US and global growth to support the USD

US bond yields have spent the year-to-date retracing some of their rapid rise after the US election on 8 November. Concurrent with this correction is a weaker USD, notably against the JPY, but also more generally. However, the US wages data last week tend to confirm that the labor market is now critically tight and inflation risks are rising in the US. USA Fed member Williams agreed and noted the upside risks that come with the calls for fiscal expansion. The US administration and Republican-controlled Congress plan to pursue wide-ranging corporate tax reform. This is likely to sustain a lift in US economic confidence and uplift in inflation expectations well before legislation is enacted. Global growth and inflation indicators have also lifted, but rather than supporting other currencies, this may tend to boost the real yield gap in favor of the USD and support the USD in the year ahead; including against AUD and NZD.

Trump Fatigue

The USD has had a setback so far this year on fatigue after its surge since the 8 November election and uncertainty as the market contemplates the challenges faced by the incoming administration delivering on a wide-ranging and ambitious agenda.

The correction reflects uncertainty over which parts of the agenda the administration will pursue first. If it is repealing and replacing Obamacare, it might trap the administration and Congress in a well-worn quagmire with no clear boost to growth or economic confidence. If it is to pursue trade restrictions against China or immigration controls it may also damage economic confidence and see further USD correction of its post-election gains.

There are a lot of distractions that may undermine confidence; including US intelligence allegations that Russia attempted to influence the election, Administration nomination hearings and renewed calls by key Republicans to place more oversight and operational rules over the Federal Reserve.

However, there is still more reason to see optimism towards the US economy, potentially reasserting the rising US dollar trend.

Rising wage inflation

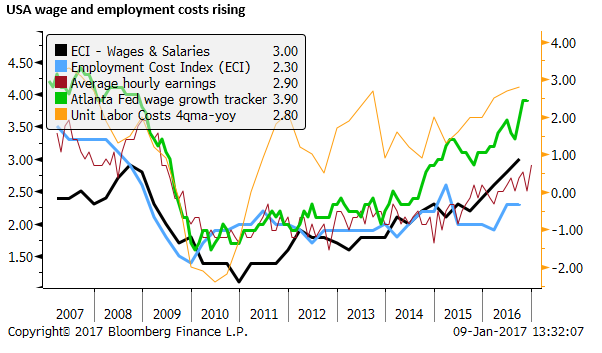

First and foremost, the recent economic trends suggest economic growth has improved in the last few months, the economy is close to full employment and inflation is more likely to rise. The hard facts tend to support a stronger USD.

The wages data on Friday were stronger than expected and have become the more closely watched component of the employment report now that the labor market appears relatively close to full-employment.

It is interesting that in the November labor report released on 2 Dec, wages were much lower than expected, falling to 2.5%y/y, below 2.8%y/y expected. This was mitigated by a lower than expected unemployment rate falling to a new cyclical low of 4.6%, stronger than 4.9% expected, and the underemployment rate also fell to 9.3% from 9.5%, confirming further tightening in the labor market.

Nevertheless, at the time, US yields and the USD had a short-lived correction lower. The market was more influenced by the lower wages data, suggesting the labor market still had significant slack. The payrolls growth of 178K in November was very close to 180K expected.

Yields and the USD later rose on stronger indicators such as ISM, durable goods, and consumer confidence, and it was given a further boost on the more hawkish than expected revision higher in FOMC rate projections at its 14 Dec policy meeting.

On Friday last week, wages data rebounded to 2.9%y/y, above 2.8% expected, more than reversing the retreat in November and sending a more consistent picture of labor market tightening. The unemployment rate did tick up as expected from its cyclical low to 4.7%, but the underemployment rate fell to a new low of 9.2%. Payrolls data were a bit weaker than anticipated.

The bond market is still working off its rapid rise in yields since the 8 November election, and thus not reacting much to the most recent rise in wages. Nevertheless, the wages and overall labor market indicators are likely to underpin the USD and yields. The evidence is building that wages growth is accelerating and may prompt still higher yields in the USA before long.

