rates view at the Fed is questioned. Brexit and banking sector concerns may weigh on the GBP and EUR. CAD looks a bit expensive relative to rates and oil prices. A number of key events this week may set the tone for CAD; including a speech by Poloz, USA presidential debate, OPEC talks, and GDP data.

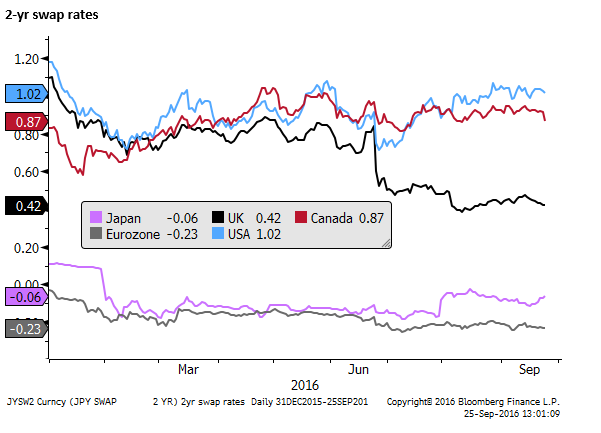

Short term yield shifts, lower in Canada, higher in Japan

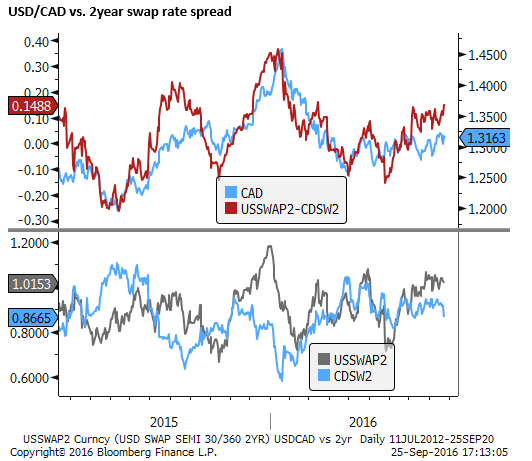

The 2 year swap rate chart below shows that US rates have been on a flat trend for two months, not far from the highs for the year in May. This reflects the mixed nature of US data with solid but steady labor indicators and a Fed that appears keen to eke out one hike this year, but then may be on hold for some time.

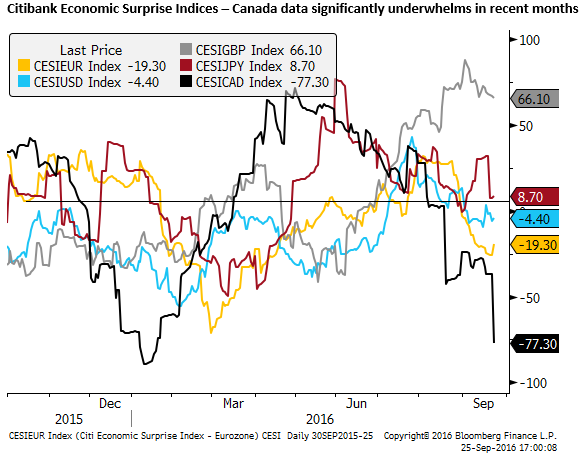

Canadian 2yr rates have fallen below those in the USA by the largest margin since March. They failed to pick up as much as USA rates after the Brexit vote on 23-June, in part as US payrolls recovered from a Q2 slump. More recently, Canadian economic data has tended to be weaker than expected. Its CPI and retail sales data at end last week decelerated significantly more than expected. On 7 September, the BoC noted that “the risks to the profile for inflation have tilted somewhat to the downside since July”. The weaker CAD yield advantage may point to upside potential for USD/CAD (See further discussion on CAD below).

Japanese two year yields rose in late July after the the BoJ failed to deliver a rate cut. They rose in the last week, reversing modest falls in the lead-up to the BoJ’s most recent policy meeting on 21 September. Again the BoJ failed to deliver a further rate cut, disappointing expectations of some in the market. JPY retains its rising trend.

UK 2yr yields fell sharply in the wake of the Brexit vote, they have drifted lower in the last week or so as politicians in the EU and UK point to tough negotiations for the UK and the likelihood that the process will start relatively early next year. Brexit uncertainty continues to keep expectations of further BoE policy easing high even though recent UK economic data has been stronger than expected.

