Trump’s anti-globalization policies atop his agenda

There are a lot of moving parts in global financial markets that are yet to come together and make a cohesive narrative for global investors. For one there are the immediate economic trends that may have taken a backseat recently to the longer term implications of a Trump presidency. The USA has exhibited somewhat firmer activity in recent months and higher wages. This alone helps account for some of the rise in US rates, yields and the USD exchange rate. The crucial labor market data at end week may bring attention back to the economic and Fed policy outlook. Agreement at the OPEC meeting on Wednesday 30 November to cut output is seen as crucial to preventing a deep fall in oil prices. This could influence confidence in the energy sector and bond yields. The Italian referendum next Sunday, 4 December, may speak to market fears over anti-establishment politics potentially undermining the EUR and global investor appetite. Trump sent his first message to the American public since the election last week, it did not mention infrastructure spending or tax cuts, two factors that have fired up optimism. Instead, it emphasized an anti-globalization message which is a threat to US equities and global investor appetite. We may be close to a top in the recent run-up in yields which may see some correction in the USD against the JPY. There are risks to global asset markets from anti-establishment policy trends that may get more attention into the Italian referendum, which could reverse recent global investor optimism and some of the recent rise in EUR/JPY and other JPY crosses.

The Trump rally in perspective

The rise in optimism following the Trump election in the USA has seen US rates yields, the USD exchange rate, and the stock market rally significantly. This may reflect some pent-up momentum that was awaiting the conclusion of the hard-fought divisive election campaign that distracted attention away from investment, hiring and spending. It may also reflect the hope that a Republican-led Congress and administration can get things done. It may reflect the sense that a Republican government, the traditional party of capitalists, will make policy that benefits business.

Industrial commodity prices, outside of oil, have surged in part due to the overtures Trump has made to boosting infrastructure spending. This drew more attention to a trend in more infrastructure spending begun or planned in many other parts of the world. China has boosted infrastructure spending this year to underpin economic growth and continues to pursue a far-reaching policy of promoting infrastructure spending across regions with its One Belt One Road (OBOR) new Silk Road policy and its lead role in setting up the Asia Infrastructure Investment Bank (AIIB).

Rising commodity prices have added to reasons for global yields to rise, helping boost inflation expectations.

Yields have risen also because of a push-back against central banks’ negative interest rate and quantitative monetary policies. These policies persist and restrain the rise in yields, but the market had gone too far in fearing the extension of these policies even as they appeared to be counter-productive by hurting financial sector companies and households relying on interest income while undermining economic confidence and inflation expectations. The market may be now seeing the benefits of these policies more clearly in a rising yield environment, by keeping real yields low and foreign exchange rates cheap, providing support for investment spending.

Yields may be rising in the US as evidence of wage growth has shown up more clearly, combined with low unemployment. The outlook for economic growth has improved, supporting further tightening in the labor market.

Yields may be rising in the USA due to risks that the Trump policies, including more infrastructure spending and tax cuts, may halt and reverse narrowing in government fiscal deficits at the Federal, State, and local level.

A destructive component to higher yields

Yields may also have risen because of a more destructive fear; that anti-trade, anti-immigration policies may limit productivity growth and raise inflation as growth hits upon supply constraints across the economy. Lower immigration may raise wages and curtail expansion in a number of small businesses. Less trade may limit access to cheaper goods and services used in production in the USA, while reducing access to markets abroad. This may reduce business expansion and at the same time raise costs and in-turn prices in the USA. A rise in yields to reflect these concerns is likely to feedback to a weaker economic outlook, weaker equity prices and in time dampen the uplift in USA yields and the USD exchange rate.

Trump’s anti-globalization contract with the middle-class

Trump’s election message is that he will put America First, negotiate more advantageous trade deals for the USA and bring home jobs to the USA. His promise to middle-class Americans in its ‘Rust Belt’ was that he would halt and reverse the decline in US manufacturing; including steelworks. People in these swing states, including Michigan, Wisconsin, and Pennsylvania, were the key to Trump’s victory. His promise to bring back jobs drew votes away from Democrats, the party that is more known for championing workers’ rights.

Trump appears to understand this contract he has made with America. In his first message to the public since election night, made on Monday last week, 21 November, via a video release, he said his “core principle” is to “put America first”. He said, “Whether it’s producing steel, building cars or curing disease, I want the next generation of production and innovation to happen right here, in our great homeland: America — creating wealth and jobs for American workers.”

In this speech, setting goals for the first one-hundred days in office, and even “day one”, Trump identified the low hanging fruit of withdrawing from the Trans-Pacific Partnership (TPP) trade agreement, and canceling “job-killing” restrictions on the production of energy, “creating many millions of high paying jobs”.

He also said he will create a rule that for every new regulation, two old ones must be removed. And he will ask the Department of Defense and the Chairman of Joint Chiefs of Staff to develop a comprehensive plan to protect America’s vital infrastructure from cyber-attacks and all other forms of attacks.

He will direct the Department of Labor to investigate all abuses of visa programs that undercut the American worker.

And he will impose a 5-year ban on executive officials from becoming lobbyists after they leave the administration and a lifetime ban on lobbying for foreign governments.

Trump, on YouTube, Pledges to Create Jobs – NYTimes.com

This video message did not mention the controversial and divisive election campaign promises to build a wall on the Mexican border or prosecute the Clintons.

Neither did it mention infrastructure spending that was a key message in his election night victory speech, or tax cuts. To be fair, these goals may not be achievable in the first 100 days in office, the subject of the Trump address, but it does appear to shift the priorities from the policies that may be responsible for the burst of optimism in US asset markets.

