US-China tensions weaken CNY, EUR may offer more sustained strength over Asian currencies

The US-China tensions ratcheted higher in recent days with accusations by the US administration of China hacking to steal COVID research followed on Wednesday by the US forcing the China consulate in Houston to be closed in 72 hours. China has threatened counter-measures.

This is just the latest salvo across a long list of flashpoints this year related to trade, technology, COVID, Hong Kong, the South China Sea, and the treatment of Uighurs. A tough on China policy is a key feature of the Trump re-election campaign, and both sides of politics are claiming they will treat China increasingly as a rival.

We should expect these tensions to remain high and potentially ratchet higher into the November Presidential election. And indeed to be a constant for the long term.

There is a risk that these tensions become negative for global investor confidence. They could raise the concern of a breakdown in trade relations, retaliation against US companies doing business in China, cause disruption in high tech industry supply chains, and raise the risk of a military conflict.

These tensions can just bubble in the background and have no lasting impact on global investor confidence. Nevertheless, there is a growing risk to global markets.

USA equity futures dipped in Asia on the announcement of the China consulate closure but recovered to be higher again in US trading.

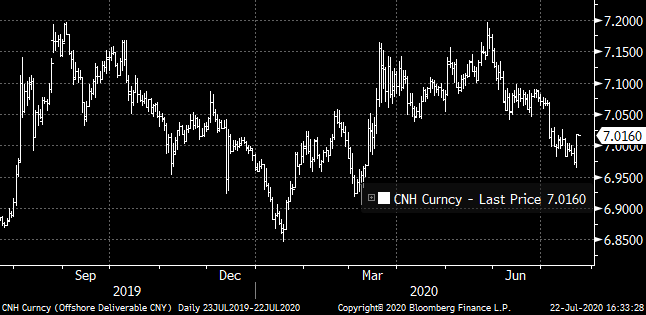

However, the CNY has reacted more significantly. CNH is down a relatively large 0.6%.

CNH has been generally rising against a weaker USD over recent months. It has largely ignored the ratcheting up of tensions related to Hong Kong including the US Administration removing Hong Kong’s special trading status, and tit-for-tat sanctions against individuals in government. This strength in CNY coincided with a surge in Chinese equities that appeared in part driven by Chinese government persuasion.

It appeared that China was encouraging a stronger equity market and currency to distract the market from the international condemnation of its new security laws in Hong Kong. The CNH is frequently driven by political factors. China will prevent it from falling sharply for fear of generating capital flight and negative impacts on its domestic capital markets. However, it may allow it to fall at times to signal that it wants to help its export industries in the face of trade threats from the USA.

The gains in CNH in recent weeks may also reflect a relatively solid economic performance in China in recent months as it rebounds from the COVID crisis that peaked in China in Feb/Mar. Its weakness in response to the Houston consulate action may reflect fears that the US-China tensions will damage Chinese trade interests in the USA and globally. Alternatively, it may reflect concern that Chinese officials will respond to these tensions by allowing the CNY to weaken to signal to the USA it may use its currency to support its export industries. The USA administration has often complained that China has manipulated its currency when it has fallen.

USD/CNH rose on US-China tensions and makes an outside range day in a downtrend, a technical signal for a reversal in the trend

The CNY was the weakest currency in the Asia region on Wednesday. Nevertheless, the slide in CNY did drag other Asian currencies down to be overall slightly weaker on Wednesday despite some further strength in the EUR and further sharp gains in gold, and surging silver.

It remains to be seen how China will respond to the US consulate action. This may prove to be just another small skirmish between the two superpowers. However, there is some risk to Asia markets from the prospect of further tensions between China and the US. It may tend to see some further reversal of recent CNY strength and see other currencies in the region, including the AUD, stall or give back some recent strength.

Considering the recent resurgence in EUR that has held above the pivotal 1.1500 and, at least briefly, breached its 50% Fibonacci retracement at 1.1595, its gains against the USD may be more sustained than the CNH or other Asia currencies.

The AUD along with the EUR has risen strongly in recent weeks and both have broken key resistance levels. However, the AUD may be more vulnerable to US-China tensions especially if they spill over into weaker global equity markets and a weaker CNY.

EUR/AUD is sitting near a base support line, tensions between the US and China may support the cross