Trump tax and trade policy supports USD

Trump’s respected economic team of Cohn and Mnuchin released the broad strokes of the tax plan that were leaked out and reported to the media in the last day or so. The plan is very ambitious and focused on making US companies internationally competitive, with the intention of bringing business investment and revenue to the USA. The muted market reaction reflects doubts that comprehensive tax reform can get through Congress. However, there is scope for market optimism to build. The plan is being led by respected economic advisors who recognize the need to build consensus and demonstrate a willingness to negotiate. The Trump administration is taking a more proactive role in tax policy than it took with Healthcare. Further boosting the prospect for tax reform are reports that the Freedom Caucus holdouts on the Healthcare bill may now support an amended bill. Passage of a bill to repeal and replace Obamacare would clear the way for negotiations on tax policy, and improve Trump’s record on delivering policy. Further supporting the USD are actions and orders that restrict international trade with the US. These have weakened the CAD and MXN in recent days, pose risks for China and Japan, and, more generally, for countries reliant on global trade; including many emerging market and commodity currencies. Finally, Trump has taken funding the Mexican border wall out of the government funding bill negotiations, lessening the risk of a negative fallout to near-term economic confidence in the USA.

US Tax plan to make USA companies internationally competitive

Trump’s key advisors on economic policy, Director of the National Economic Council Gary Cohn and Treasury Secretary Mnuchin have outlined a bold and audacious plan to cut and reform taxes.

The announcement outlined deep corporate tax cuts (from 35 to 15%), and extension of this much-reduced rate to small and medium sized businesses that currently are required to pass through earnings to their income tax return.

It announced an unspecified tax break for accumulated foreign earnings held offshore by American companies to entice repatriation. And proposed a shift to a territorial corporate tax system, so that US companies will no longer for be liable to pay tax on future foreign earnings.

White House memo – 2017 Tax Reform for Economic Growth and American Jobs – CNBC.com

Overall the tax breaks appear huge and virtually impossible to fund in a budget neutral way. The Trump economic advisors offered no detail on how these massive tax breaks might be paid for. But Mnuchin did say Treasury modeling assumed big increases in real economic growth and trillions of additional revenue.

Market displays skepticism

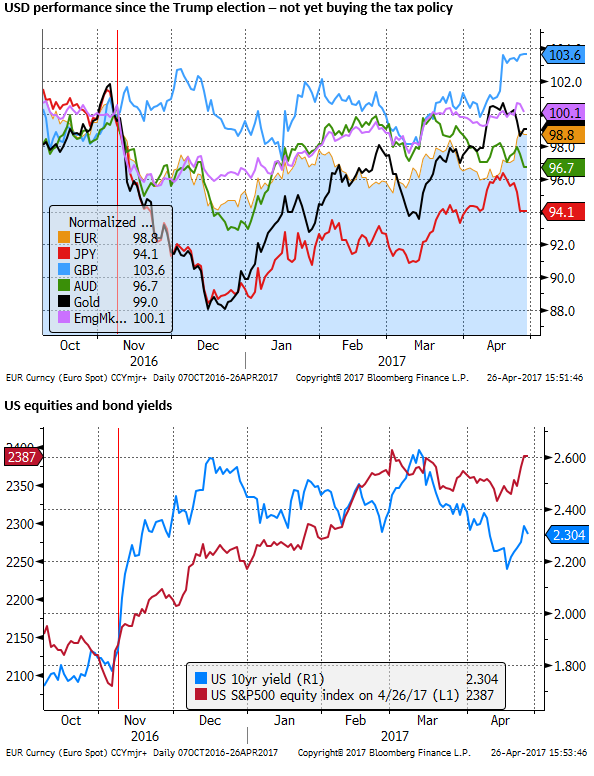

These policy announcements are similar to key promises made by Trump during the election campaign. The so-called Trump rally that came in the early months after the election were built on the idea that significant tax reform would happen.

More recently, engulfed in controversy, sidetracked on other issues like border security, immigration, healthcare and geopolitical risks, the market has lost confidence in the Trump administration capacity to deliver on its growth agenda, including tax reform.

The realities of moving bills through Congress have also come into focus, following the failed attempt to pass a Healthcare bill or to get initial funding for the Mexico border wall. There remain considerable doubts that this tax policy will come to life, notwithstanding the Republican majority in both houses of Congress.

Tax reform is likely to take a long time, probably after the next fiscal year beginning in October. The Tax reform debate will run into the debt ceiling problem around October.

