Trump in his element responding to Harvey

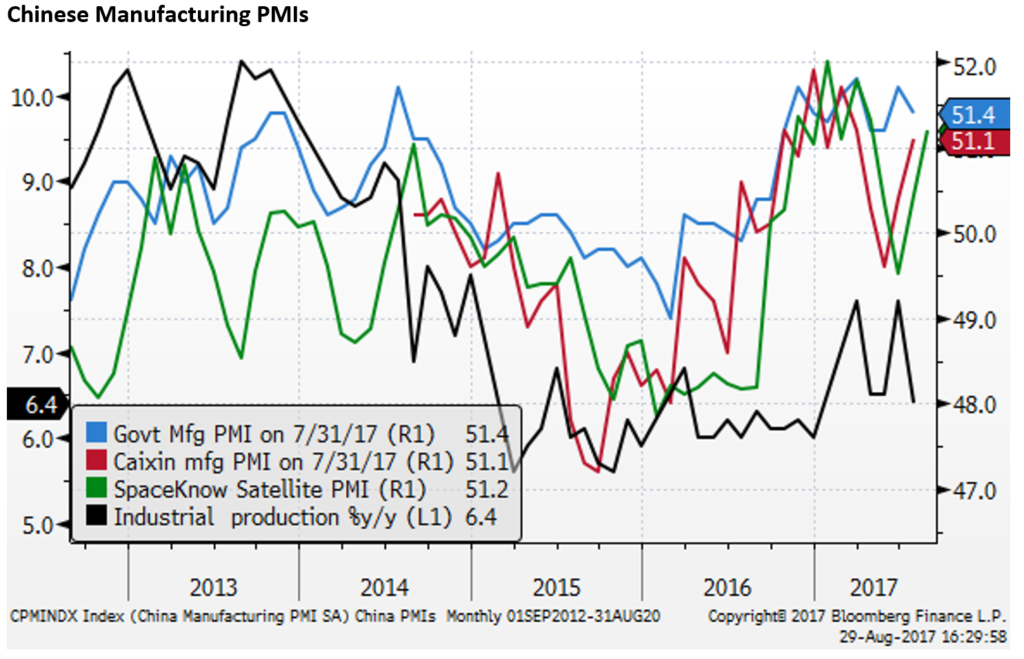

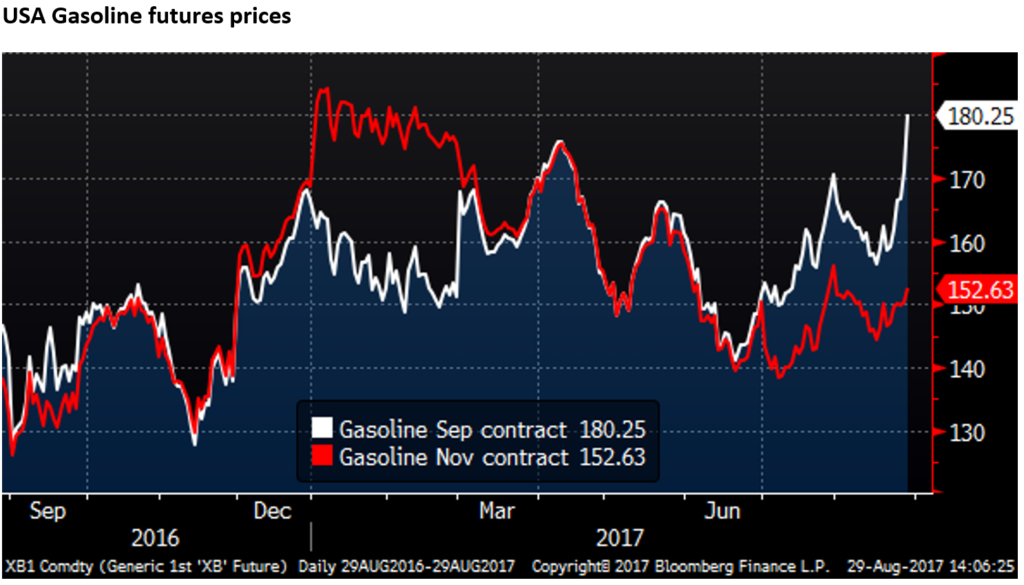

North Korea and Hurricane Harvey are dominating attention in the market. The market is bracing for some disruption to the US economy. Gasoline prices in the US have surged for the front two contracts, adding to near term US economic disruption and uncertainty. US rates and yields are off their lows on Tuesday, but are down by around 4bp since last week, near lows for the year. This suggests that the market sees the Fed responding to Harvey by tightening policy somewhat more cautiously. However, fallout to the US and global markets is contained, as most expect the disruption to be relatively short lived, and give-way to stronger demand once repair, rebuild and replace activity begins, probably sometime in Q4 onwards. Trump is on his A-game responding to the Harvey disaster, and this may help relieve some of the political risk in the USA. However, uncertainty remains high as the spending bill/debt ceiling/North Korea issues remain key flash points in the near term. Key events on the economic calendar still await this week. Apart from US inflation and payrolls, Chinese PMI data are due on Wed/Thu. July activity data were weaker than expected in China, and Chinese metals futures prices have retreated significantly in recent sessions. The PMI data may help set the tone for Chinese metals, AUD and EM markets. Other global PMIs are due from Thursday and may further influence the global economic outlook. The Australian economic calendar hots up in the next week, and the capex survey on Thursday may be highly influential.

Harvey generates some economic uncertainty

Economists are now doing their sums on the impact of Hurricane Harvey on GDP growth. Strategists will be comparing the current market response to similar historic episodes.

The event will cause some degree of weaker national economic growth in Q3. But this will fade and turn into, potentially, catch-up growth in Q4 and into H1 next year. The disruption phase will depend on how long it takes for water inundation to recede and allow the affected communities to begin the recovery. Insurance claims will have to be made and paid to facilitate the repair/ replace/ reconstruction phase.

The events are largely localised, but higher gasoline prices or shortages could spread the disruption nationally.

