Trump is a dead-weight on the USD

Global investors heading into Japan equities may no longer be routinely hedging the JPY currency exposure. Equity investors, viewing the largely trendless major currency markets over recent years, albeit with some sizeable swings, and more recently a weaker USD, may be moving funds into Japanese and European equities without currency hedges. These equity flows may be playing a bigger role in currency performance than in previous years when monetary policy divergence and relative interest rates dominated. US Economic momentum remains intact; GDP is set to rebound in Q2; the labor market is tightening; and gradual Fed tightening remains on track. This may not be the time to sell the USD after its broad-based fall this year. But Trump’s antagonistic ill-disciplined style of economic nationalism is a dead-weight on the USD. The US economy must continue to prove its mettle to ensure the USD does not continue to drop. The recent rebound in CNY, while eye-catching, doesn’t reflect any new economic development in China, and still leaves the CNY as one of the weakest currencies in Asia this year. The AUD remains threatened by evidence of some slowing in demand and tightening credit conditions in China, and signs that the Australian housing market is peaking.

Japanese equities break away from USD/JPY

As the USD/JPY flirts with the key 110 level, consisted with a weaker USD more generally, and lower US 10 year govt yields (at their low since the first few days after President Trump’s election in November last year) Japanese equities have surged to new highs.

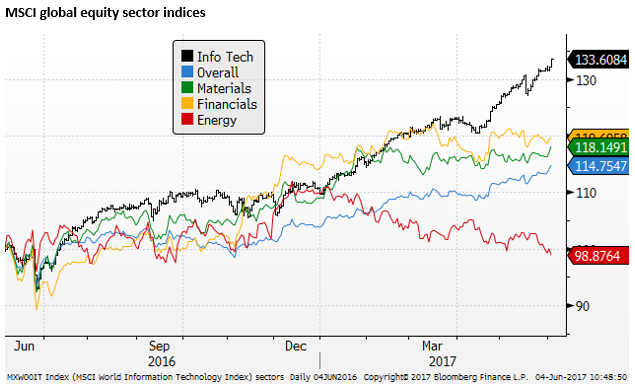

The Japanese stock market has seen solid inflows from foreigners and April and May and continues to be supported by BoJ purchases of ETFs. InfoTech shares have been leading global equity indices higher; including in Japan. Japanese bank shares are also significantly higher in recent sessions, in contrast to weaker banking shares in other major countries recently. Japanese equities may have also got a technical boost as the Nikkei 225 index rise through the 20,000 level for the first time since 2015.

Signs of economic improvement in Japan

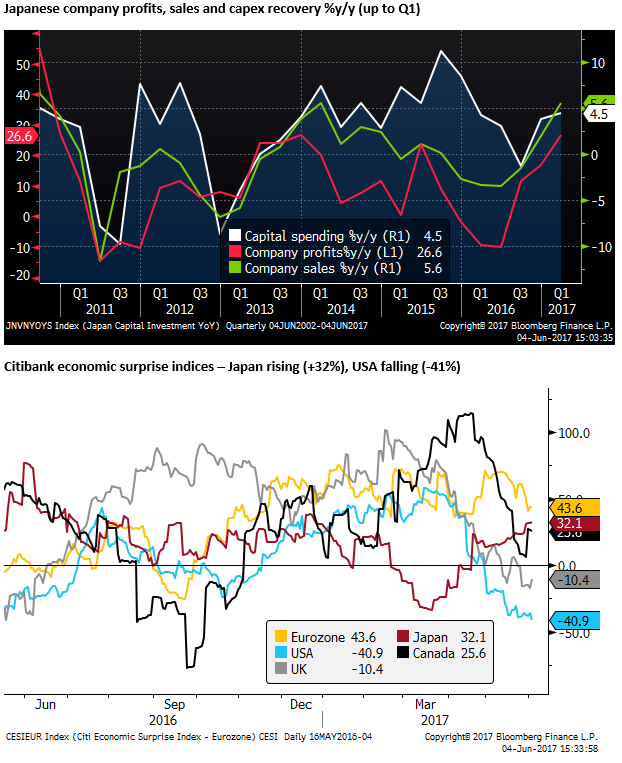

It may be too early to presume that the market is eyeing a turn in BoJ’s ultra-easy monetary policy stance. But Japanese economic data has shown signs of improvement in recent months and confidence in a sustained period of recovery may be growing. The MoF reports corporate earnings rose 26.6%y/y in Q1.

Monetary policy in Japan and Europe working more through asset price channel

We may be moving into a phase where Japan’s easy monetary policy works more through lifting domestic asset prices rather than weakening the JPY exchange rate. The later stages of US QE/zero rates policy in 2012/2013 appeared to work less through the currency channel and more through boosting asset prices. In Europe, the EUR has been largely stable for some time and its QE monetary policy may also be working more through lifting asset prices.

