Trade war horse bolts, AUD trades like an Emerging Market Asset

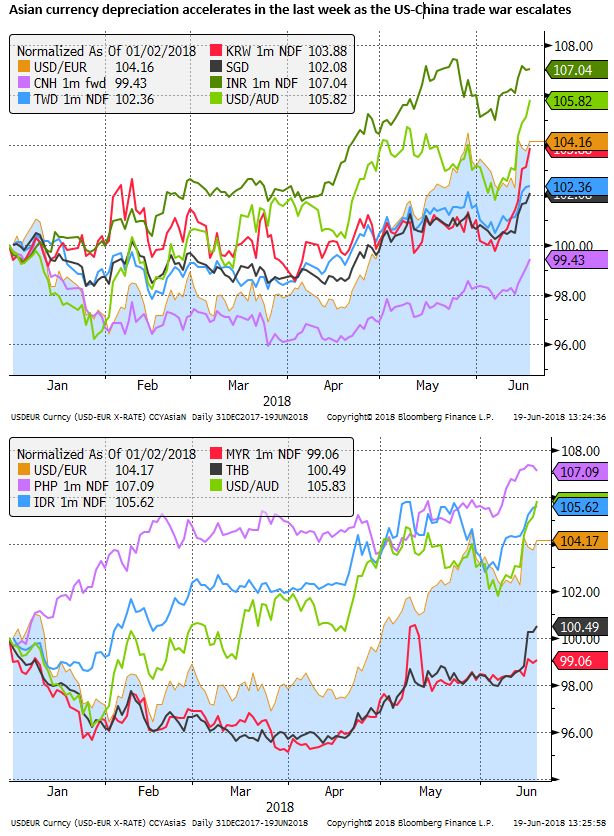

Trade war escalates and the horse bolts in Asian EM assets. Uncertainty is likely to remain elevated for some time, keeping Asian EM markets in a weaker trend. It seems unlikely that the trade threat will de-escalate. In fact, the risk is high that it ratchets up with the US yet to announce restrictions on Chinese investment in US companies. The US administration is still investigating tariffs on European cars. The trade war may also bring to the surface other threats such as weaker credit growth in China. AUD is trading more like an emerging market asset. Australian bank funding costs continue to squeeze higher; this appears to be viewed as a vulnerability in the Australian financial system.

The Horse bolts

The markets have reacted to the US-China trade war with some gusto on Tuesday. The US and China are talking tough on retaliation and the risk is that they implement wide-ranging tariffs and engage in an all-out trade war.

It is possible that, hit with a potential backlash in their domestic financial markets and economic outlook, they decide to come together and walk-back on the threats. However, it is far from clear that either side will back down.

In fact, Trump and his advisors appear to be fully prepared to escalate, believing they are better placed to win a trade war and force concessions, willing to dig in for the long haul and accept some domestic economic fallout.

Furthermore, the USA may yet turn its attention to tackling its other big trade deficit with Germany. The administration is currently investigating using national security as a basis to raise tariffs on European cars. This may take well into next year, but it appears that the US is still looking to expand its tougher trade policy, not rein it in.

The horse may have already bolted the gate, and it seems a bit late to start selling assets at risk of a trade war, but it is far from clear there will be a quick recovery. The risk is high that the trade war deepens as tariffs are implemented.

The USA is still planning on announcing investment restrictions aimed at preventing Chinese companies from gaining access to US technology by the end of the month.

Looking out for the real economic impact

Perhaps we need to move on to assess the real economic impact of trade restrictions.

This is a complex task, but the immediate presumption is that it will reduce trade flows and slow global growth.

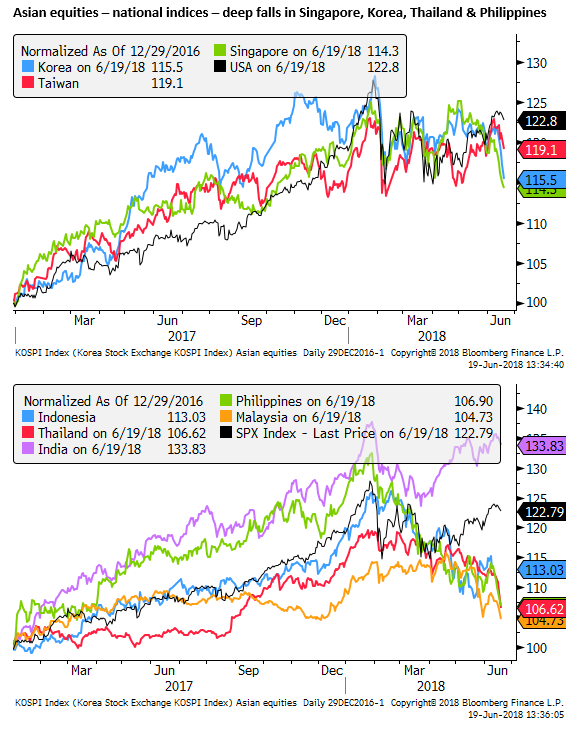

The market reaction so far suggests that China and its Asian trading partners that form part of a highly integrated supply chain have more to lose than the USA.

However, the USA economy is not expected to be a net winner from a trade war. China is not without market clout, and tariffs increase costs on the US economy.