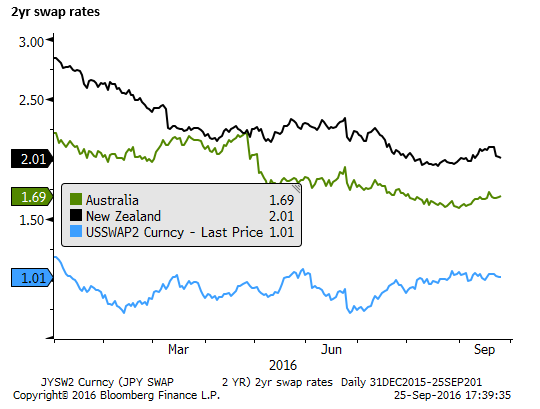

New Zealand 2 year swap rates fell after the RBNZ reaffirmed that it expects to cut rate again and the housing market faces the prospect of stalling as new macroprudential measures come into effect on 1 October.

Australian yields firmed a bit as the RBA changed Governor, with the ascension from Deputy of career central banker Lowe. A new statement of the policy agreement with the government emphasized flexibility in the inflation targeting regime, suggesting the Bank has the comfort to stay below target inflation for longer. Rates may also be responding to a solid recovery in coal prices and stable iron ore prices at higher levels than earlier in the year, supported by fiscal and monetary stimulus in China underpinning property and infrastructure spending, and cut-backs in China coal production.

Significant Uncertainty for CAD

There is significant uncertainty over the Canadian economy as it:

- Recovers from the slump in Q2 related to wildfires, and anticipates a fiscal bump from Childcare rebates in July and infrastructure spending later this year:

- Awaits the USA election that poses risks for USA trade partners:

- Deals with a slump in energy related investment that it hopes will bottom out towards the end of this year;

- Looks for a recovery in the USA to help drive a recovery in exports and non-commodity investment in the coming years, and

- Responds to increasing volatility in oil prices and OPEC’s efforts to come to an agreement to control to supply.

On Friday, core CPI inflation fell to 1.8%y/y in August below 2.0% expected, down from 2.1% in July, to a two year low (below the BoC’s 2.0% target).

On 7 September, the BoC acknowledged that on balance, “risks to the profile for inflation have tilted somewhat to the downside since July”, but were still hopeful that monetary policy could remain unchanged for some time. It said, “The Bank’s Governing Council judges that the overall balance of risks remains within the zone for which the current stance of monetary policy is appropriate.”

Bank of Canada Monetary Policy meeting press release – 7 September – bankofcanada.ca

The market will be eager to hear from BoC Governor Poloz later today, wondering if the recent soft CPI, retail sales, and softer USA activity indicators have moved the dial somewhat closer to a rate cut. As it stands, Canadian cash rates (0.50%) are already near record lows after two rate cuts in 2015 in response to the slump in oil prices; there is little expectation of a further cut in the near term.

A number of events may influence sentiment this week for the CAD.

Significant events this week for CAD include a speech by BoC Governor Poloz on Monday in the USA on the topic of trade (sensitive to the US election) and monetary policy.

Later on Monday evening the US presidential debate may influence the CAD. Any ascendency in the debate by Trump or criticism of trade pacts, such as NAFTA, may be seen undermining both MXN and CAD.

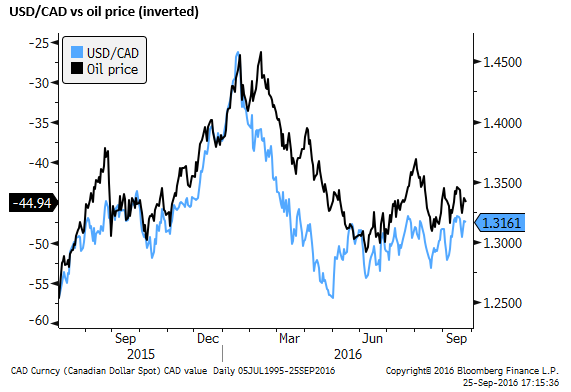

Oil prices have been more volatile in recent months and are responding to negotiations between OPEC members and Russia over a possible deal to cut output to boost prices. A possible production freeze has been kicked around since April, but producers have been unable to agree on a deal. Oil fell back on Friday reversing gains earlier in the week as hopes of a deal rose and faded again. Prices are firming in Asia on Monday on reports that there may be progress at an informal gathering of OPEC members in Algeria this week.