It is well recognized that any major tax reform is an uphill battle. Many will see this tax plan (outlined in broad strokes without funding) is more an opening gambit by the administration that a fully formed plan.

Scope for optimism

Nevertheless, the shift in the Trump administration’s focus to tax reform may begin to rebuild strength in the USD and yields again, towards the highs seen early in the Trump administration.

The deep involvement in Trump’s key economic advisors (Cohn and Mnuchin) gives this tax plan more gravitas. These people are credible, more so than the President.

Cohn and Mnuchin heavily emphasized that the tax overhaul is designed to boost growth, boost business investment, and improve the international competitiveness of US business. They said that these were the core principles of the tax overhaul that have broad agreement with Republicans in Congress.

Importantly, both advisors highlighted that they have been working on this plan for a long time and are working closely with Republicans in Congress. In contrast to the healthcare bill that has so far failed to be passed, the administration is deeply involved with Republicans in Congress that will ultimately need to come together to vote for a final tax overhaul.

Both advisors highlighted that coming to a final policy will require significant effort and will take some time, demonstrating a degree of humility lacking in the President and recognition that it will be a combined effort between the Administration and Congress.

Notwithstanding the considerable uncertainty over the final form and the timing of tax reform, there is scope for the financial markets to build in more confidence that something substantial will become law.

Tax policy is dollar boosting

While the administration is making broad tax proposals that impact on personal income tax, the most significant part of this reform is on corporate tax. There are several aspects of the corporate tax that appear to boost the USD.

The size of the cut, down to 15%, would make the USA internationally competitive. Such a low tax rate might encourage US and foreign companies to set up operations in the USA. The USA might, therefore, attract direct investment and more revenue as a new tax-haven.

Secondly, the administration tax plan includes a one-time tax break to repatriate accumulated earnings. This could generate a surge in capital inflow after the policy was enacted. It would also help provide a boost to tax revenue at least for that first year.

More generally, a fiscal stimulus would tend to boost domestic demand and lift US interest rates.

The global and longer-term implications of big unfunded tax cuts are far less obvious. Higher government debt and inflation in the US pose risks, especially if potential growth does not rise with demand. Tax cuts in the US may pressure other countries to cut taxes too to compete, boosting global demand but increasing global government debt and inflation risks with uncertain fallout to asset prices. Nevertheless, the immediate impacts in the first year or two appear quite clearly positive for the USD and US bond yields.

Progress on Healthcare

Confidence in the administration to achieve policy reform may get a boost from news that the Freedom Caucus in the Republican party that was primarily responsible for the failure of the healthcare bill to reach the floor of the House, have said they will support a new version of the bill.

As such, it appears that Republicans are coming together on the repeal and replacement of Obamacare, one of its keep policy objectives. Movement on this issue would provide more clarity on funding and clear one obstacle in the way of tax reform.

GOP Health Care Plan Gets Backing From Freedom Caucus After Changes – NBCnews.com

The passage of a funding bill to keep the government operating beyond this week is still top of the agenda in Congress. Trump has reportedly backed down on requiring initial funding for the Mexican border wall in this bill. As such this bill now appears more likely to pass, removing one very near term piece of uncertainty for US financial markets.

Trade policy further supports the USD

One area where Trump has found fewer speed bumps on the road to delivering his ‘America First’ agenda recently is toughening its stance on international trade. In its spotlight recently is Canada, after the US administration announced tariffs on Canadian lumber imports

The media has reported that Trump has been drafting an executive order to be unveiled late this week or early next week that includes a timeline for exiting the North American Free Trade Agreement (NAFTA). The aim is to renegotiate NAFTA to extract better terms from Mexico and Canada.

White House readies order on withdrawing from NAFTA – Politico.com

Last week Trump directed the Commerce Department to investigate whether imports of foreign-made steel was a national security risk. The directive appears to be a precursor for imposing trade restriction on steel imports.

Trump resorting to unilateralism with steel probe: China Daily – Reuters.com

These moves undermine confidence in countries that are significant exporters to the US or are more reliant generally on international trade to support their economic growth.

This has weakened the CAD and MXN in recent days, pose risks for China and Japan, and, more generally, for countries reliant on global trade. This includes many emerging market and commodity currencies

Stronger global growth indicators have supported a number of emerging currencies this year. However, a shift in focus back to tougher USA trade policies, combined with a tax policy agenda in the US that emphasizes repatriation and drawing investment towards the USA, might swing the pendulum back towards a stronger USD.