Perhaps global investors heading into Japan equities are no longer routinely hedging the JPY currency exposure. Equity investors, viewing the largely trendless major currency markets over recent years, albeit with some sizeable swings, and more recently a weaker USD, may be moving funds into Japanese and European equities without currency hedges. These equity flows may be playing a bigger role in currency performance than in previous years when monetary policy divergence and relative interest rates may have dominated.

Global equities have shown consistent strength this year, diverting investor attention away from other asset classes. The US equity market has a relatively high P/E and appears more fully priced for perfection than many other markets. Political risk in the US under a Trump presidency also appears to be growing, creating more uncertainty for both US equities and the USD. Investors may be seeking to diversify away from both the US equity market and the USD.

The JPY and EUR have also benefited from stronger trade performances, lifting their trade balances into surplus, while the US trade deficit has widened somewhat over the last year.

USD/JPY outlook appears more balanced

It may be premature to expect a sustained rally in USD/JPY through 110 as US rates are expected to be raised further next week, and BoJ policy is set to remain as it is for the foreseeable future. Nevertheless, the outlook for JPY appears more balanced and, under certain conditions, its relative safe-haven status could see it rebound significantly further.

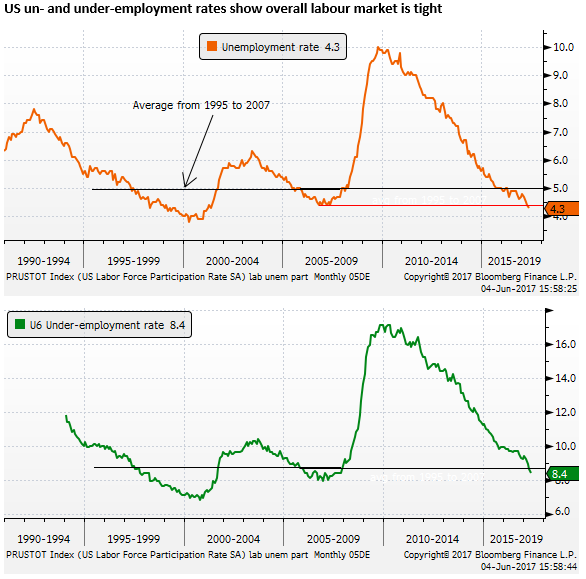

Tighter US labor market

The rise in non-farm payrolls in May was less than expected, however, the fall in the USD and yields on Friday is surprising considering the rapid further tightening in the US labor market; as shown by the sharp drop in the unemployment rate and broader measures of under-employment.

At 4.3%, the unemployment rate is now below the cyclical low point in 2006/07 (4.4%), and below the average of two economic cycles from 1995 to 2007 prior to the Global Financial Crisis in 2008 (5.0%). It is also now clearly below the FOMC’s current median estimate of NAIRU (4.8%).

The broad U6 under-employment measure that accounts for discouraged and marginally attached people in the labor force, and part-time workers for economic reasons, has dropped by a full percentage point in the last four months to 8.4%; now also below the 1995-2007 average (8.7%).

The labor market has tightened noticeably in recent months and suggests that the slower pace of payrolls growth may reflect supply reaching constraints rather than weaker demand. Wages have not responded to tightening yet, but the risk is that they will before too long. As such, the Fed should at least maintain its gradual policy tightening outlook.

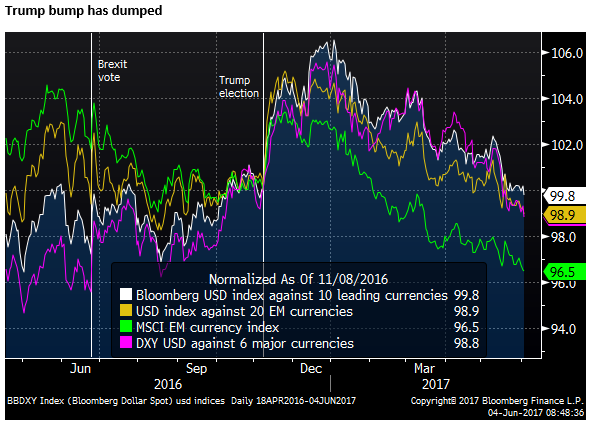

Trump has been a dead-weight on the USD

The USD performance has been broadly very lackluster this year. Broad dollar indices against major and developed currencies have unwound all of their post-Trump election rally in Nov/Dec last year.

The fall in US yields and the USD may reflect growing unease with the Trump Presidency. The testimony by former (sacked) FBI Director Comey on Thursday this week may be lifting anxiety.

The criticism of Trump by several US business leaders and internationally after he pulled out of the Paris Climate Agreement may also have added to a broad lack of confidence in the policy direction in the USA.

