US Wages data a potential flash point, Global markets inflection point

Global markets and investor confidence have reached an inflection point. They have recovered from the extreme bearishness in the early months of the year supported by significant further monetary policy easing, cooperation among oil-producing nations, a sense that Chinese policymakers are working harder to underpin growth and stabilize its capital markets, and ECB efforts to mitigate the dampening effects of its negative rate policy on bank profits. However, last week, global asset markets retreated after bumping up against down-trends established over the last year. Investors are worried that global growth and potential earnings remain tepid, that structural problems in emerging markets and over-supplied commodity markets remain. They may be concerned by the prospect of a return to monetary policy tightening in the US, the lingering doubts over bank profitability and loan quality, and limited further space to ease monetary and fiscal policy if required. The outlook for US monetary policy will be important and key events this week will be watched closely. We see the wages data at end week particularly important in the wake of a benign wage growth outlook in the 16 March FOMC meeting.

US Wages data at end week a potential flash point

After the Fed lowered its projections for unemployment in the 16 March FOMC statement, the market may be less worried that a stronger than expected payrolls and a lower unemployment rate this week will bring on Fed rate hikes sooner.

(FOMC median projections for unemployment were unchanged at 4.7% this year, lowered from 4.7% to 4.6% in 2017, lowered from 4.7% to 4.5% in 2018, and lowered in the long run from 4.9% to 4.8%)

However, more attention may be paid to the wages growth number. The FOMC projections of lower inflation next year (core lowered from 1.9% to 1.8%) and no upward revision in core inflation this year, despite higher than expected outcomes for the last three months (core forecast unchanged at 1.6%, lower than the most recent outcome of 1.7% in Feb), suggests that the Fed sees less risk of higher wages.

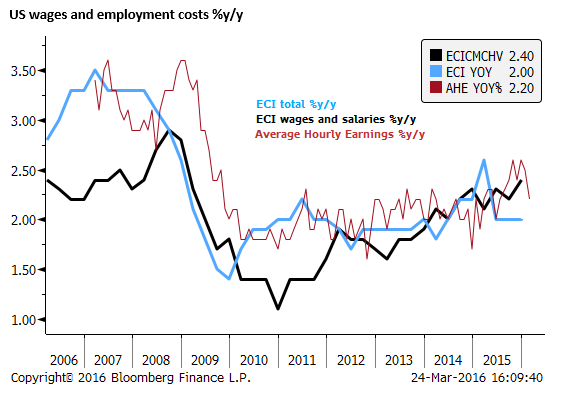

In fact the last payrolls report was stronger than expected (+242K in Feb, above 195K expected, +30K net revisions for the two previous months), but the USD was weaker and US equities rose strongly in response because the wages figure was significantly lower than expected (2.2%y/y in Feb, below 2.5% expected), reducing fears that the Fed might hike in March.

The 16 March FOMC statement and press conference tended to confirm that the Fed took more notice of the low wages outcome than it did the stronger payrolls outcome.

Earlier in the year, wages were stronger than expected in January (rising to 2.5%y/y in Jan, above 2.2% expected, and revised up from 2.5% to 2.6%y/y in December), released on 4 February, keeping US rate hikes expectations alive despite the elevated global markets uncertainty at that time, boosting the USD.

Payrolls in January were lower than expected (+151K in Jan, below 190K expected), but the unemployment rate dropped below 5.0% to 4.9% for the first time in the post crisis-era. On balance the market took more notice of the higher wages outcome and lower unemployment rate (that was then equal to the Fed’s stated long-run neutral level, although it has since been lowered to 4.8%).

As such, much may depend on the wages outcome in March. If it rebounds, it will make the lower than expected February number appear to be the outlier, and suggest wages are trending up in response to a tightening in the labor market. This would throw considerable doubt over the FOMC projections and dovish statement on 16 March. On the other hand, a steady wages growth outcome of 2.2% would tend to confirm the assessment in the FOMC statement that appeared to suggest that the Fed can wait for some time yet before raising rates a second time.

Inflation rising trend, not yet worrying the Fed

As the Fed’s preferred gauge of inflation, the PCE Deflator, due on Monday, along with personal income and spending data, may also be important for markets. Recent US inflation data, both from the CPI and the PCE Deflator have been higher than expected for core measures.