The focus of this address was on turning inwards; cutting back on trade, clamping down on immigration, reducing foreign influence in Washington, and protecting against cyber-attacks (presumably foreign). The emphasis is on appealing to the middle-class white manufacturing worker that thinks his jobs have been exported and taken by immigrants.

Without making comment on whether these inward looking policies will boost the middle-class or not, what they do do is create risks for business. They imply business will have less access to traded goods and foreign labor. This is a negative for the USA stock market.

These policies might still support USA yields and the USD exchange rate, since they imply less trade, potentially narrowing the trade deficit, while increasing inflation pressure at home, requiring tighter monetary policy than might otherwise be required. In a stricter interpretation of this inward-looking policy, USA companies (and government), including its globally integrated financial system, may find they lose access to global marketplaces that diversify risks and provide access wider liquidity pools, contributing to higher risk premiums in capital markets; another reason to see higher bond yields in the USA.

If bond yields and the USD exchange rate rise due to these anti-globalization policies, then they, in turn, add to downward pressure on USA equities, raising financing costs and reducing income on exports.

Ant-establishment politics a risk for Western Developed World

Anti-globalization type policies are taking hold in many other parts of the world, particularly in Western developed countries. Politicians around the world are seeing the Trump victory as a sign that they too must now appeal to their own middle-class workers that feel squeezed out by immigrant workers and government policies that pay too much attention to international commitments.

This policy agenda, unfortunately, lends itself to nationalist parties that appeal to racists and generate conflicts across ethnic groups within countries. Trump appeared to gain support from fueling these ‘Alt-right’ ideals which have little merit in promoting a stronger more productive economy. And in fact may undermine economic growth by generating distrust, distracting people from productive pursuits, hardening enclaves and promoting even less international cooperation. This trend towards support for Alt-right parties is occurring in many countries and may be seen as a further threat to globalization and growth. This threat is rising particularly in Europe.

At the other end of the scale, is a shift in support to left-wing parties. This support arises from a similar concern over globalization having gone too far and favoring big business over the middle-class. It has been described as an anti-establishment mood. Bernie Sanders campaign for the Democratic Party nomination was more successful than many people expected (even though he lost). That he was able to do so well in the USA where unemployment was relatively low, sends a potent message for the Eurozone where in many countries, including Italy, Spain, and France, unemployment remains high. Parties at this end of the spectrum may not appeal to Alt-right bigotry, but they are also against trade and want governments to be more domestically focused. Mainstream parties are reacting more urgently to these pressures from their electorates and this is likely to be a factor slowing and diminishing globalization.

Immediate threats in Europe include the 4 December (next Sunday) referendum in Italy. A No Vote on constitutional reform will be seen as a victory for anti-establishment parties that threaten to pull out of the Euro.

It is hard to quantify the effect on investor confidence and the broader implications for the stability of the Euro. But it will represent a further significant blow to globalization and European integration. It might be expected to weaken the EUR exchange rate and European asset prices. This might have some broader negative consequences for global risk appetite.

Anti-Globalization fears in Emerging Markets point to risks for USA equities

While anti-establishment forces are at work in major developed Western economies, many emerging markets that have relied on international trade to drive their economic development are threatened by these trends.

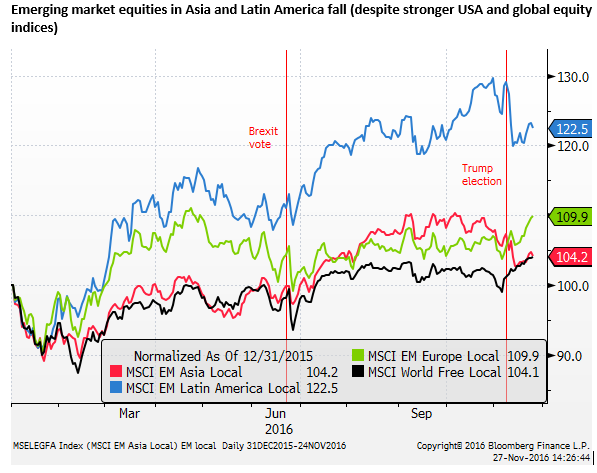

There is some evidence that the market has responded with weaker equities and currencies in many of these countries, particularly in Asia, but also in Latin America.

This points to a potential threat to the USA stock market. If investors see anti-trade rhetoric by Trump and related trends in other developed markets undermining emerging market assets, then it must also see risks that companies in the USA will also suffer by retaliatory policies in emerging markets where large US companies operate.

China reaches out as the USA withdraws

It is also the case that emerging economies that represent now at least an equal share of the global economy and do not have the same anti-establishment driven politics, will be more prepared to work with each other.

The USA in particular risks accelerating its decline of power and influence in other parts of the world that have the greatest growth potential. By immediately pulling out of the TPP, the USA has set in motion more intense efforts by other nations in the Asia-Pacific to pursue trade deals that exclude the USA.

This is a key moment for China to accelerate its influence in Asia and other regions with less competitive pressure from the USA. The USA already decided to stay out of the AIIB that has over 50 member countries including most other developed countries, a multi-lateral organization that was started by China and may prove to be a potent vehicle for it to drive development and cooperation just at the time when the USA turns inward.

As such, the anti-globalization policies Trump intends to pursue may turn out to be a major detriment for USA companies that will have long-lived implications.

Trump appears to have the attitude that the USA is so big and powerful that the rest of the world will still be knocking on its door.

However that time may have passed, just as it has passed on views that China and Japan are currency manipulators and by easing restrictions on energy production millions of US jobs will be created.