Fed President Williams “signaled support for forecasts of three quarter-point interest rate increases this year” according to a Financial Times article citing the evidence in the employment report. Williams is not a voting member this year, but is always close to the center of FOMC policy direction.

Fed official says strong jobs data rule out fiscal boost – FT.com

Trump tax cut doctrine

Fatigue and uncertainty over the Trump government agenda may account for some retracement in US yields and the USD this year. Nevertheless, it remains an important fact that the Republicans control both houses of Congress. This should smooth out the appointment of Administration nominees despite some controversy over the picks. And allow the administration and Republicans in Congress to achieve significant progress on new legislation, much more than was possible in the last six years of the Obama administration or would have been possible if Clinton had won the election.

The big business experience of key picks for Treasury Secretary (Steven Mnuchin), Commerce Secretary (Wilbur Ross) and Secretary of State (Rex Tillerson) suggest the Administration will move ahead purposefully with significant corporate tax reform.

In early December, Mnuchin outlined plans to restore the status of the Treasury Department as the vital driver of the economy. He gave more momentum to the ambitious claims made by Trump during the election that the administration thinks it can restore growth to levels once seen as the norm in the 1990s of between 3 and 4%. Many economists, seem to believe that this is a tall task, with constraints on labor force and productivity growth; the Fed projects long-run potential growth at only 1.8%.

Mnuchin claimed this would be achieved with the “largest tax change since Regan”. Top of the list is a big cut in the corporate tax rate from 35 to 15%. The new Republican big business friendly administration believes big tax cuts and other changes to the tax code and regulation will help bring home investment and jobs to the USA.

There will inevitably be some push-back from deficit hawks in Congress, but the Republican movement is still heavily biased towards corporate tax reform and will see the next four years as an opportunity to drive forward this agenda. It is likely to buy into the argument that corporate tax cuts can be paid for with stronger economic growth and company profits. As such there is more reason than not to expect fiscal expansion and lower corporate taxes.

While some may argue that it will still take most of the coming year to pass tax reform, the prospect of this happening is likely to sustain a pickup in optimism long before it is delivered.

Mnuchin aims to restore Treasury as the economy’s crucial driver – FT.com

Republicans plan radical overhaul of corporate taxation – FT.com

A weaker USD policy would be meaningless

Some have argued that the administration may pursue a weaker USD policy to help boost net exports and manufacturing in the USA. However, everything about their domestic policy agenda will tend to support the USD, and they will have limited capacity to influence the exchange rate.

Tax cuts and fiscal expansion at a time of full employment will tend to put upward pressure on interest rates and yields. Threatening to impose trade restrictions against other countries also tends to place upward pressure on the exchange rate via limiting imports and raising potential costs and inflation in the USA. Tax policies mooted, including tax breaks for foreign sourced income, or tax penalties on American companies importing goods manufactured abroad may also tend to boost the USD.

Global recovery to support the USD this year

The USA is not the only country showing improved economic momentum in recent months. The same is true in most developed and many emerging economies. This may allow more buoyant capital markets globally and provide some support for other currencies.