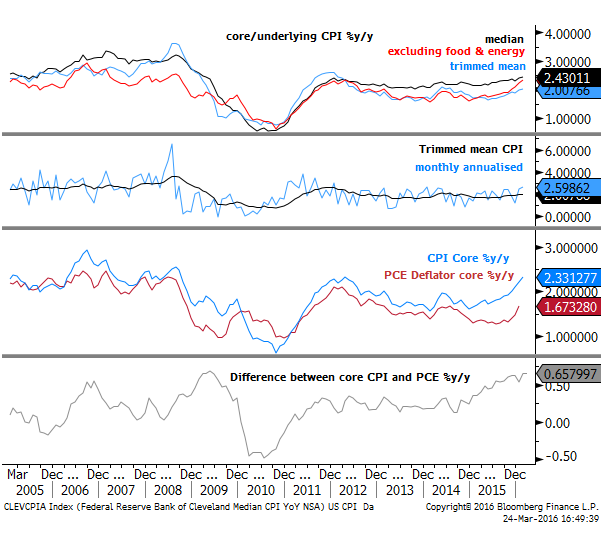

Core PCE Deflator inflation (%y/y) has been trending up since July last year and in January reached its high since February 2013 (+1.7%y/y). Core CPI has been trending up since December 2014 and reached its high since April 2012 in February (2.2%).

As such the data are testing the theory in the FOMC statement that core inflation is expected to remain below 2% for another two years. In fact the FOMC is forecasting it to drop back later this year to 1.6%.

Market expectations are for the core PCE Deflator to rise to 1.8% in February data released on Monday (probably because the CPI was higher than expected), taking it further above the 1.6% FOMC median projection for end-2016.

This appears to be a fairly lofty expectation, and in fact 8 out of 24 market forecasters are predicting core PCE stays at 1.7%, while the other 16 are at 1.8%. So there appears more risk that the data comes in below the median market expectation. Nevertheless, the data appears to be placing some pressure on the FOMC to raise its forecasts, which is why it was odd that the FOMC in fact lowered its 2017 forecast.

Fed President Evans said last week that Fed research suggests that there is some residual seasonality in inflation data that tends to make the data higher in the first half of the year and lower in the second half of the year. The recent low wages data and this research, and perhaps also low surveys of inflation expectations, may be encouraging FOMC members to pay less attention to the recent rise in inflation data. As such, this might diminish the importance of the inflation data for the next few months.

Nevertheless, the recent pickup in inflation data is pretty sharp and hard to ignore and will probably still raise debate in the market over whether the Fed might change its mind and raise rates sooner if it continues to rise abruptly.

While the core of the FOMC appears less persuaded by recent higher inflation readings, at least some appear more eager to raise rates. Clearly Esther George did, as she dissented in favor of an immediate hike in March. Comments from Bullard, Williams and Harker last week also suggest they are leaning towards a hike in the next two meetings (only Bullard of this trio is voting this year).

Fed’s Chair Yellen speaks on Tuesday after the latest inflation data are released, and faces questions by Economist Alan Blinder.

Global Markets at an Inflection Point

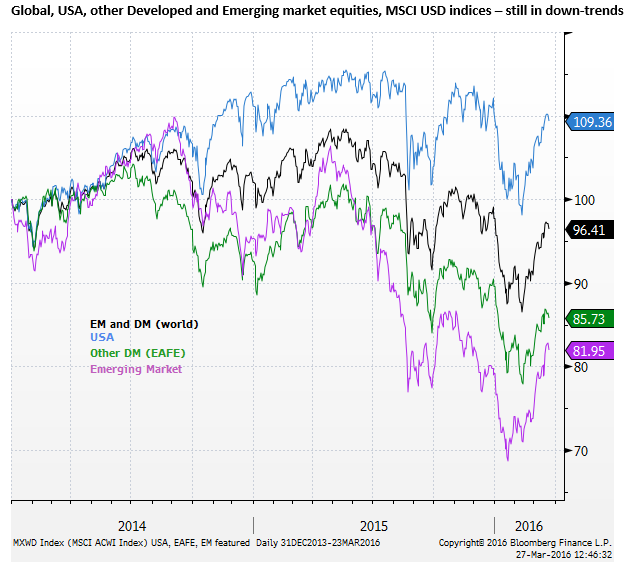

Global financial markets showed some return to the unease that dominated in the first two months of the year last week, with little stand-out reason. The terror attack in Brussels has kept the Brexit fears alive. However, it also appears to be the case that after a strong rebound in global asset markets and risk appetite from the lows in early-Feb, the market has reached something of an inflection point.

While global equities have recovered from the lows, this comes in response to global monetary policy easing, cooperation among oil-producing nations, a sense that Chinese policymakers are working harder to underpin growth and stabilize its capital markets, and ECB efforts to mitigate the dampening effects of its negative rate policy on bank profits.

This may have reduced the immediate fears of global and economic catastrophe, but investors are now worried that global growth and potential earnings remain tepid, that structural problems in emerging markets and over-supplied commodity markets remain. They may be concerned by the prospect of a return to monetary policy tightening in the US, the lingering doubts over bank profitability and loan quality, and limitations in further monetary policy and fiscal policy space to ease if required.

