Transfixed by the Brexit Vote

As the UK romances the idea of Brexit, the global financial markets, world leaders and policymakers are watching on in amazement that it would consider such a risky move. It is fair to say we are all transfixed and no decisions will be made until we know the outcome. Markets are likely to be frozen in time, or gyrating on voting opinion polls. Even the FOMC and BoJ policymakers are likely to tread much more carefully in their policy deliberations this week, preferring to wait out the 23 June referendum.

Market still thinks Brexit less likely

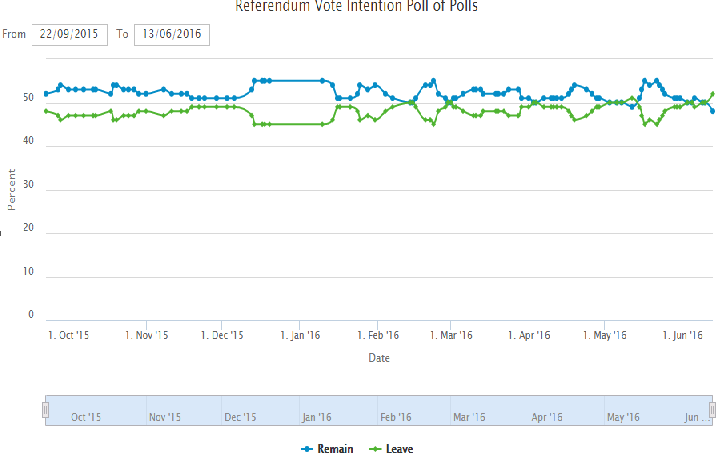

The market has watched the tight polls and built in some risk of a Brexit, but it is still finding it hard to believe that the UK people will risk so much in return for what is unclear.

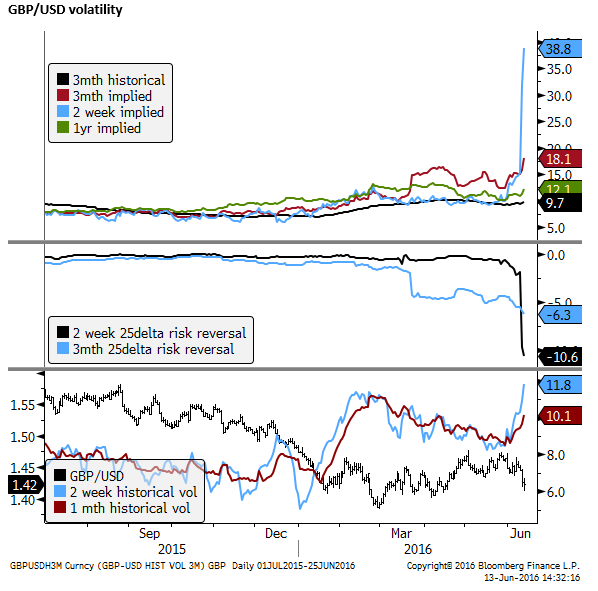

Global investors see a very uncertain future for the UK outside of the EU and are apportioning a significant risk premium to UK assets, principally via the GBP exchange rate. The GBP/USD has weakened since the beginning of the year as it became clear that the UK government was likely to call a referendum around mid-2016.

The date for the 23 June referendum was set by the UK PM Cameron after he returned from negotiations with EU officials providing some minor concessions and special status for the UK on 19 February. The GBP came under more pressure as popular MP Boris Johnson, former mayor of London, joined the ‘leave’ campaign on 22 Feb. Since then GBP has gyrated in response the debate and polls.

The FX options market illustrates that it is very costly to hedge GBP around the event in under two weeks. It also shows a massive skew in downside risk for the GBP, such that it is expected to plunge more sharply on a vote to leave than it is expected to rally on a vote to stay.

Somewhere between bad and disastrous for the UK economy

The market has come to the conclusion that a vote to leave is somewhere between bad and disastrous for the UK economy. The main point of concern is that the UK will be forced out of the EU free market and this will reduce its trade with the EU.

It follows then that businesses are very unlikely to invest in the UK at least until it is made much cheaper by a weaker GBP or some alternative trade deals are struck.

New trade deals take years to negotiate and will potentially leave the UK out in the cold for years trying to renegotiate with the EU and indeed the rest of the world.

A further point of concern is that the UK economy is highly dependent on its position as the premier place of business for global financial services. However, if it goes down the path of withdrawing from the EU it threatens this position.

A more immediate but substantial risk is political turmoil. The ruling conservative party is already pulling itself apart over this debate, but a vote to leave will probably unleash more intense blood-letting including the scalp of the PM himself. The mess that unfolds may make it even more difficult to renegotiate trade deals as Britain extracts itself from the EU, a process that legally takes a minimum of two years.

