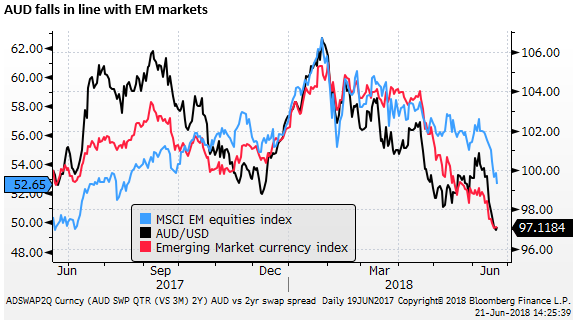

Upside potential for AUD and GBP

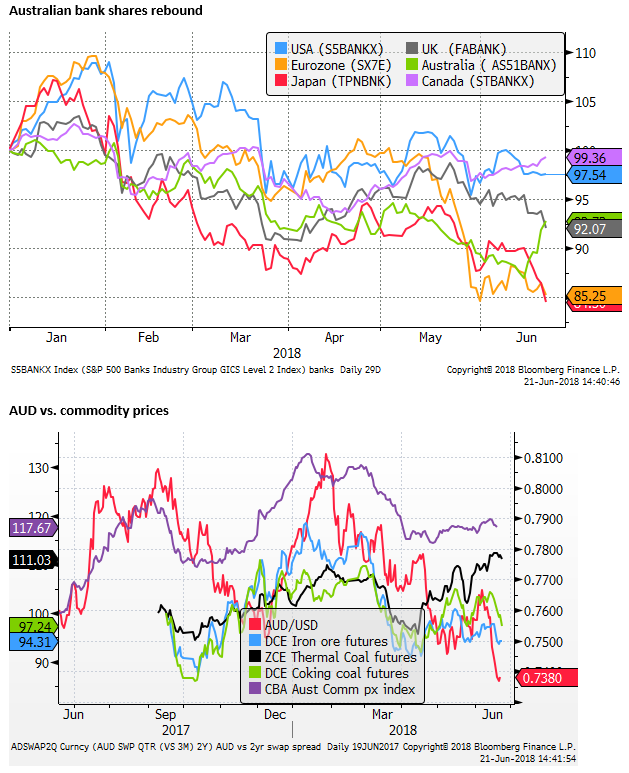

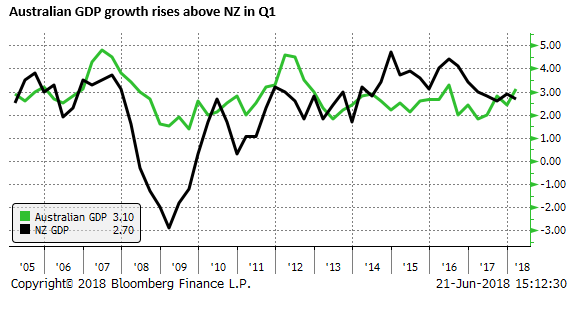

Some upside risk for GBP after the BoE firmed plans to hike in August and PM May keeps hold of the Brexit reins. AUD looks beaten down on weak EM assets. However, the rumour mill suggests that the USA and China may restart trade talks. Australian bank shares have rebounded from their lows, mining companies have announced new capex plans, and the Australian government has passed income tax cuts. Any settling of nerves over US-China trade should also bolster the AUD/NZD after NZ GDP slowed below trend and below Australian GDP in Q1

BoE stays on the path to hike in August

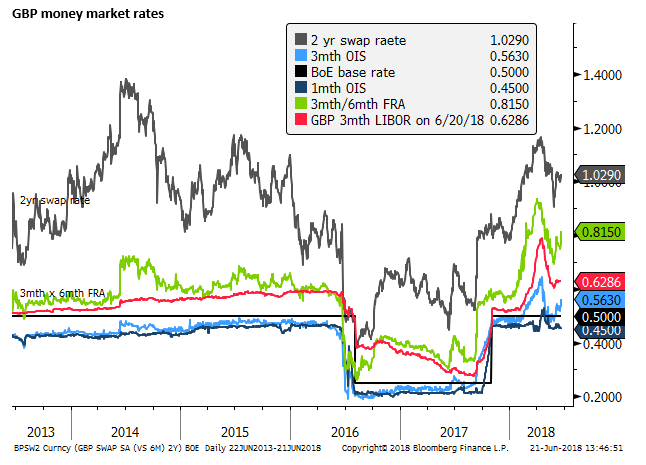

The outlook for the GBP has improved with the Bank of England staying firm in its view that it expects to raise rates gradually. At this meeting, a third MPC member (Chief Economist Andrew Haldane) joined the two policy hawks that had already voted for hikes at the two previous policy meetings, for a 6 to 3 vote to leave rates unchanged.

The tone of the statement suggests that the Bank is now poised to hike at its next policy meeting on 2-August. This is 67% priced-in to UK money markets and would be the second hike in the current cycle after the Bank raised rated from the record low 0.25% to 0.50% in November last year.

The MPC said, “A number of indicators of household spending and sentiment have bounced back strongly from what appeared to be erratic weakness in Q1, in part related to the adverse weather.”

And, “Most indicators of pay growth have picked up over the past year and the labour market remains tight, suggesting that domestic cost pressures will continue to firm gradually, as expected.”

MPC lay groundwork for QT

The MPC also laid the groundwork for when it might begin to reduce its stock of purchased assets (so-called quantitative tightening). It said, “The MPC now intends not to reduce the stock of purchased assets until Bank Rate reaches around 1.5%, compared to the previous guidance of around 2%. Any reduction in the stock of purchased assets will be conducted at a gradual and predictable pace.”