The market may appear more stable, but it is now facing key resistance levels in the roughly year-long downtrends in global equities and high yield bond markets.

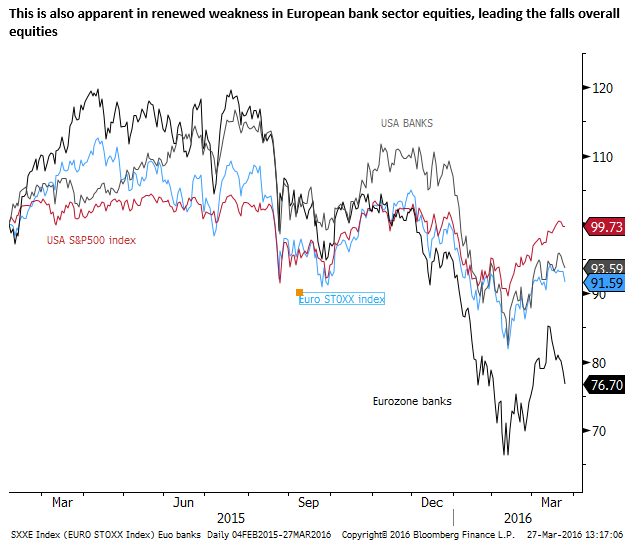

Credit spreads in Europe have been widening again over the last two weeks, despite the ECB’s announcement that it was planning to purchase corporate bonds as part of its asset purchase plan.

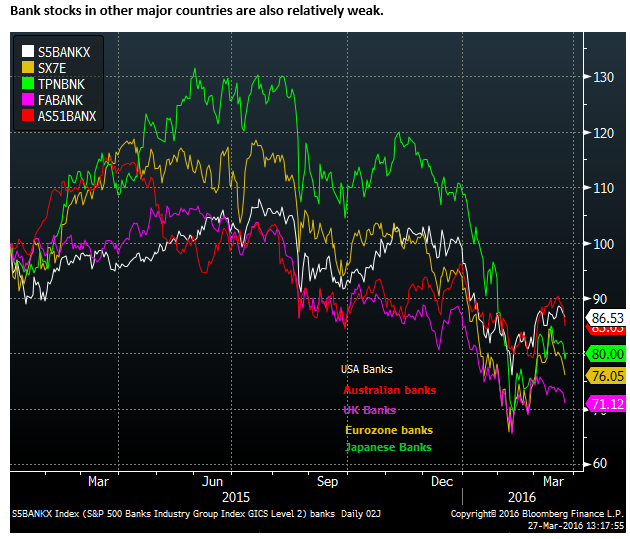

Financial sector credit risk appears to have risen more-so, suggesting greater concerns remain for bank profits.

Bank shares drag down Australian share market

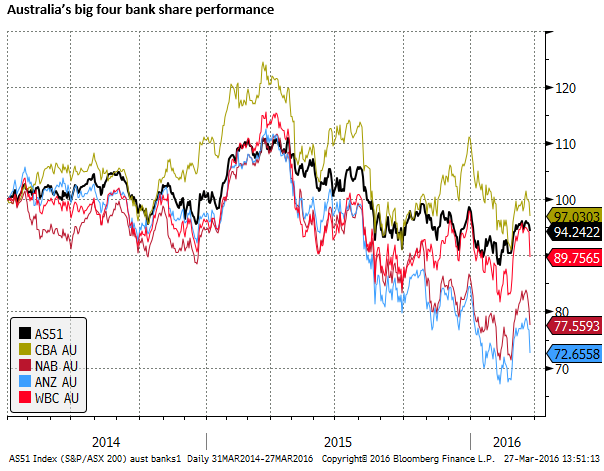

Australian bank shares came under pressure last week on announced increases in bad loan provisions by ANZ and Westpac. ANZ bank has been the weakest performing owing to larger loan loss provisions related to its lending in Asia and the Australian resources sector.

Westpac also noted that there were pockets of stress in consumer loans in Western Australia and Queensland, states most exposed to the downturn in the resources sector, and some problem loans related to the down-turn in New Zealand’s dairy industry. Australian banks are also the predominant lenders in New Zealand.

The chart below shows the equity performance of the big-four banks in Australia compared to the overall equity index. These four banks make up about 25% of the overall market cap of the Australian stock market and the overall financial sector accounts for around 40%. As such they tend to set the tone and direction of overall equities in Australia.

In his speech last week, RBA Governor Stevens said that the Australian banking system, “has fairly modest direct exposure to the falls in oil and other commodity prices, with lending to businesses involved in mining and energy accounting for only around 2 per cent of banks’ total lending.”