Gasoline September futures prices are up 13.5% in the last week. This is significant and might be expected to have some dampening impact on consumer spending nationally. However, the futures market shows that the price spike is not expected to remain for more than two to three months.

Concern over oil refining supply disruption and the degree of disruption to the economy may not have peaked yet, with gasoline futures prices yet to clearly peak and news reports discussing uncertainty over the degree and time of flooding.

The following article from the WSJ attempts to provide some context for assessing the economic fallout. Tropical Storm Harvey Will Cost Tens of Billions of Dollars – WSJ.com

“About 2 million barrels a day of refining capacity—about 10% of the nation’s overall refining capacity—is now offline, according to Moody’s.”

“Moody’s preliminary estimate is that the storm will cause between $30 billion and $40 billion of property damage.” This suggests that this event is more severe than most storms, but less severe than Katrina (2005; $100bn) and Sandy (2012; 71bn). But this estimate is initial, and risk appears towards it rising rather than falling, and it’s not clear how much property damage correlates with economic disruption; the key variable is how long the flood waters take to recede.

“Moody’s estimates thus far that there will be $6 billion to $8 billion in lost output in the weeks ahead. That is barely perceptible in a U.S. economy that produces more than $19 trillion worth of goods and services annually.”

Prior to the event, recent reports suggest that the US economy had started the second half of the year on a stronger growth path than the first. As at 25 August, The Atlanta Fed GDPNow forecast was at 3.4% for Q3. As such, the overall economy appears in a solid position to absorb the loss to activity expected in the disaster affected regions.

Fed may be more cautious, but unlikely to change course

It will be more difficult for the Fed and economists to get a clear picture of the underlying trends in the economy for several months. This might to some extent make the Fed approach further policy tightening more cautiously than they would otherwise. It would risk undermining confidence if the Fed were to proceed with policy tightening in the disruption phase.