A deal may help boost oil prices back towards $50 a barrel from around $45, providing modest support for the CAD. However, a sustained rise in oil prices above $50 might do more to boost the USD and since it would encourage a faster recovery in the USA oil industry that has been the most flexible producer in recent years.

USA Durable goods orders on Wednesday may influence the CAD as much as the USD, since the BoC is anticipating a recovery in USA business investment to help boost non-commodity exports in Canada.

Canadian monthly GDP for July released on Friday will be important for establishing how significant is the bounce back from the Alberta wildfire effects on Q2.

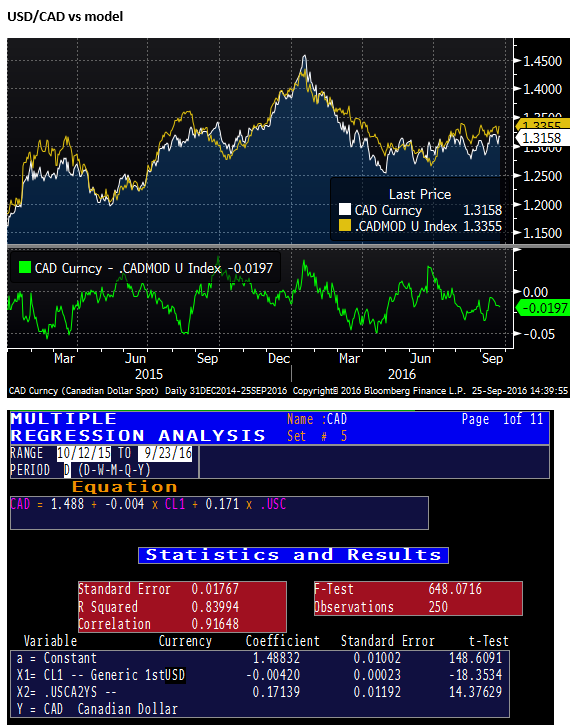

CAD appears to be a little expensive compared to rates and oil

Like many currencies, the CAD has been rather directionless over recent months, establishing a range. Compared to its yield advantage and oil prices it may appear somewhat expensive, based on a simple regression analysis.

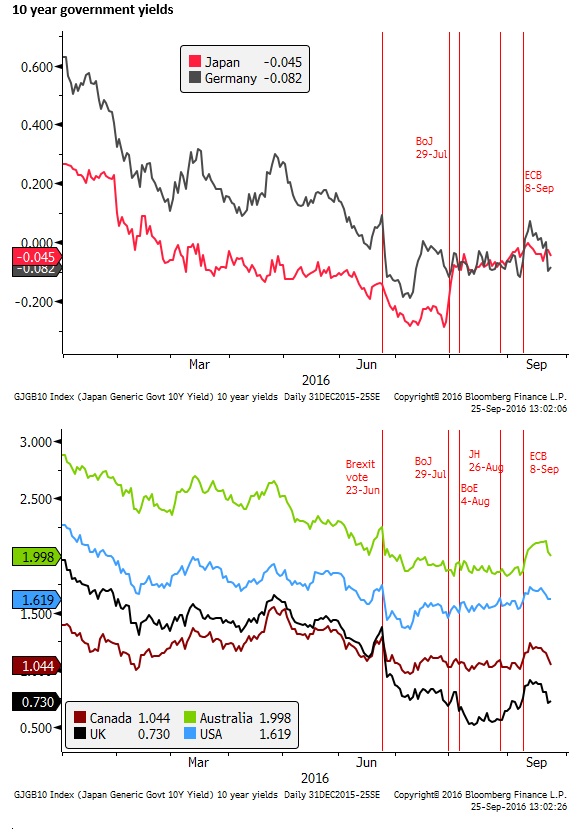

Long term yields fallback

Global bond yields fell back sharply after the BoJ and FOMC meetings last week. The BoJ failed to pursue as much curve steepening as it might have and the Fed forecast weaker growth and a lower long run neutral policy rate.