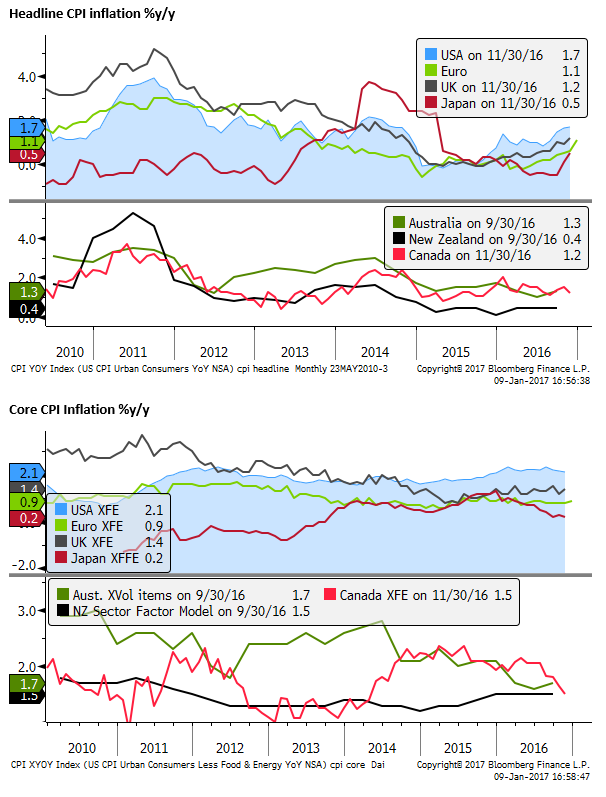

However, the USA is further along the economic cycle towards generating inflation than most other developed countries. It is more likely to raise rates and pursue higher real interest rates to keep inflation expectations from rising too fast.

The ECB, BoJ, and a number of other countries will welcome higher inflation and lower real interest rates at this stage of their recoveries.

In this sense, stronger growth outside of the USA may, in fact, tend to support the USD. It will tend to help sustain the impression that US exports will not be severely undermined by a stronger USD. And it will tend to raise global inflation expectations and widen the real yield gap favoring the USD.

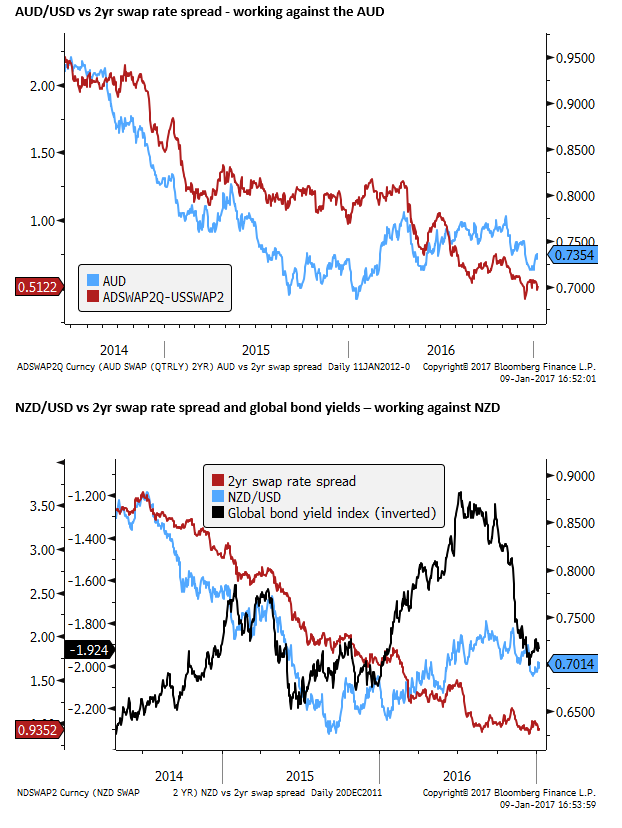

In previous decades, the AUD and NZD would tend to be boosted by stronger US and global growth. As commodity producers, higher global growth would tend to amplify growth and inflation expectations in Australia and New Zealand.

However, the starting point for inflation, relative to target, is lower in Australia and New Zealand compared to the USA.

Australia, more so than New Zealand, has more slack in its labor market.

Perhaps more pertinently, Australia and New Zealand now have significantly more heavily indebted households and are likely to face greater headwinds from any upward pressure on global yields.

Australia and New Zealand are also now much more influenced by the economic and financial outlook in China than the USA. USA growth momentum is picking relative to China, and scrutiny over trade and economic relations between the USA and China are likely to increase under the Trump administration; such that recovery in the USA may do less to lift economic confidence in China than past cycles.

At this stage, we expect both AUD and NZD to be sluggish this year, weaker against the USD, despite evidence of global economic recovery.