Economic nationalism (Pittsburg before Paris) may have some features that support growth in the USA and the USD. However, the market may be thinking more about the US isolating itself from the rest of the world, encouraging other countries to pursue a form of globalization that excludes the USA. Even big US companies may attempt to distance themselves from Trump’s America and align their business with foreign trends.

Trump’s style, designed to appeal to the old-technology manufacturing American rust-belt, is antagonizing the dynamic high-tech, green-friendly sectors, and other nation’s political and business communities.

Foreign tourism appears to be slowing in the USA, even as it surges globally. While this is a drag for the US tourism industry, it may also have parallels for foreign business investment and capital flows towards the USA.

Not Coming to America – WSJ.com

A number of foreign governments have announced big individual investments in the USA to impress Trump on official visits, but this appears aimed at appeasing Trump to avoid possible trade restrictions rather than a genuine sign of cooperation and deepening economic ties.

US asset prices surged in the first months after the Trump election on the prospect for a more business-friendly agenda; deregulation, tax cuts, and infrastructure spending. Instead, Trump and Republicans have been side-tracked and focused on policies that may sustain his standing with his core voter base, but tend to weaken growth potential, drive a wedge in American politics and lessen the chances of meaningful tax reform.

The controversy over Russian interference in the election and possible collusion with the Trump team has grown in part because of the poor handling of the issue and ill-discipline of Trump, highlighting his lack of experience in political office.

The US economy has continued to grow in spite of the Trump whirlwind. US consumer confidence and small business confidence still appears to have been boosted by the Trump growth agenda, but US financial markets (USD and bond yields) suggest investors are far less convinced that he will deliver any positive reforms. Some may consider stronger US equities as a sign of confidence in Trump, but global equities are rallying and US markets are just along for the ride.

If Trump and Republicans can generate momentum in tax reform there is considerable scope for a rebound in the USD and US yields. But there is also a risk that Congress is distracted by the approach of the debt-ceiling limits and the need for a new spending resolution bill from September; not to mention the ongoing investigation into Russia’s election meddling.

Economic momentum remains intact. GDP is set to rebound in Q2, the labor market is tightening, and gradual Fed tightening remains on track. This may not be the time to sell the USD after its broad-based fall this year. But Trump is currently acting as a dead-weight on the USD. The US economy must continue to prove its mettle to ensure the USD does not continue to drop.

Taiwan and Korea currencies stall near key resistance

Asian currencies and equities have been among the strongest this year. Leaders have been the High Tech economies of Korea and Taiwan benefiting from strong equity performance in this sector, driving the rally in global equities.

There is a risk that this sector may now be over-bought. The TWD and KRW, which have led gains in Asian currencies, are near key supports for the USD. It remains to be seen if they have the impetus to push the USD lower.

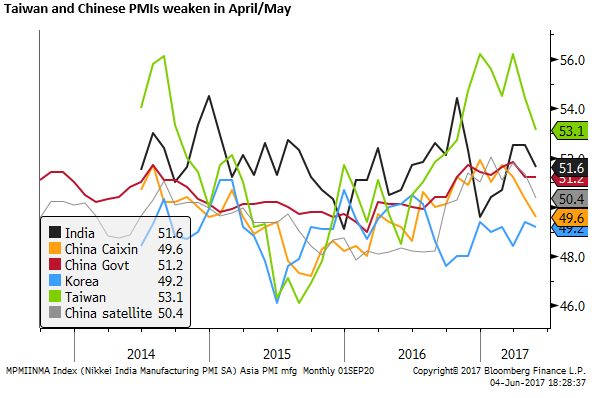

The Taiwan manufacturing PMI has led the recovery in Asia’s PMI in the last year, but it has fallen in Apr/May; alongside a retreat in China’s manufacturing PMI

China Currency rebound says little about China market risks

The Chinese currency appreciated sharply, by its standards, in the last two weeks rising above its January highs. The CNY had been relatively stable until recent weeks against the USD, However, this has resulted in significant under-performance against most other currencies. As such, the rally in the last two weeks only serves to unwind some of this under-performance.

The CNY remains heavily managed, and while the authorities have let market forces play a bigger role (mostly resulting in a weaker CNY over the last two years), this sudden rally is essentially induced by policy-makers.

There is a range of theories for why now? One is to appease President Trump; another it to create the appearance of a more solid and broadly stable CNY as it deals with the potential negative fallout from tightening conditions in Chinese credit markets to reign in excessive shadow-bank lending growth.

The recent rebound in CNY, while eye-catching, doesn’t reflect any new economic development in China, and still leaves the CNY as one of the weakest currencies in Asia this year.