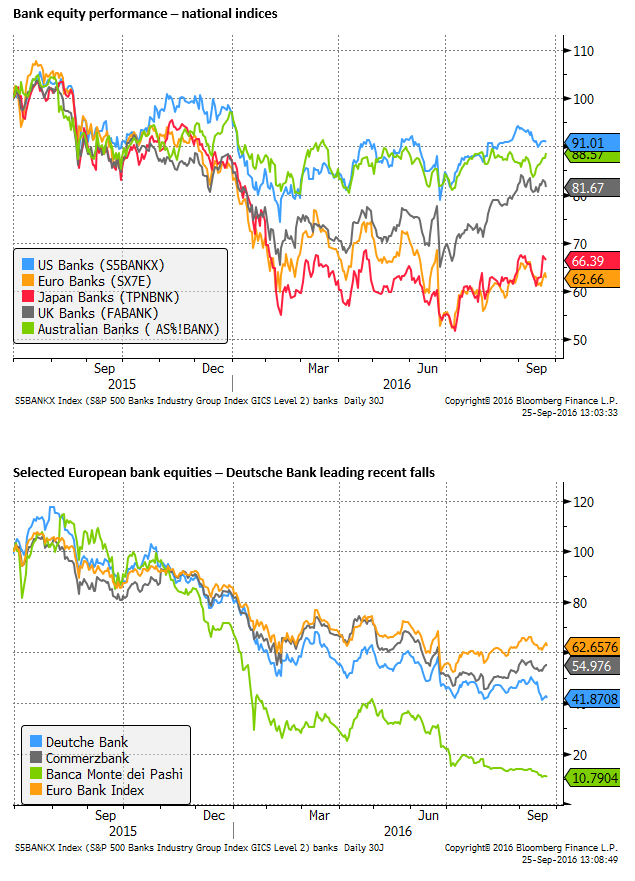

German yields fell back into the range that preceded the 8 Sep ECB meeting that had been a catalyst for the earlier rise in yields. Relative weak European bank equities, mixed economic reports and renewed Brexit uncertainty may have weighed on both German and UK yields

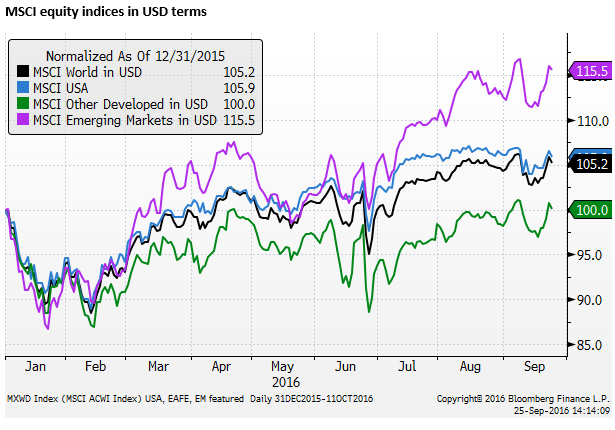

The fall in global bond yields has helped renew a recovery in global equities, led by emerging markets,

Looking for signs of inflation and recovery in the USA

The US sees two key data points this week, durable goods orders on Wednesday and PCE inflation on Friday. The former will be key to establishing if there is hope for a lift-off it capital investment after a long period of downward drift over the last year or so. Core capital goods orders increased a little in the two months to July, it will be interesting to see if it can build on this start.

The Fed presented a relative down-beat view of inflation; anticipating slow recovery towards 2% over the next few years from a PCE core rate of 1.6%y/y in Aug. The market anticipates it will firm to 1.7%y/y in September. As such it doesn’t seem that far from the Fed’s 2.0% target, and yet the FOMC did not project it above target in its three year horizon presented last week, and still had it below target until 2018.

The CPI report suggests that there is more evidence of inflation. The gap between the core PCE and CPI (excluding fresh food and energy) is at its widest level in over a decade.

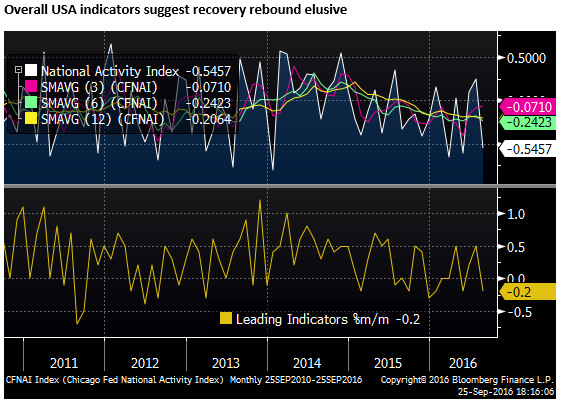

However, while the inflation trends appear to be rising, a concern is that recent activity indicators, including PMI data, have been relatively soft. The Chicago Fed National Activity index and Conference board Leading Indicators suggest growth may still be sub-trend, placing in question the notion of a recovery in the second half in the USA.