At the current pace of hikes (around 9 months apart, if they go ahead and hike on 2 August), it would be more than two years away; not necessarily something that the market will think much about at the moment. At the margin, it might add to a broader sense that major central banks are moving from QE to QT.

Monetary Policy Summary and minutes of the Monetary Policy Committee meeting – BankofEngland.co.uk

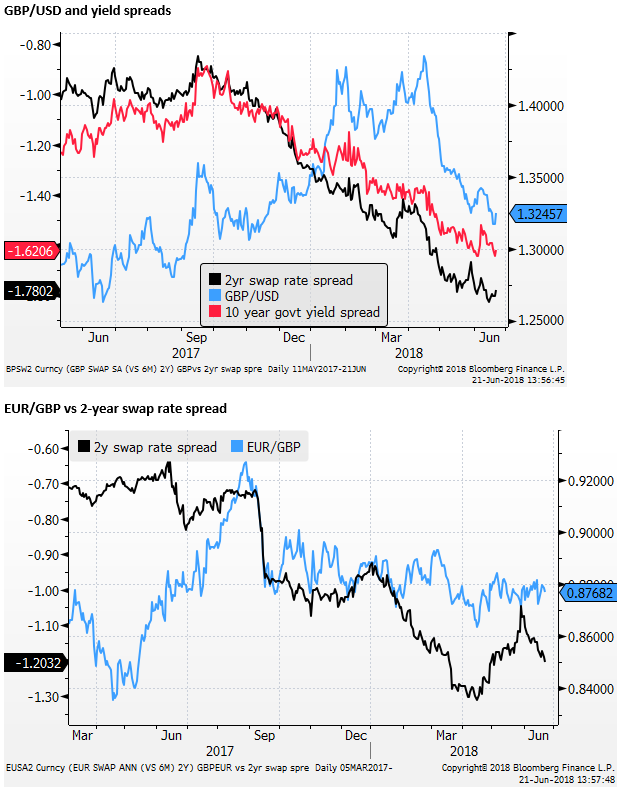

GBP yields firm vs the USD and EUR

2yr GBP swap rates rose 1.2bp, on a day when rates were softer of weaker equity markets. EUR 2yr swap rates fell 0.4bp and USD 2yr swap rates fell 1.4bp.

The modest improvement in GBP rates along with political wins by UK PM May in the last week to keep both the eurosceptics and europhiles in her own party at bay and retaining albeit tenuous control over Brexit negotiations, may help support further gains in the GBP.

The bounce in GBP has been modest, however, as the path towards progress on Brexit negotiations surrounding trading arrangements and the Ireland/Nothern Ireland border remains elusive.

EUR shrugs off higher Italian yields

Italian bond yield spreads over bunds lead some re-widening in periphery spreads on Thursday. However, the EUR rallied modestly, paying little attention to the implied lift in Eurozone political risk.

Rumours China and the US to restart trade talks

The market appeared to pay relatively little attention to the news suggesting that the US and China may be looking to restart negotiations on trade to limit the planned implementation of tariffs. Perhaps it is highly sceptical that either the US or China is willing to back-down on the key issues related to China’s policy objective of boosting its high tech industries, and the US objective of preventing technology transfers to China.

U.S. Weighs Resuming China Talks with Split on Trump’s Trade Team – Bloomberg.com

However, the reports suggest that there is a possibility of a cooling in trade tensions. For instance, there is a risk that the US decides to delay the implementation of its first round of tariffs slated for 6 July to enable last-minute negotiations to proceed.

This could see a partial rebound in Asia EM assets and risk appetite more broadly. However, since the news reports, US equities and EM equity ETFs remained near their lows for the US session

Any cooling in trade tensions, for example, might lead to a rebound in the AUD, that has matched the fall in Asia EM assets in recent weeks.

AUD/USD returns to positive carry

One interesting development in AUD that has mixed implications for the currency is that short-term AUD funding costs have shot up, surpassing the well-documented rise in USD funding costs over US cash rate expectations.

On the negative side, this highlights the vulnerability of financial conditions in Australia to tightening global credit conditions. On the other hand, it increases the carry return from holding AUD long positions.

Despite a cash rate target in Australia now 33bp below the Fed funds rate target, the 3mth carry return from a long AUD/USD position has returned to positive for the first time since February.

The presumption is that the higher AUD funding costs will ease back after the end of the Australian financial year end on 30-June.

AUD upside risk

Negativity around the AUD is high after it broke a 2-year uptrend line to be trading at a low in around a year.

It has been dragged down by a soft housing market, pressure on banks, undermining their equity performance and tightening credit conditions for housing. Fears over the impact of the tariffs and credit tightening in China also added to the bearish view.

However, we should be wary of a rebound. Tariffs news could improve if the US and China restart negotiations. Australian commodity prices remain high relative to the exchange rate, especially for energy prices. GDP rose a strong 3.1%y/y in Q1, above potential, supported by government infrastructure spending, strong service export sectors (education and tourism), high population growth, high business confidence and investment.

Recent reports from mining companies point to a moderate recovery in capital spending, firming up evidence that the mining investment bust is over. The Government has just passed tax cuts that may help their electoral prospects in a looming election, and help underpin consumer confidence.

The income tax cut win that genuinely lifted the Coalition – AFR.com

The Australian equity market has out-performed regional peers with a rebound from recent lows in bank shares, suggesting that the market is moving beyond the risks generated by the Royal Commision into their past bad behaviour.