The leave campaign understandably argues that the UK can handle Brexit without significant economic fallout, and it could be free of red-tape and transfer payments attached to EU membership. It argues that it will be able to negotiate better deals and do more business outside the EU. And of course, the main reason for many for wanting out, is that the UK can limit unfettered immigration from the EU, including refugees coming from the Middle East.

The market clearly disagrees, or at least sees this as an unlikely best case scenario. The risk is heavily skewed to a worse outcome. The Stay campaign is beating this drum, warning that leaving the EU will bring significantly weaker growth and income over the foreseeable future.

The UK’s EU referendum: All you need to know – bbc.com

The market still clings to the hope that Britons come to their senses

This fear of a worse outcome in fact has probably prevented the market from truly factoring in Brexit to the extent that the opinion polls suggest it is a risk. The market believes Britons will come to their senses and vote to stay in the EU rather than risk severe contraction in the economy.

Since the referendum was called, opinion polls have suggested that the outcome will be very close, roughly 50% stay or go. However, the betting market rated the probability of leaving at below 30% for much of the year to-date.

The latest polls show that the leave campaign has gained the upper-hand for the first time. The undecided voters appear to have begun to be moved towards the leave camp. The betting market has taken notice and the implied probability of leaving have increased to the range of 35 to 40%

EU referendum: leave takes six-point lead in Guardian/ICM polls – theguardian.com

EU Referendum Poll of Polls – whatukthinks.org

Brexit Referendum Betting Odds – oddschecker.com

It seems remarkable and even unlikely that undecided voters will choose to leave faced with warnings of economic ruin. Typically the undecideds tend to go with the safer option. But the recent evidence suggests that they are moving the other way.

The campaign is now moving into fever pitch with much at stake for the UK economy. And we might expect every poll to be scrutinized and the vote count to receive enormous global attention.

Global Markets at Risk

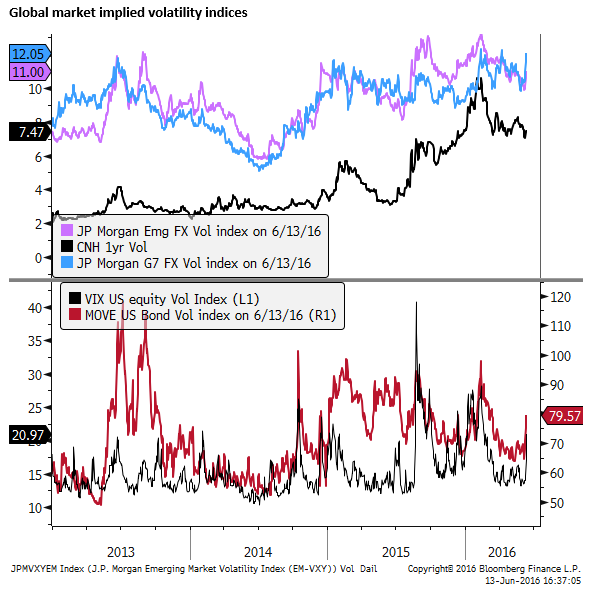

The GBP and UK rates market are in the direct firing line of the vote, but global markets are also at risk. It is harder to reconcile why the UK referendum matters so much to global markets. However, global investors have been conditioned to believe it is crucial by global policymakers.

The G20 meeting communique on 27 February, only a week or so after PM Cameron set the referendum date for 23 June, singled out Brexit as a potential downside risk for the global economy, to the surprise of many. The Fed’s Chair Janet Yellen noted potential market turmoil from Brexit as a reason to consider delaying a hike. There is little positive that can be said from a global perspective seeing weakening relationships between major countries. But the global focus on the Brexit has substantially increased nerves over the vote. The market has been conditioned like Pavlov’s dogs to sell on rising Brexit risk.

The economic effects on the rest of the world are not easily identifiable. Any loss to the UK related to its diminished capacity to trade with the EU is probably someone else’s gain, although a significant loss of confidence in the UK is likely to cause some drag on the global economy.

However, global leaders are fearing a lurch in politics towards the left and right, a drift towards populist and isolationist polices that threaten global trade and growth. A vote to leave may significantly influence the tone of the US presidential debate and increase fears that the USA will also lurch towards isolationism. A vote to leave might be seen as a win for extremists and question the basic humanity of the world.

In the event, if the UK vote to leave, it seems the market is ready to sell everything. This may be a vast over-reaction. But who is to say that it will not be the bail of straw that collapses the back of a fragile global economy threatened by weak growth, excessive debt, and gripped by political instability.