Chinese financial and economic risks rising

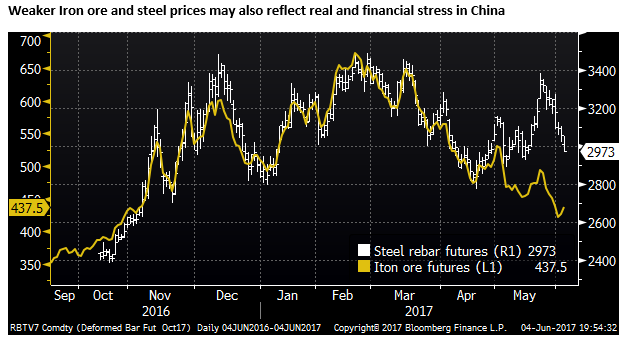

Internal market dynamics in China continue to reveal risks for the region and commodity currencies; in particular, the AUD continues to trade a Chinese financial risk barometer.

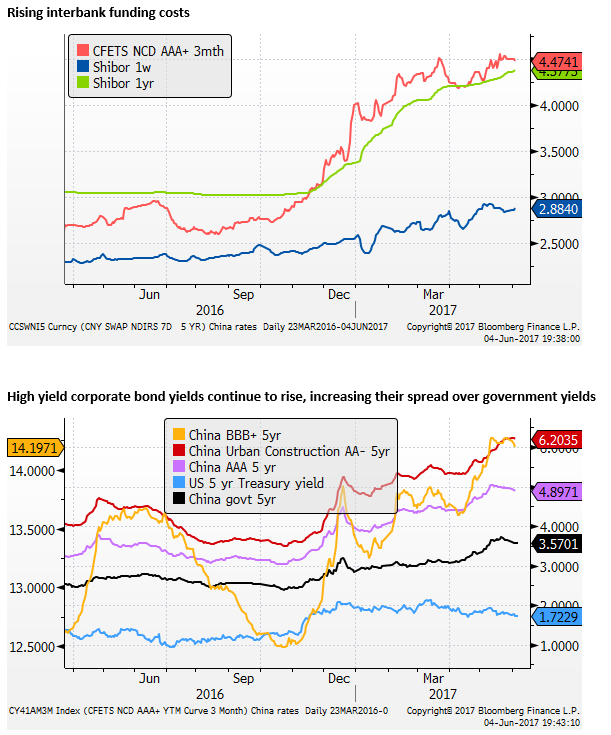

While 1 to 10-year Chinese swap rates have been falling in the last month, shorter term interbank money market rates have been creeping higher, suggesting there is some funding stress developing. This may reflect regulatory efforts forcing banks to report at the end of each quarter balance sheet metrics that now include their holdings of off-balance-sheet wealth management products (WMPs) that invest in a wide range of often undisclosed financial assets, including other WMPs.

Chinese Negotiable Certificates of Deposit (NCD) rates are higher. These are commonly used by smaller banks to finance holdings of WMPs.

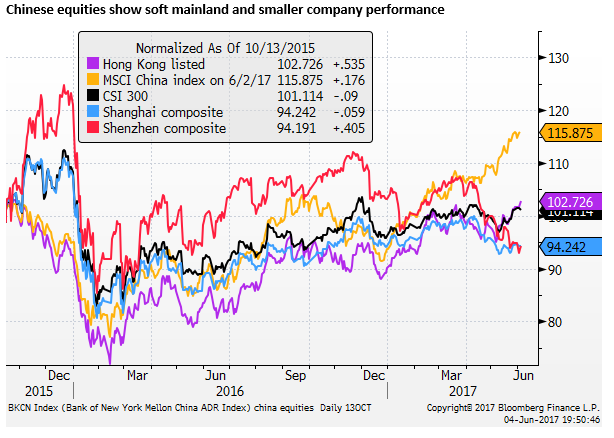

Chinese equities have joined the global rally, however, mainland-listed equities have lagged those listed offshore, and broader equity indices that include smaller company shares have under-performed the main CSI 300 index.

As we move into the final month of the half-year, and another reporting period for Chinese financial institutions, it will be interesting to see if shadow-banking sectors continue to be squeezed. And whether the authorities can maintain the delicate balance of injecting enough liquidity and moral suasion to keep investor confidence afloat.

The AUD has been one of the few currencies not to rise against the USD in recent months. Instead, it has been on a choppy downtrend. This may reflect, in part, evidence of tightening financial conditions in China.

Australian economic activity indicators in the last week suggest that the domestic economy is not as bad as some feared. Retail sales began to recover in April from a weak Q1, Private Capex is showing signs of bottoming, and job ads growth remains solid. However, the early evidence that house prices may have peaked had a bigger impact in dampening sentiment, seen as a major risk factor for financial and economic stability in Australia.

The AUD remains threatened by evidence on some slowing in demand and tightening credit conditions in China, and signs that the Australian housing market is peaking.