As such, bond yields globally are somewhat lower and global equity markets are weaker. Asian equities have been hit the hardest in the last week. Asian currencies have also been relatively weak.

Weaker currencies should help Asian economies absorb the downside risk from a trade war, helping bolster after tariff export returns, and helping them compete in a diminished export market.

It is too early to know if the further depreciation seen in the last week is enough. The risk is that Asian currencies continue to weaken beyond what might ultimately be justified by the trade war as investors seek to avoid the greater uncertainty.

Uncertainty over the economic impact is compounded by the wide range of potential retaliatory measures, and policies to compensate for weaker potential growth.

Exposing China’s other vulnerability

Additionally, there is the risk that a confidence hit from tariffs might bring to the surface other vulnerabilities; including signs that Chinese corporate debt excesses are becoming a problem.

We discussed this in more detail in our Blog last weekend: (Catch-Up! ECB/Fed, China and AUD melt-down).

It is far from clear that the Chinese government will have the fiscal and monetary tools to fully contain the economic and financial damage from the combined threats of US trade policy and tightening credit conditions.

Many analysts believe that China will ease policy to bolster growth. However, its policymakers may think its corporate credit excesses can no longer be simply contained by halting or reversing its financial sector reform.

For instance forcing state-own banks to keep afloat struggling debt-ladened companies may significantly reduce their capacity to finance productive dynamic enterprises, and do little more than moderate the slowdown in economic growth while damaging longer-term economic potential.

We suspect China may not be willing or able to simply ease monetary and fiscal policy to underpin growth to the same extent as it did in 2016/17.

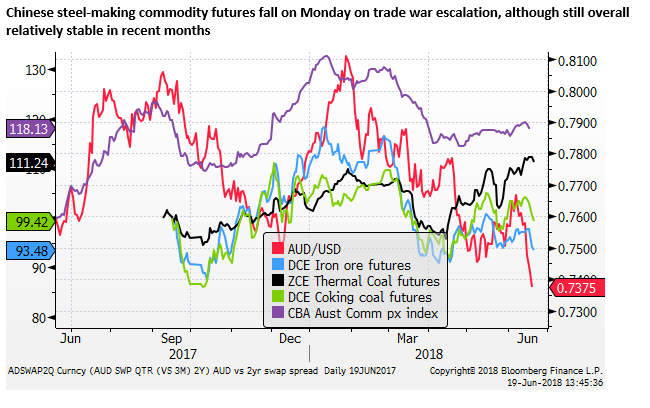

AUD trading like an Emerging Market currency

AUD has been hard hit along with Asian EM markets. It is often viewed as a proxy for Chinese economic and financial risks.

We discussed vulnerabilities in the Australian housing market in our blog last weekend (Catch-Up! ECB/Fed, China and AUD melt-down)

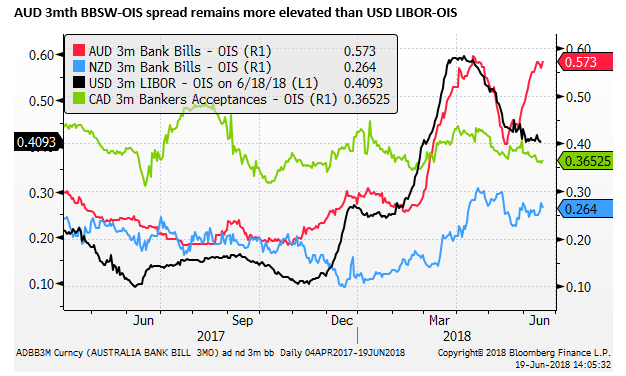

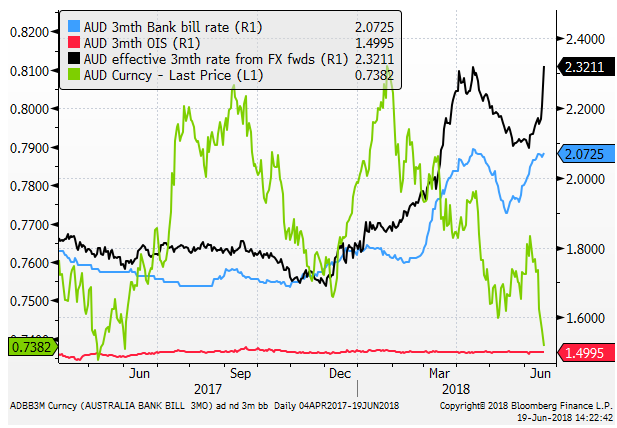

The effective borrowing costs for AUD in FX forward markets are even more elevated than BBSW. This reflects wider cross-currency basis swap, implying that Australian bank funding costs from offshore money markets are hitting new high spreads over domestic cash rates.

On the one hand, higher bank funding costs raise the carry from long AUD FX positions and might be regarded as supporting the AUD. On the other hand, it cuts into Australian bank profits and creates pressure for banks to tighten credit conditions in Australia, potentially dampening economic growth, and delaying RBA rate hikes.

If anything it appears that rising bank funding costs in Australia are undermining the AUD. This may reflect a view that rising bank funding costs represent a vulnerability in the Australian financial system to tightening global credit conditions. This is making the AUD trade more like an emerging market asset.