However, The Fed has no immediate plans to raise rates until maybe December. It would seem unlikely that Harvey will be concerning enough to prevent the Fed kicking of its first tentative steps towards Quantitative Tightening (QT) at its September meeting. By the middle of Q4, the market may even begin to draw confidence from the rebuilding phase.

Market response

With markets also responding to the latest North Korea incident, it had hard to say what impact Harvey has had if any. The USD was on a weaker trend last week ahead of Harvey, and to some extent, this reflected higher risks of a government shutdown over a needed spending bill and debt ceiling increase.

The USD and US rates fell sharply on Monday and Tuesday in Asia but are recovering on Tuesday in the USA. Basically, Harvey and NK have generated higher volatility without a clear direction for the USD.

2yr US swap rates are lower by around 4bp since last week, suggesting some risk of less Fed policy tightening in the year ahead.

10-year yields are also down by about 4bp since last week, but have rebounded from being down by around 8bp, earlier on Tuesday in Asia/European trading.

US equities have rebounded during trading on Tuesday to be up on the day.

It is hard to make much sense out of these market developments. The USD is doing quite well on Tuesday, considering US rates and yields are still lower than last week, and are around their lows for the year. But the USD may have become oversold last week and on Monday, after reaching new lows on broad indices since Jan-2015.

Trump in his element

Another question is will Harvey have political implications. Prior to its hitting, and the NK incident, Trump was reported to be about to pivot to promoting tax reform. That is on the back-burner again. But it also may have prevented Trump from raging over NK.

Trump is probably aware that how he responds to Harvey will be more crucial to his political standing. President Bush is widely regarded to have bungled his initial response to the Hurricane Katrina disaster in 2005. Trump may sense this is an opportunity to demonstrate strong leadership and compassion. He is using his twitter account to bring attention to the disaster and this may work well.

Trump had most of his cabinet with him on Air force One, making appearances in Texas, leaving nothing to chance on public relations and using his celebrity and charisma to full effect.

He could parlay a good performance in Texas into placing subtle pressure on Congress to get on with spending bills and tax reform. Funding for the contentious border wall may no longer seem as imperative in the next stop-gap spending bill, helping smooth its passage and the debt ceiling in Sep/Oct.

There is a possibility that Trump’s Harvey response could end up being seen as an important turning point for his presidency and a circuit breaker in Congress.

However, the market will remain cautious in guessing what Trump will do. He tweeted in recent days that the wall must be built and Mexico will pay for it. And threatened to pull out of NAFTA again. A tougher line on the wall and NAFTA might be seen as raising risks of a government shutdown, while also generating fears for global trade.

Trump so far has said little about the NK missile, which may be helping the market reverse some of its knee-jerk sales of the USD, US yields, and equities. However, it may be wishful thinking to assume Trump will not unleash fear and fury.

Key events to keep the market guessing

The rest of the week includes a number of interesting data points that may further complicate market trends.

There has been a significant retreat in Chinese steel-making commodity prices in recent days and Chinese PMI data are due on Wednesday and Thursday. Chinese market watchers may be nervous after the July monthly activity data were weaker than expected. This could pose a threat to the AUD and EM markets.

A number of key Australian data points are coming in the next week or so, leading up to its GDP release and RBA policy statement next week.

We are interested to see if the Q2 capital expenditure survey (Thursday) starts to reveal strength more consistent with the rebound in business confidence, non-residential building approvals, and stronger government infrastructure spending. We see this as an upside risk for the AUD.

From Thursday and into next week we see many global PMI data points that will help establish how strong the global economy is.

US PCE inflation data are released on Thursday and payrolls on Friday. While Harvey may have injected uncertainty, the market will still be influenced by what the data says about the pre-Harvey economic trajectory.