Over 60% of bank loans assets in Australian banks are mortgages (28% of loans are to non-financial corporations) so the big factor that influences their performance is the state of the housing market that remains buoyant overall, although property prices in Perth, the capital of Western Australia, are in decline. And the market is perhaps showing some concern that the housing market faces headwinds going forward as more supply hits declining population growth, particularly in the apartment sector.

A national election expected in July also features the opposition party offering up a policy to significantly reduce tax breaks to investors in housing. However, the ruling party is probably well placed to win this election.

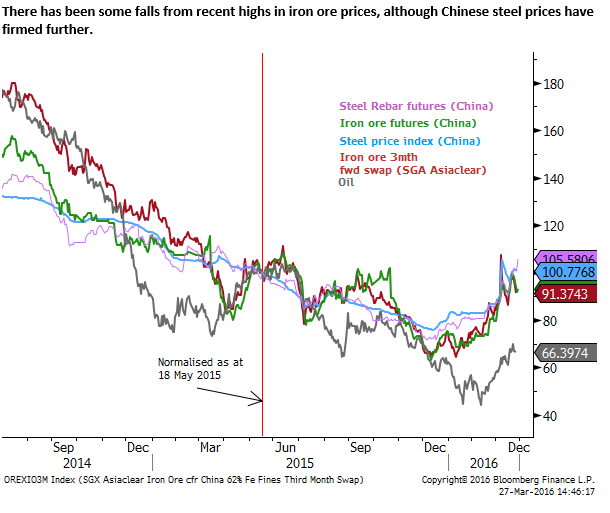

Chinese commodity prices still buoyant

Chinese data has helped restore some confidence in global markets in the last month. In particular, signs of recovery in the Chinese property market may have helped lift commodity prices. Overall fixed asset investment data also turned up in Jan/Feb, against expectations that it would fall further. Chinese fiscal stimulus and policy easing appears to have lifted the property and construction sector out of its doldrums of recent years.

Weaker Chinese currency still a concern

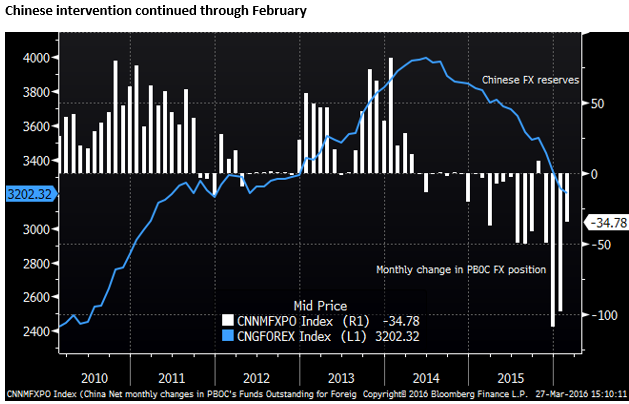

A key point of concern for global markets early in the year was fear of depreciation in the Chinese currency driven by capital outflow, diminishing Chinese FX reserves. The market may have feared that capital flight from China represented internal concern over economic and financial stability. It also worried that China might allow the currency to weaken more abruptly in a manner to help boost its export competitiveness and drag down other EM currencies with it, potentially fueling competitive currency devaluation and capital flight from EM markets.

As such, the performance of the CNY remains a key point of concern for global markets. One measure of capital outflow, Net monthly change in the Chinese central bank’s funds outstanding for Foreign exchange, showed outflows ease in Jan/Feb from a peak in December, but they remained significantly negative, indicative of FX intervention, soaking up CNY to keep it from depreciating more sharply.

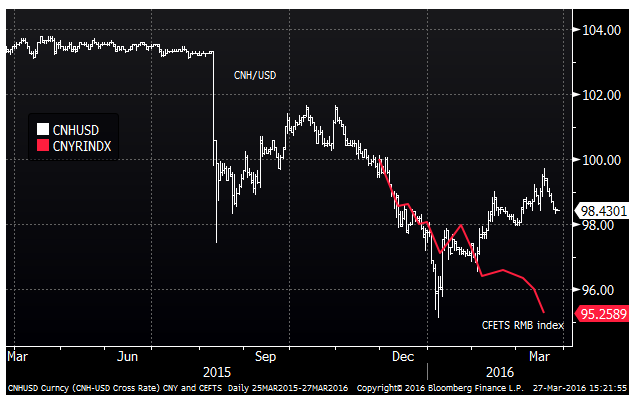

The CNY has strengthened against the USD most noticeably since around the Chinese New Year holiday break in early February, helping stabilize global market confidence. However, China has continued to allow the CNY to depreciate against the basket of currencies that it has nominated as its new proxy for managing the currency. This suggests that capital outflow pressure persists and underlying pressure remains for CNY depreciation.

U.S. Jobs, Yellen, Nuclear Summit: Week Ahead March 28-April 2 – Bloomberg.com